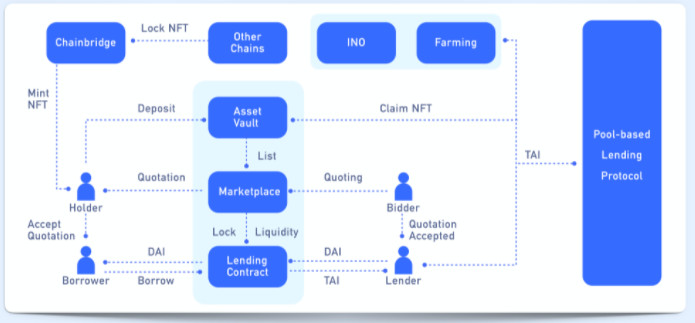

Taker is a liquidity protocol for novel crypto assets. It uses a quote-by-lock-in approach to utilize novel crypto assets. Asset holders can utilize their locked liquidity by borrowing stable coins.

Taker uses NFT assets as the starting point to provide lending services for all kinds of novel crypto assets of the future. It is one of the first batch of NFT loan protocols which supports Uniswap V3 LP tokens. It increases the liquidity for NFT assets and improve the efficiency for NFT lending and borrowing services.

What are the current problems with NFT markets?

1. Poor Liquidity

Current NFTs are very illiquid and lacks application scenarios and liquidation tools.

2. No Application Oracles

AMMs have a very high liquidation risk and pricing difficulty for NFTs

3. Low Interoperability

NFTs cannot do liquidity mining like ERC20 with AMM trading pairs.

Solution by Taker

1. Locking

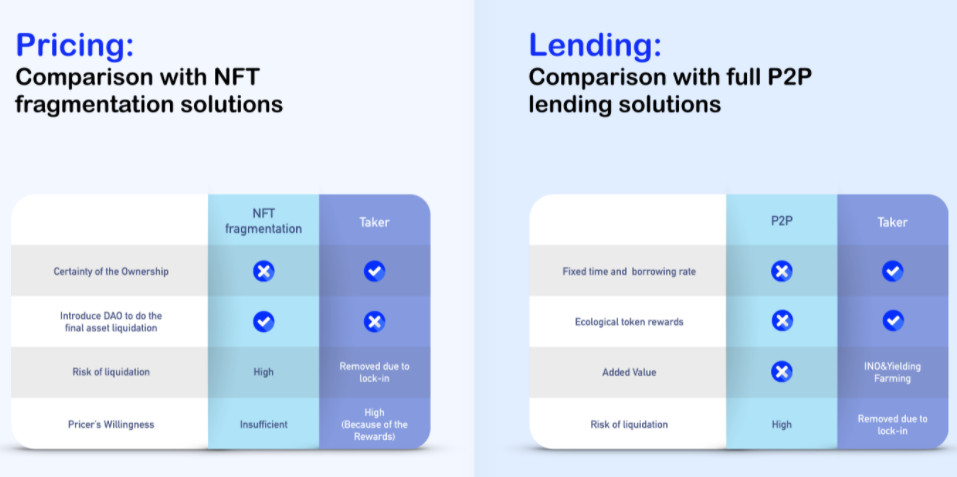

Taker removes the requirement for oracles by locking price and peer-to-peer quoting.

2. Token Incentive

Both borrower and lender will get incentives in the form of ecosystem tokens as rewards.

3. ERC-20 Token Minting

TAI is an ERC-20 asset and lenders can use it to mint the ecosystem token or join other DeFi activities. It is an interest bearing token. A lender can get an equal amount of TAI after lending DAI. TAI serves as a gateway for NFT to the DeFi world. It is not tethered to fiat. Its price reflects the healthiness of the NFT market.

4. Ecosystem Rebalance

You can use TAI to buy newly issued NFTs through INO activities from the Taker platform.

What does Taker do?

With the launch of Uniswap V3, the LP tokens are changed from ERC20 into NFTs. Taker have developed specially designed incentive mechanism to attract Uniswap V3 LP token holders, which provide sufficient asset and liquidity. With the huge traffic generated from V3 LP tokens, Taker can redirect lenders for the whole loan market for NFT assets.

NFT Lending

The Taker protocol designs a new model for NFT lending. Soon, NFT synthetic indexes will be introduced to DeFi NFT assets and stimulate the liquidity and turnovers of NFT’s. TAI is an interest-bearing token. After lending out DAI, a Lender can get the equal amount of TAI. However, as an ERC20 Token, TAI is not fiat-tethered and only serves as a gateway for NFT’s to enter the DeFi world.

1. The price of TAI reflects the healthiness of the NFT marketplace

2. Multiple scenarios for the TAI circulation to incentivize lending & borrowing

3. A link between the DeFi world and the NFT world

4. Essential to build a pool-based NFT lending protocol

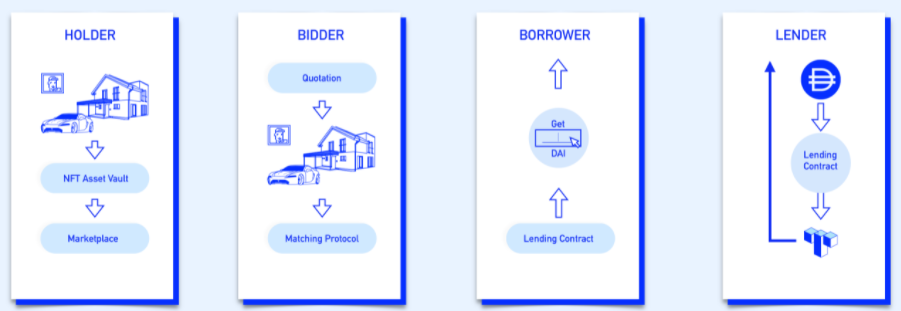

Lending and Borrowing

NFT tokens have different IDs corresponding to individual assets, therefore it is impossible for the market to price them uniformly. In Taker protocol, an NFT asset is inherently deemed to have a value of zero, which changes only after the corresponding lending transaction is completed. Next, the lender becomes the temporary holder of the NFT asset and receives interest-bearing tokens and homogenized ERC-20 token TAI.

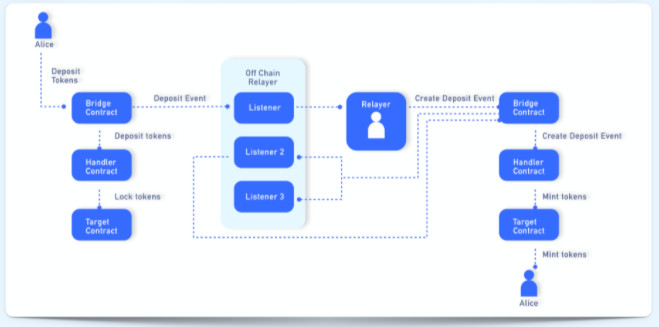

Cross-chain Bridge

Currently, DeFi is built on Ethereum, supporting almost exclusively Ethereum assets. However, quality assets across other public chains should be made available for DeFi, too. It is utterly necessary for the Taker Protocol to deploy a multi-asset, cross-chain bridge contract with reference to Chainsafe’s Chainbridge solution. This contract can transfer ERC721 assets.

The Taker protocol builds cross-chain bridges to connect various public chains, such as ETHEREUM, POLKADOT, NEAR, SOLANA, and Polygon. These bridges will enhance the efficiency of asset transfer and enrich application scenarios.

DAO Governance

The Taker token ensures effective collaboration for holders to use their voting power and participate in community governance.

Layer2 Network

The Layer 2 network is constructed using Polygon to reduce gas cost, improve asset turnovers, and expand data processing capacity. The network’s DeFi attributes and NFT ecology are supported by our protocol.

Pricing Process

NFT types supported:

Taker supports Encrypted Collectibles, Commercial Papers, Metaverse Assets and Physical Assets.

Protocol Overview

What are the uses of Taker Token TKR?

1. Governance

Holders can participate in on-chain governance and voting as decision-makers for major events.

2. Dividends

Holders of Taker token will receive a share of the platform’s interest or liquidation income.

3. Collateralization Rate

TKR holding can affect the loan-to-value ratio in the future thereby reducing the collateral required for taking out loans.

4. Staking

TKR holders can stake their tokens to receive various staking rewards.

Join us on Telegram to receive free trading signals.

For more information on cryptocurrency, visit the Altcoin Buzz YouTube channel.

Images courtesy of TradingView.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.