A derivate is one type of financial instrument whose value is dependent on a certain asset. For example, currencies, commodities, stocks, etc. Therefore, when we talk about this concept in the crypto industry, it means that there those assets can be any token.

Nowadays, the crypto derivatives market is growing by leaps and bounds. According to CoinGecko, it currently has $2.6 billion with more than 13,400 projects in it. Therefore, Crypto.com has developed a report where they talk about derivatives.

Did you know those derivate assets are commonly traded on exchanges or over-the-counter (OTC)? They are purchased through brokerages. The Chicago Mercantile Exchange (CME) is among the world’s largest derivatives exchanges. However, anyone can trade crypto derivatives in a decentralized platform, 24/7.

In this report, you will find information related to the most important types of crypto derivatives. Perpetual, Future, Options, and Liquidations. So let’s dive more into the report. But before this, let’s define some basic concepts:

Basic Concepts About Derivatives

- Funding Rates: Periodic payments to traders based on the difference between perpetual contract markets and spot prices.

- Perpetual Contracts: One type of derivative that has no expiration date, allowing them to be held or traded for an indefinite amount of time.

- Spot Prices: Is the current price in the marketplace of the given asset.

- Future Contracts: A financial tool in which you can buy or sell a particular commodity asset at a certain price at a specified time in the future.

- Options Contracts: An agreement between two parts to facilitate an asset transaction at a preset price and date.

- Liquidations: Liquidation is when a trader has not had enough funds to keep a trade open.

Now, let’s take a look at what the Crypto.com report has to show you:

BTC/ETH Perpetual Funding Rate

In the following charts, you will see how BTC funding rates were volatile in April 2022 while the price of bitcoin was in a negative trend. On the other hand,

Moreover, in ETH, this indicator decreased, which proves that traders with short positions increased.

Note: Data shown in charts were extracted from Binance, Bitfinex, BitMEX, Bybit, Deribit, Huobi, Kraken and OKex.

BTC/ETH Perpetual Open Interest/Volume

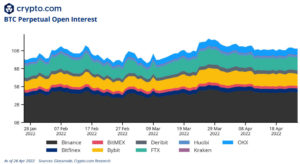

On the other hand, the open interests of BTC perpetual contracts vary according to the exchange. In the following chart, you can see that OKX and Binance have the highest and lowest interest respectively.

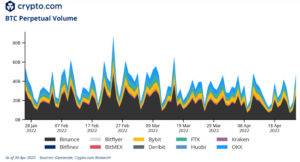

On the other hand, the volume of BTC perpetual contracts reached 80 billion in February 2022. In the other months, the average volume was nearly 40 billion. You can look at this in the following chart.

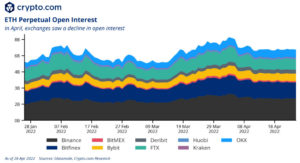

On the other hand, ETH had a different behavior in comparison with BTC, where OKX reached more than $10 billion in open interest in March 2022. However, ETH got a maximum of $8 billion in the same factor and month.

BTC/ETH Perpetual Open Interest (OI) /Future Volume/Options Volume (All Exchanges)

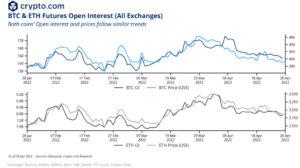

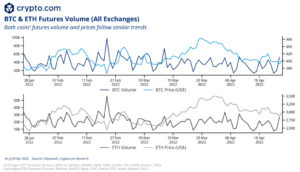

In the future open interest, the BTC OI is bigger than the BTC price from April 2022 until now. However, the ETH price is almost higher than the ETH OI indicator since the beginning of the year.

Moreover, in both future volumes charts, the BTC and ETH price is higher than the BTC and ETH volume since March 2022. This means that the behavior of future trading volumes and prices follow a similar path.

In addition, in the BTC/ETH future volume indicator, both cryptos have very similar behavior. In March 2022, the BTC/ETH price KPIs are higher than the BTC/ETH option volume. It’s important to mention that these measures were made from exchanges like CME, Deribit, FTX, and OKEx.

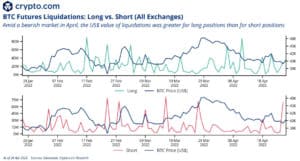

BTC/ETH Future Liquidations: Long & Short.

The short strategies in traders who made their centralized exchanges had higher and more frequent peaks than in the long strategy. Also, the maximum volume of BTC handled by such traders doing long strategy is $80 million while in the short was $75 million.

On the other hand, the ETH liquidation KPI for long and short positions follows the same path as BTC. Traders who use centralized exchanges had higher and more frequent peaks in the short strategy than in the long one. Also, the maximum volume of ETH handled by such traders doing long strategy is $75 million while in the short was $60 million.

Conclusions

In general terms, what this report leaves us with is that traders that use centralized exchange use more bitcoin than ether. Therefore, the movement of these derivatives tools influent more in the asset price. Finally, the tendency of crypto derivatives, mostly BTC and ETH, will continue having a great adoption in traders, and the supply of these products will improve as time goes on.

Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ACCESS PRO membership (worth $99). MEXC supports U.S Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership DM us with your ‘newly signed up MEXC UID’ and ‘Telegram ID’ on our Twitter @altcoinbuzzio)

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.