YfDFI, the project aiming to rebuild traditional financial services with a community-built DeFi ecosystem rolled out its Q1 and Q2 2021 roadmap. And we must say the roadmap is aggressive and really impressive. As a one-of-a-kind project built in the most decentralized manner, YfDFI has achieved almost all the milestones defined for Q4. Furthermore, it is heading towards the much-anticipated Liquidity Farming Platform (V1.0) release before Christmas 2020.

A team of DeFi enthusiasts initiated the project. They want to give the world a DeFi Financial Center fully owned and governed by the community. Initially, it started as a Telegram group of like-minded DeFi enthusiasts who received YFD tokens as rewards for their skill contribution. At that time, YFD now trading at $284 was a valueless token. However, weeks later people started volunteering to contribute to YfDFI ecosystem development, community management, social media building, and marketing.

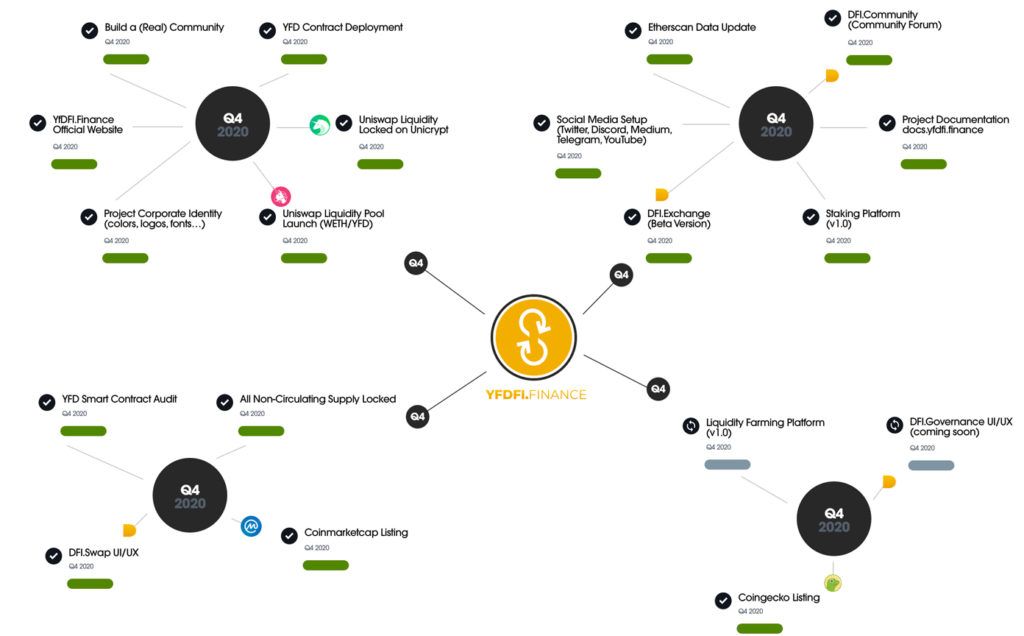

Here is what YfDFI achieved in Q4 2020.

Build a (Real) Community

The project has built a real community. Even with a heavy bitcoin retracement, YFD is holding strong. This is because the supply locked in the staking pool is yielding 375% fixed APY. Moreover, this will continue until April 2021.

YFD Contract Deployment

The community developed the contract and Nasdax Security Team audited the same.

Uniswap Liquidity Pool Launch (WETH/YFD)

With an initial YFD supply of 6,500 tokens, the liquidity pool was launched on Uniswap. Moreover, the liquidity providers are currently earning 0.3% of transaction fees on Uniswap. Also, the Unicrypt contract locks the entire YFD liquidity on Uniswap.

DFI.Exchange (Beta Version)

The beta version of DFI.Exchange, the first Decentralized Exchange (DEX) dedicated to DeFi projects. The team launched it in mid-October 2020. Interestingly, the DFI.Exchange is fully governed by YfDFI Finance community. What does that mean?

- The community will choose the tokens to be listed or delisted on DFI.Exchange. Using DFI.Governance, the community will conduct voting to reach a consensus.

- The YFD holders will share the income generated by the exchange on monthly basis. An automated revenue sharing system will support the setup.

- Reasonable listing costs.Furthermore, the team is currently working on ChainLink API integration to ensure the best price feeds to the DEX. Other integrations in the pipeline are the Chartex APIs to make sure the DEX has maximum chart features.

DFI.Community (Community Forum)

The DFI.Community, the forums to discuss technical aspects, proposals, staking, rewards, announcements, knowledge, and general items are live and active.

Staking Platform (v1.0)

The team released DFI.Staking Pool A in mid-October. The YFD token holders are staking their tokens and earning up to 7.2% interest WEEKLY (APW). Furthermore, the interest generation might continue until April 2021. Moreover, by this time all YFD tokens reserved for Pool A will be distributed.

All Non-Circulating Supply Locked

The non-circulating token supply on Uniswap, the team tokens, the staking pool contract, and more remain locked in different contracts. So, until the end of development, the community can enjoy peace of mind.

DFI.Swap UI/UX

The team released UI/UX of DFI.Swap in mid-November. Furthermore, it is a kind of community-powered Uniswap dedicated to DeFi where YFD holders will share all income generated. DFI.Swap v1.0 Alpha version is under development and will include:

- Integrated ERC-20 non-custodial wallet creator

- Dedicated wallet for YFD token

- Metamask support

- Support Deposit/Send DeFi tokens (ERC-20)

- Atomic-Swap between ETH, YFD token and other DeFi tokens

- User transaction history

Coinmarketcap Listing | Coingecko Listing

Coinmarketcap listed YFD token was on 16 November 2020 and yesterday it was listed on Coingecko too. Furthermore, the YFD holders can now track their portfolios in real-time on Coingecko.

Check @YfDFI_Finance

🚀10,200YFD over 50% of Supply has been locked in staking pool yielding 375% Fixed APY until April 2021

🚀Around 1MIL Mcap & just listed in Coingecko

🚀Roadmap and Liquidity Farming Coming Soon🚀AUDITED, RUGPROOF

— Vanessa ₿ (@CryptoVanessa) November 26, 2020

Coming soon!!

Liquidity Farming Platform (v1.0)

The Liquidity Farming Pool might go live before Christmas 2020. The community is pretty excited about the launch as all Liquidity providers (LPs) on Uniswap will be able to farm their LP tokens (Uniswap Pool Tokens). In addition to that, they will earn up to 10% interest WEEKLY (APW).

DFI.Governance UI/UX

The team claims, DFI. Governance will be the fairest and most effective on-chain community voting system. Furthermore, the team will release the UI/UX of the platform soon and by the end of Q1 2021, the first version of DFI.Governance will also release.

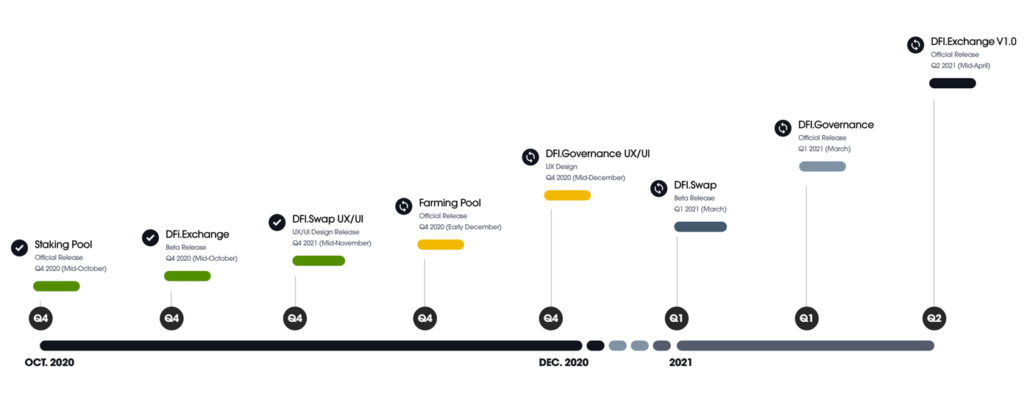

Busy Q1-Q2 2021

According to the roadmap shared with Altcoin Buzz, during the Q1 of 2021, the team will build the DFI.Swap and DFI.Governance. By the end of Q1 2021, both platforms will go live.

During Q2 2021, the team will release a complete version of DFI.Exchange. Currently, the team is working on improving the user experience on staking/farming platforms. Moreover, it is quite possible that in 2021, YfDFI will integrate Ferrum Network, the first Staking-as-a-Service platform to expand the features of Staking.

All in all, the team will release all the above platforms before the summer of 2021. Furthermore, the team will also kickstart the development of DFI.Insurance, DFI.Self-Banking and DFI.Ventures.

YFD Price

At the time of press, Coingecko shows the YFD token is up by 12.2% in the last 24 hours. Currently, YFD token is trading at $284.4.

For more crypto-related updates, do check-out our Altcoin Buzz YouTube Channel.