FTX, LUNA, 3AC, BlockFi, and Voyager. 2022 was brutal for crypto traders. But in the long term, these wash out events turn to be good for the market. How? Why? How can people losing faith in crypto be good? How can people losing billions of dollars be good?

In this article, I’m going to explain it to you why exactly this great crypto Market Cleansing is good for the market. And you need to know and understand this because this is the only way you can time big gains in this bear market rally.

How Is This Good for Crypto Market? Because First Principles

I’d think your first question about this would be what can possibly be good about this?We’ve seen many projects go bankrupt and people lose billions of dollars. How can that be good? And of course, the answer is it’s not good especially if people lost their life savings.

Crypto originally, especially in the form of Bitcoin, was founded upon some key principles. And let’s be honest, some of our industry either never learned this or need to be reminded of what those key first principles are. Principles like:

- Self-sovereignty.

- Privacy.

- Decentralization.

- Separating Money from the State.

- Censorship Resistance.

- Financial Inclusion for Everyone.

- Self custody.

What is the total #crypto market cap in 2023?

Total crypto market cap ended January at $1.07T, a 30% increase YTD and above the $1T mark for the first time in two months. pic.twitter.com/zSehG8KSlQ

— Ganymede (@Ganymedem_com) February 6, 2023

These 7 are some of the most important elements for the entire industry. Now let’s look in more detail. FTX is a great example here. It was a fraud. We know this now. And it looks like it was a fraud from the very beginning. With its commingling funds between it and Alameda and ‘selling’ its customers Bitcoin it did not have. Look at this list of 7.

Does FTX Satisfy Any of Those Key First Principles?

The answer is No. Had they done what ethical exchanges do, which is say use us to buy your crypto and then move it to a self custodied wallet, that would be in line with first principles. But they didn’t. And they were:

- Centralized.

- Not Private (customer lists are becoming public now).

- Not a money issuer or attempt to be one with their FTT coin. Only used their scam coin to finance future investments and control in other projects.

- Not censorship resistant since as a centralized exchange they can negate transactions or halt withdrawals as they have done.

- They custodied everything themselves instead of encouraging you to self custody.

So based on the first principles of the industry, is losing FTX such a big deal? No. It’s a benefit that scammers and those that don’t want to follow what’s important to us as an industry are exposed for what they are. Now don’t get me wrong. We still sympathize with investors who were defrauded by this and it’s terrible that it happened.

But is it bad for the industry? Is it going to kill crypto? Obviously Not.

Market Volatility

You may have noticed recently, especially in December that volatility in Bitcoin and Ethereum wass way, way down. It seemed like Bitcoin was trapped between $16,600 and $16,800 for over a month. That range is only 1% of Bitcoin’s price. This is the same asset we’ve seen move 15-20% daily. Now only 1% over an entire month.

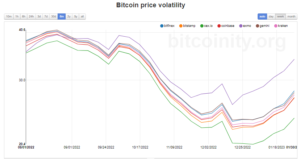

But then we saw a huge comeback in January. Is the bull back or is this a bear market rally or bull trap? We don’t know. The numbers on volatility bear this out too. Since November, after a slight drop in late October and recapturing the same 25%+ Volatility throughout November, volatility has dropped like a stone.

Many of us think of volatility positively since the history of crypto has been profitable and growing. But volatility has downsides with both huge moves downward and long bear markets as we have now. Peak volatility for Bitcoin in Q4 was 26.26% and now after a long steady drop to 9.37% in early January it’s only just climbed back into the teens getting closer to normal levels.

Bitcoin got a nice bump from $16,500-$17.500 range to the 22,000-24,000 range now. That’s an almost 40% gain on still relatively low volatility. The 6-month chart is even more striking. Seven major exchanges see a drop from 48% to 10% volatility, matching the BitMex numbers. Volatility bottomed up in January and is still relatively low.

Source: Bitcoinity.org

Why is Low Volatility Good?

For the current market, low volatility is good because many speculators are out of the market. Volatility is lower because derivatives like futures and options are trading lower. Many billions more in BTC and ETH futures trade than spot trades in BTC and ETH.

And more futures meant more volatility. Now fewer gamblers like FTX and fewer legitimate speculators are in the market. This means projects that are building can build and not be as worried about price. Projects can also focus on their communities and not have to answer questions from a 3AC about why their price isn’t moving when some other project has a higher price.

This is good news. Less gambling and nonsense and more of trying to build independent, sovereign financial and income-generating tools for more people. This recent rally doesn’t change that either. Overall sentiment is still sideways to partially negative. A good time to build.

Do you think these quieter days of lower volatility are good or bad for crypto? Let us know in the comments below.

Trading Volume

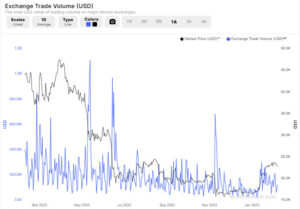

While Binance gained market share against other CEXes from 48% to 66%, total CEX volume dropped huge. It dropped 46% in 2022 from 2021. Part of this is 2021 up until November was a bull market and people were trading a lot. Also, another part is people seeing that all centralized projects have potential issues and could blow up as Voyager and BlockFi did.

Source: Blockchain.com

Another is all the FTX volume went away. It was a popular exchange. Yet another reason is that people remembered that decentralization and self-custody are first principles. They went to look for DeFi options like Uniswap and PancakeSwap instead. Uniswap now has higher trade volume than Kraken.

Volume is way down and this is both a positive and a negative. That’s despite recent increases from this rally. The negatives are pretty obvious. Less trading activity means fewer big moves for short-term profits. Fewer futures traders mean fewer spot traders too as many trade in both markets together in what’s known as the Carry Trade. Also, it can make markets less liquid. But, as this rally is showing us, buyers are still here. And some volume has come back. But not like it was.

Why is Less Volume Good?

Less trading volume is good for crypto mostly because many are asking questions about if the industry itself can survive. I understand why this is but honestly, it’s a silly question. The industry is far too big and important, especially in emerging markets, to go away now. So the facts are we have much lower trading volume. And what’s happening differently?

It turns out not much. Everything in the market from exchanges to swaps to DeFi to metaverse to NFTs to games is functioning just fine with lower trade volume. So while it’s nice to have more volume, the idea that financial speculation and short-term quick flips to make money are the reason many of us are here turns out is not really true. Many profiting in this rally are still holding too and not selling.

People are here for projects and sectors they care about. And that will continue, as will crypto as an industry.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.