Based on the Polkadot (DOT) blockchain, Polkastarter is a decentralized protocol built for cross-chain token pools and auctions that allows new projects to raise funds in a decentralized, permissionless, and interoperable environment.

Due to its interoperability nature, the Polkastarter platform allows cross-chain interaction with different blockchains, thereby increasing the boundary of the blockchain system. This is one of the important factors that most of the new projects are looking at, considering the current scenario of the blockchain ecosystem.

Polkastarter allows decentralized projects to raise and exchange capital. Projects can list their native tokens into the Polkastarter DEX platform with a fixed price per token throughout the initial supply. Companies will be able to raise funds using various auction models such as sealed-bid auctions, Dutch auctions, dynamic, and fixed ratio swaps.

Features

- Cross-Chain Swaps

- Fixed and Dynamic Swaps

- Anti-Scam Features

- Full KYC Integration

- Governance Model

- Permissionless Listing

The platform also offers several other features that include permissionless listings, token swaps by smart contract, private pool with password protection, whitelisting, and high slippage price alerts.

What is a Fixed Swap Pool?

Every project comes with an initial token supply when it gets launched in the blockchain eco-space. The Fixed Swap Pools in Polkastarter aim to maintain the initial set token price throughout the sale until the initial supply is completely exhausted.

Polkastarter allows the new incoming projects to list at a fixed price. Using a Fixed Swap Pool, projects list their token and set up a pool with a fixed per-token purchase rate.

With this concept, the idea is to bring control over the token price volatility from its launch. This will also help in building trust and transparency on the project and its investors over the amount of money raised and tokens sold.

Advantages of a Fixed Swap Pool

Fixed Swap Pools aim to resolve the following three main challenges:

- Lack of control mechanisms – unfair token distribution and liquidity rug pulls

- Prevent token dumps by private investors

- Reduce token offering costs

In the case of a token launched via AMM liquidity pools, the price of the token increases with the increase in supply. That means if you are an early buyer, your profit margin will be greater than those who have invested later than you as they need to pay a higher price per token.

But with a Fixed Swap Pool, the token price is set for the entire initial supply. Projects using the Initial DEX Offering (IDO) model know precisely how much money they’ve raised and how many tokens they’ve sold. It controls the maximum investment per user or the number of investors allowed in the pool. Soft caps and hard caps can be hardcoded into the smart contract. Apart from this, several other elements can be set to ensure maintaining a transparent and democratic environment for all token holders.

How Can Projects Use Polkastarter?

Polkastarter allows a new token launch platform to raise funds by setting up a swap pool based on a fixed rate for token purchase.

These Fixed Swap Pools offer many advantages as compared to traditional fundraising models like ICOs, IEOs, and IDOs (Initial DEX Offerings) as it helps in maintaining the initial token price throughout the sale until the initial supply is exhausted.

Polkastarter helps projects to raise capital in a cheap, fast, and transparent way. It will avoid the predominance of savvy investors to buy out the max pool share of a newly created token before other normal user participation.

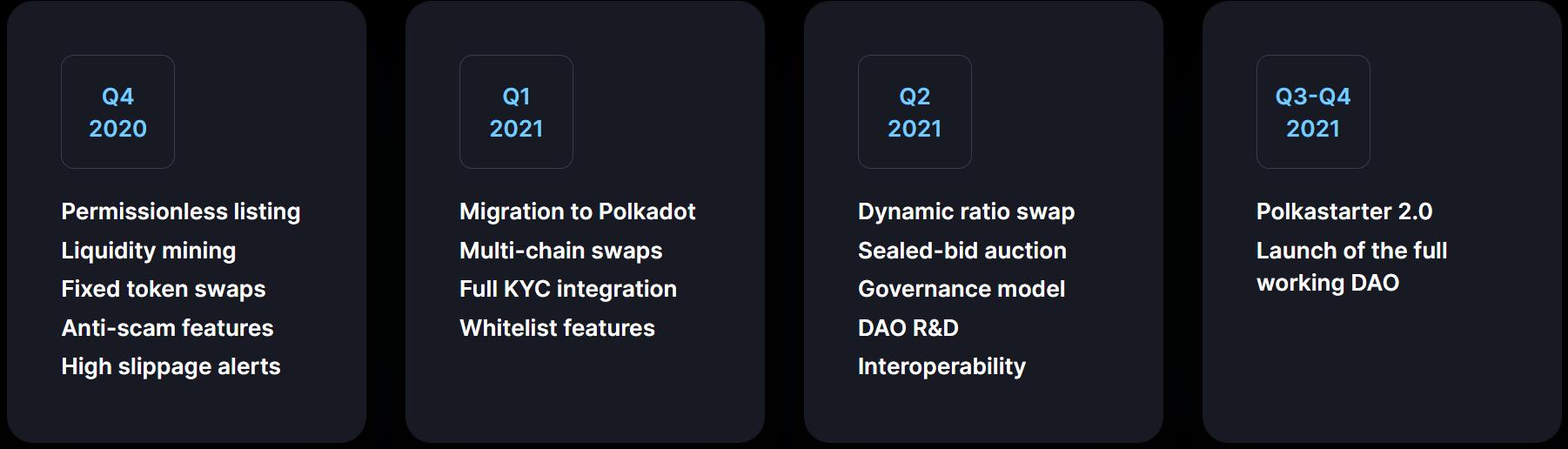

Quarterly Overview of 2020 and 2021 Roadmap

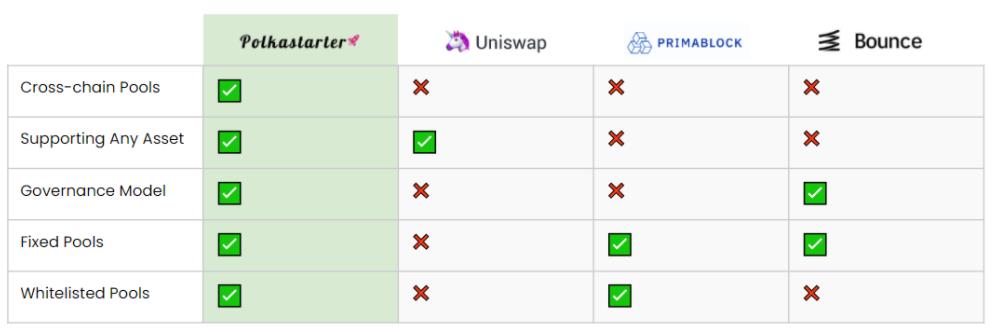

Comparison With Other DEXs & Swap Platforms

Polkastarter offers quite a few attractive features that are making it different from other DEXs or swap platforms.

With its upcoming MVP, the platform is planning to focus mainly on the FixedSwap smart contract. The unique $POLS staking, governance model, and Polkadot migration features can make Polkastarter become an ideal choice for a project’s token launch platform.

Platform Overview

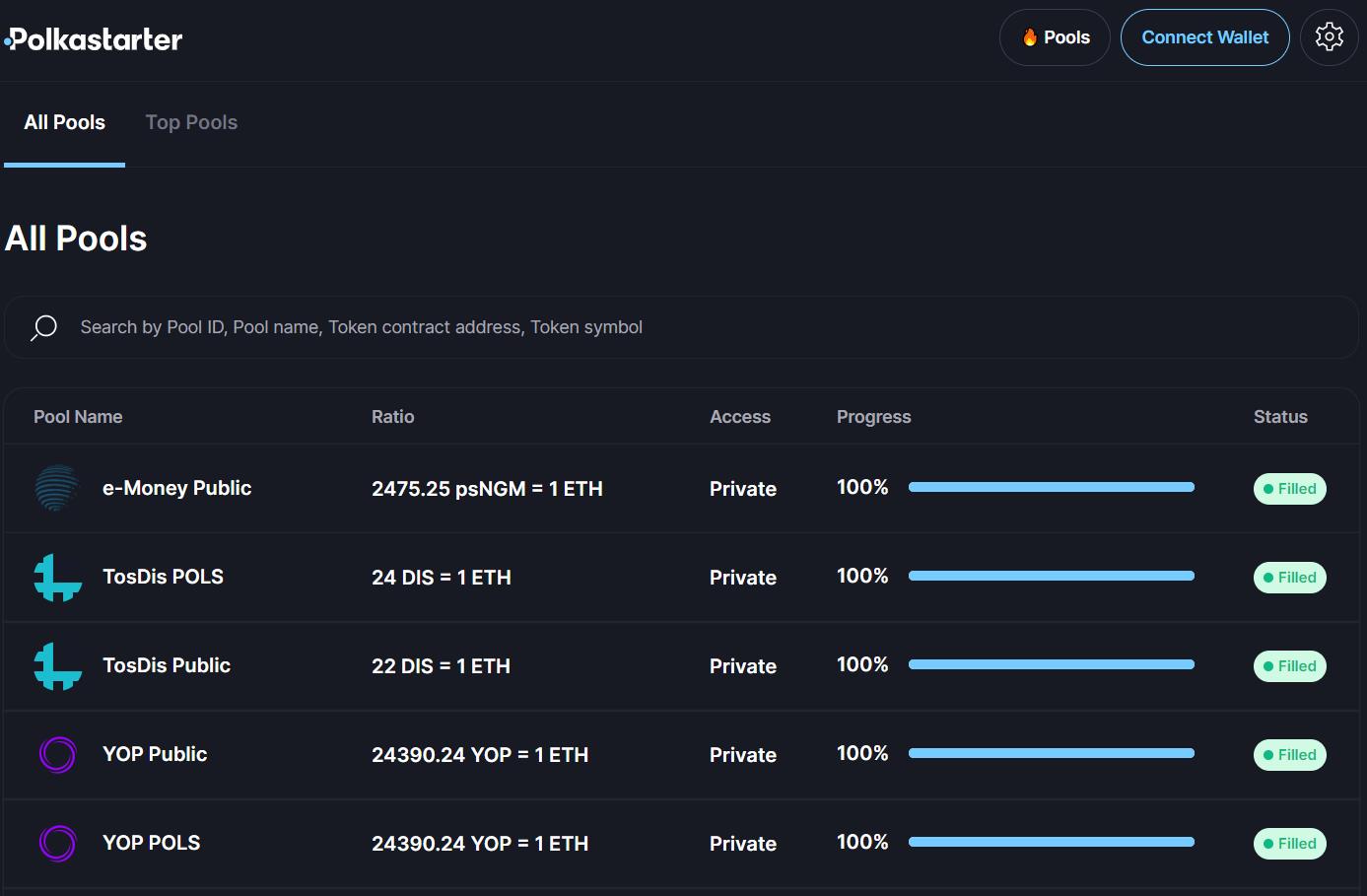

Go to this page. As of February 16, 2021, the platform has conducted various Initial Decentralized Exchange Offerings (IDOs) with 38 different pools consisting of both public and private offerings. Out of which, only one pool failed to sell out.

You can see the list of all filled/closed pools from the tab.

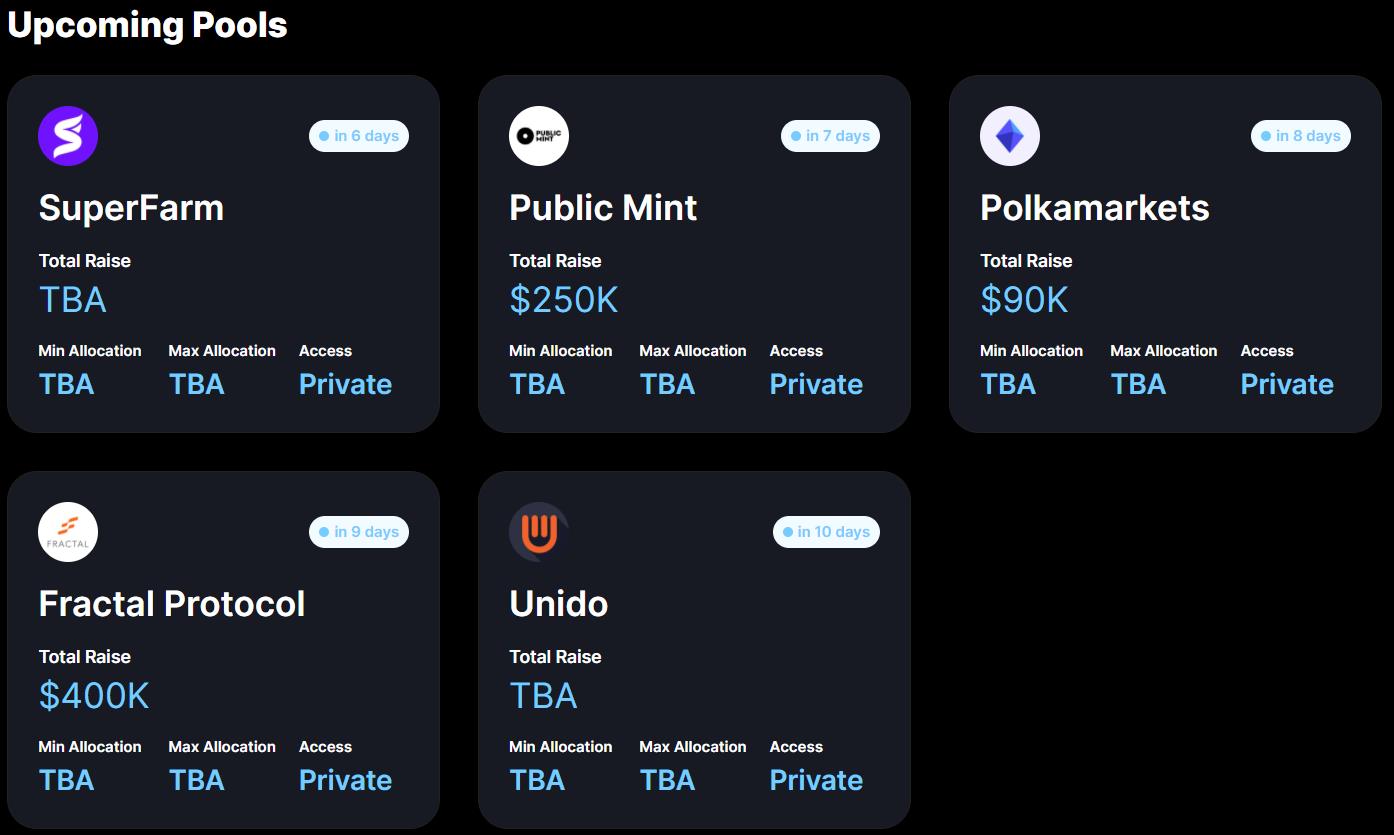

You can also check the upcoming pools here where you can participate.

POLS Token

Polkastarter’s native utility token is the POLS token. The POLS token has several utilities. It can be used to pay for the transaction fees. The token holder can participate in the community governance model. Users can also stake their POLS tokens and earn rewards.

Social Presence

Conclusion

Polkastarter is an innovative project that aims to change the fundraising process of crypto projects. Being backed up by Polkadot and with many successful IDOs help in bringing trust among the common masses, which can easily be seen with the recent price hike in the POLS token. We can say that Polkastarter definitely offers those features that are in need of the current blockchain space to move it a step further. The advantage of interoperability and fair token price will help in increasing the platform’s adoption and popularity among various user groups and organizations.

Resources: Polkastarter Website

Read More: RAMP DEFI: Usage Guide of Tezos rStake Integration