Venture Capital funds or VCs are at the core of many start-ups. They finance them. In crypto, we also have quite a few VCs. Among others, 3 Arrows Capital, about whom we already wrote. Other names you may have heard of are a16z and Electric Capital.

Now that 3AC is in serious trouble, we may see a domino effect on other VCs. Others may succumb to the main culprit, illiquidity. Besides that, there are 4 other threats we will cover here that threaten a crypto VC. So, let’s dive straight in.

What Is Venture Capital Financing in Crypto?

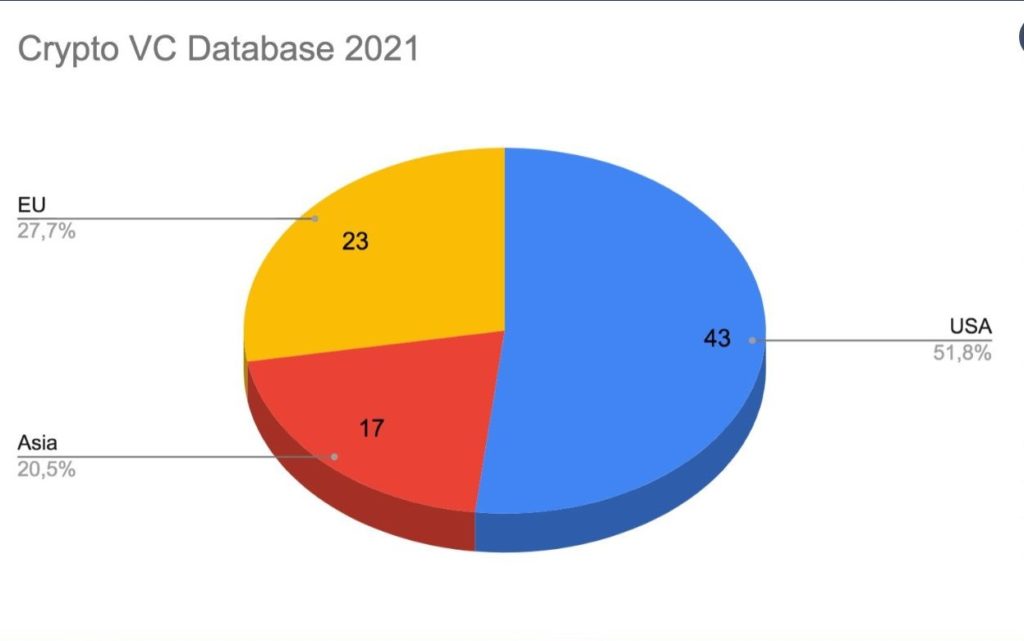

The idea of a Venture Capital is to finance crypto start-up projects in their early stages. The main idea is to make a profit. Nowadays, VCs direct a lot of attention to DeFi and NFTs. Therefore, Crypto Fi dedicated a Twitter thread about why a crypto VC is vulnerable now. Furthermore, the picture below shows a listing of VCs, split up around various parts of the world.

Source: Decentralized Finance

They operate as a pool of investors. They spend time evaluating projects, looking for the ones that can make a profit. In general, they spread out their investments. In other words, they don’t like to put all their eggs in one basket.

Although crypto projects can usually get retail funding, VCs also have a foot in the door now. Most of the money they make early on, during seed rounds. However, most likely they also stay around for A, B, or C funding rounds.

But, now 3AC tumbled, as we reported already. Everybody considered 3AC to be the Holy Grail of a crypto VC. But now the unthinkable happened. Shockwaves started to make their rounds. Can more VCs tumble now that 3AC paved the way? Are we going to witness a domino effect with VCs? It’s time to have a look at the four greatest threats that VC firms face:

-

Regulation

Too many events happened that caught the eye of regulatory offices. For example:

- Terra/Luna collapsing

- 3AC being insolvent

- People losing money in crypto Ponzi schemes

Another sample was the front running at the OpenSea, the NFT marketplace. One of their employees used insider information. It turned out to be a product manager. U.S. prosecutors charged him with one count of wire fraud and one count of money laundering. He faces a maximum of 20 years in jail, for each count.

Firms and exchanges are most likely on top of the prosecutor’s list. Their priority should be to protect their investors. If they fail to do so, regulators will step up at some point. So, if we look at firms, that’s where the VCs fit in.

2. The Bear Market

Bear markets follow the law that the strongest will survive. During bear markets, the trees get shaken violently, and the weaker ones will fall out of the trees. This can have a serious impact on specific parts of the crypto industry.

Crypto Fi correctly mentions that; ‘useful and core concepts will remain, as always‘. However, he thinks that most of DeFi is useless. That this statement is debatable, is an understatement. However, in many other ways, VCs will feel an impact.

It’s widely agreed that this bear market will last for another year and a half to two years. That happens to be the time of the next Bitcoin halving. During this time, it requires disciplined investment. Not the exchange list price is key, but use cases of projects become the dominant factor. Not what they promise, but what they can deliver, will rule, and dictate investments. And this leads us to the next point.

The following 2 years will now require disciplined investment.

Projects will need to be vetted for their use cases, rather than their exchange listing price.

Or what they promise to achieve.

There will be a need for higher quality labour in order to achieve this:

— Crypto FI (@Crypto8Fi) June 27, 2022

3. Diversified Labor

We see plenty of layoffs during this bear market season. Big crypto firms are not exempt. In other words, VCs will need to choose their staff more carefully. Crypto Fi expects VCs to continue to work with smaller, more specialized teams.

4. Seed Rounds

VCs have been relying too much on seed rounds. In the past, this worked fine for larger VCs. However, this resulted in a lower focus on building ecosystems. They aimed the focus more on mercenary capital outflows. Crypto Fi makes this clearer with a sample:

A VC provides $100K to crypto project X which locks this for 2 years. Now, crypto project X guarantees to list the investment at a price where the $100K is worth $4 Million. And we, the retail investors, are their exit liquidity. In the picture below, you’ll see how the crypto VCs are distributed in different parts of the world.

Source: Twitter

Conclusion

The current outlook for the US economy doesn’t look good. The crypto market will most likely be an extended bear market. We can also see a prolonged sideways shuffle as an alternative.

As a result, Asian or Chinese VCs may take the upper hand. One major factor is that they face lower wages. See the picture above. However, we also see the first-mover advantage. VCs that enter the market now, will have a disadvantage compared to established VCs.

Moreover, diversification is a major contributor to future success. To be successful, VCs will need to:

- Spread their investments, and not only eye the crypto market.

- Look for low overhead costs. Like lower wages.

- A small but specialized workforce.

- A dedicated team to deal with inbound regulation.

Finally, This list is a good starting point for VCs to make sure that they can survive.

⬆️ Win $6,699 worth of bonuses in the exclusive MEXC & Altcoin Buzz Giveaway! Find out more here.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.