But if you missed the original, are the derivatives a good investment?

Wolf Game was the first fully on-chain risk protocol game to be released a few weeks ago. Since then, this style of game has absolutely taken over.

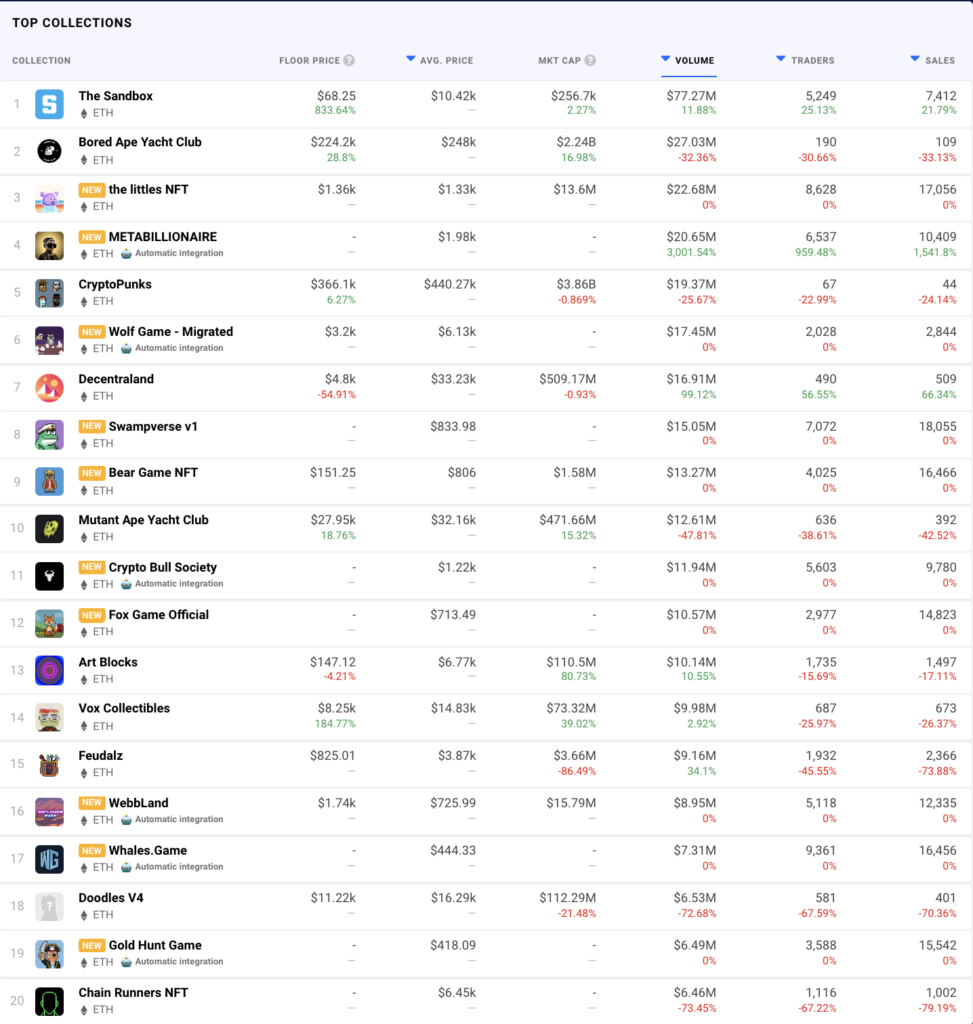

According to DappRadar, 5 of the top 20 collections on ETH from the past month are either Wolf Game or a derivative.

These games give the illusion that you can make more passively than your initial investment. Are they still a good investment if you missed Wolf Game?

Why Is Wolf Game the Most Popular?

When we first mentioned Wolf Game, it was a fairly simple stake for varying rewards with an element of risk. When exploits were found, the game evolved and expanded. Since then, Farmers and Land were minted, as well as the announcement of Wool Pouches. The game launched in January 2022.

Wolf Game has expanded much beyond the simple few weeks-long game it was originally created to be.

Now, the game is planning to have an entire ecosystem around $WOOL, with Farmers, relics, resources, animals, and more rumored. And of course, the ability to mint new NFTs with the possibility of receiving a Wolf.

How Do the Other Games Differ From Wolf Game?

Well, they really don’t. They all have the same or similar mechanics, with a different skin on the NFTs and a different token. Most of these ___ game NFTs don’t even hide it

In the race between cat and mouse, the mouse mostly wins…🐭

Because the cat runs for its food but the mouse runs for its life.🐈

Purpose is more important than need, instead of fighting for scraps of $wool get the whole $cheddar wheel in the game of cat and mouse.🧀

— Cat & Mouse Game (@catandmousenft) November 21, 2021

🔺MINT LIVE🔺Fork of popular #WolfdotGame on #AVAX / You can mint sheep and wolves! In a few hours, those with AvaWOOL can start buying cows! It's a farm here, not a simple #NFTGame between sheep and wolves ! #nfts #WHALEALERT

— 🔺AvaxWolfGame🔺MINT LIVE🔺 (@AvaxWolfGame) November 30, 2021

Storm has blown over for a while.

You have one hour to make an incredible journey what everyone else thought was impossible.

Let the gold rush begin!

– Skipperhttps://t.co/NKM2QiivxY

— Gold Hunt Game (@goldhuntgame) November 30, 2021

All of these games pop up, have crazy high volume, but the floor price stays stagnant. Take Gold Hunt Game for example. Originally minting on November 27th, the price surged to an average of Ξ0.17 and has since leveled off to just above mint at Ξ0.06.

The total volume? Almost Ξ1000 in 4 days.

Are These Alternatives Worth the Investment?

These games are only designed to last a short finite amount of time. There is a limited supply of the token, and the more that is burned to mint more NFTs that are staked to generate the token only speed up the game. In other words, the more participation in the ecosystem, the faster the game goes.

These games need constant innovation and new features to continue to maintain the token and floor prices. If their only ability is to copy and paste ideas from Wolf Game, is there any long-term sustainability there?

Probably not.

Analysis

These games do pose an opportunity to generate large amounts of ETH dust if you get in and out at the right time though. Minting for 0.05 ETH, Gold Hunt Fever generated 10,000 $GGOLD tokens daily for each Miner staked. After the 20% tax to pirates, one could have:

1) Mint for 0.05 ETH + gas

2) Stake and accumulate $GGOLD

3) Sold tokens on November 30th when the price hit ~USD $0.04/$GGold.

4) Sell the NFT for an average of 0.144 ETH on OpenSea that same day.

If you perform the trades perfectly and get in and out at the peaks, you clear ~$320USD and ~0.07 ETH. Not a bad day, if you time everything perfectly. If not, you could be at the other side of the crash.

In the short term, if you know what you’re doing and you have the time to monitor for new game copies, quick profits can be made. But for the average trader who gets stuck with these illiquid, useless, dead game NFTs, they won’t see these returns.

If you’re going to take your chances on these games, make sure you do your research and get in and out quickly.

Something to consider: Remember always to do your research, make your own decisions, and invest in projects that interest you!

Follow our new Altcoin Buzz Public NFT Wallet to keep an eye on collections we’re buying, selling, and holding! Use this as a jumping-off point for your research.

0x7304689aAc83c3B236332B0C233878F1819cA89d

Join us on Telegram to receive free trading signals.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.