Bitcoin’s value rose to $28,921.37 during the week but it continues to be range bound between $29,000 and $30,000. %. The increase was brought on by news of First Republic Bank’s potential demise. Ethereum also saw an increase but is failing to hold above $2,000.

With the macro events still in a cautious mood we’ll take a look at how the NFT market reacted during the first week of May.

1) NFT Market Cap & Volume

In the first week of May, the NFT market cap increased by 0.12% to $4.19M from the previous week. However, the seven-day trading volume of NFTs has decreased by 20.44% to 81.09K ETH, indicating a drop in NFT demand.

2) Downward trend in NFT Market Continue

Although the number of NFT holders has increased slightly by 0.16% in the first week of May, the number of traders has decreased significantly by 24.82%. Furthermore, over the same period, the number of buyers and sellers decreased by 29.00% and 25.88%, respectively.

This data indicates that the NFT market is still experiencing a slowdown in trading activity and consumer interest.

3) Drop in NFT OpenSea Trading Continues

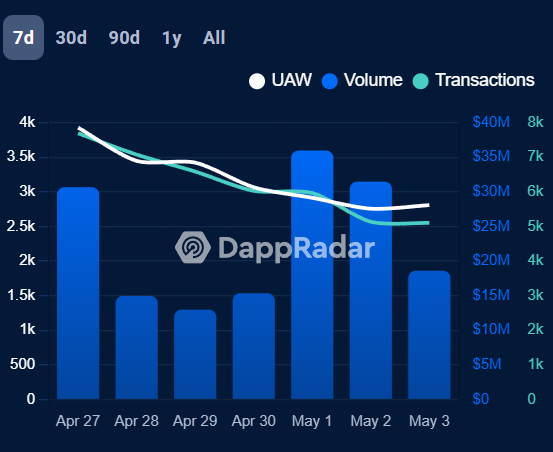

The number of unique active wallets (UAW) has decreased by 16.04% to 35.73k, while transaction volume has decreased by 20.87% to 68.69k. The trading volume has also fallen by 11.44% to $30.76M. The smart contract balance, on the other hand, has only decreased by 1.01% to $71.66k.

These figures indicate that the decline in NFT trading activity on the OpenSea platform has continued into the first week of May, indicating that the overall market may still be slowing.

4) Decline In Blur Activity

There has been a drop of 20.68% in active users to 13.99k and a 26.53% dip in transactions to 42.3k. The volume of trades has dropped by 41.18% to $143.97M.

However, the money held in its smart contracts has grown to $118.2M, a 14.37% increase. While the decline in trading activity on the Blur marketplace has continued into May. The rise in its balance indicates that some investors are still holding onto their assets on the platform.

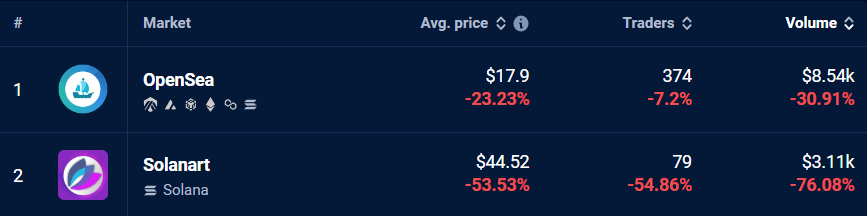

5) Dip in Solana NFTs

During the first week of May, the NFT market on both platforms saw a decrease in trading volume and average price.

There was a drop of 23.23% in the average price of NFTs on OpenSea, bringing them down to $17.9, and the number of traders decreased by 7.2% to 374. In addition, a significant decrease of 30.91% in trading volume resulted in $8.54k being traded.

On the other hand, the average price of NFTs at Solanart has dropped by 53.53% to $44.52. Trading volume fell by 76.08% to $3.11k, while the number of traders fell by 54.86% to 79.

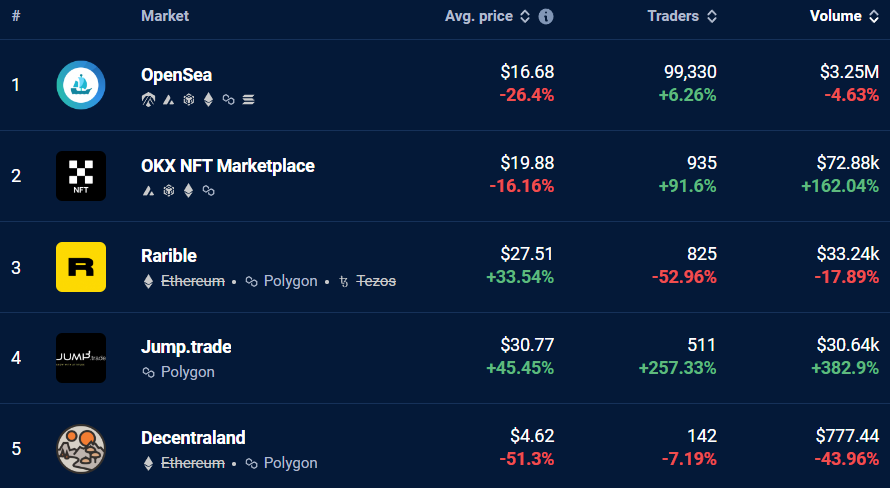

6) Polygon NFTs Performance

Despite being the most active platform with the most significant number of traders, OpenSea experienced a 26.4% decrease in average NFT price to $16.68 and a 4.63% decline in trading volume to $3.25M. Although the average NFT price fell by 16.16% to $19.88, the number of traders and trading volume on the OKX NFT Marketplace increased significantly.

The average NFT price increased by 33.54% to $27.51 on Rarible, which supports multiple blockchains, including Ethereum, Polygon, and Tezos. But, the number of traders decreased by 52.96%, and trading volume dropped by 17.89% to $33.24k.

In the first week of May, Jump.trade’s performance skyrocketed. Trading volume increased by 382.9%, and the platform’s number of traders rose by 257.33%. In addition, the platform’s average NFT price rose by 45.45% to $30.77.

In contrast, Decentraland’s performance was notably unfavorable. As a result of the 51.3% decrease in the average NFT price to $4.62, there was also a 7.19% reduction in the number of traders. Furthermore, the trading volume decreased by 43.96% to $777.44.

7) Actionable (Non-Financial) Advice

Every week we will offer some actionable tips for those that want to get more involved in the NFT market. The sections will vary but we’ll be bringing you something every week.

Walts Vault

Walts Vault, one of the most anticipated NFT mints, is releasing something major on April 30! Creative storytelling and developing anticipation for what’s coming have helped the team gain traction.

Starlight, star bright, the first star I see tonight ✨

The vault is yours, beyond the magic of the moonlight.Mark your calendars, reveal is on Sunday.

Dreamers shall rejoice, what will your story say? pic.twitter.com/PzTT6HDkgl— Cohl World (@Cohl_world) May 5, 2023

Its profound mythology and high-quality hand-drawn animation are reminiscent of early Walt Disney animation. However, despite its name, Walts Vault is not associated with Disney. But given the name of the collection and the style of the NFTs, the team is definitely playing on this unofficial connection.

Last hope of NFT community… or one of the most hyped mints up to date

Wonder and success of @WaltsVault_NFT

Thread on how this project is attracting and maintaining attention in the worst NFT market ever 🧵

(+ what we can expect from mint) pic.twitter.com/uwetYJyoOs

— Kinetic⚡️ (@kineticweb3) April 26, 2023

The project has many facets, (but the best collections do—think Yuga, Memeland, etc.) The team’s previous collection Ravendale has a current floor price of 0.65ETH. This new collection is rumoured to provide holders access to “Merkel Coin” in a future drop.

Many believe the drop of 30th April will be the primary collection. Currently, at the time of writing it is available on OpenSea and has a floor price of 0.065 ETH

8) Quick News Round-Up

- Blur and Paradigm introduce Blend, a protocol for perpetual NFT collateral lending.

- Blend, a peer-to-peer perpetual lending protocol that supports NFT collateral, was introduced by Blur and venture capital firm Paradigm to accelerate financialization.

- Blend doesn’t charge borrowers or lenders. The protocol uses an interest-rate “Dutch auction” for refinancing if a lender terminates a loan against the borrower’s wishes.

2. Wemade Debuts Bored Ape Golf Club NFT Collection on NILE.

-

- Wemade launched Bored Ape Golf Club NFT collection on the NILE platform with ALTAVA Group. The collection has 110 Bored Ape Yacht Club (BAYC) NFTs; sales began on May 4, 2023.

- The BAGC NEITH NFT collection includes 300 exclusive “golf ball” NFTs that grant golf country club access and a voxelized character. NILE and ALTAVA Group plan to work on more blockchain projects with golfers and WEMIX holders.

3. Solana NFT Marketplace Tensor Surpasses Magic Eden with a Market Share of 45%.

-

- Tensor, an upstart Solana NFT marketplace, has overtaken Magic Eden with a 45% market share, according to data from Tiexo. Tensor’s promotion for Mad Lads traders helped push them over the top, while Magic Eden offered zero marketplace fees and 2,000 SOL worth of airdrops in the first 30 days after launch.

4. VeChain partners with GS1 and launches the VeAce NFT collection for tennis tournaments.

-

- VeChain is now a Silver Member of the GS1 US Solution Partner Programme, used by over 2 million companies globally for supply chain management. This group offers tools and support to help communities adopt GS1 standards quickly.

- VeChain partners with tennis tournaments to showcase VeAce digital collectibles. Participants can claim digital collectibles to win sports caps or ATP Finals tickets. VeChain also launched VORJ, a simple platform for deploying Web3 assets without technical expertise or fees.

5. Palm NFT Studio simplifies generative art creation on the blockchain.

-

- Palm NFT Studio launched Palm Generative Art Maker for minting generative art on the blockchain. The tool simplifies rendering, trait and rarity systems, asset generation, and text/metadata creation for 3D assets.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.