Cross-chain or interoperability. This seems to be the keyword for blockchains in 2022. Keeping all transactions exclusive on your very own blockchain is just not doing the trick anymore. But being able to move your assets freely around to other blockchains is not only trending, but it is what we need actually.

Nowadays, there are a few blockchains like Avalanche, Cosmos, Polkadot, and Wanchain that offer interoperability. And as you can imagine, each project has its way of doing this. Also, we see a few of our favorite blockchains listed here. One of them is Cosmos. THORchain (RUNE), our topic for today, is built with the Cosmos SDK/Tendermint Core.

After some recent hiccups, they are coming back, stronger than ever. Just today THORchain recorded a monthly volume of $1.25B with 400% growth. Therefore, in this article, you will discover why THORChain (RUNE) is a hidden gem.

What is THORChain?

THORchain (RUNE) calls itself a decentralized cross-chain liquidity network. In simple words, that means If you’re looking into a decentralized solution that allows you to easily swap tokens across chains without the hassles of wrapping or pegging tokens, then THORChain might be what you’ve been searching for.

Source: THORChain

The big news is that the THOR team is launching Terra today and this could send $RUNE, its native token, to the moon. This is because Terra integration brings the LUNA token, along with the TerraUSD (UST) stablecoin, to the THORChain ecosystem and gives users more trading and staking options.

What sets Thorchain apart from other chains is:

- It doesn’t use wrapped tokens for interoperability.

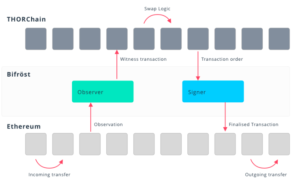

- It uses a cross-chain, oracle-free bridge, called Bifröst.

- Until Thorchain, only a CEX could trade assets that aren’t wrapped.

- Earn yield with your deposit of native assets. Of course, in the liquidity pools of the network. This is currently at 37.553%.

Also, another aspect that makes Thorchain attractive is that it battles the whales. Let me try to explain how. Large whale transactions incur slippage. So, Thorchain increases the transaction fees when slippage increases. This kind of discourages the whales from dumping tokens which leads to price crashes.

When we compare Thorchain to other popular DEXs in the space like Bancor or Uniswap it’s pretty much like them as it uses an AMM (Automated Market Maker), but there is one big difference: One of the pairing assets is always the RUNE token. This makes RUNE the base swap pair, but it’s not the destination for any transaction. As a result, it concentrates liquidity because each pool always has the RUNE token as a pair. Unlike other DEXs.

How does THORchain Connect to Other Blockchains?

Ok, you might tend to skip this section because it could get a bit technical. But you must watch it to build your belief in ThorChain’s revolutionary technology. Let’s dive in:

Bifröst connects the blockchains. It uses smart tokens, similar to the Bancor system.

- They are the Continuous Liquidity Pools (CLP).

- The CLPs facilitate the exchange of assets.

- LPs get rewarded CLPs for contributing liquidity in all pools.

- Thorchain offers insurance to LPs, preventing impermanent loss.

- They have a very user-friendly UI

Source: THORChain Docs

Also, one of the reasons RUNE is seeing such a positive price surge is because they launched synthetic asset trading on March 10th. This offers instant settlement, low gas, and no risk of Impermanent Loss.

Moreover, the same day, RUNE surged 37%. A week later, it’s up 87%. In a nutshell, Rune has almost 2.5x in the last 30 days. Another neat trending value proposition they have is the name service THORname. Only larger chains and ecosystems seem to have this. Long strings of blockchain addresses turn into readable names, and it allows the use of special characters/emojis.

Another exciting new feature is ThorFi, coming soon to your neighborhood. This brings lending and borrowing to the Thorchain ecosystem. Moving ahead, let’s have a look at this ecosystem.

THORChain Ecosystem

The current Thorchain (RUNE) ecosystem is completely community-driven and has 10 active sections, with over 50 dapps, including:

- Arbitrageur tools

- DAOs

- NFT collections

- Software & hardware wallets

- Swap/pool interfaces

- Liquidity provider tools

- Insurance

Some projects include

- Thorswap – The world’s first cross-chain Aggregator

- THORWallet – Mobile3 app with cross-chain wallet & DEX. Allows earning passive income up to 18+% on native BTC. You can read more about it here.

- Runebalance – shows arbitrage opportunities in the pools

In addition, TVL on Thorchain is $826.88 million, with $153 million pooled and $963 million as a total reserve. An interesting ecosystem that keeps growing.

Layer0 is a generic cross-chain (EVM) messaging protocol.

Stargate is a stableswap application built on top of that.THORChain is a cross-chain (any) swapping protocol.

The two main differences relate to assurances of decentralisation and reliance on external dependencies. https://t.co/qhBUZwM1MP

— THORChain (@THORChain) March 27, 2022

THORChain Tokenomics & Team

As we just saw, Thorchain is a popular project. Looking at the current market cap, Thorchain is ranked #52 with a $2.75 billion m cap and a circulating supply of 300m or 66% out of a total supply of 500m. In one month, the market cap increased by $1b. The current price is $9.15.

Also, you can stake RUNE by adding liquidity into pools. The average APY is around 37.5%. Peaks are up to 140% (BEP-20 on BNB Chain). The RUNE token has 4 key roles:

- Liquidity—as a settlement asset

- Security—as a Sybil-resistant mechanism, it also drives economic behavior

- Governance—signaling priority on-chain

- Incentives—paying out rewards, charging fees, subsidizing gas

On the other hand, THORChain started as an anonymous group of developers in 2018. Still, they made the project as transparent as they possibly could by publishing everything on Github. These are the project custodians.

Now they are moving to a community for governance. This is called the Aesir protocol. Aesir were old Norse Gods that discuss everything and make all decisions. The community is slowly taking over, lines between the OG custodians and the community are blurring. This is a unique concept because they are decentralized. They are not a company, but they are open source, transparent, and a fluid team with a flexible community.

TVL broke top 20 for Thorchain on Defillama. 🎉

The total addressable market (TAM) is much higher than even Ethereum itself which is the largest TVL. More chain integrations, Thorfi, and more will help to bring even more liquidity.

Lets keep building.🛠️ pic.twitter.com/zQ5FwS6R0R

— Asian | 0xV (@Asian0xV) March 27, 2022

Join its discord if you want to participate in the project.

Competitors & Risk

Are there any competitors for Thorchain? Other protocols or blockchains that are interoperable can be considered competition, besides the major ones, some smaller projects may come close:

- Anyswap

- Kardiachain

- Ren (but this is a bridge and not an AMM)

However, what Thorchain does is unique. All other DeFi options use wrapped tokens for their interoperability or are single chain. Instead, Thorchain uses Bifröst as a cross-chain bridge and doesn’t wrap tokens.

Moreover, other exchanges that can move assets around between blockchains without wrapping them are centralized. Now, that is not considered competition if you look at a DeFi set-up like Thorchain.

On the other hand, so far, we have seen that Thorchain has many things going for it. There is no real competition and they are unique. This raises the question, is Thorchain all just sweet and rosy? Or are there also any risks for using Thorchain? Well, Thorchain seems to have not promised us a rose garden, so, yes, there are some risks:

- Risk of Impermanent Loss: Thorchain offers 100-day impermanent loss insurance. Coverage adds 1% of insurance per day until it reaches 100 days.

- Market and economical risks.

- The potential risk of a bug.

- Hack: In July 2021, Thorchain had 3 hacks within a month. Once was a white hacker.

THORChain Roadmap & RUNE Price Prediction

The roadmap promises more action. Cross-chain bridges are just the beginning, where synths have just been added. Also, a multichain mainnet is about to be launched, once the Chaosnet is considered stable.

Moreover, a few other features for the future are mentioned, but without further details. The next milestone that is mentioned is ThorFi. This will have:

- Lending

- Composite Assets

- Leveraged Trading

THORChain project roadmap:

* More chains (LUNA, Privacy, L2's)

* More wallets (all the big ones)

* More integrations (Dex aggregators)

* More Features: Synths, THORFi (lending, saving), THORNamesNot stopping until decentralised liquidity 10x bigger than centralised. $RUNE

— THORChain (@THORChain) March 6, 2022

On the other hand, the RUNE token has been pumping recently. During the last 30 days, the price increased by 2.5X. From $3.87 up to $9. That is a massive recovery from the bloodbath that happened after July 2021 when the hacks occurred.

Also, it’s still a far cry from the ATH of $20.78 in May 2021 but a nice comeback nonetheless. But after doing a 2.5x in a fear gripped market is there any heat left in RUNE. Here is what our technical analysis says about RUNE Price.

Bullish Scenario: If RUNE manages to break above the resistance level at $9.9 then it would be bullish. If it gains some momentum and buying pressure builds up then we might test the next resistance level at $11.9 and $14.9. Breaking above the $14.9 price level with significant buying volume will lead to a good chance of crossing above $17.

Bearish Scenario:

RUNE has been in a downtrend channel for the last few weeks. However, if the $5.6 support level is not maintained, the price will fall to $4, $3, $2.3, and even lower sooner or later.

Thorchain is being the comeback kid. All respect goes out to the project for bouncing back after the hard times last July. They have a unique way of making interoperability happen, with the Bifrost bridge. This takes cross-chain to the next level.

Now that they seem to be back on track, more new exciting features are in the making. We most certainly are eagerly awaiting these in 2022.

Join us on Telegram to receive free trading signals.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join now starting from $99 per month

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by THORWallet. Copyright Altcoin Buzz Pte Ltd.