Kava. the DeFi platform that extends DeFi capabilities and benefits to assets that otherwise cannot access DeFi, has launched its first app, Harvest. The app is the world’s first decentralized cross-chain money market and is built on the Kava blockchain. Using Harvest, the holders of BTC, XRP, BNB, BUSD, USDX, and KAVA can stake their assets to create a lending pool for borrowers. In addition to the interest, the participants will also earn native governance tokens, HARD (HARvest Decentralized). The holders can use HARD to vote on Harvest upgrades or sell them in secondary markets.

In short, Harvest is a yield-generating DeFi platform for major non-Ethereum assets like Bitcoin, XRP, and more. It supports crypto loans and enables investments in liquidity pools. This DeFi capability was limited to Ethereum tokens until now. According to Kava co-founder Brian Kerr, Harvest holds promise to bring order to the chaos of the DeFi market. This seems quite possible because, with the entry of major non-Ethereum assets, the DeFi market will mature faster.

Harvest app is now live!

Lend and earn on $USDX, $KAVA, #BNB, and $HARD!https://t.co/540aq8GfGO

— Harvest.io (@harvest_io) October 15, 2020

First cross-chain money market – Harvest

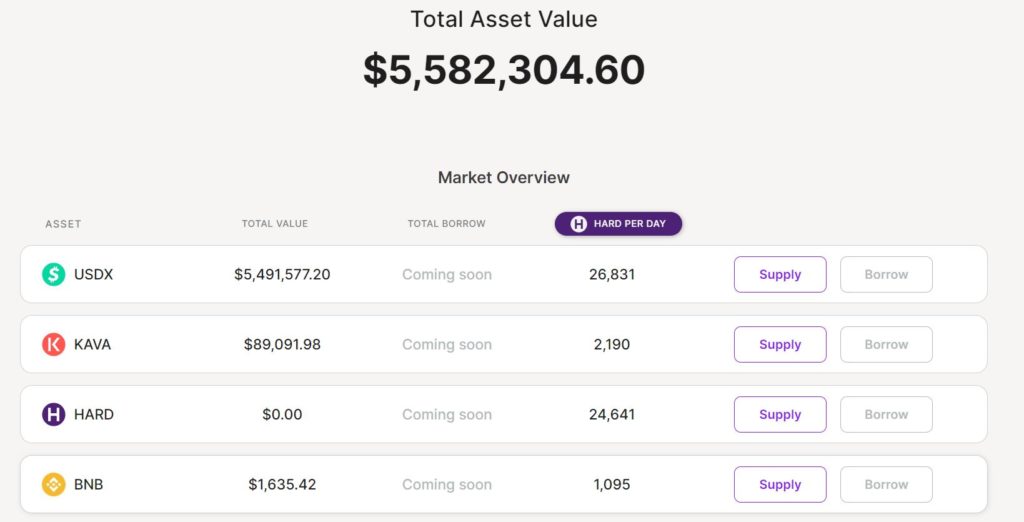

The Kava DeFi platform proposed Harvest in September 2020, and since then, the team has been working tirelessly to launch Harvest. On October 15, the DeFi platform launched the first phase of Harvest. Phase 1 allows participants to build the supply side of the money market. At the time of the press, the total asset value locked in Harvest is worth $5,583,980.70. Currently, it supports the supply of USDX, KAVA, BNB, and HARD.

Source: Harvest.io

At the time of the press, we do not see BTC, XRP, and BUSD supply features active on Harvest.io. We might see that happening soon as Kava also announced its KAVA 4 Gateway launch, the biggest launch of the year. According to the official blog, the Gateway expands Harvest capabilities to support BTC, XRP, BUSD, and more cross-chain assets.

The Kava 4 Gateway launch is successful. This monumental upgrade expands support for collateral assets to BTC, XRP, BUSD, and others. Also, @harvest_io, the world's first cross-chain money market application on Kava is now Live.

Learn More:https://t.co/2UzRS4NMlT

— Kava Labs (@kava_labs) October 15, 2020

Phase 2 of Harvest is scheduled for December 2020. This will enable the borrowing side of Harvest and will add governance capabilities to the HARD token. Additionally, it will add support for Chainlink in the same month.

Decentralized but curated

Harvest is similar to leading DeFi protocols like Compound and Aave but it supports non-Ethereum projects too. By leveraging the Cosmos SDK modular and interoperable framework, it offers cross-chain asset support and that is how it serves DeFi capabilities to non-Ethereum tokens too.

Kava has employed its Apple-like approach to make sure Harvest meets all the necessary security and quality standards. As the fees are almost non-existent on the Kava blockchain, using Harvest will be cheaper than its Ethereum analogs.

According to Coin98 Analytics, the all-time high ROI of the Binance Launchpad project Kava has been 1,197%. And this is just the beginning.

ATH ROI of Projects on @binance LaunchPad.

The Avg. ATH ROI is 1,290%How about $INJ? @cz_binance $EGLD $BAND $MATIC $BTT $KAVA $WRX $SAND $ONE $CTSI $FET $CELR $WIN $PERL $ALPHA $TROY $INJ pic.twitter.com/9hVfhscLGL

— Coin98 Analytics (@Coin98Analytics) October 13, 2020

KAVA price

In spite of these major announcements, KAVA token price is down by over 11% in the last 24 hours.

Undoubtedly, Kava is a sleeping giant, and with these big announcements, we expect the token price to show some big price movements soon.

For more crypto-related updates, do check out our Altcoin Buzz YouTube channel.