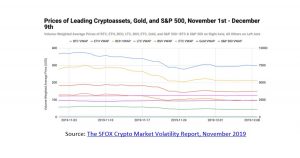

As we all know the crypto market is highly volatile. A December 2019 Report published by SFOX, shows that compared to cryptocurrencies the price of traditional investment mediums like Gold and S&P 500 have been more stable.

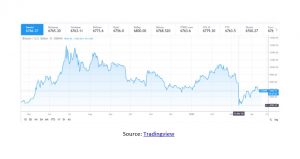

On November 22nd, the volatility in the crypto market was pronounced as the price of Bitcoin fell by 6.44% and Ethereum fell by 8.30%.

The Opportunity

The cryptocurrency market is volatile by nature. The industry is new and prices are still speculative. However, this does not change the fundamentals of some of the major projects. Such projects are fundamentally built on innovation and end-user satisfaction. The low price points are excellent entry points to get into such projects.

To a new investor, the volatility might bring with it a sense of fear and uncertainty. However, for advanced traders, this brings with it a plethora of opportunities. AAX is an exchange that provides the right platform, safety features, and tools for both beginner and advanced users.

Atom Asset Exchange (AAX)

AAX is a digital asset exchange developed in collaboration with the London Stock Exchange Group’s LSEG Technology. It is the first cryptocurrency and digital asset exchange to be powered by LSEG Technology’s Millennium Exchange matching engine, and the first exchange to join the London Stock Exchange Group’s ‘Partner Platform’. AAX focuses on trading high-liquidity digital assets, as well as OTC, spot and futures markets.

Spot trading

Spot trading is straightforward. It is mainly used by beginners and HODLers. Profit or loss is directly proportional to price movement. If the price goes up by 10%, and the user decides to exit the market, he has made a 10% profit. If it goes down by 10%, and the user sells, he’ll have lost 10%.

The Stop Loss feature protects the investor from huge losses. Buy or sell is triggered at a user-defined pre-determined price.

Futures trading

Futures trading is for advanced traders. A skillful trader can make a profit even if the market price is going down. The user takes a view on the future price of Bitcoin and trade into contracts that derive their value from Bitcoin. The users purchase futures contracts and go ‘long’ or ‘short’. If the price is expected to go up, the user goes long. If the price goes down, the user goes short. So, the user can make a profit in either of these two scenarios.

- If he goes long and the price goes up

- If he goes short and the price goes down

Sign Up To AAX

Leverage

Leveraged trading is riskier but also the most profitable if done correctly. This is, however, more suitable for the super-advanced traders. Through leverage, a user may deposit a small margin, but increase exposure significantly. AAX supports up to 100x leverage.

Therefore, even in case of losses, you can never lose more than what you’ve put in. There is a trigger for automatic liquidation of the user’s default position whenever loss nearly equals to the investment price.

The higher the leverage, the bigger are potential profits, but the less room a user has for the price to go in the undesired direction. AAX provides lesser leverages, for example 2x, for more room to cope with price volatility.

Default fund

If due to lack of liquidity, automatic liquidation for a leverage position does not happen on time, the AAX’s Default Fund covers the outstanding difference. As a result, the user never loses more than the invested amount.

Vanilla contract

Most Exchanges offer Inverse Contract. In such contracts, USD is the base currency and settlement happens in another currency, for example, BTC. In Vanilla contract, it is the other way round. For instance, in the BTC/USDT vanilla contract, BTC will be the base currency and USDT will be the pricing and settlement currency.

By trading in vanilla contracts to settle the profit or loss in USDT, users can avoid potential loss while exchanging to other tokens.

Over the counter (OTC)

On AAX’s OTC platform a user can currently buy and sell Bitcoin, Ethereum and USDT in exchange for the Hong Kong dollar, Chinese Yuan and US dollar. In terms of trading, the exchange thus matches the best available option that meets the user’s request immediately and seamlessly.

Advantages of partnership with the London Stock Exchange Group (LSEG)

One of the key advantages of going with AAX is that it uses the Millennium Exchange™ matching engine technology of LSEG. This is, incidentally, the first deployment of the technology in the cloud.

Now, the Millennium Exchange offers several benefits for the users. Foremost is the adaptability of the technology, as it allows configuration to trade any type of product in any market. Moreover, it combines reliability with scalability, thanks to its rule-based, distributed, and fault-tolerant technology design.

Road Map

AAX has solid plans for 2020. Notable ones include:

Q2

- Launch native exchange token, AAB

- Wealth management, part 1: borrowing

- Tokenized commodities: Gold

Q3

- Wealth management, part 2: lending, staking

- Bitcoin dimensions contracts

- Multi-asset as collaterals for trading

Q4

- Margin trading

- Options

- Social trading and a trading bot

AAB token launch

AAX is currently conducting its native exchange token (AAB) launch which is an ERC-20 token on the Ethereum blockchain.

The token will provide platform users access to crypto and crossover markets adding an extra dimension to trading with AAX. Additionally, the AAB token holders will have a share in the exchange growth.

Learn more about AAX and Sign Up here!

—

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This interview, overview or update article has been compensated for media cooperation and has been sponsored for by the interviewed or reviewed organization. Copyright Altcoin Buzz Pte Ltd. All rights reserved.