Crypto is gaining popularity all over the world. The number of new participants in crypto keeps growing. We dive deeper into a 2021 crypto report covering Europe from Coinbase.

The Coinbase Crypto Report Europe (CCRE) investigates various aspects of crypto consumer behavior. Topics they touch on include:

- consumers’ crypto holdings in 2022

- new investment opportunities that are specific to the crypto space

- and staking and other crypto investment opportunities.

For the report, they interviewed a total of 6018 people in six countries. These countries are France, Germany, Italy, the Netherlands, Spain, and the United Kingdom.

Central, Northern, & Western Europe (CNWE) make up the largest crypto economy in the world. This is according to a Chainalysis report. CNWE accounts for 25% of all global activity. This translates to over $1 trillion in cryptocurrencies. The increase was due to growth in large, institutional-sized transactions. These are transactions worth $10 million or more. But the crypto report focuses on retail investors.

The inflow of newcomers in the worldwide crypto space keeps increasing. This is despite many hurdles to overcome. The Covid-19 pandemic and the corresponding economic wariness play one part. Another factor is social unrest. Yet, both could not stop the phenomenon of crypto growth. Despite the volatile nature of cryptocurrencies, the market acceptance of cryptocurrencies keeps increasing.

Furthermore, Europe has some of the most crypto-friendly countries in the world. Portugal has no taxes on crypto for capital gains, cashing out in fiat, or for crypto payments. Also, Switzerland has friendly tax laws for crypto. Malta is very friendly towards cryptocurrencies. This resulted in many crypto exchanges moving to Malta. Especially so after China and Hong Kong tightened up their regulations. The German authorities don’t consider cryptocurrencies legal tender. They rather treat it as financial instruments. Anybody who holds a cryptocurrency for longer than 18 months, is tax-exempt. Thus, putting a brake on high-volume trading in cryptocurrencies there.

Coinbase Crypto Report Europe (CCRE) Adoption vs the Rest of the World

The Coinbase crypto report Europe is specific to European countries. But it doesn’t hurt if we look at some worldwide trends as well. Thus, allowing to put everything better in perspective.

In 2021, there was a worldwide Bitcoin trading volume increase of 489%. This relates to an increase of $2.1 trillion for the first half of 2021 on the largest exchanges in the world. Furthermore, there is an increase in crypto wallet users worldwide. This happened during the same time frame. They went from 66.2 million to 75.5 million. The United States approved the first exchange-traded fund (ETF) for Bitcoin futures. Meanwhile, German authorities granted a custody license for crypto assets. Coinbase Germany GmbH received this permission from BaFin, a German financial supervisory authority. But the icing on the cake is the introduction of Bitcoin as legal tender in El Salvador.

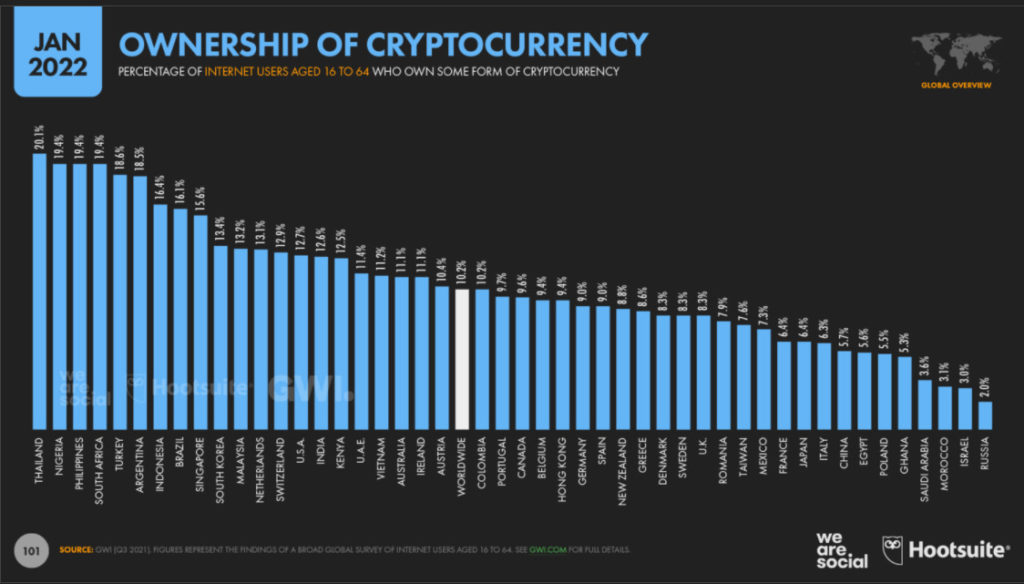

Of internet users aged between 16 and 64 who own some form of cryptocurrency, Thailand leads the way. No less than 20.1% of the Thai population own cryptocurrencies. Followed by Nigeria, the Philippines, and South Africa, each with 19.4%. The crypto report by Dataportal shows that the Netherlands are in the lead in Europe with 13.1%. Switzerland follows with 12.9%. Ireland comes in third place with 11.1%.

Source: Dataportal

These figures confirm that crypto acceptance is growing worldwide. Momentum seems to be growing that will be difficult to stop.

European Investor Prospects

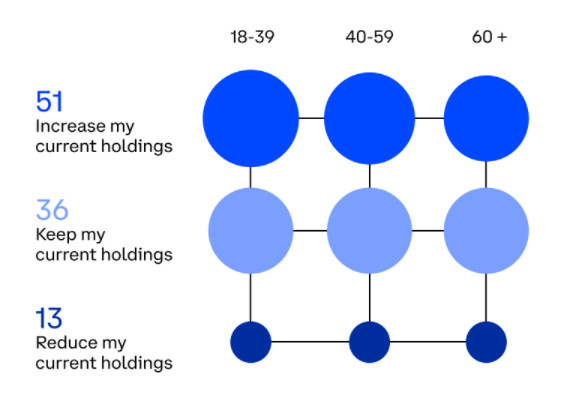

The CCRE crypto report investigated if participants planned changes to their portfolios. The mentioned time frame covered the next twelve months. So, the report splits up 2000 participants over three age groups. It may come as no surprise, that the result reflects the 3rd quarter 2021 bull market sentiments. Over 50% plan to invest more and increase their portfolio. Moreover, a grand total of 87% have no plans to reduce their current positions. Only 13% of the crypto holders have plans to reduce their portfolios.

Especially the younger participants, aged 18-39, are most enthusiastic about increasing their holdings. This marks the importance that this age group has in the current economy. They are sending a clear signal. Furthermore, this generation takes their financial responsibility into their own hands. As a result, companies trying to connect with this group will have to come up with new strategies. They will have to adjust their future business models to appease this generation.

This group of young investors is losing their trust in banks and traditional finance. In turn, we can expect an increasing demand for cryptocurrencies from this group. The influx of new crypto wallets keeps growing. These young newcomers will have an exponential share of this growth.

Another interesting observation is that these investors show interest in crypto investment options. They know their way around staking, crypto lending, various yield, and margin options. This indicates that they consider crypto as a serious long-term investment. Furthermore, they are not afraid to explore the options available to investors. Active and passive forms of income are part of their trading strategies. These are indicators that these new investors are in it for the long term. This, in turn, gives off more signals that mass adaption is coming nearer, each year.

What are first-time crypto-purchases and current holdings?

First-time crypto purchases add to the total market adoption. The adoption rate keeps increasing among the public. The crypto space can welcome plenty of newcomers each year. First-time investors make up a yearly increase of 29%. But, 60% of this growth occurred between 2019 and the 3rd quarter of 2021. This trend started in 2016, in sync with the crypto ecosystem’s development. The crypto infrastructure, services, and products have improved to accommodate public demand.

Another reason for this growth is the growing acceptance of blockchain technology. Regulatory progress plays its role in this process as well. All this combined led to an all-time high for the crypto market capitalization in December. The total crypto market capitalization passed a $3 trillion mark. This happened shortly after Bitcoin’s $69,000 all-time high.

Bitcoin, Ethereum, and Litecoin are the three most popular crypto coins among investors. According to the CCRE crypto report, 75% of report participants hold Bitcoin. Ethereum comes with 39% in second place. This is due to its versatile use cases. With dApps and DeFi comprising a large part of this attraction. The upgrade to Ethereum 2.0 will allow for greater scalability and cheaper gas fees. The Proof of Stake consensus mechanism replaces the Proof of Work mechanism. This change should happen during 2022. Ethereum’s already high popularity may increase even more because of it.

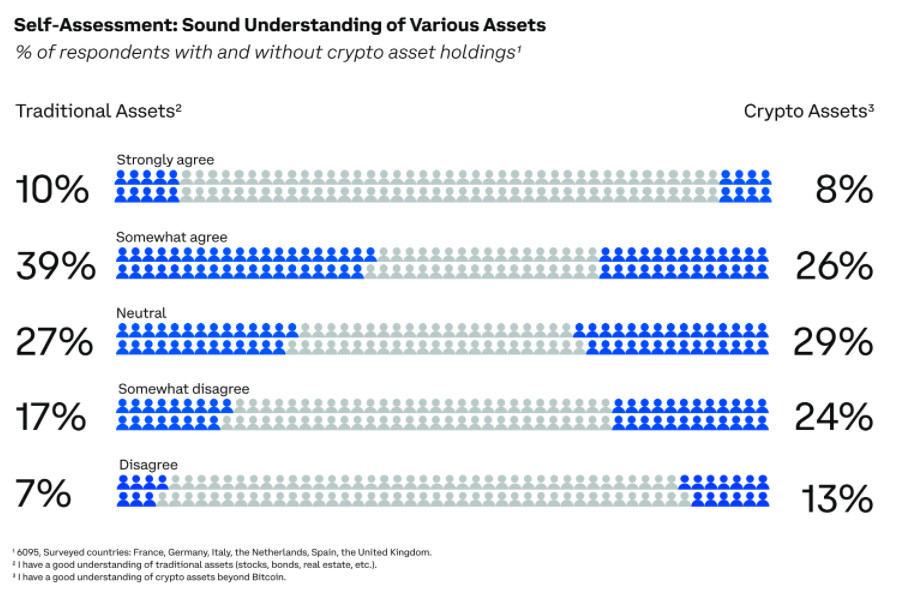

The last part of this crypto report shows one more fascinating insight. Investors in the survey understand the difference between traditional and crypto-assets. Easy access to educational material available for the crypto market accommodates this.

Conclusion

The crypto markets continue to grow, year after year. Many indicators point to mass adaption soon. This CCRE crypto report confirms this in various ways. There is an influx in institutional capital. Coinbase Germany GMBH, receiving a grant for a crypto asset custody license. Most of all, 51% of new crypto investors want to increase their portfolio. Young investors are also interested in long-term investment options. They look for typical crypto investment opportunities. Staking, yield options, and margin trading are all avenues they use. These are good developments. Early 2022 saw some increased volatility. Despite this volatility, long-term prospects in Europe look good. The crypto market is showing signs of closing in on mass adaption.

Also, join us on Telegram to receive free trading signals.

Furthermore, find out more about the blockchain and crypto space on the Altcoin Buzz YouTube channel.