You may have heard about whitepapers in crypto projects. However, you are not quite sure what they can offer you. In short, a whitepaper explains what a project is about. It explains the technology behind a project. Furthermore, it looks into what the project wants to achieve. In other words, what is the purpose of the project.

We take you by the hand and give you a real-time sample of how to use a whitepaper. It is an important part of ‘DYOR’ or do your own research. As a sample, we use the Venus Protocol, a DeFi project. So, let’s have a look at their whitepaper.

Source: Venus Protocol whitepaper

How to Use the Whitepaper

A whitepaper should start with an introduction. This should cover the problems the project sees or finds. Consequently, the project will give you a solution. Last but not least, the team should list some use cases for the project.

In our sample, with the Venus protocol, that is precisely what they do. A brief introduction to the Venus protocol first, though. It is an algorithmic money market protocol on the BNB chain. They took the Compound and MakerDAO protocols as samples and combined the best of both worlds. This intro is called the Abstract.

After the introduction, we look at some real samples. We will compare items listed in the whitepaper and see how they work out in real life on the protocol. Did the protocol deliver on the whitepaper, or is something delayed or changed? We will show you and find out.

The Introduction of a Whitepaper

The problem-They discuss the hoops and loops somebody has to go through to receive a loan. That’s not easy in the current traditional financial world. For example, you need to provide creditworthiness. On top of that, you need a provable income, and plenty more. Even if you have a collateral, like a car or a home.

Other DeFi protocols build on Ethereum, well they have high gas fees and are slow. They also don’t offer BTC, XRP, or Litecoin in their lending markets. Furthermore, Compound is heavily centralized. On the other hand, MakerDAO has $1 billion locked up in ETH in smart contracts without earning any value.

Last but not least, if you mint stablecoins, you need to lock them up in a smart contract. There is no benefit for the underlying asset that you use as collateral.

The solution-The Venus protocol offers with the BNB chain a fast and low-cost option. The collateral that you supply, gives three earning options:

- Earn interest on the collateral.

- Borrow against the collateral.

- Mint stablecoins on-demand.

A blockchain-based solution. Moreover, they offer access to liquidity in real-time with a variety of assets.

Use cases-If you have crypto, but don’t want to sell it, you can use it as collateral. You remain the owner of the crypto assets and have more benefits. You can take out an over-collateralized loan and borrow against it. All this without interference of a third party. Furthermore, you can mint stablecoins and use them in DeFi yield farming.

Venus isn’t the only one trying this but they do have some unique features. Let’s see how they are doing.

How Did Venus Protocol Follow Up on Its Whitepaper?

As part of showing you how a whitepaper works, we will follow up on the whitepaper’s promises. This article will check the Protocol section of Venus. We have written another article that checks all the facts of the Venus section. So, let’s check all mentioned features, one at a time. As already mentioned, for the Protocol section. This is the more technical part of the whitepaper. However, as always, we will explain this in an easy-to-understand way.

The Controller Contract

- What is it according to the whitepaper?

This is the decentralized version of a processor. It makes all communication between smart contracts possible. As a result, this is the most important smart contract of the protocol. It validates liquidity and collateral of all transactions. They will use the Band Oracle for market rates and to update the on-chain protocol.

- How does it work on the protocol?

This seems to work fine on the protocol. It has a different name, and most functions come together in what the docs call the ‘Unitroller’. It determines the needed collateral and when a user gets liquidated. These documents are an easy-to-follow explanation of how the protocol works.

The Collateral Value

- What is it according to the whitepaper?

They will use the Band Oracle for market rates and to update the on-chain protocol. You can supply, borrow, or mint on the protocol, it uses an underlying asset for this. In turn, this bonds with vTokens. This is the collateral that has a dollar value. These are also tied to the vTokens.

- How does it work on the protocol?

This seems to work fine, since the supply and borrow APY’s are constantly updated.

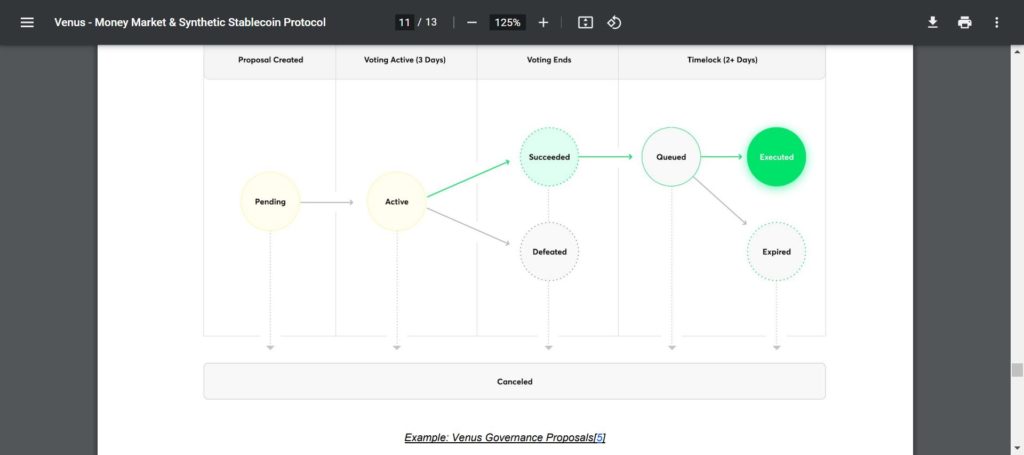

Governance

- What is it according to the whitepaper?

The team, developers, and founders didn’t receive any XVS. Hence, the community controls the core of the protocol. However, you need to mine Venus tokens (XVS) to have any control. A proposal to change anything costs 300,000 XVS. Before it’s approved, it needs to reach a total of 600,000 XVS. For example, this can include

- Adding new tokens or stablecoins

- Changing variable interest rates for all markets

- Delegate protocol reserve distribution schedules

- How does it work on the protocol?

It appears that this is working perfectly. The documents describe exactly this.

Source: Venus docs

Liquidations

- What is it according to the whitepaper?

As a borrower, you need to put down an over-collaterized asset. However, it can still happen that price changes have an effect. For example, if your collateral falls below the borrowing threshold. This will incur a liquidation fee. Furthermore, the lender could get his share back. That’s after liquidation fees and covering the loan value.

- How does it work on the protocol?

The documents give a clear explanation of how the liquidation process works. Once more, this seems to work just fine.

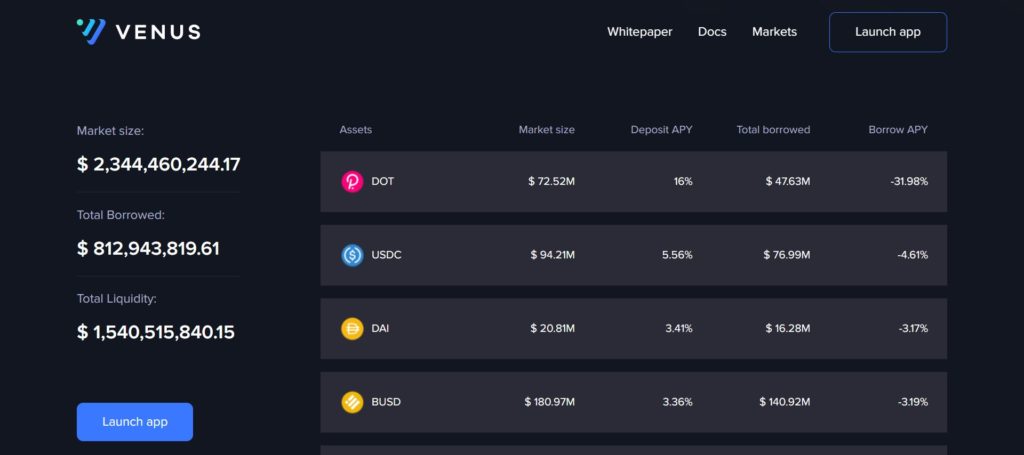

Interest Rates

- What is it according to the whitepaper?

These are the rates a supplier or borrower has to work with when lending or borrowing assets. They are dynamic rates, and as a result, they change regularly. On the other hand, Venus uses fixed interest rates for the synthetic stablecoins. They can only change through governance interaction.

- How does it work on the protocol?

The interest rates are clearly visible on the website and the app. As mentioned in the whitepaper, they are dynamic and change. In the docs, there is a great explanation how they calculate the accrued interest. After that, there is also a good explanation how they calculate the APY per block.

Source: Venus protocol

Conclusion

We showed you what good a whitepaper does when you do research in a project. It is an important part of a project, and files under fundamental analysis. Moreover, we showed you some real-life samples with the Venus protocol whitepaper. In our sample, they stayed well within the whitepaper objectives. This is not always the case. Either objectives haven’t yet materialized or work differently. But now you do know why a whitepaper is of importance.

⬆️ Also, get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️In addition, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.