You may have seen on CryptoTwitter that Terra’s UST just passed Binance’s BUSD to become the 3rd highest market value stablecoin behind USDT and USDC. And that’s a cool story and we like the Terra ecosystem here at Altcoin Buzz. But that’s just one point of many that show us that public and investor interest in stablecoins is skyrocketing.

Let’s take a look at stablecoins in some more detail.

First, we are going to look at the top 5 stablecoins, listed in order here by market value. They are:

- USDT Tether

- USDC USD Coin

- UST Terra USD

- BUSD Binance Dollar

- DAI

And they all come to their stable-ness differently. Three of them are centrally issued. They are USDT, USDC and BUSD. Tether issues its USDT, while Circle issues USDC and Paxos, home of the Paxos Dollar USDP, issues BUSD for Binance. DAI was an algorithmic coin but now is a hybrid of sorts. It was designed to be algorithmic only but DAI, which is really Multi-Collateral DAI now has 51% of its backing from USDC so the two are more closely linked now. UST is algorithmic. It uses a smart contract and a minting/burning mechanism with LUNA to maintain its peg to the Dollar.

Now that we see how they stay stable, we will look at a couple of tools to see how often people are using stablecoins.

Daily Transactions

One way to see how popular stables are is to look at daily transactions. We are looking at Glassnode and Nansen.ai as our 2 main sources of data here. They are great and both offer free subscription levels that give you lots of access to tools if you don’t have enough need for a paid plan.

We aren’t shilling for either here but really they are great and they do have FREE plans you can use.

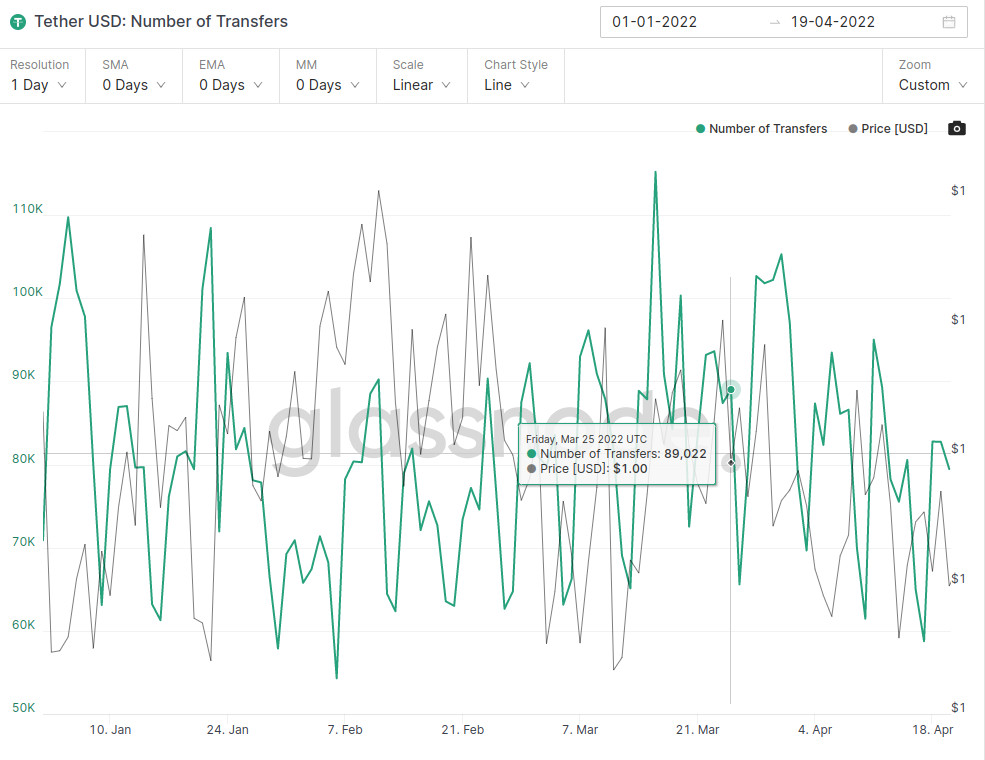

Here are the numbers, thanks to Glassnode.

Since the beginning of the year, daily transactions by number and volume, looking at transfer count and transfer volume are:

- Tether– between 60k to 85k transactions daily and $2-$6 billion daily.

- USDC- between 40k to 75k transactions daily and $4-10 billion daily

- UST- The Terra Network has between 500k to 700k transactions daily, many of which involve burning LUNA to mint UST. LUNA’s circulating supply drops by on average 600,000 LUNA daily. That’s lots of new UST coming onto the market. Exact numbers are difficult to find on UST with Terra’s block explorers

- BUSD- between 700 to 1400 transactions daily and volume of $250k up to $1 billion. I think these numbers showed netted-out transactions on Binance as BUSD is involved in so many trading pairs there that this daily transaction number has to be higher.

- DAI- between 6k to 12k transactions daily and $1-$3 billion daily.

Here’s what Tether’s Transfer Count looks like on Glassnode.

Even if we exclude UST and take the lowest numbers, we still have ~110,000 daily transactions at ~$7 billion. That is A LOT of money moving around on a daily basis.

Supply Growth

The supply of all 5 is growing too. From January 1 until now,

- Tether grew from $78.3 billion to $82.8 billion, or 5.7%

- USDC grew from $42.4 billion to $49.8 billion, or 17.45%

- UST grew from $10.1 billion to $17.8 billion or a whopping 76.2%, thanks to Coingecko and Terra Analytics for that one.

- BUSD grew from $14.6 billion to $17.3 billion or 18.49%

- And DAI fell from $9.3 billion to $9 billion or 3%

So even with DAI falling in value, we still have an increase of $22 billion in the supply of these stablecoins from $154.7 billion to $176 billion, or an increase of 14.2%. In only 3.5 months.

Daily Active Addresses

This is another great indicator as active addresses mean people are using stablecoins. So again, since January 1, the number of active addresses for,

- Tether increased by almost 2000 from 48,528 to 50,359

- USDC increased by 2600 from 20,941 to 23,593

- UST increased by 23,100 nearly doubling from 25,232 to 48,370

- BUSD increased by 194 from 567 to 761

- And DAI increased by 331 from 3312 to 3643.

Total daily address growth, mostly powered by UST, increased by over 28,000 addresses. Again, that’s LOTS more people using stablecoins on a daily basis than were using them before.

Conclusion

So what’s the point? Aside from throwing lots of numbers around.

Well, the point is billions of dollars of value every day are moving through the cryptoeconomy through stablecoins. More than $7 billion at a minimum. You already know that stablecoins provide 3 important services by:

- Providing an on and off-ramp to the fiat market

- Providing a basis for many major exchange trading pairs

- Being the preferred method of crypto payments for many due to price stability

Add these things together and our downtrending now choppy market and more people are holding, using, and trading with stablecoins than ever before. And it doesn’t matter if they are centralized or not. All the top 5 except DAI are growing by huge amounts.

It’s just one more way to show that the cryptoeconomy is here to stay.

Price Activity

At the time of writing, 3 of our stablecoins: USDT, UST, and BUSD are trading at $1. USDC is off slightly at 0.9991 and DAI is off slightly at 0.9998. All on volumes of 400 million for DAI up to almost 61 billion for Tether.

⬆️Get $125 for SIGNING UP with MEXC Exchange (FREE $25 in your MEXC wallet + 1-month ALTCOIN BUZZ ACCESS PRO membership (worth $99). MEXC supports U.S. Traders in all trading pairs and services.

(To get your ALTCOIN BUZZ ACCESS PRO membership, DM us with your “newly signed up MEXC UID” and “Telegram ID” on our Twitter @altcoinbuzzio)

⬆️Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

⬆️Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.