As selling orders continue to gush into the stock markets, Dow dropped by another 13% this Monday. Particularly, this time the selling was even sharper and faster. Other major indices followed Dow’s stomp. S&P, Russell 2,000 and Nasdaq Composite pinned-up the worst trading days in the last 33 years. Moreover, Wall Street’s historic market rout was mirrored by the Asian markets too.

Ever wondered what are seasoned investors like Warren Buffett doing right now?

Source: CNBC.COM

Frazzled by the Monday meltdown, Gold prices also inched lower the very next day. Last week, the crypto market also gawked at the worst panic sell-offs as the prices plunged by almost 50%. All in all, investors are pulling out their money from almost every market.

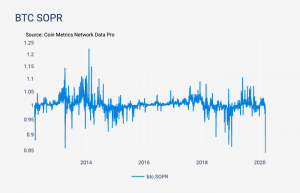

Source: Coinmetrics.io

On March 12, Bitcoin SOPR dropped below 1 and touched 0.843. As SOPR indicates the ratio of price sold over the price paid, its value as of March 12, clearly indicates that panic selling is on.

Amid the growing panic over the coronavirus pandemic, everyone seems to be clueless about how long this economic unrest will take to settle. Till then everyone is playing safe. Investors are cashing their investments even if it means selling their stocks, cryptocurrencies, and gold at bottommost prices.

Adding Oil to the fire

And then the vicious oil-war. On March 8, the oil-price war between Saudi Arabia and Russia was launched. And is posing a serious threat to already collapsing stock markets. This war not only menaces with America’s growing shale industry but also gashes the debt-burdened US oil majors. This is the fourth oil-price war and historically speaking, they do not end soon.

Source: Dailyfx.com

In times like this, when the fear of recession is gripping world leaders like “Donald Trump”, it is better to cease panic selling. This is the right time to become better investors by studying the strategies of the most influential investors.

Someone is high-spirited right now!

In his recent interview with CNBC, Warren Buffett said, “When the stocks are down, we’re going to be buying on balance”. Unfazed by the market going down, Buffett explains why this opens a buying opportunity for the investors.

Buffett is known to be the one who buys a stock when there is “blood on the streets”. While he is worried about the state of the economy and the volatility we are facing today, his strategy remains the same as the 2008 recession. And his advice has helped many investors ride out the market turbulence.

Don’t look at the price, look at the business

According to Buffett, successful investing is not a sprint, it needs a marathoner’s spirit. Furthermore, he adds that an investor must never buy because of the price rally, but must always judge the underlying value of an asset.

And that’s exactly what he did during the 2008 crises. The crisis-era deals had raked in $10 billion for the Oracle of Omaha by 2013.

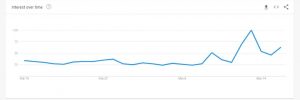

Alternative market interest grows

According to recent Google Trends data, the search volume for Bitcoin has grown over the last 30 days. And this is a strong indicator that investors are looking for alternate markets as stocks continue to plummet.

Source: Google Trends

StormGain, a popular cryptocurrency trading platform headquartered in London, is offering investors an opportunity to get a feel of real crypto trading with virtual money. Even when the traders will not be risking real money, yet they can win over 100,000 USDT as prize money.

The only clause is that you need to reach the list of top 500 traders of virtual money on the platform for the month of March. StormGain’s innovative contest provides traditional investors with a mock crypto trading opportunity. And who knows it might lead to a shift from stocks trading to crypto trading.

Ignore the background noise

While everyone was busy selling, Warren Buffett stood by his cardinal rule, “Be fearful when others are greedy, and be greedy when others are fearful.” Back in 2008, Buffett started buying stocks and his Berkshire Hathaway made heavy investments from 2008 to 2011. But he got involved only with giant, blue-chip companies namely Mars, Goldman Sachs, Bank of America, and Dow Chemical.

When Lehman Brothers collapsed, Buffett bought preferred Goldman Sachs shares worth $5 billion. And in the spring of 2008, Warren Buffett helped Mars’ with $23 billion to purchase Wrigley. With his sound research, Buffett was sure within 5, 10 and 15 years, these pieces of business will be worth much more. And that is exactly what happened.

According to Buffett, the bad news is an investor’s best friend. And even the Bitcoin investors seem to be following Buffett’s recession advice.

This is the first time in a while I've felt like buying bitcoin. That drop was too much panic and too little reason.

— Edward Snowden (@Snowden) March 13, 2020

Why Buffett’s advice makes sense for Bitcoin investors too?

Yesterday, we covered how the Bitcoin network continues to stay strong in spite of massive sell-off. And if it continues to do so post-May 2020 Bitcoin halving event, it will once again establish its resilience to economic disasters.

Although the current plummet was unanticipated, the third bitcoin halving is predicted to favor Bitcoin’s price. But the primary liability lies on your shoulder. Just like Warren Buffett executes his own research before investing in the asset, you must do that too.

Previously, we covered why Bitcoin price post third Bitcoin halving rally looks bullish.

Blessing in disguise

When Bitcoin was on the way to become the digital haven, all the markets were hit by the coronavirus pandemic. While the weak hands sold off their holdings, this opened an opportunity for both new and veteran Bitcoin believers to enter or re-enter the market.

The fact is there is no perfect time to enter the market. Even Buffett admits in 2008 he was 4-5 months off the right opportunity. But the point here is, “better late than never.” A territory that requires your research effort right now is finding a reliable crypto trading platform.

Why do we say platform and not just an exchange? The essence of the crypto market lies in its volatility. Making it important for you to have reliable access to a crypto wallet, trading platform, exchange and wide range of crypto assets.

If you are a newbie, platforms like StormGain provide you an opportunity to Demo Trade. And when you feel confident enough, you can enter the live market.