Fantom is a layer 1 blockchain that has been around since 2018. It’s a platform that is active in the DeFi space. According to DeFiLlama, they take 8th spot in TVL (total value locked) with $607.8 million.

Andre Cronje is the Director who is getting Fantom right on track. So, let’s have a look at the 3 best DEXes on Fantom.

Why do people choose to use CEX over DEX?@kfeng027, Head of DeFi at @WooNetwork explains 👇 pic.twitter.com/NXqoKQ2sM2

— Fantom Foundation (@FantomFDN) December 19, 2022

1) SpookySwap

SpookySwap is the most popular DEX on Fantom. According to DeFiLlama, their TVL is $105 million. Their dominance in the Fantom DeFi ecosystem is currently 20.81%. SpookySwap is a native AMM (automated market maker) and DEX on Fantom. It offers a lot of DeFi features:

- Swapping.

- Farming.

- Staking.

- Cross-chain bridging.

- Minting.

- Lending.

Time-Weighted Average Price swaps are now live on https://t.co/DDd1to2qY5! 🧙♀️📈

Thanks to @orbs_network, $FTM investors can minimize a large order’s impact by executing in smaller quantities over time 🚀 💰

Learn more in our latest $BOO Medium article:https://t.co/AlNdcRbuFy

— SpookySwap (@SpookySwap) February 21, 2023

SpookySwap offers very low swap fees. Furthermore, their farms and pools have no deposit or withdrawal fees. The current bridges include Ethereum, BNB Chain, Avalanche, among others.

Furthermore, SpookySwap is active in the NFT space. For example, you can also mint NFTs on their platform. However, for swapping or gas fees, you need FTM in your wallet instead of their native BOO token. You can swap either at market price (0.2% fee) or limit order (0.22% fee). With the fees, the platform tends to buy back BOO.

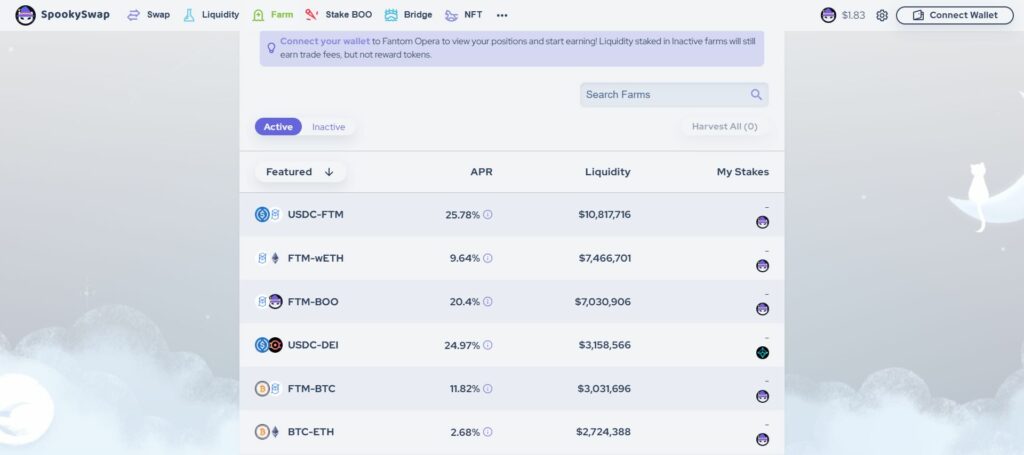

When you bridge to Fantom, you can also get some free FTM from a faucet. When using the platform, make sure to connect to an EVM compatible wallet. The farms offer some juicy rewards for stablecoins. For example, currently you get a 25.78% APR for the USDC-FTM pair or 24.87% for a USDC-DEI pair. Or how about 32.93% for USDC-BOO. Your rewards are in BOO. See the picture below.

Source: SpookySwap

2) Beethoven X

Beethoven X is currently the second most popular DEX on Fantom. DeFiLlama has their TVL at $83.74 million. The team built Beethoven X on top of Balancer V2. In other words, you can heave pools with more than two assets.

That’s not it. This brings more benefits and features. For example, besides being an AMM, it also offers:

- Liquidity provider.

- Price sensor.

- Automated portfolio management.

DeFi Re-Imagineered!

A brand new primitive is gracing the stage!

Reliquary is taking the $BEETS ecosystem to undiscovered heights.

☑️ Maturity Adjusted Rewards

☑️ Maturity Adjusted Voting Power

☑️ Zero Locking📅 01.03.23#maBEETS pic.twitter.com/Gh1sINWrt8

— Beethoven X (@beethoven_x) February 23, 2023

Furthermore, you can find a variety of different pools. For instance,

- Weighted pools with up to 8 assets. Each asset has a different weight, pending on their share in the pool.

- Stable pools of assets that trade at near parity. For example, stablecoins or synthetics.

- Boosted pools link idle capital with yield generating protocols.

- Metastable pools with two closely related tokens instead of pegged tokens. For example, ETH and stETH. A base token and a staked derivative.

- Liquidity Bootstrapping Pools for fair token launches.

The native token is BEETS has two use cases:

- Take part in governance.

- Earn rewards as liquidity provider.

Maestros,

Round 30 of the Beethoven X Gauge is done & the results are in! 🗳️

Top Pools:

1⃣Late Quartet @beethoven_x

2⃣ Another Dei, Another Dollar @DeusDao

3⃣ FireBird USDC @FinanceFirebird

4⃣Fantom of the Opera Act 2 @beethoven_x

5⃣Pirate Party @LiquidDriver

Mini 🧵 pic.twitter.com/ShczDvTdep

— Beethoven X (@beethoven_x) February 20, 2023

3) Curve

Curve is available on 12 chains. However, it seems there’s no TVL on Harmony. According to DeFiLlama, their total TVL is $4.98 billion. Of this, on Ethereum it locks $4.64 billion. Fantom is in sixth spot with $26.63 million.

As the TVL shows, Curve is a leading DeFi protocol. You can use it to swap stablecoins. However, you can also swap other coins. It offers low fees and minimal slippage. Slippage is the difference in price between submitting a transaction on one side. On the other side, it’s the price once it’s processed.

Staked ETH pools got some incentives this week – concentrated stETH pool and v2 rETH pool pic.twitter.com/TUhzortugg

— Curve Finance (@CurveFinance) February 23, 2023

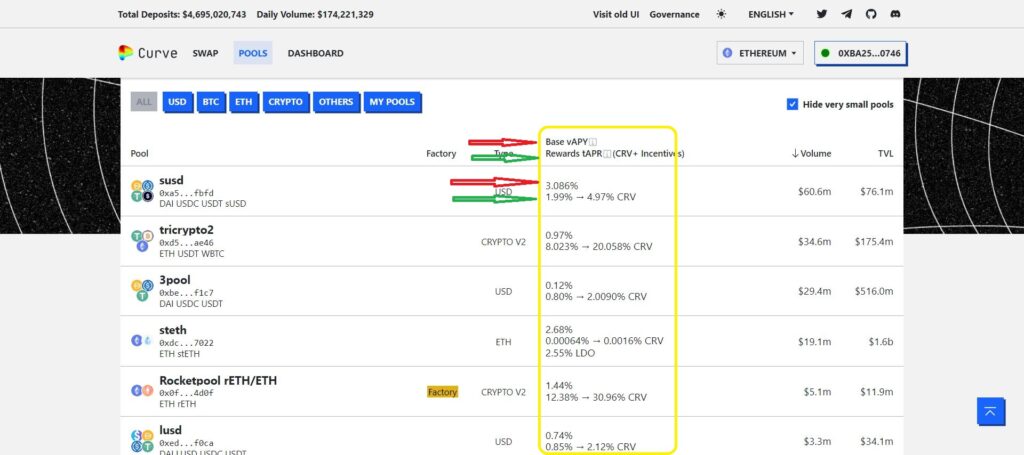

It’s run by the Curve DAO, which are the CRV governance token holders. The exchange launched in January 2020. Each transaction has a fee of 0.04%. You can swap and add liquidity to pools. One of the first pools was the 3pool, which is still active. This contains DAI/USDC/USDT in equal parts. There’s now also a Curve V2, which can swap uncorrelated assets. With the pools, you can see two percentages above each other:

- One is Base vAPY: This is the yearly rate of fees that liquidity providers earn in a pool. It’s the number on top with the red arrow.

- The other one, the number below the vAPY, is the tAPR with the green arrow. Liquidity providers can earn bonus rewards in CRV. See the picture below, in the yellow box.

Source: Curve pools

Conclusion

In this article, we discussed the three best decentralized exchanges on Fantom. These are currently, SpookySwap, Beethoven X, and Curve.

The current price of FTM is $0.498958. The market cap is $1,382 billion. Out of 3.175 billion FTM tokens, 2.775 billion already circulate.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.