Over the last six months, the U.S. dollar has been in a state of free fall. With the spread of the COVID-19 pandemic, the weakening was expected. However, its recent slide at the end of August made analysts believe that the U.S. dollar depreciation could persist for over a decade.

In July 2020, we witnessed the U.S. dollar fall to a two-year low against the euro and has since struggled hard to pull up. A declining dollar means that its demand in the international market will decline, which could increase the price of imports and contribute to inflation.

USD vs Euro

Source: finance.yahoo.com

What is fueling the U.S. dollar decline?

The U.S. dollar started giving back its early gains when the Fed stepped into the financial markets to ease the impact of COVID-19. In the month of March during the Wall Street washout, the Fed announced that it would pump $2- $6 trillion into the financial system and drop interest rates to zero. Furthermore, to bolster the economy in the short term, it started quantitative easing by buying securities, Treasuries, bonds, and equities. This move, in turn, reduced the value of USD.

The current U.S. dollar meltdown followed Federal Reserve Chairman Jerome Powell’s announcement of super-low interest rates for a long time. According to this policy, the Fed will keep the interest rates very low even if inflation goes above 2%. For the month of July, the inflation rate was 0.5%.

Speaking about the lifespan of the current stimulus regime, Powell said the Fed expects the economic recovery to begin in H2 of 2020 and the recovery could last over the next couple of years. According to Powell, the current near-zero interest rates will support this recovery, but this could prove to be a big negative for the U.S. dollar.

Low-interest rates, a weaker dollar

When the Fed cuts interest rates, investors tend to sell their dollar-denominated assets. They tend to buy foreign currencies, weakening the dollar exchange rate, and that is exactly what is happening now. But if substantial investors wash off their dollar holdings, it could lead to a dollar collapse.

If the dollar continues to weaken, we would start seeing a pronounced impact on the U.S. economy. This is because a weaker dollar increases the price of imports and drives up the price of oil and some foreign contracts.

A plus side of dollar weakening

There is no doubt that the weakening dollar will help U.S. exports. As the goods become cheaper for foreigners, U.S. stocks will attract more foreign investors, which could strengthen the economy.

How does the dollar weakening impact Bitcoin?

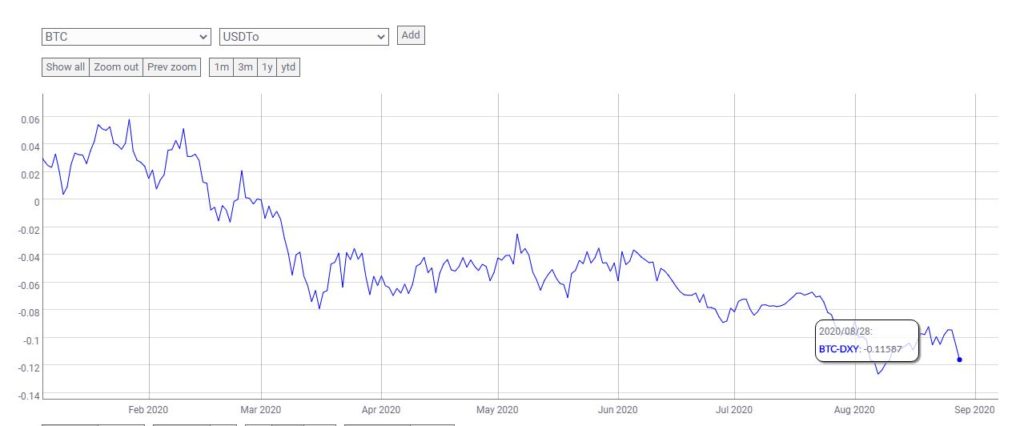

There exists no rule of thumb to ascertain how the dollar performance impacts bitcoin price. However, when we look at the BTC-DXY correlation charts by Coin metrics it is evident that since March 2020, both the asset prices are highly uncorrelated. When the correlation ratio is 1.0 it means the two assets are highly correlated and when it’s -1.0 it means they are not correlated at all.

As can be seen in the below chart, the current correlation ratio sits at – 0.11587. This is a clear indicator of a very low correlation. In simple terms, if the U.S. dollar continues its free fall, its expected that bitcoin price will head towards upwards.

Source: Coinmetrics.io

Do have a look at the deeper analysis of the correlation and current crypto market dip by Frank on our Altcoin Buzz YouTube channel.

Previously, we covered how the support for cryptocurrency in the U.S. is strengthening.