In contrast to popular belief, traders make the most money during a bear market. That works the same in TradFi and crypto markets. You can use specific bear market trading tactics. On the other hand, you can lay the foundation for once the markets recover again.

It’s time to accumulate and be prudent. Look at blue-chip coins and stablecoins. Maybe not the most exciting movie, but you want to survive, right? And, potentially come back stronger. So, let’s look at how you can do this. Find strategies that allow you to survive a bear market.

Why Is Important to Set up Your Portfolio?

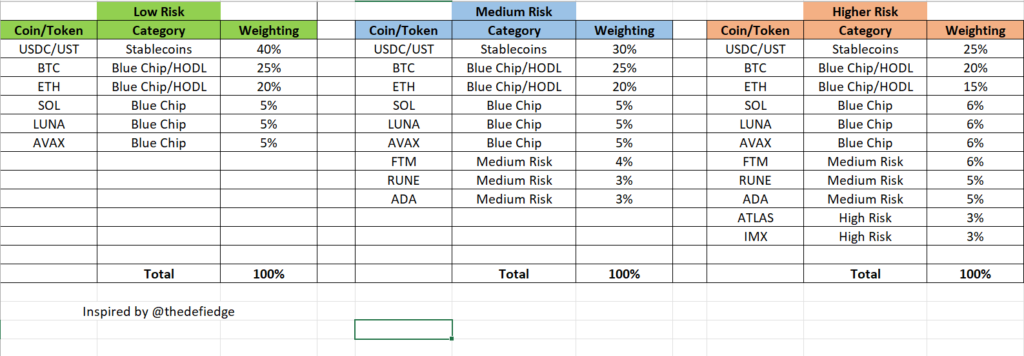

Setting up your portfolio is important because you set up the foundation for the next bull market. Now is the time to play safe. Once that next bull market arrives, there will be a new ATH. However, some projects will not survive the bear market. Below, you can find a picture of a few sample portfolios. They range from low to high risk. Here is an example of low, medium, and high-risk portfolios.

Now, this may not have the projects that you prefer. But, don’t worry, you can set up your portfolio as you like. What is of importance now, is to position yourself in the right way. There’s a logic to follow.

- Figure out how you like to balance your portfolio. Stable-, low-, medium-, and high-risk coins or tokens.

- Chose the projects accordingly.

For the low and medium risk projects, it’s mainly L1 chains. By choosing higher-risk projects, you can decide where you want to put your money.

Then, small-cap coins are risky in a bear market, they may not survive. Hence, blue-chip coins are a safer bet now, they have better funding and most likely more adoption.

Keep on top of your portfolio. Manage and adjust wherever and whenever it’s needed.

1) Stablecoins to the Rescue

On the other hand, this is the time to invest in stablecoins. Even up to 50% of your portfolio. Yawn, yes, we know. However, they are what they say, stable, and that’s what you need in this situation. You don’t need another loss of 70% to 80%. How about making some profits on your stablecoins instead? We show you how you can make a profit on a stablecoin.

- Before you find yourself in a bear market, don’t forget to take profits. Once you double your investment, take it out. All the rest is now 100% profit. You can put your original investment for 50% in stablecoins and 50% in Bitcoin or Ethereum.

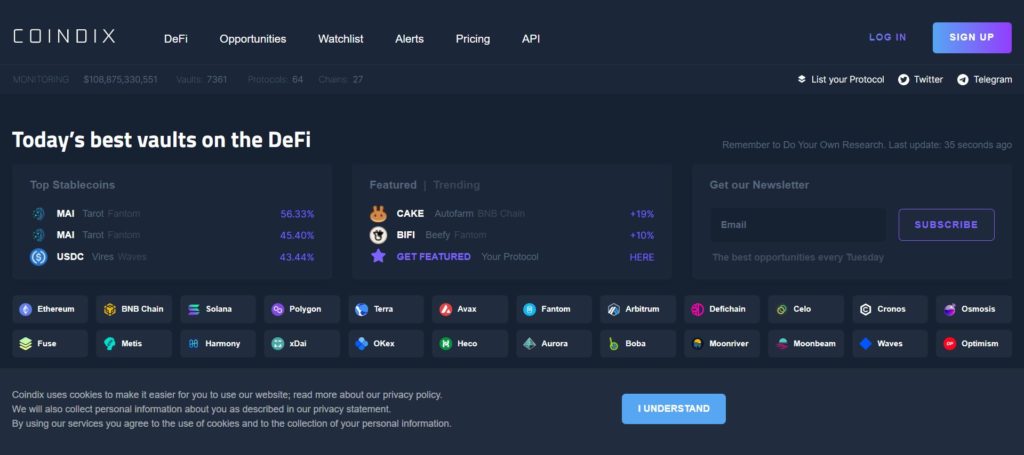

- The easiest way to invest in stablecoins is on Anchor. Currently, at 18%. There are always different strategies you can follow, and we post about many of these. Farming is a great way to earn passive income on your stablecoins. Some farms offer up to 35% to 40%.

- From your yield farming, turn some of your profits back into stablecoins. First, you earn more tokens when the price is down. Once the price goes up again, you have double gains. You accumulated more tokens, and you get a higher price now. To find the best yield farms, you can check the Coindix link below this picture.

Source: Coindix

It’s also a good idea to follow Crypto Twitter and assorted YouTube channels. Lots of good and solid information is available on these platforms. However, stablecoins are not completely without risk.

- The algorithmic stables can de peg.

- Then you have centralized coins like USDT, USDC, or DAI. There is a potential risk that a government freezes them.

2) Buying the Dip?

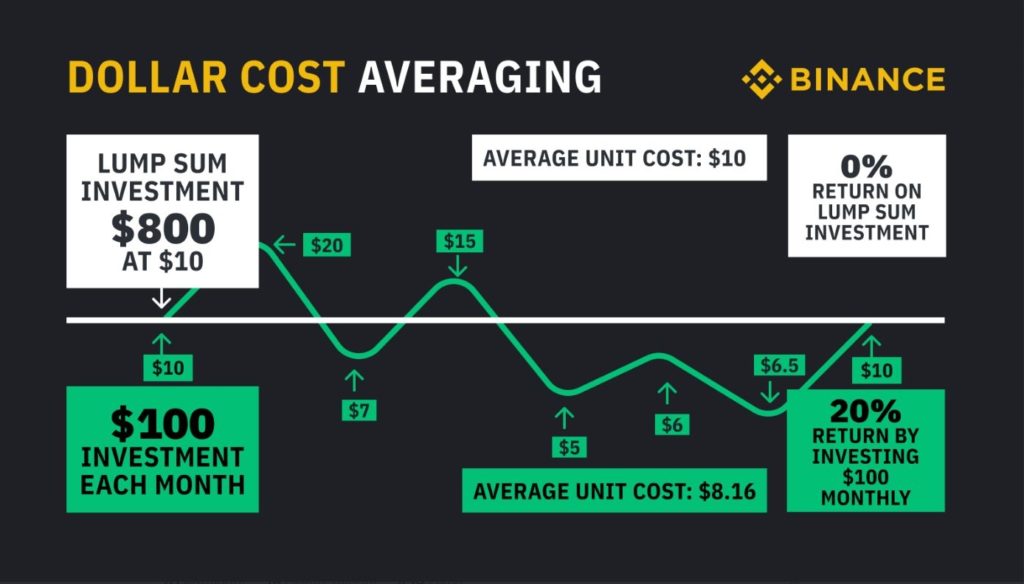

That’s the most heard advice, buy the dip! However, when does the dip stop? That’s a crucial question, right? Well, to tell you the truth, nobody has a crystal ball that allows them to know the future. Dips can be like a falling knife, and you would rather not want to catch that.

So, we have a good option for you; DCA or dollar cost average. Instead of going in with a big wad of cash on one specific day, spread that amount out over several weeks or months. This way you spread your risk. On a regular basis, you add money to your portfolio, regardless of the current price of that asset. Here is a very popular strategy that professional traders use to take advantage of this feature.

Source: Twitter

3) Non-Crypto Passive Income

Yes, having a passive income stream outside of crypto is a good and smart thing to have. Look into having more avenues of income. You can look into a variety of options.

- Invest in traditional stocks or real estate.

- Move forward in your current position. Ask for a higher salary or switch careers.

- Cut down on your expenses.

Furthermore, in the crypto space, there’s high demand for staff. It’s not exactly passive income outside of crypto. However, crypto jobs tend to pay well, pending your qualifications. Web 3.0 is calling! There are many courses out there, and plenty of them are for free.

- Learn a blockchain coding language.

- Video editing. YouTube is a big part of the crypto market.

- Marketing or digital sales.

- Copywriting or technical writing.

- Data analytics.

This is a great quote.

4 years of studying at university can get you a job.

4 years of studying Web 3 can get you financial freedom.

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) April 29, 2022

4) Dive Deep Into DeFi

During the bear market is when you should put the hard work in. Set everything up in such a way that once the bull market starts, you can take your profits. That’s when you can relax and kickback.

Stay updated in DeFi. It’s not always an easy task. However, it’s likely that new DeFi strategies will be even more complex. Work on your basic knowledge now.

Work together with others. Start or join Discord or Telegram groups with like-minded people. Figuring out complicated projects or strategies is easier with others than doing it on your own. Here’s an interesting list of what to do in a bear market.

Source: Twitter

Conclusion

By now, you should have a better understanding of bear markets and making profits during them. Traders make most money in bear markets. We showed you a variety of strategies to follow during a bear market. So, when the next bull market hits, you can reap the benefits from your hard work during the bear market.

⬆️ Also, get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️In addition, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.