Liquid staking is an up-and-coming form of staking. It’s gaining increased popularity in the DeFi space. Fantom is also offering this relatively new way of staking. The rewards can compound, so it is well worth finding out how it works. We will explain to you how liquid staking on Fantom works. Furthermore, we will show you what the best liquid staking options on Fantom are.

Currently, Fantom liquid staking has only a few options. Learn how, besides staking, you can increase your APY. With Fantom liquid staking, you can also:

- Take part in liquidity mining.

- Farm LP rewards.

- Stake farmed tokens.

- Vaults.

- Lending.

All this on top of your staking. Liquid staking adds layers of income.

Liquid Staking is one of Fantom's most exciting features.

In other Proof-of-Stake networks, you have to choose whether to stake your tokens to secure the network and earn rewards

OR

give up the staking rewards to use your tokens in DeFi.

Fantom is different. 👇

— Fantom Foundation (@FantomFDN) February 10, 2021

What Is Fantom Liquid Staking?

When you stake your Fantom tokens, you need to lock them up. (See our previous article on Fantom staking.) The longer you stake, the more yield you receive. The shortest locking period is two weeks and earns 4.8%. On the other hand, if you stake your FTM for a year, the rewards go up to 14.68%. Here is the interesting part. Fantom allows you to mint new tokens in a 1:1 with your staked tokens.

There are a few different ways you can mint new tokens. Just to clarify, you can now use these newly minted tokens in the Fantom ecosystem. As a result, you can earn extra income, on top of the tokens that you already staked. In other words, your staked Fantom becomes liquid. Here are some options how to use Fantom liquid staking.

1. Minting sFTM

Once you lock your FTM, Fantom allows you to mint sFTM 1:1 with your staked FTM. You can use sFTM as collateral in the Fantom ecosystem. Furthermore, you get access to the Fantom DeFi Suite. This suite allows for:

- Minting of synthetic assets—You can mint synths and trade them for other synths. Plans for listing include: FTM, fUSD, fGBP, fCNY, fEUR, fKRW, fJPY, fCHF, fBTC, fETH, fLINK, fBAND, fBNB, fGold, fSilver, and fWTI.

- AMM trading.

- Lending.

- Borrowing.

So, whilst you stake your FTM, new ways of generating revenue open up. In case you don’t lock your FTM tokens, there is an unusually short unbonding period of only seven days. The sFTM gives you access to wrapped Fantom (wFTM), which you can use in many places to generate more income.

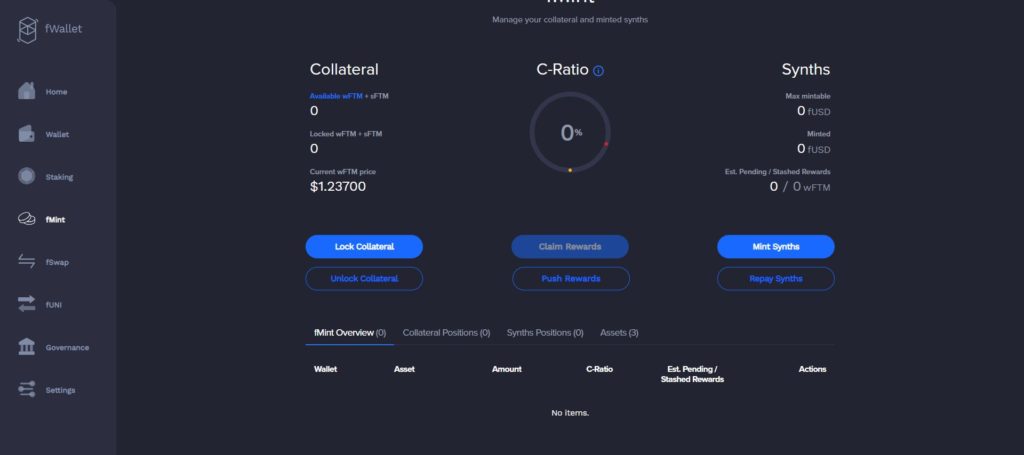

2. Using fMint

The fMint function in your fWallet allows you to mint fUSD. This is the Fantom stablecoin, pegged 1:1 to the USD. You can use any locked amount of staked FTM as collateral to mint fUSD.

- Swap your FTM for wFTM (wrapped Fantom) using fSwap in your wallet.

- Go to fMint and lock your wFTM. The locked wFTM is now your collateral to mint fUSD.

- Go to “Assets” and mint fUSD. There will be a 0.5% charge for minting. This is automatically deducted from the minted amount.

- Set your c-ratio.

Source: fWallet

What Is the C-Ratio?

The c-ratio is your collateralization ratio. On Fantom Finance, you need at least a 300% c-ratio. For example, with the current price for FTM at $1.25, this means that you can lock 1,000 FTM. That is $1,250. You can mint up to 1/3 of this amount, or $416.

However, if you have a minimum c-ratio of 500%, you earn an extra 6% APY, paid in wFTM rewards. On the other hand, your c-ratio can also drop below 300%. This will lock your collateral wFTM. However, only as long as your c-ration is below 300%. Once it’s back at 300%, it’s unlocked again. Furthermore, fMint currently has no liquidation. In other words, you can’t lose any locked wFTM.

Meanwhile, it is important to claim minting rewards on a regular basis. The c-ratio over 500% gives 6% APY in wFTM rewards. However, note that this is only over the minted fUSD, not the wFTM. In case you don’t claim the rewards and your c-ratio drops below 500%, the mechanism burns the rewards.

Source: fWallet

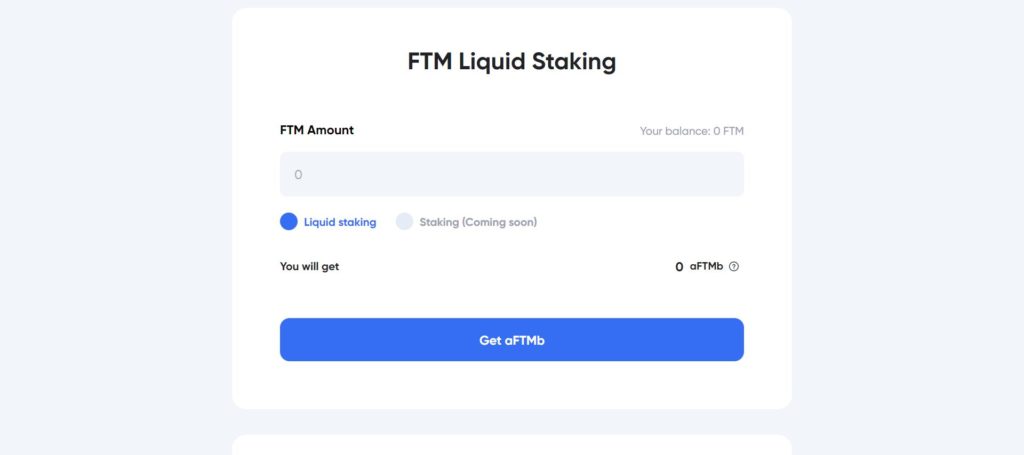

3. Fantom Liquid Staking on Ankr Earn

Stake your FTM on Ankr for a 9.3% APY. In turn, Ankr will lock and delegate your FTM and give you aFTMb tokens in return for your locked FTM. Furthermore, you can also swap FTM for aFTMb tokens on a DEX. Every day, you will earn aFTMb tokens as a staking reward.

But here is the kicker – you can use this aFTMb also to generate more passive income. Various layers of DeFi options are available. For example:

- Liquidity mining.

- Staking rewards on farmed tokens.

- Lending.

- Borrowing – Borrow FTM and stake it again.

- Yield farming.

- Arbitrage trading.

The unbonding period is 28 days. Thereafter, you can claim your funds. However, you still earn staking rewards during this time.

Source: Ankr Earn

There are still other options out there, like using fMint once more. Lock your FTM as wFTM. You can use wFTM in a variety of DeFi options. For example, SpookySwap has some wFTM liquidity pools. For instance, a wFTM/TOMB pool, and many more.

Besides these options, Stader Labs also expands to the Fantom ecosystem. This brings new liquid staking options. According to their roadmap, that should happen in March 2022. Stader is a Terra native app expanding to Fantom.

Conclusion

Fantom liquid staking is an interesting way to make your staked Fantom work. It allows for several avenues of generating passive income. We showed you three liquid staking options. However, there are more options out there, or they are in the making.

Moreover, for more great info, join us on Telegram to receive free trading signals.

Above all, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us from $99 per month now.