When Bitcoin hit the scene in 2009, the idea was to send money via the internet. To this date, that is still one of the purposes of Bitcoin. However, a lot has changed since 2009. There are more cryptocurrencies and Bitcoin became a store of value.

The crypto scene grew a lot in 13 years. As a result, many crypto holders want to use their crypto for payments. We also see more businesses embracing crypto payments. They play into this demand. So, let’s have a look at current crypto payments and 3 popular coins for payments.

How did crypto payments increase during the last year & months? Which coins are customers using to pay the most?

At @CoinPaymentsNET we tried to answer these questions by sharing charts based on our data.

See the full report: https://t.co/yWaWa7pOne#cryptocurrency #Bitcoin pic.twitter.com/25APnMmfiC

— CoinPayments (@CoinPaymentsNET) July 20, 2022

Growth of Crypto Payments Since 2021

CoinPayments published a report on crypto payment trends. This report includes the top 5 coins used for payments. We cover BTC, USDT, and LTC in this article. We have another article, covering two other popular coins, ETH, and DOGE. All data mentioned in this article, come from the CoinPayments report. We will also look into some other cryptocurrencies that didn’t make it into the top 5.

What we see is that both crypto owners and businesses want to use crypto as a payment option. We already see large companies accepting crypto payments. For example, PayPal, Microsoft, or Twitch. Not to mention El Salvador, the first country to adopt Bitcoin as legal tender.

So, how does this affect crypto payments? What we see, is an increased demand for crypto payments. Big companies and small retailers both want to get in on this.

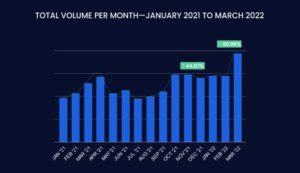

That said, transactions slumped in 2021 by 17.92%. However, if we add Q1 of 2022, we notice an increase of 32.52%.

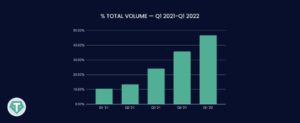

If we look at volume, it’s all looking green there. In 2021, there was a 44.67% increase at CoinPayments. If we add Q1 2022, it’s just under 100% (99.98%). In other words, CoinPayments saw volume double from early 2021 to the end of Q1, 2022.

It looks like both consumers and businesses move away from seeing crypto as an asset class. Just like bonds or gold. Now they see it more as a currency to spend. So, it’s time to have a look at what coins merchants and consumers use.

Source: CoinPayments report

What Are the Top 5 Cryptocurrencies Used for Payments?

Out of the top 5 cryptocurrencies used for payments, we cover BTC, USDT, and LTC in this article. ETH and DOGE are the other popular options.

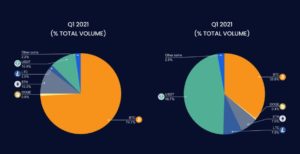

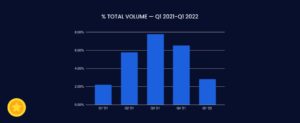

CoinPayments compared Q1 2021 with Q1 2022. In both transactions and volume, we saw some interesting results between BTC and USDT.

We see a trend in volume and number of transactions. On both counts, it shows that Bitcoin lost ground and USDT picked up the lost ground. The shift indicates that people are not willing to spend their BTC as much anymore. The USDT stablecoin is now a much more appealing alternative.

Bitcoin (BTC)

Bitcoin is the OG of all cryptocurrencies. It allows for P2P electronic transactions. It launched in 2009 and Satoshi Nakamoto designed it. However, Nakamoto is a pseudonym for one or more persons. We don’t know who he/she or they are.

It uses blockchain technology and is fungible. BTC is also in short supply. There will only ever be 21 million BTC. The P2P setup cuts out all middlemen. It’s censorship resistant. In other words, no government, bank, or other entity can control it.

Bitcoin has been the dominant cryptocurrency on the market since its launch. It leads all other cryptocurrencies in market capitalization. For over a decade, it has been the most used crypto for payments. However, it looks like that is about to change.

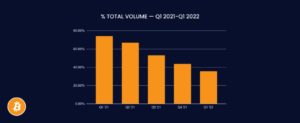

- Bitcoin Payments in Volume

During Q1 2021, BTC was good for almost 75% of the volume. However, that dropped to 35% in Q1 2022. It went from three-quarters of CoinPayments in total volume to a third. Within a year, that’s a 38.5% drop. That’s quite a drastic change. It shows that Bitcoin is losing its dominant position.

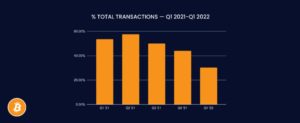

- Bitcoin Transaction Numbers

If we look at transaction numbers in the same period, it’s similar. In early 2021, BTC had a 53.6% market share of all CoinPayments transactions. This dropped to 30.24% in Q1, 2022. Nonetheless, Bitcoin remains in the top 5 of most used cryptos for payments.

Bitcoin seems to become scarce, and we see the results. Bitcoin holders prefer to hodl instead of spending their BTC. They prefer other cryptos as a payment option.

Tether (USDT)

USDT is currently the most popular stablecoin. It launched in 2014 as RealCoin. However, four months later, it was already renamed Tether. USDT collateralizes with fiat. It pegs 1:1 to the US dollar. Among others, US treasury bills, cash, and secured loans back Tether.

The idea behind USDT is to offer a stable and transparent stablecoin. Furthermore, it also offers low transaction costs. Besides being the most popular stablecoin on the market, they are also #1 for crypto payments. On top of that, they also have a first mover advantage.

- Tether Payments in Volume

In Q1 2021, they just had a 10% cut in the total volume. However, in Q1 2022, they are dominating this segment with 46.7%. That’s almost half of the total payment volume and is a 36.6% increase. The monthly average growth was around 9%. This was enough to take the top spot from Bitcoin.

- Tether Transaction Numbers

In the number of transactions, Tether managed a stunning 8.6x between the two quarters. It went from 4.1% to 35.3%. Most of this increase is during Q4 2021 and Q1 2022.

Both merchants and consumers seem to have a soft spot for Tether. Both parties shifted away from BTC and drifted towards Tether.

Litecoin (LTC)

Charlie Lee founded Litecoin already back in 2011. It started as a Bitcoin fork. Just like Bitcoin, it’s a P2P electronic cash system. Lee calls Litecoin ‘a lite version of Bitcoin’. He also compares LTC to silver, and BTC to gold. However, there are some differences. For instance, LTC has 84 million coins, and is about 4 times more than Bitcoin. New blocks come 4x faster at 2.5 minutes, compared to BTC’s 10 minutes.

Coinbase, by far the largest US exchange, offered LTC almost straight from the start. As a result, Americans have a long history with this coin and feel comfortable using it. It’s also, at least in crypto terms, an old project. All these factors contribute to LTC being in this top 5.

- Litecoin Payments in Volume

Although Litecoin doesn’t come near the top 3 for volume, its volume did grow. Q1 2021, saw a 2% presence. In contrast, Q1 2022 saw 7.5% in volume. In 2021, its volume increased by 2.69x. However, this dropped slightly in Q2 2022.

- Litecoin Transaction Numbers

Litecoin also saw an upwards trend in transactions. It went from 9.5% to 13.5%. Not as drastic as the volume, but nonetheless an uptrend. However, if we compare Q4,2021 with Q1 2022, we notice a 3.5% decrease. From 17% to 13.45%.

Although Litecoin has a small market segment, it did grow. For the foreseeable future, it appears that Litecoin will stay in the top 5.

Other Crypto Coins

Maybe you miss your favorite crypto payment option in this list. Although CoinPayments offers 175 other crypto coins to pay with, they didn’t make it into this list. The reason is simple, they don’t have the volume and transaction numbers.

- Other Coins Payments in Volume

Still, in volume, they managed a 2.8% market share. With this, they only managed to pass DOGE in the top 5. Quarters 2, 3, and 4 in 2021, saw an increase, but most likely Tether crushed this in Q1 2022. They respectively had almost 6% and 8% and Q4 saw well over 6%. Q1 in 2021 saw over 3% and 2022 saw almost 3%.

- Other Coins Transaction Numbers

In transactions, they had a 5.5% share. This even surpassed Tether, who had a 4.1% share. However, this dropped to 3.7% in Q1, 2022.

Despite the low numbers, this is still a niche market. It is not impossible for a coin from this group to make it into the top 5 someday.

Conclusion

Here are a few takeaways from the CoinPayments report. The first is the Bitcoin lost its dominance. That’s not so strange, considering how scarce BTC is. Tether, came, saw and won. It easily took over BTC’s place in volume and number of transactions. However, both combined, we see a strong bond. Between the two of them, they corner 82.3% of the volume market. For transactions, that number is 65.5%. Finally, Litecoin saw a steady increase.

These numbers tell us that both merchants and customers have their fave coins. Still, there are plenty of other crypto payment coins out there, lurking in the shadows.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.