Today we’re sorting and sifting through the rubble left by the Terra/Luna tragedy. It’s still making its way through the markets – the first week the Terra and UST holders got rekt. In the second week crypto projects who held these tokens in their portfolio, & farming, and liquidity pools got rekt.

In this article, we’re gonna take a quick look at the tragedy and most importantly, give you a secret tip – a warning signal – that can protect your stash if a token or a stablecoin might be falling off a cliff thanks to Evai.

The Terra/Luna Tragedy

So what happened? Basically an unknown attacker borrowed 100,000 Bitcoins in order to short them, plus he sold BTC to LUNA in return for $1,000,000,000 UST that he dumped on the market exactly at the right moment – as Curve was switching from a 3-pool into a 4-pool. Thus investors got squeezed, because there was nobody who wanted to buy their UST and the price fell from the cliff. You can read the whole story in our previous Altcoin Buzz articles & analysis here.

This yet again shows that the crypto industry is a very risky beast. Leaving many people asking themselves: “Was there any way I could have seen this coming?” But there is a tool that can give you signals like this. We’ll show you this tool in a second. But first a story. We think you will see why it’s relevant to our discussion here…

Enter Evai

Back in August 2021 we discovered a new project called Evai. The idea is very simple – crypto ratings. A powerful concept copy/pasted from the stock market industry. If something works, there’s no need to reinvent the wheel, right? Basically in stocks it’s Standard & Poors awarding companies with different ratings. As an investor, this gives you an important signal to know how much risk you’re dealing with when investing in a particular stock.

Evai does the same in crypto. The A ratings are the best “blue chip projects”, Bs are in the middle, and Cs are very weak – enter at your own risk. The only difference is that in crypto the ratings change much more often. Because the market has more volatility. We have written an entire article here about how their platform works. The most important thing you need to know is that the ratings come from sophisticated AI & ML algorithms thus removing the potential for human bias and error.

If you’re a keen investor you’re like: “Okay. If this platform gives ratings to crypto projects, then this rating will change over time. Can I make money on this? For example, as soon as I see the rating going up, I will long the token, or I will short it if the rating goes down.”

Trust But Verify

Great question my dear Watson. That’s the same thing we asked ourselves when we came across this project. But you know in crypto people will promise you the sun AND the moon. So that’s why we put their ratings to the test last year. And the results were astonishing. We did 30 days of paper trading to prove if their ratings work or not (initially we wanted to invest live money, but some tokens Evai pointed to were not listed on major exchanges).

Time To Make Money

Astonishingly, even as an amateur trader, I was able to make 34% profit in just 30 days. Our Altcoin Buzz colleague, crypto investing & technical analysis expert Pratik AKA Crypto Mathemagician, was able to make 179% in the same time frame. Incredible. You can dive into our whole trading story here.

Early signal for Terra/Luna tragedy?

Now let’s come back to the Terra/Luna tragedy. It left us wondering – what if Evai’s ratings could have warned us about this crash? Just like the canary in the coal mine – giving early warning to the traders. So you could safely withdraw your money or maybe even short Luna and make a fortune? Could Evai ratings see this coming?

Of course, we wanted proof. So we contacted Matt Dixon, Evai’s Founder and CEO and asked him to give us the Luna charts and ratings to see how Evai fared. Nick was glad to show us. And here they are just for you.

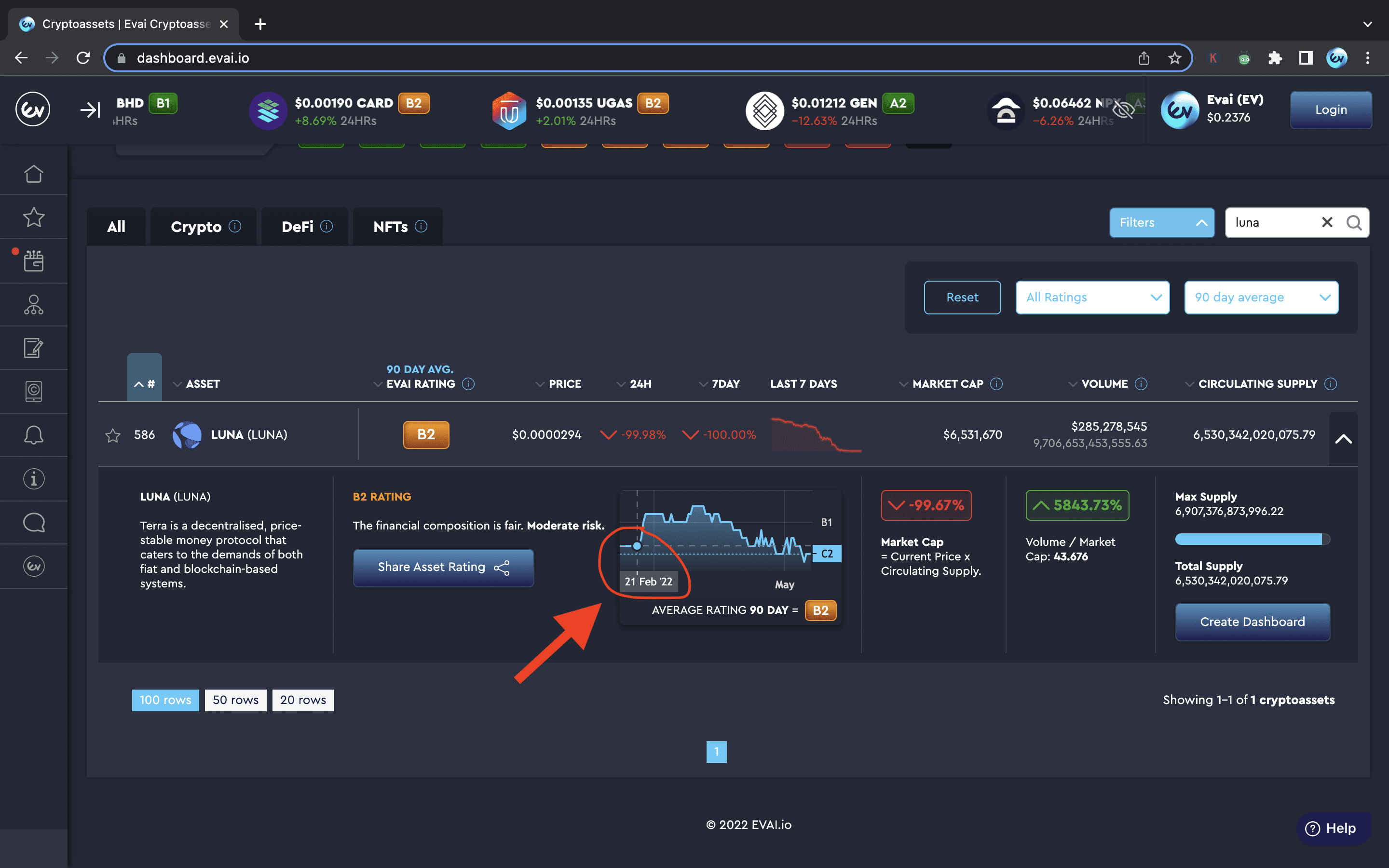

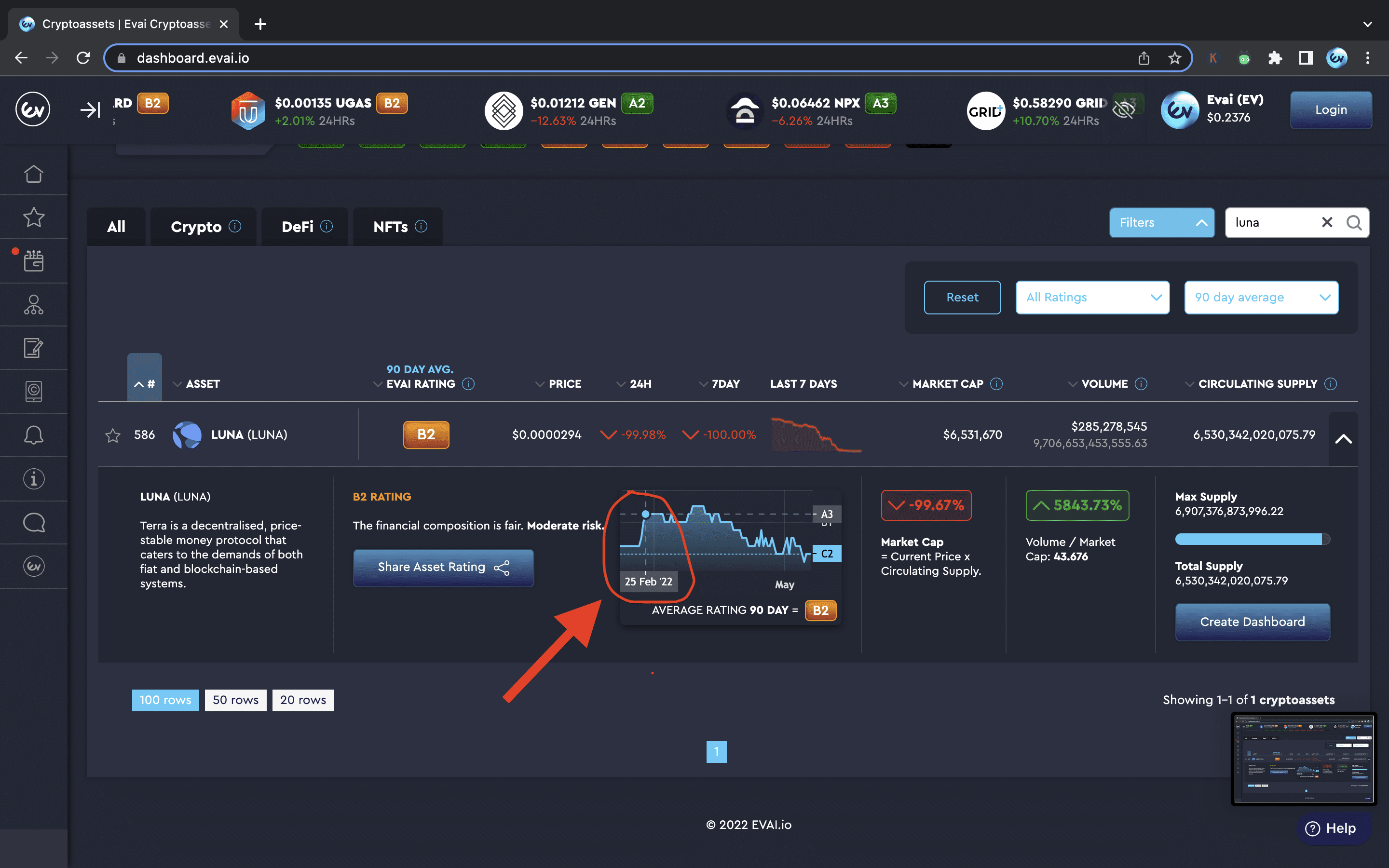

As you can see on February 21st Terra is C2. The price is $49.61. Then the rating improves over the 4 days into A3 – the blue-chip zone. The price stands at $65.44. Then Terra makes the run for it all the way to $116.29 on April 6th – trading between $75 to $100 from Feb 28th to that fateful May 6th. What a great call from Evai here! Giving a signal at $65.44, just before the rally started.

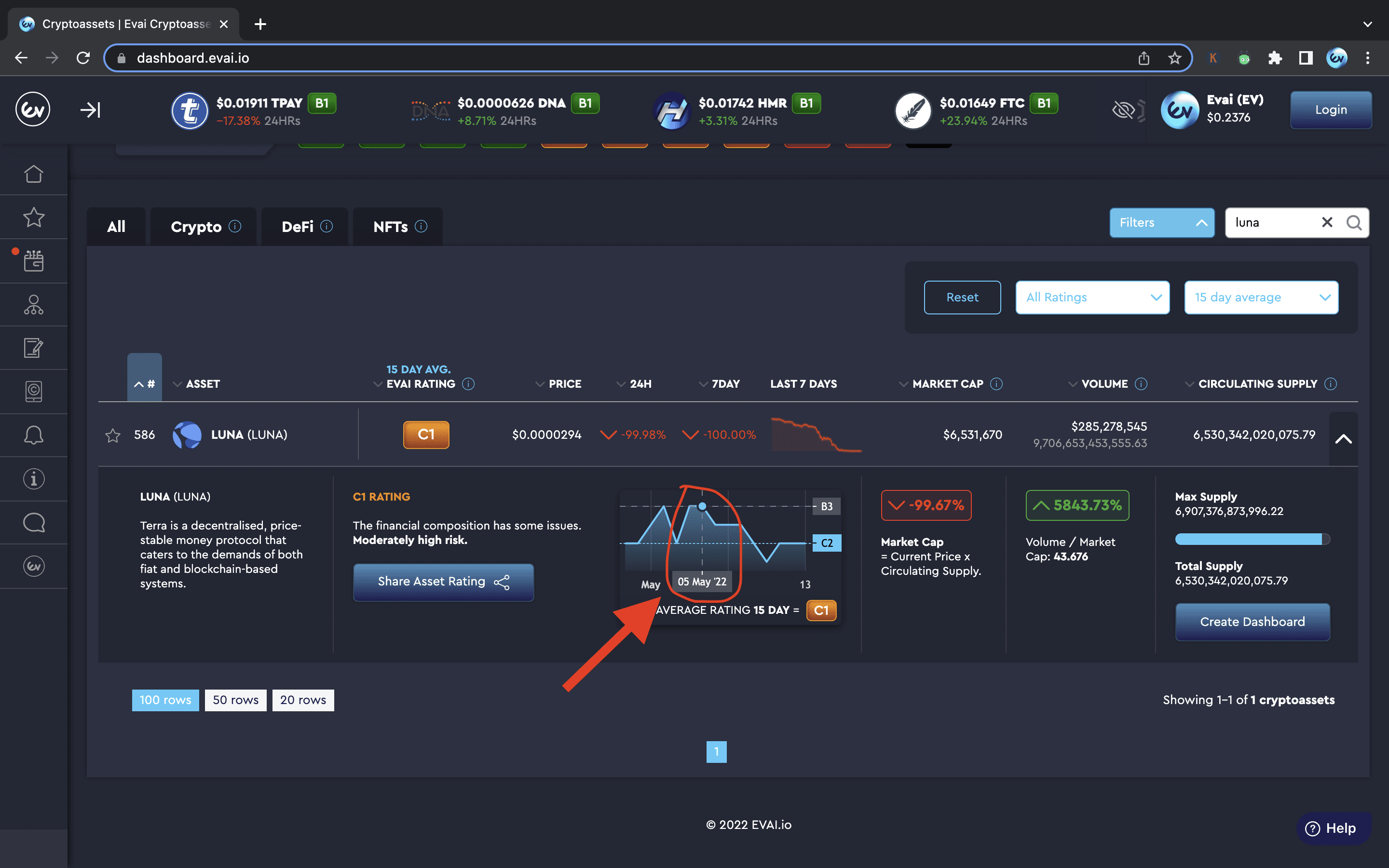

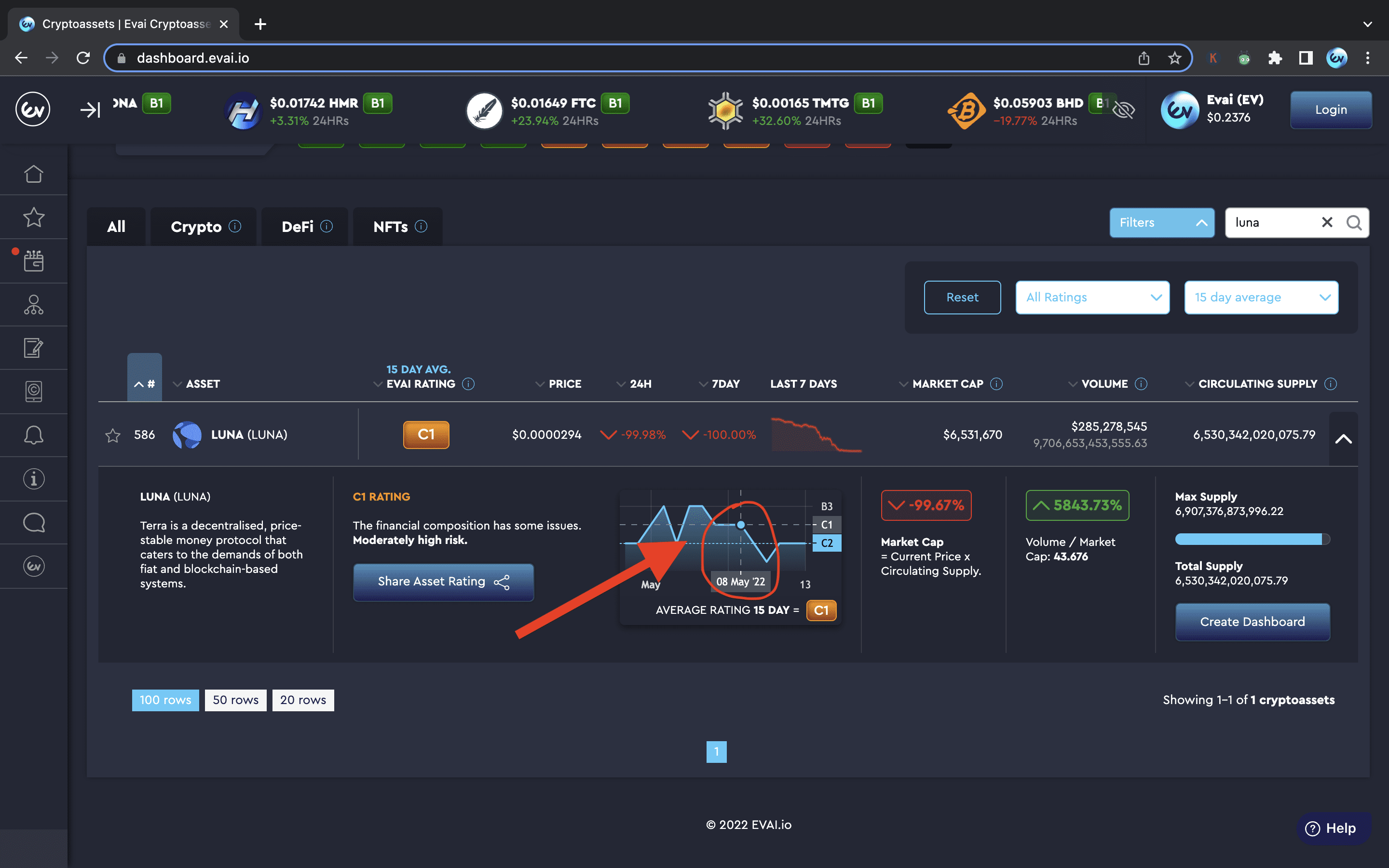

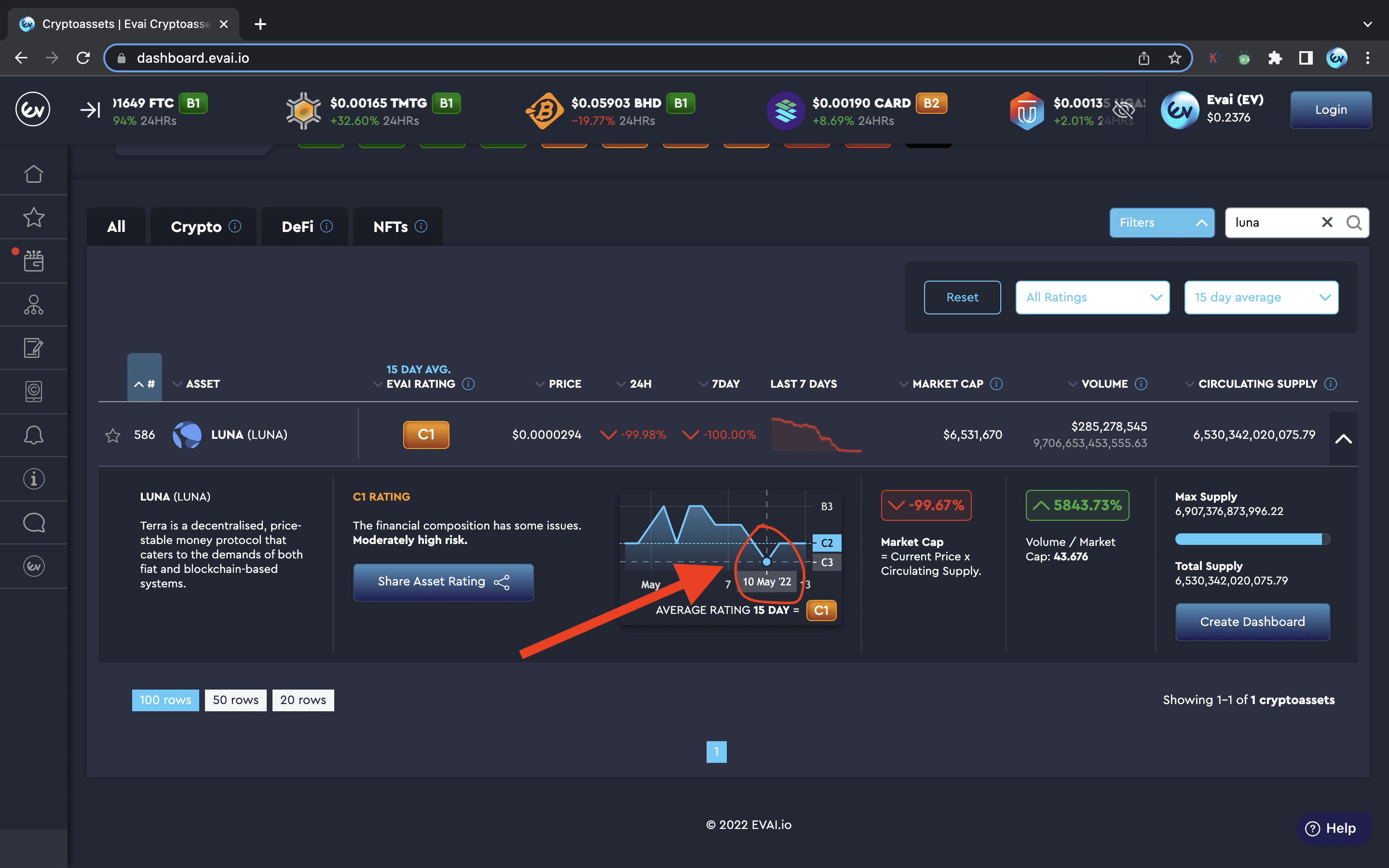

What about Luna’s downfall? We see the rating tumbling from B3 on May 5 to C1 on May 8. Then all the way down to C2 on May 10. That’s your canary in a coal mine warning signal right there.

Here are all the screenshots from Evai’s dashboard about the changes in the Luna ratings. And FYI, Evai is not currently tracking LUNA so you won’t be able to find these ratings on the site today.

Two screenshots below show Luna’s rating improving from C2 on Feb 21 to A3 on Feb 25

Luna’s downfall – Rating tumbles from B3 on May 5, to C1 on May 8 and to C2 on May 10

Parting Thoughts

Is Evai the magic bullet that can predict all the market moves? No. Nobody can do that. At the same time, it’s a great tool you can use for your trading and investing. Here are just a couple of ways how it can help you make more money:

- Provide you with an initial assessment of how risky is the token you’re thinking about investing in.

- Give you hints about future price movements when the ratings change. Thus giving you signals for potential long or short positions.

- Giving you early warning when the tokens you invested a lot of money in, might be going down. So you can get in quickly and do what’s necessary to protect your stash.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Evai. Copyright Altcoin Buzz Pte Ltd.