DeFi is becoming more popular. DEXs are in great demand and seem to thrive well. Especially after we saw a major CEX like FTX going down. Still, both CEXs and DEXs have their pros and cons. But what if you combine the best of both worlds? That’s where Polkadex enters the scene. They offer an order book on a DEX.

So, let’s have a look at what exactly is going on at Polkadex. Enjoy the following short introduction video to Polkadex.

DeFi and an Order Book DEX

DeFi means Decentralized Finance. In other words, there is no middleman involved in any transaction. This is in contrast to trading on a CEX. You face a centralized trading process on a CEX. DeFi changed all this. You can argue that Bitcoin started DeFi. After all, it lets you control this digital asset. Especially in the beginning, when it was all P2P trading.

However, we’ve come a long way since. In 2015, Ethereum launched. This enabled smart contracts. In 2017, MakerDAO and a few other DeFi platforms launched. In 2020, we saw Compound launching the first DeFi token, COMP. Now we see growth in DeFi platforms that are not Ethereum-based.

One of the main reasons that DeFi is so popular is that it is non-custodial. In other words, you are in control of your crypto assets. On a CEX, the centralized exchange has the keys to your wallet. Remember FTX? Many people lost lots of money because of this.

But DeFi also never promised you a rose garden! DeFi and DEXs also have a few pitfalls to consider. During the early Ethereum days, there were silly high network fees. And that’s not all, here are some other things DeFi brings along, for example:

- Price slippage

- Front-running

- Low interoperability

- Or how about limited functionality

🎉 POLKADEX ORDERBOOK IS LIVE 🎉

The CEXier DEX is finally here 😏

Combining the advantages of CEXs and DEXs while tackling the issues of both, #PolkadexOrderbook is set to revolutionize #DeFi & become the trading engine for #Web3.

Get all the details👇https://t.co/e8JjZqsH3t

— Polkadex (@polkadex) October 31, 2022

What Is an Order Book DEX?

An order book DEX works differently compared to a traditional DEX. In the popular AMMs (Automated Market Makers), liquidity pools are the norm. There’s no order book. The price of an asset is mathematically calculated. It depends on the supply and demand of the crypto assets in a pool.

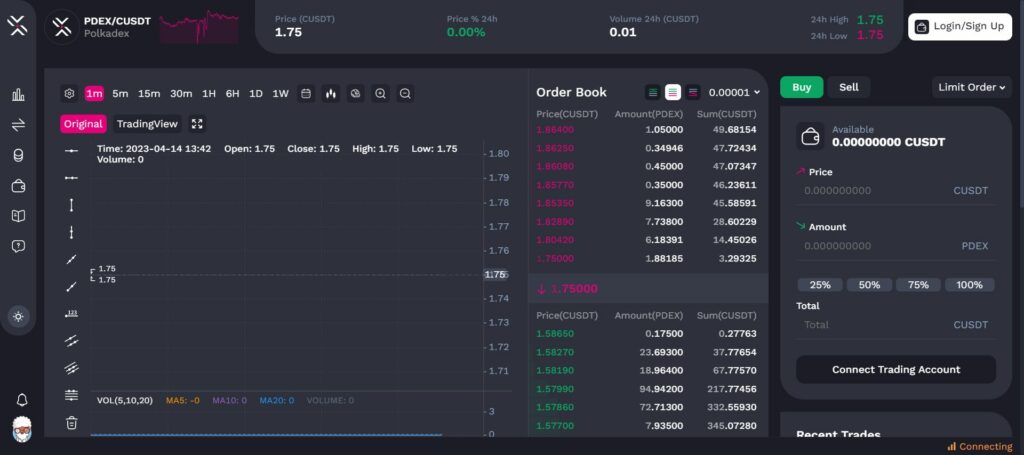

On the other hand, an order book displays buy and sell orders. The order book matches buyers and sellers. There’s the highest buy price, or best bid, on one side. Then we have the lowest sell price or the ask price on the other side. There’s a limit order, which lets you determine at which price you want to sell or buy. Alternatively, there’s also a market order. When you use this, it executes at the current best price.

Once the order book matches a buy and a sell order, the transaction goes through. It swaps the assets and it’s a done deal. It’s a dynamic market, always acting and reacting. The order book gets updated all the time.

What Is the Polkadex Orderbook DEX?

The Polkadex order book combines the best of two worlds. I already discussed a few drawbacks of a DEX. For instance, high network fees. So, this is a reason that many users still stick to a CEX. However, these have their own drawbacks. How about hacks, data breaches, or custodial wallets? The latter was made real by the FTX collapse. Overall, you are handing control of your assets over to the CEX.

So, it comes down to choices if you choose a DEX over a CEX. For example, which one is:

- Cheaper

- Faster

- Custodial or non-custodial

- Offering better trading options or privacy

This is where Polkadex makes a difference. As already mentioned, it combines the best of both worlds. Furthermore, both options have issues, but Polkadex tackles them. As a result, it looks and feels like a CEX. On the other hand, it has the security and non-custodial advantage of a DEX.

Polkadex leaves you in control of your own assets. If you keep your non-custodial wallet safe, there’s no hack. You trade as fast as on a CEX with a TPS of 500,000. That’s the trades per second! So, there’s high scalability. Latency is also sub-millisecond. That’s the time it takes from adding a transaction to a network and its confirmation.

Here’s a great explanation on how to set up a Polkadex account. You will also find detailed information on how to trade on the Polkadex Orderbook. The picture below shows the Polkadex UI.

Source: Polkadex Orderbook

The Current Polkadex Orderbook Version

The current version of the Polkadex Orderbook launched around six months ago. It takes time, trial, and effort to build this. That’s why you can currently only trade with the PDEX-USDT pair. PDEX is their own token.

However, they are getting ready to introduce more parachain tokens. Among others, Moonbeam. When that is successful, they will bring on as many DotSama projects as possible. DotSama being Polkadot and Kusama! This should be during May. Towards the end of May, their mainnet may be fully functional. This will also see the listing of DOT.

Conclusion

With the Polkadex Orderbook DEX, we see a change of direction in the traditional DeFi setting. It proves that DeFi is evolving and examining new ideas and plans. We see improvements in transparency and liquidity. This also includes improved price discovery.

An order book on a DEX will be key in the adaptation of DeFi. You are in control of your assets, with non-custodial wallets. However, you can enjoy the benefits of a CEX. But, without the pitfalls of centralization. It’s a perfect hybrid between a DEX and CEX.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Polkadex. Copyright Altcoin Buzz Pte Ltd.