A decentralized exchange (DEX) is a peer-to-peer marketplace designed for users to trade cryptocurrencies in a non-custodial manner. They substitute traditional intermediaries such as banks with smart contracts that allow people to exchange assets.

Blockchains like Polygon host some of the best-decentralized exchanges, which we’ll talk about in this piece.

1) Uniswap

There’s no doubt that centralized exchanges are losing credibility with investors. So, platforms such as Uniswap have become popular. Uniswap is a DEX that introduced the automated market maker (AMM) model for the first time.

It allowed traders to tap into a steady pool of liquidity and trade against an algorithm using a constant product formula. Uniswap was originally launched on Ethereum. However, its V3 version allowed the exchange to extend to other blockchains other than Ethereum.

This is as exciting as it gets. A massive step towards Polygon's inevitable mass adoption. No other chain is built for mass adoption like Polygon and Uniswap dropping on it is further proof of this. Some very exciting stuff happening here!

— ForbiddenSec 💜 🦇 🔊 🌿 (@ForbiddenSec) December 23, 2021

Following the launch of the AMM model in V1, the V2 model supported trading between different ERC-20 token pairs rather than swaps between ETH and ERC-20 tokens. This had an immediate impact. It resulted in less slippage and the implementation of protocol fees. V2 supported the use of wrapped Ether as token pair liquidity rather than native Ether.

Liquidity providers can create distinctive price curves and center their capital at preferred prices in the V3 version to increase capital efficiency. Additionally, the v3 version enabled the automatic withdrawal of funds in the event that prices rose above the LP’s price range. Uniswap debuted on Polygon in line with the release of V3. Users now have access to a far more inexpensive trading experience because of Polygon’s lower gas fees.

The V3 version features a variable price structure for payment. The fee for stablecoin trading pairs is 0.05%. The fee for typical non-correlated pools, such as ETH and stablecoins, is 0.3%. Meanwhile, the fee for other pairs is 1%. Also, stablecoins and wrapped tokens, like USDC, Wrapped BTC, wETH, and DAI, are the most liquid options on Uniswap.

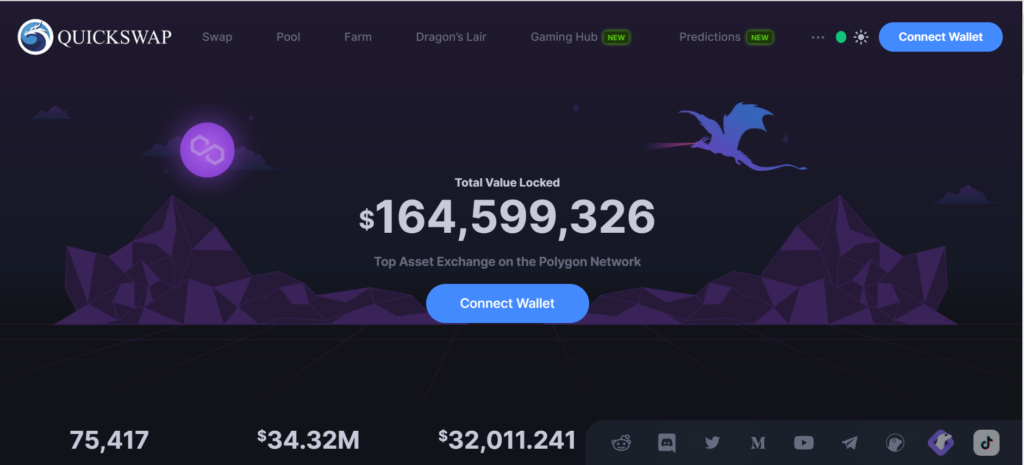

2) Quickswap

QuickSwap is a permissionless DEX built on Polygon Layer 2 infrastructure for scalability. This project is a Uniswap fork and an automated market maker (AMM). Quickswap has a similar structure to Uniswap. It does, however, outperform UniSwap in terms of speed. Quickswap allows users to bridge ERC-20 tokens from Ethereum to Polygon. They can also trade any pair as long as there’s a liquidity pool for it. Also, by supplying a token pair, anyone can launch a new liquidity pool and begin earning transaction fees from other participants.

Quickswap’s token, QUICK, also grants governance rights to holders. Quickswap is controlled by a decentralized community. So, holders of QUICK tokens have the ability to vote on various issues. The community can, for example, vote to alter the commission or the formula for distributing rewards.

3) Balancer

Balancer is an automated market maker that has enjoyed widespread support due to its innovative features that set it apart from its rivals. Users can swap ERC-20 assets using the Balancer AMM, DEX, and liquidity pool protocol without the need for any centralized intermediaries. Anyone who has a compatible wallet installed can access Balancer due to its permissionless platform. Balancer supports wallets like MetaMask, WalletConnect, Coinbase Wallet, etc.

BAL is live!

The 435k BAL for liquidity providers of the first three weeks of liquidity mining (145k per week) have just been sent out to the wallets used to provide liquidity on Balancer.https://t.co/pkXFzwzPVC

— Balancer (@Balancer) June 23, 2020

Balancer, as an automated market maker (AMM) platform, differs from conventional centralized exchanges in that you are not required to register for an account or go through any verification procedures in order to use the site.

Anyone can use Balancer to trade, generate, and supply liquidity to Balancer pools, and it is fully permissionless. Pool operators can choose their own swap costs, which sets Balancer apart from many other AMMs. Balancer is also a cheaper spot for trading stablecoins, giving it an edge over rivals like Uniswap.

All the DEXs listed here are contributing to the market activity on Polygon. As of this writing, Polygon has a TVL of $1.15 billion.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.