Binance Smart Chain’s daily transaction count is going ballistic. In less than a year, the daily transaction count went up from 38 (August 30, 2020) to 11 million (May 14, 2021). Meanwhile, the daily transaction count on Ethereum, the first-ever smart contract platform, on May 14 was somewhere close to 1.5 million only.

With soaring Ethereum transaction fees and slow transaction speeds, users are naturally looking for alternatives. As Binance Smart Chain closely resembles Ethereum blockchain’s traits, it has become an obvious choice for users.

Before we jump into the recommendations, let us look at how BSC also fuels the growth of these top 5 low market cap BSC coins.

Is BSC a Looming Threat to Ethereum?

Binance CEO Changpeng Zhao (CZ) has maintained his stand that Binance Smart Chain (BSC) was not built to replace Ethereum. He stated that Binance Smart Chain (BSC) is more like ETH1.8. That’s because it’s backward compatible with Ethereum. It is also faster with 3-second block times and has almost 97% lower fees when compared to the current Ethereum network.

The tokens we are covering in this article are low market cap projects. With these low market caps, there exists extreme room for growth. Interestingly, the growth of these low market cap gems will not be restrained by challenges like high transaction fees and low transaction speeds.

Our Picks – Top 5 BSC Low Cap Gems

When we set out to identify the low cap gems, we try to seek answers for these questions:

- Does this project solve a pressing problem?

- Is it the first one to do it or does it bring an innovative approach?

- Does it have a well-supported token?

If the answer to all three questions is yes, that is the gem we are looking for. Here are 5 such promising BSC projects:

#1 Linear Finance

Ticker: LINA

Token Type: BEP-20, ERC-20

Current LINA Price: $0.070755

LINA Price Prediction: $0.3653

Total Token Supply: 10,000,000,000

Circulating Token Supply: 2,476,691,266

Reasons to Buy:

+ LINA token is a multi-functionality token used for governance, staking, and payments.

+ The main use of LINA tokens is as collateral to mint Liquids through Buildr.

+ ℓUSD, the base currency, is used to over-collateralize the synthetic asset. This ensures that even when the market is experiencing extreme volatility like the black swan, the system will not break.

+ By staking LINA, users receive exchange fee rewards and inflation rewards.

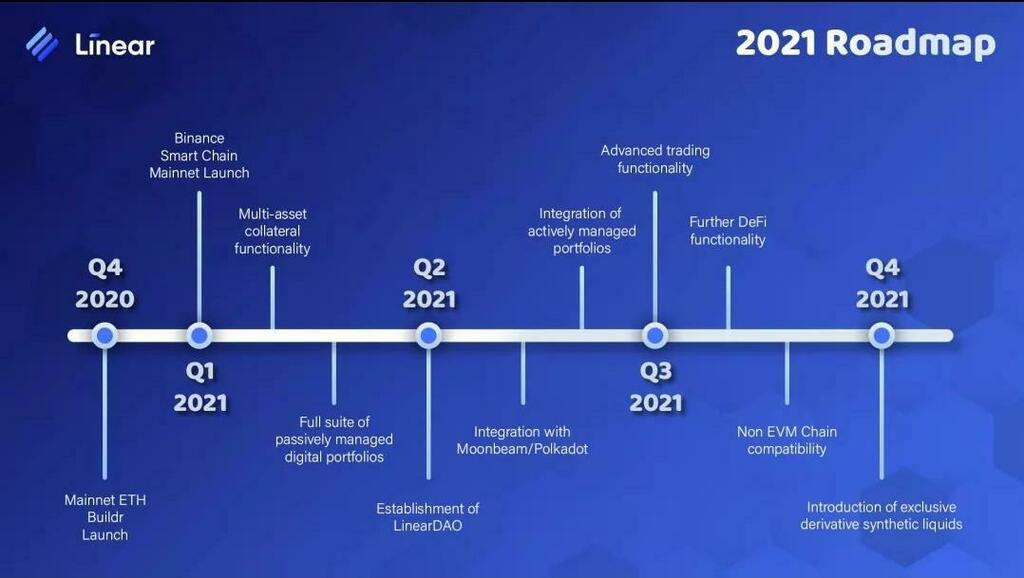

A look at the Linear Finance 2021 roadmap reflects big things are about to happen.

Reasons to Avoid:

– LINA’s public sale went live in September 2020 and was sold at $0.004. From there, the LINA token price surged to record an all-time high of $0.298, which is a 7,350% jump. However, at the time of press, LINA is trading close to $0.711.

– This is a good buying opportunity. However, we cannot ignore the fact that the token could not hold its price during the market mayhem. This happened despite the fact that the project is foundationally very strong.

What Is Linear Finance?

Linear Finance is a fairly new blockchain project that is trying to fix some major issues in the DeFi ecosystem. These issues are front-running liquidity and expensive gas fees.

Interestingly, the users are able to avoid the above problems by utilizing derivative offerings of Linear Finance. Basically, Linear Finance is the first-ever cross-chain compatible delta-one asset protocol. Built on Ethereum, Linear Finance can work with DeFi products. Now that it has been added to Binance Smart Chain also, it can work with DeFi products building on BSC too. Using Linear, users can mint derivative assets and trade them on the synthetic asset exchange platform which facilitates cheaper and faster transactions.

As a cross-chain platform, Linear exposes users to a wide range of assets without actually buying the asset. Additionally, the platform provides new yield-generating opportunities also.

Linear Finance Ecosystem

Even after being a fairly new project, Linear Finance has made a lot of progress on the development front. Here are the details:

Buildr – LINA, the native token of Linear Finance, can be staked to mint or burn ℓUSD, the base currency of the exchange. Using ℓUSD, users can purchase synthetic assets on the exchange.

Linear.Exchange – The synthetic assets created in Buildr using LINA are known as liquids and can be traded on this exchange.

Linear.Swap – This serves as a bridge between BSC and Ethereum.

#2 Cartesi

Ticker: CTSI

Token Type: BEP-20

Current CTSI Price: $1.19

CTSI Price Prediction: Available at our free Trading Signal Telegram channel

Total Token Supply: 1,000,000,000

Circulating Token Supply: 310,844,937

Reasons to Buy:

+ After the massive Bitcoin crash, most of the altcoins started bleeding, and CTSI was no exception. However, the token has now started to recover and is up by over 14.6% in the last 24 hours.

+ Layer 2 scaling projects like Cartesi are in demand. Interestingly, the demand for the Cartesi platform will not be affected by the release of ETH 2.0. That is because it offers a blockchain-agnostic development experience to the dApp developers.

+ Cartesi is functioning on a proof-of-stake consensus mechanism. As a result, the more the number of dApps built on the platform, the higher will be the demand for CTSI.

Reasons to Avoid:

– Cartesi is really up against fierce competition. To outrace the rest, it really needs to up its development pace. It must be noted that, over the last year, CTSI token price has rallied over 4,200%.

What is Cartesi?

Cartesi is a blockchain project that is scaling smart contracts to solve Ethereum’s urgent issues of high transaction fees. To accomplish this, the Cartesi team has taken a unique approach. It is using a variant of Optimistic roll-ups and is revolutionizing smart contract development. That is being achieved by enabling the development of smart contracts using mainstream software stacks rather than Solidity.

Interestingly, developers can use Linux to build their dApp on the blockchain of their choice. In short, developing dApps using Cartesi is a blockchain-agnostic experience. This feature is already being supported for the Ethereum, Binance Smart Chain, and Polygon chains.

#3 Litentry

Ticker: LIT

Token Type: BEP-20

Current LIT Price: $6.86

LIT Price Prediction: Available at our free Trading Signal Telegram channel

Total Token Supply: 100,000,000

Circulating Token Supply: 18,000,000

Reasons to Buy

+ LIT is the native token of Litentry. It has multiple functionalities like paying different types of user fees on the platform, staking, paying rewards, used as collateral in DeFi, and more.

+ A look at LIT token release chart reveals there are no large release cliffs that could flood the market and impact the price.

+ From the supply perspective, LIT will not face extensive inflation or supply saturation, which is a good sign for its long-term price.

+ Its project will be launched as a Polkadot parachain. This could be a turning point in LIT token price, which is already up by over 127% in the last three months.

Reasons to Avoid:

– The only risk this innovative project is facing is if a competing protocol achieves the same vision before Litentry or does a better job.

– Also, the team has been preparing for the parachain slot, which is a scarce Polkadot resource. If it fails to grab the slot, we might see a temporary negative price movement.

What Is Litentry?

Decentralized ID management is a big problem for the dApps built on blockchain, and Litentry promises to solve this issue. To state an example, the loans on DeFi are heavily over-collateralized because the protocol does not identify to who it is lending the assets. This is just one aspect of issues faced by decentralized ID management.

Litentry promises to solve the ID management problem by aggregating and managing decentralized identifiers across different blockchains onto a single platform. Interestingly, Litentry is also building a protocol that will enable the use of DIDs in a private and secure manner.

#4 Reef Finance

Ticker: REEF

Token Type: BEP-20

Current REEF Price: $0.03878

REEF Price Prediction: Available at our free Trading Signal Telegram channel

Total Token Supply: 20,000,000,000

Circulating Token Supply: 12,666,667,338 / 15,934,019,762

Reasons to Buy:

+ Reef is a multi-utility token. It can be used for staking, yield distribution, governance, and for paying protocol fees.

+ Q2 of 2021 is a big quarter for Reef Finance as some major products are being launched, and this could be very good for promising price action.

+ Reef is a groundbreaking platform but that has not been translated into impressive price action. That is why we believe it is a sleeping giant and that Q2 can possibly be the game-changer for Reef.

Reasons to Avoid:

– Almost three months back, Reef Finance faced a market cap issue. That’s because some of its tokens exist as ERC-20 and others exist as BEP-20 (Binance Smart Chain token). But market aggregators like Coinmarketcap and Coingecko were just showing the ERC-20 token market cap, and people started thinking the project is a scam. We believe many people cashed out their Reef during this time, and this hurt the price of the token. Eventually, as the team continues to deliver on their promises, this project will earn its spotlight position again.

What Is Reef Finance?

In simple words, Reef Finance is a liquidity aggregator. In addition to that, it offers a multi-chain smart yield engine that enables the integration of any DeFi protocol. Effectively, Reef Finance will pave a way for retail investors to the world of decentralized finance (DeFi), and this will be a turning page in the history of DeFi evolution.

Basically, Reef is a chain of smart contracts. These are the base component of the system that composes and integrates the entire ecosystem. Primarily, it forms an engine that communicates with liquidity aggregators and allows a retail investor to create entry and exit positions on numerous DeFi platforms.

In short, Reef Finance is one such project that promises to bring about mainstream adoption of DeFi.

#5 SafePal

Ticker: SFP

Token Type: BEP-20

Current SFP Price: $1.91

SFP Price Prediction: Available at our free Trading Signal Telegram channel

Total Token Supply: 500,000,000

Circulating Token Supply: 108,166,667

Reasons to Buy:

+ SafePal introduced SFP, the utility token, in January 2021. It’s a BSC token and can be used to pay fees with SFP and avail discounts. Additionally, SFP tokens can be used to receive bonuses and airdrops, as well as being governance tokens.

+ SFP can also be staked in SafePal Earn, which is a financial aggregator of DeFi and CeFi. With SafePal Earn, users can earn extra yields according to their risk preference.

+ The team has also promised a second airdrop of SFP tokens.

Reasons to Avoid:

– Before the token was listed on exchanges like Binance and Gate.io, there was a scam going around. The scammers were selling fake SFP tokens on exchanges like WBT. While buying SafePal, all you need to do is to be careful about the scams.

What is SafePal?

SafePal is a cryptocurrency wallet backed by Binance Labs. It aims to provide users secure, easy-to-use hardware and software wallets. As both are manageable via the SafePal App, the users find it easy to store, trade, and swap their assets. Interestingly, the wallet has given leading hardware wallets like Trezor and Ledger a run for their money. This is primarily because:

- It is the cheapest hardware wallet available at the time.

- It has a self-destruct mechanism that prevents malware attacks.

- Interestingly, it is completely air-gapped as it needs no wi-fi, Bluetooth, or NFC connectivity.

- Its 1.3-inch IPS screen is a big competitive advantage.

For coins with 100x potential and the best May 2021 coins, do check out our Altcoin Buzz News YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Cartesi. Copyright Altcoin Buzz Pte Ltd.