It’s hard to think of a DeFi protocol that’s been around for 5 years and done $7 billion worth of transactions as unheralded and underrated. And yet, that’s what Kyber Network is. Many people are not familiar with them and their services despite doing these huge numbers.

But you’ve probably used their services without even knowing it. Let’s take a look at what Kyber offers.

Introduction to Kyber Network

Kyber Network is a multi-chain liquidity hub and liquidity provider that has seen a lot in its 5 years of operations. Its flagship product, KyberSwap, is a DEX aggregator aimed at being the best liquidity platform to swap and earn on all chains. As they say in their anniversary post, they hit some big firsts for the industry too like:

- Aggregating liquidity pools

- Launched Wrapped Bitcoin (WBTC)

- Introducing the IEO/IDO fundraising mechanism

- Developing capital efficiency for any token pair (not just stablecoins)

- And was the first major DeFi project to encourage DAO governance by rewarding voters with tokens.

So as you might guess, they’ve seen a lot.

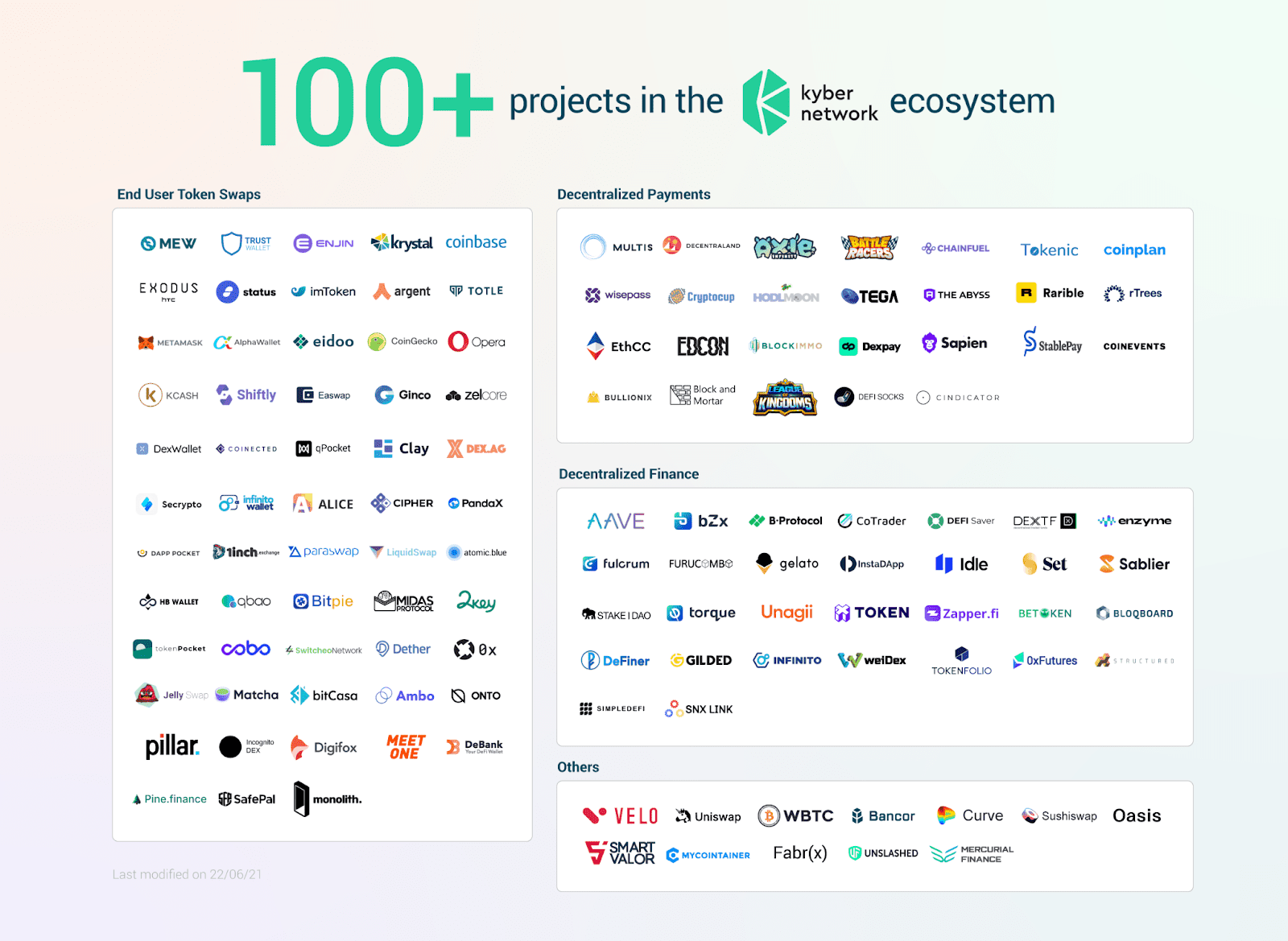

And they do lots of work behind the scenes, too. In fact, some integrations they already have that you might not be aware of include:

- Exodus wallet and Trust Wallet

- NFT and e-commerce payments for Axie and Battle Racers

- Automatic, decentralized token rebalancing and liquidation services for platforms like AAVE and Set

- And many more. Just find your favourite project below.

After all, that $7 billion has to come from somewhere if you are going to do it quietly, right? They enable all these services as ‘powered by Kyber Network’.

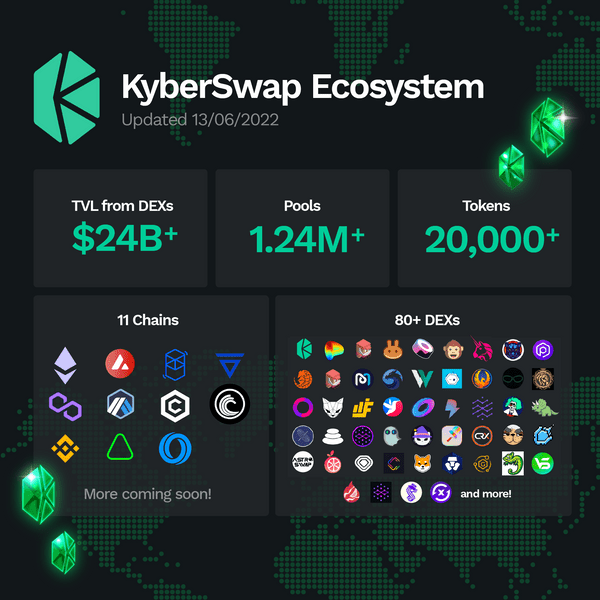

Kyber Network’s flagship product, KyberSwap is a DEX aggregator, sourcing and providing liquidity on 11 different chains by sourcing liquidity from over 80 DEXes to give the best swap rates.

Kyber Network’s goal is to make Decentralized Finance easy for all. After a successful ICO in 2017 under Vitalik Buterin’s mentorship and securing backing from top VCs such as Hashed, Signum Capital, HyperChain Capital, ParaFi Capital and Pantera, Kyber Network is building a group committed to accomplishing this goal.

With KyberSwap, the most advanced DEX Aggregator in DeFi, KyberDAO, the community at the forefront of DeFi and Kyber Ventures, supporting and providing guidance to the next generation of DeFi entrepreneurs, Kyber Network is moving towards a future that is multi-chain, interoperable, where DeFi can be accessible, easy, cheap, fast, and secure for all users.

In the wake of what’s happened to UST, Celsius, and now 3AC, we see that liquidity is important in all crypto markets, but especially in DeFi. After all, a 20% drop, which we’ve seen can happen in a day or two can convert a properly collateralized loan position into one that requires a margin call. Liquidity providers like Kyber Network play an important role in the system.

What is Kyber Swap?

Kyber’s most popular service is Kyber Swap DEX aggregator. With it, you can swap, farm, or earn by adding liquidity to one of the pools with high capital efficiency.

For traders, you can swap thousands of different tokens including some ones we’ve never heard of like the Jarvis Synthetic Euro and common ones such as ETH, wETH, DAI, USDC, and USDT. They even show you different options of where your receiving coin might come from like Curve or Uniswap since it aggregates prices to give you the best deal. You can swap fast at the best rates and for low fees, without comparing on multiple platforms. On their ‘Discover’ page, you can even find trending tokens to swap using their novel algorithm. It’s a great service.

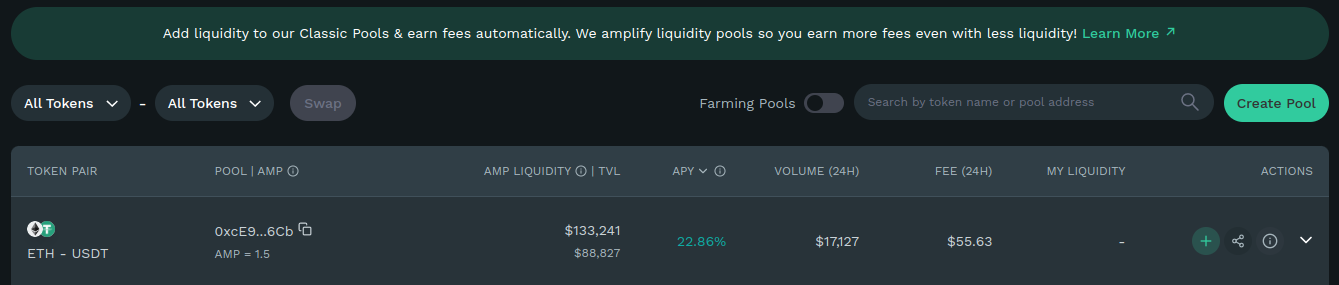

For liquidity providers, KyberSwap has special pools with high capital efficiency that maximizes earnings for liquidity providers. These pools allow deposited liquidity to mimic a much higher level of liquidity.

Two of the more interesting pools we found are:

- Their version of the 2pool with USDt – USDT.e on Avalanche that’s very liquid and when you include farming rewards pays 29% APR. You can also try the USDt-USDC pool on Avalanche which gives 14.3%. Both are very nice rates.

- And if you think the crypto market leaders will move together higher or lower, then this Wrapped Bitcoin-ETH pool is an interesting choice. It pays 12.33% and if you think the leaders will rise together, then your risk of impermanent loss goes down while holding the 2 leading projects in the industry.

The highest yielding pool we found is a nice one for ETH fans as it’s ETH-USDT paying 22.86%.

KNC Price Activity

And lastly, for today, Kyber Network has its own native token $KNC, currently used mainly for governance on KyberDAO where KNC holders can stake their KNC assets and vote on governance proposals in return for KNC rewards. These rewards come from a portion of network fees collected through trading activities on KyberSwap. As more trades are executed and new protocols added, more rewards are generated.

Unlike most in the industry, they haven’t gone down 90% in the last 6 months. Its recent high after a nice run-up was $5.70 in late April but now it trades at $1.43 well off its low from a year ago. KNC is bucking the trend of all-time lows in the market.

A little more than half of their tokens are circulating in the market with 102 million out of 198.9 million in circulation. This reduces the odds of dumping newly issued tokens into the market. Today, the 24-hour volume is just under $20 million and its current market value is $146 million, making it the 194th largest project in the cryptoeconomy.

As we said at the top, underrated and under-recognized for its successes in the market.

If you want to stop losing money on DEX exchange fees and save 0.2% on each trade, start using KyberSwap today.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Kyber. Copyright Altcoin Buzz Pte Ltd.