The QuarkChain network is all set to launch a new chapter in DeFi. It plans to build a next-generation DeFi network that offers higher security, lower transaction fees, and higher usability. Evidently, QuarkChain has proved to be a serious contender of Ethereum. It had solved most of the existing problems faced by Ethereum with its proprietary Boson consensus technology. Now, it plans to leverage multi-native tokens, DEX, and sharding to build the next generation DeFi network that will support large-scale DeFi platforms.

According to QuarkChain Founder and CEO Dr Qi Zhou, the next generation DeFi network needs to be secure, scalable, and user friendly. Speaking at the On-Chain Fintech Conference, Dr Zhou explained how QuarkChain plans to build an even more flourishing DeFi ecosystem.

After a very busy first half of 2020, QuarkChain is now focusing on building QSwap functionality. This is a new product for decentralized exchanges (DEX) that will solve a very big concern for its next-generation DeFi network. Apart from this, some exciting DeFi games are also under development.

In the month of July, QuarkChain achieved some major milestones. It announced an official partnership with an ecological department under a Chinese government province. Furthermore, it launched a Blockchain as a Service platform in-deep technical cooperation with AWS.

QuarkChain will launch the first phase of its DeFi campaign in August. It will give participants an opportunity to create multi-native tokens through a bidding process. Whether a participant wins a bid or not, he will receive rewards.

How does QuarkChain plan to solve existing DeFi Challenges?

DeFi has been expanding rapidly. In February 2020, the Total Value Locked (TVL) in DeFi was close to $1 billion and at the time of press, it has surpassed $4 billion. Undoubtedly, the scale of activity on DeFi is remarkable but it faces some major deficiencies. According to Dr. Zhou, existing DeFi ecosystem is facing 4 major challenges:

- Security

Even the well audited DeFi platforms like Bancor, Lendf.me, and Balancer suffered security vulnerabilities. All three platforms suffered an attack due to different types of security vulnerabilities. While Bancor suffered due to a major security flaw, Lendf faced a reentrancy attack and Balancer was in soup due to a non-standard ERC20 token.QuarkChain’s solution

According to Dr. Zhou, multi-native tokens can help solve security issues. In the existing DeFi set up a user needs to “approve” the user’s asset (ERC20 token) before participating in a DeFi dApp. In order to avoid multiple approvals, a user provides approval with an infinite allowance. And this puts all the user’s assets at risk. This is exactly what happened in the Bancor hack where assets worth $455k went missing.With a multi-native token approach in the DeFi ecosystem, the user approval would no longer be required. Moreover, the token issuers can claim ownership, and owners can be DAO and mint the tokens. This approach would also resolve the non-standard ERC20 token security issues (Lendf.me).

- User Experience

Currently, all DeFi users need to have ETH to pay the transaction fees on DeFi platforms. A lot of work is being done to support ERC20 tokens as fees.QuarkChain’s solution

The project intends to solve user experience challenges by providing multi-native token support and DEX. Using DEX, the DeFi users can swap the native tokens with default gas tokens. This also solves a major concern that could arise due to the usage of multi-native tokens. If the new generation DeFi network can use multi-native tokens for transaction fee payments then they would beat the utility of default gas tokens. DEX plays a crucial role in preserving the utility of these default tokens. - The Scalability

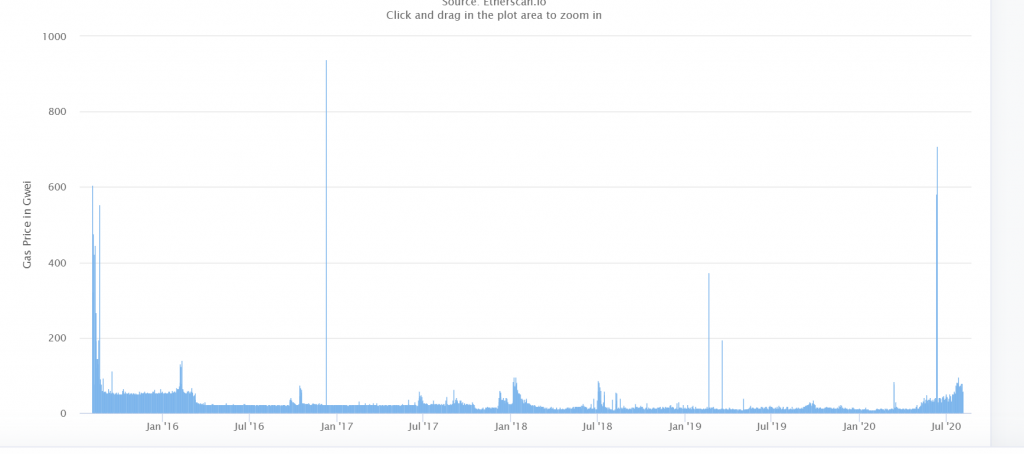

Ethereum network has faced scalability challenges earlier. The kind of attention DeFi is grabbing, it is congesting the network and causing the platform usage fee to spike.

Source: etherscan.io

QuarkChain’s solution

Multi-Chain technologies such as sharding promised by ETH 2.0 is a solution to scalability challenges. But it is being questioned whether ETH 2.0 will be able to retain cross-chain composability. Many believe that ETH 2.0 will be able to retain it but that would require modifications in ERC20 tokens.

Using QuarkChain moving native tokens between shards will enable cross-shard DeFi composability.

4. Developer Experience

Currently, developers need to put considerable coding effort to support ETH and ERC20 tokens on any DeFi platform. For example in Compound, two sets of code CErc20.sol and CEther.sol are required to support both the token.

QuarkChain’s solution

QuarkChain will ensure that on the next-generation DeFi platform, minimal code is required to support multi-native token. This would considerably bring down the coding effort the developers put in today.

Previously, Altcoin Buzz covered major QuarkChain updates on our YouTube channel-

Building a stronger community

The size of the QuarkChain Korean community doubled in the month of July after the community held a 5-day quiz event. In the month of August, QuarkChain will be holding round #3 of its bounty program. The participants will have an opportunity to share millions of QKC rewards.

Currently, QKC is trading at $0.00711109.

—

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This interview, overview, or update article has been compensated for media cooperation and has been sponsored for by the interviewed or reviewed organization. Copyright Altcoin Buzz Pte Ltd. All rights reserved.