An ‘eventful’ first half of the year bids goodbye. Enthusiasm, along with retail confidence, disappeared. Many projects are dead, some rugged, and many investors are rekt. But throughout the year, we all have learned too! Sometimes lessons are more impactful than short-term gains. Now, it’s time for an inclusive assessment of the State of the crypto market: narratives, trends, and more.

TLDR

- Liquidity drives price

- Gaming as a strong narrative

- Metaverse and Opportunities

- State of De-Fi

- Analysis of the bear market

- NFTs and Valuations

- Stablecoins: the rise, and the fall

Liquidity Is The King

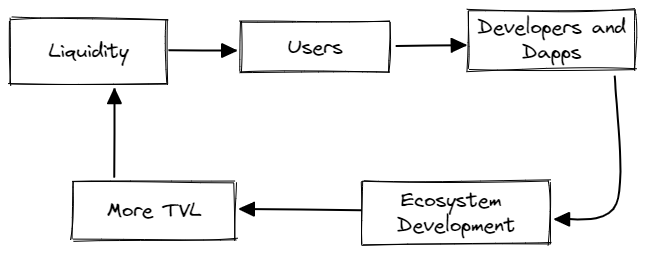

In any layer-1 blockchain, liquidity drives investors, developers, and price. Hence Ethereum is the top smart-contract chain despite its high gas requirement. Binance is the leading exchange because it has good liquidity. Finally, Bitcoin is the king of cryptos due to its enormous liquidity.

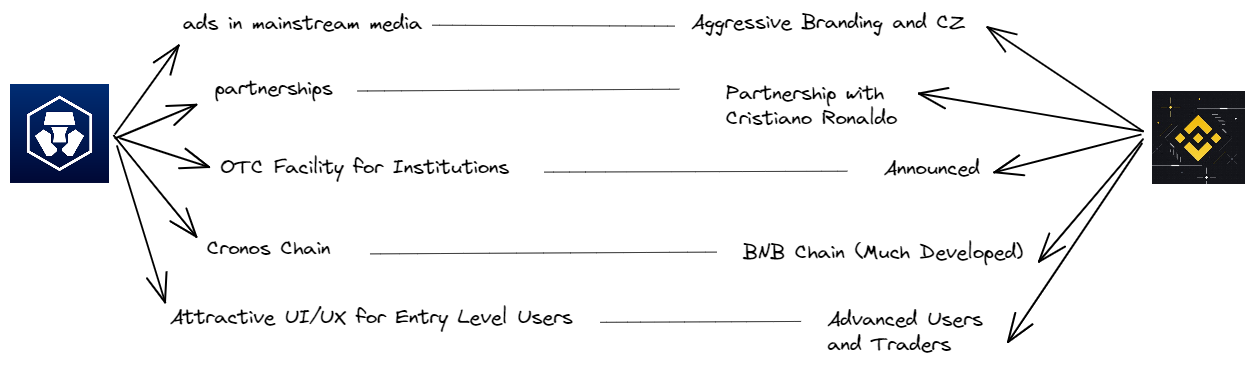

We see Crypto.com pushing for market share quite often, and if it can attract liquidity, the native token $CRO can outperform all the exchange tokens.

Binance is actively hiring, while Crypto.com had to cut 260 positions, with both platforms employing almost 4400 people.

So $CRO is a medium risk – high gain investment in a stable market.

Stability is not the lack of volatility but steady growth in confidence. When retail participation returns, we can conclude that the market is stable.

Gaming is an Upcoming Narrative

Ever since A16Z’s $600 million gaming fund, the confidence in blockchain gaming has been booming. A16Z is a reputed VC firm with years of successful investment experience. Earlier, speculators have seen Solana as the undisputed champion for blockchain gaming. But its sustainability is in question, and games are moving to other blockchain ecosystems.

Who can emerge as a winner?

Currently, it is the Polygon Network that funnels games from Ethereum, Solana, and BNB Chain into its fast, cheap, EVM-supported solution. A good developer community, the safety net, the support of Ethereum developers, and the growing ecosystem act as bonuses to Polygon.

Immutable X is also competing with Polygon in the gaming niche. It recently launched a $500 million ecosystem fund to support games in its ecosystem.

We're launching the @Immutable Developer & Venture Fund worth $500M to accelerate the adoption of Web3 games & projects.

Learn more ➡️ https://t.co/iUs5uYQsIq

Continue the thread below. 🧵 pic.twitter.com/u5rPPsApAt

— Immutable | $IMX ⓧ (@Immutable) June 17, 2022

Metaverse Will See A New Influx Of Investors

It goes without saying, the metaverse will drive the growth of technology in the next decade. As a result, there are bold predictions that metaverse will be worth $1.6 trillion in 2030. At present, metaverse has a $124 billion valuation.

Projects building metaverses will benefit from the growth, and pioneer projects that shift to the metaverse will see explosive user growth. Also, projects like Sandbox can act as a teleporting platform to the metaverse.

De-Fi: Way Forward

DeFi is the most innovative development in crypto after the ICO boom of 2017-18. However, defi is going through a difficult phase right now.

The collapse of Luna and its stable coin UST mark the beginning of this downtrend, with Bancor’s liquidity crisis being the latest woe.

Many defi protocols will fail to withstand the test of the bear market. Needless to say that their governance tokens and reward tokens will free fall.

But at the same time, this crisis itself is a huge opportunity. Defi protocols that continue innovating and experimenting will emerge as defi champions in the next bull run. Projects like Aave, Frax, Curve, and Uniswap are noteworthy in development, and Balancer, Bancor, and Compound are the next ones ready to resolve their existing problems.

State Of The Bear Market

Although the 4-year cycle is a well-acknowledged concept in crypto, there is immense uncertainty in the duration of the bear market. We see persistent regulations from governments and their agencies, the collapse of neo-banks like Celsius, liquidated VC firms, etc – as a red flag. Is that a red flag on the future of the crypto industry? No! But these red flags remind us to consider realistic valuations of crypto projects before investing in them.

Attracting liquidity and investment is the biggest challenge in the general market, but not in the crypto industry. It is not uncommon to see startups without a working product or even a whitepaper launch at $100 million valuations.

Yet, it is unnatural considering the healthy valuation of such startups. Any long-term investments in this bear market should go through the valuation lens. Else, some bubbles can burst in a bear market too.

NFTs

Art is never chaste. Where it is chaste, it is not art.

Pablo Picasso

NFT is a revolutionary concept, often misunderstood by skeptical crypto investors. People take pride in their NFT holdings, and some wonder how a jpeg can be worth a fortune!

Any crypto traveler who wishes to try their luck in NFTs should understand that art can not have standardized valuations. Although, art needs to evolve to fit into the NFT world and vice-versa. That pushes me to say that many NFTs in the market are driven by wash trading and the myth of diamond hands.

Only a trained eye can see through real art. But we are investors, and for us, NFTs are valuable when they have utility. Now, what kind of utility? It depends on the type of narrative it has. Does the NFT help you to access secret metaverse events? or does it grant membership to a highly cohesive community?

These are mere examples, and utilities for NFTs are endless, from gaming to identity, from keys to locks.

Opensea leads the NFT sector in terms of volume and collections. Although Looksrare, MagicEden, and others are growing steadily, the hegemony of Opensea is slowly becoming a monopoly. Even though Opensea has not decentralized its governance through tokenization, a token airdrop like Optimism is always on the table.

Stablecoins

Who can forget the unparallel rise of Luna – from 50 cents in December 2020 to 100 dollars in 2021 end – 199x gains in a year!

But remember the fall of Luna – not just price-wise, but also trust-wise. The collapse of Luna and UST wiped out billions of dollars from the market because of poor design and knee-jerk reactions.

Of course, Luna serves as an example of nothing is too big to fail. Yet it drained potential investments and threatened the survival of many projects.

$USDT also has its shortcomings, but it defended the 1:1 peg.

$USDC and $BUSD survived the stress test and emerged as winners.

$USDC was instrumental in defining the stable coin standards in 2022. It secured a $400 million investment from banking giant Blackrock. Also, using the Axelar network, it expanded to the Cosmos ecosystem. Later Circle announced a Euro-backed stable coin, displaying its ability to become the top-ranked stable coin in the near future.

$BUSD chose to remain in the BNB ecosystem because that is how it can be most liquid efficiently. Binance also removed the withdrawal fee of $BUSD in the BNB chain network.

But both $USDC and $USDT missed an opportunity to expand into the Polkadot ecosystem. After the launch of parachains, Polkadot was clearly in need of a stable coin to carry forward its liquidity provisions. Acala’s stablecoin, $aUSD, was quick enough to respond to this need and has now established itself as the de facto stablecoin for the network.

Well, that’s a wrap for the state of the crypto market report.

Win $6,699 worth of bonuses in the exclusive MEXC & Altcoin Buzz Giveaway! Find out more here.

For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.