Many of you know by now about Curve Finance and its 2Pools and 3Pools. They are a great way to provide liquidity to DEX aggregators and exchanges and you can make some money while doing so. You can also use Curve to find great prices on swaps of many of the most liquid cryptos like stablecoins, ETH, or wrapped BTC (WBTC).

But the Curve Finance TriCrypto Pool is a unique offering where you can unlock some big rewards for holding the most popular cryptos. Let’s check it out.

How Curve Finance Works

Curve focuses on stablecoins. But that’s not all they do in their DEX. The most popular pools on Curve are the 3Pools where you have pools of 3 stablecoins that you can easily trade back and forth between them.

In fact, one of the Curve 3Pools involving UST was how the UST-LUNA implosion began last spring by creating a liquidity issue for the coin with a huge withdrawal. So Curve provides something all crypto markets outside of Bitcoin really need. Liquidity. Combine this with easy and fast trading and swapping and that’s why Curve is so popular.

The Curve Finance TriCrypto Pool

While I’m not sure if the name comes from 3 types of cryptos in this pool or otherwise, this pool starts like one of Curve’s most popular 3Pools. That pool is the DAI-USDT-USDC pool. Along with Binance’s BUSD, these are the 4 largest and most important stablecoins in the cryptoeconomy. These are the coins you are most likely to hold if you are waiting for your next buying opportunity, as we know some of you are. This pool is on the Polygon chain.

The 3 types of cryptos in this pool are:

- Stablecoins

- Wrapped Coins

- Normal, everyday token

The 3 stables are the ones mentioned above. Then the 2 most popular wrapped coins in crypto. Wrapped Bitcoin and Wrapped Ethereum. So we have wBTC and wETH and the 3 stablecoins. Aside from Ethereum itself and BUSD, these are the top 5 largest volume, most liquid, and most popular coins with users in the Ethereum ecosystem.

Then we have the ‘normal’ token. And the token here for that where you receive your rewards is Curve’s own $CRV token. Yes, that means there are 6 tokens in this pool.

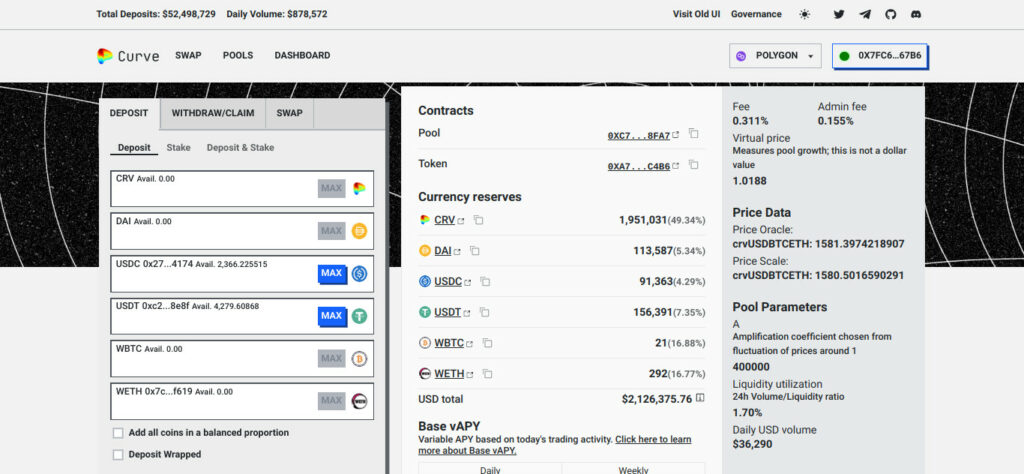

Asset Breakdown in the TriCrypto Pool

As you can see in this screenshot above, the largest reserve in this pool is for $CRV at $1.9 million. The next largest is wBTC at 21 or ~$350,000 with wETH close by. Curve’s 3Pools, which are much larger like the $612 million TVL in the DAI-USDT-USDC 3Pool, have only the stablecoins without the option of swapping, depositing, or earning on your wrapped versions of BTC or ETH.

The APY on this if you hold weekly is only 0.98% but you can boost your rewards. Those rewards are payable in the $CRV token. The way to boost is to stake your $CRV on CurveDAO and then vote lock your $CRV. Then, you can earn up to 2.5x more Curve with this method. This helps convert a low but relatively safe return into some solid returns on coins you are already likely to hold in your wallet anyway.

CRV Price Activity

Curve’s $CRV token currently trades at 56 cents. Its circulating supply is 650 million out of a maximum supply of just under 1.88 billion tokens. Curve’s market cap is $364 million, making it the 88th largest project in the cryptoeconomy.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.