Cardano is one of those sleeping giants. It’s a blockchain that has been around for a while. However, not everybody is a fan of this project. Still, they are in the top 10 chains by market cap. This surely means they must be doing something good.

So, let’s have a closer look at the state of Cardano during Q1 2023. Messari released their findings, and we’re going to dig into them.

.@redvelvetzip's State of @cardano Q1 23' report ⬇️

+$ADA’s market cap up 54% QoQ

+Total value locked (TVL) denominated in $USD on Cardano grew 172% QoQ

+@Indigo_protocol's $IUSD and @DjedStablecoin $DJED drove stablecoin value up 261% QoQFREE report link in the next tweet👇 pic.twitter.com/78MAg7npp9

— Messari (@MessariCrypto) April 18, 2023

What Is Happening at Cardano?

There are loads of different things happening at Cardano. The Messari report mentions a lot of this action. Here are some general key points. For example:

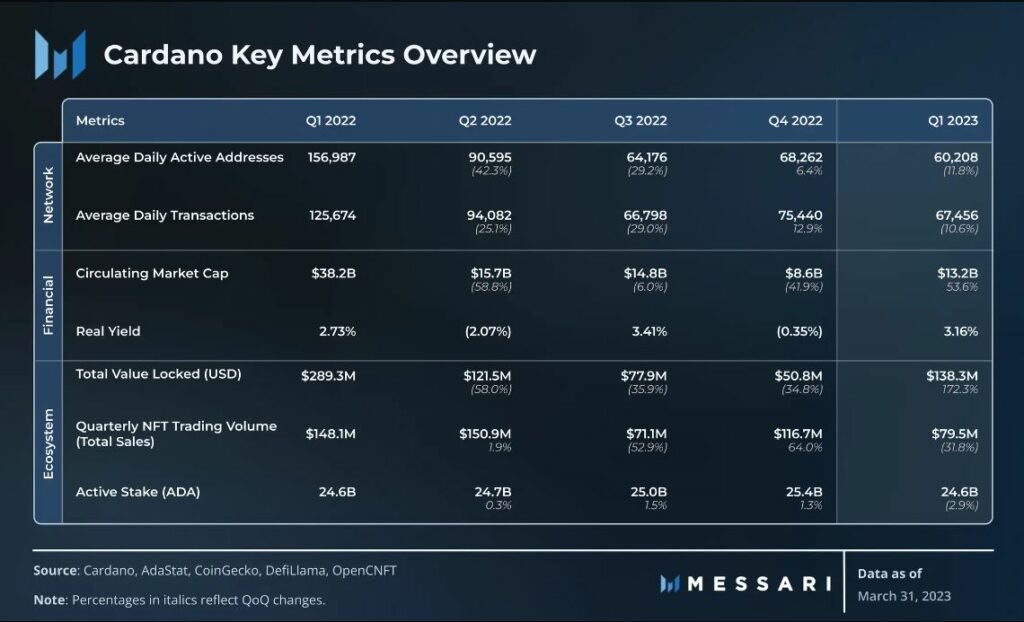

- ADA saw a market cap increase of 54%. It went from $8.6 billion to $13.2 billion. As a result, it’s now ranked #7 by market cap.

- Compared to Q4 2022, TVL increased by no less than 172%. This went from $50.8 million to $138.3 million. A new protocol, Liqwid Finance, contributed to this. More on Liqwid shortly.

- Stablecoins played a big part in the increase of TVL. DJED from Djed and IUSD from Indigo were key in this. The stablecoin value went up by 261% compared to Q4 2022. Stablecoins are a new addition to the Cardano ecosystem.

- A new Layer 2 state channel scaling solution, Hydra Head, opened on the mainnet. Still in a limited way, but it’s Hydra’s first solution of the Hydra series. This happened during March.

- Interoperability remains an important feature in the Cardano ecosystem. Four projects keep working on this:

- Milkomeda C1

- Wanchain

- IOG’s EVM proof-of-concept sidechain

- Midnight

However, in this article, we would like to concentrate on some specific points. The picture below shows the key metrics for Q1 2023.

The Cardano DeFi Space

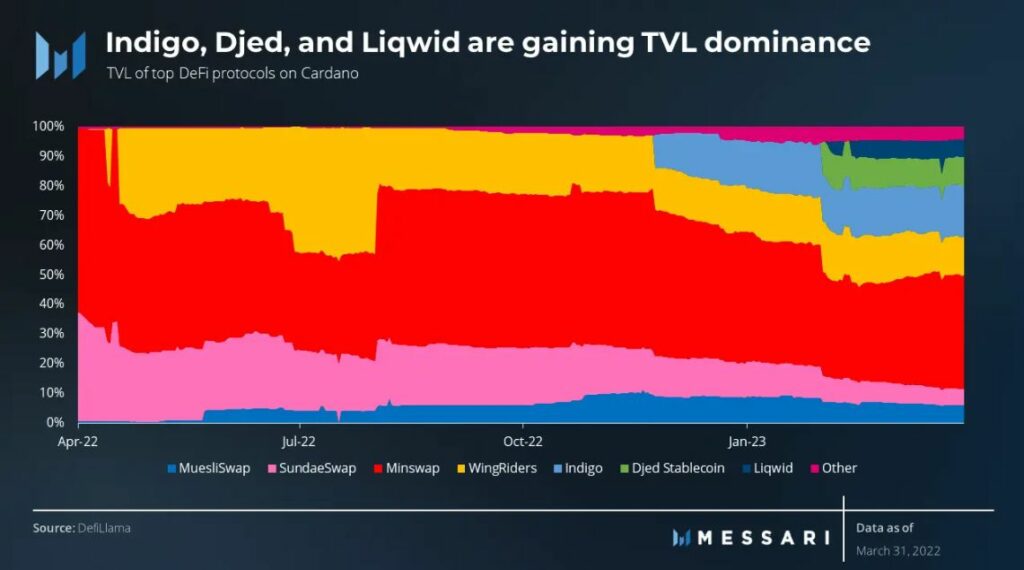

We have already mentioned the incredible growth in TVL of 172%. Part of this growth is the addition of stablecoins to the Cardano ecosystem. They played an essential role in this. However, the original DEXs started to lose ground. For example, Minswap’s dominance is declining for the second quarter in a row. The dominance of other DEXs is also decreasing. SundaeSwap, MuesliSWap, and WingRiders are all losing ground.

New DeFi dApps

So, it is interesting to see to whom they are losing ground.

- First, there are stablecoins. Their volume grew even more than DeFi TVL. 261% from $2.8 million to $10 million. Compared to 172% of DeFi TVL growth.

There are currently three live stablecoins in the Cardano ecosystem.

- RUSD, by Shareslake, launched in Q3 2022.

- IUSD, by Indigo, launched in Q4 2022.

- DJED, by Djed, launched in Q1 2023. No less than $1.8 million minted on its first day. It’s backed by overcollateralized ADA. It has a 9.5% dominance, which translates into a TVL of $13.1 million.

Stablecoin growth was in the hands of IUSD with a 72% share and DJED with a 27% share. RUSD could barely bring 1% to the table.

- Liqwid is a borrowing and lending protocol. It gained an $8.4 million TVL during Q1. This equals a 6% dominance. This is a new protocol worth keeping an eye on. In March, it saw no less than 135,000 transactions. That equals a 10.5% dominance of all dApps. All dApp transactions increased by 7.7%, or 0.3 million, to 3.5 million.

- Indigo is another DeFi newcomer. It issues synthetic assets and stablecoins (IUSD). Its dominance was 17.4%. This translates to a TVL of $24.1 million.

The picture below shows the TVL dominance in the Cardano ecosystem. The new DeFi protocols play an important role here.

Staking ADA

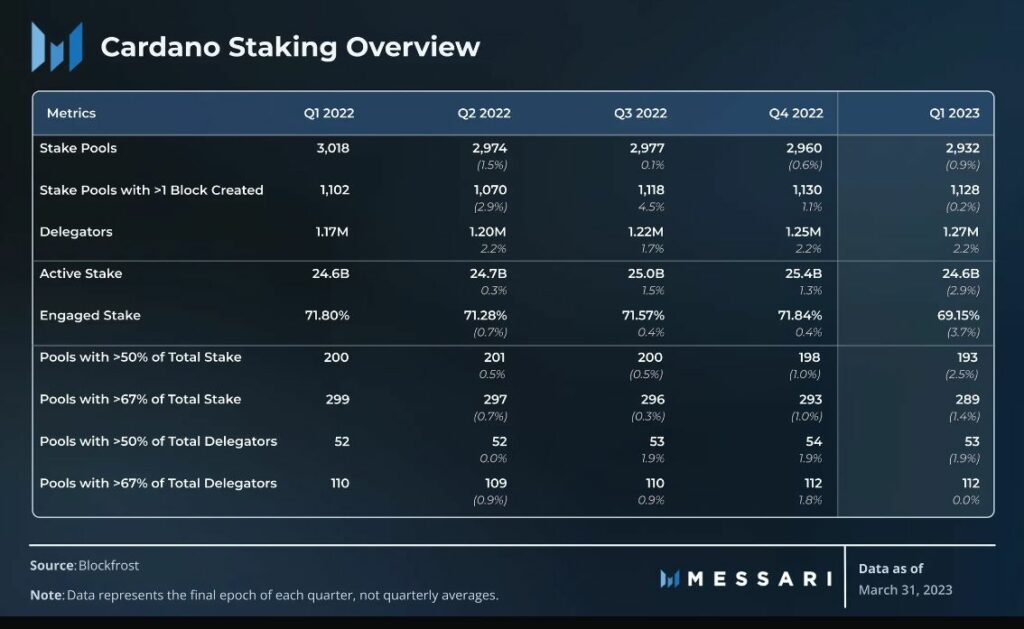

ADA can show off some impressive numbers when it comes down to staking. First, I’d like to explain two different phrases.

- Active stake is all ADA that is currently staked.

- Engaged stake is the total number that all holders can theoretically stake. It’s the percentage of active stake taken out of the circulating supply.

However, combined they are down 1 billion ADA. Nonetheless, that’s only 3% down from their Q1 2023 peak. On the other hand, the active stake is 26.4 billion ADA, or around $10 billion at the current ADA price. Only Ethereum can beat this active stake with $35 billion.

Cardano also has a 69% engaged stake. Only Solana has a similar number of engaged stake. Other large-cap networks are all below 50%. For example, Ethereum or Polkadot.

There’s a lot more going on in the Cardano space. The report also covers, among others, NFTs and sidechains. The picture below shows the staking facts of the ADA token during Q1 2023.

Conclusion

In this article, we recap the Messari report of Cardano’s state in Q1 2023. It shows interesting developments in stablecoins joining the ecosystem. There’s also a shift inside the DeFi space, from established DEXs to new protocols. Furthermore, we also noted some interesting staking facts about the ADA token.

The current ADA price is $0.3957. The market cap is $13.85 billion. There’s a 45 billion max and total supply of ADA tokens. Out of this, 35 billion ADA already circulate.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.