Risk is the likelihood that something bad may happen in your strategies that will turn out differently than what you expected. The trading of cryptocurrencies involves risk. It is the potential for a trade to end in a way that results in losses.

Risk management is the single most crucial skill for traders in the cryptocurrency market to master because of the volatility. Everyone has heard the statistic that 90% of traders lose money. While this remark may be accurate, it’s crucial to understand that the majority of traders do not practise any form of risk management.

There is a very big probability that you will sustain substantial losses if you lack the necessary expertise of how to manage risk. For instance, a 50% risk on a short position simply indicates that there is a 50% chance that the price of Bitcoin will increase, causing you to lose money.

Managing Risk In Cryptocurrency Trading

When trading cryptocurrencies, the general rule is to “never risk more than you can afford to lose.” We often urge traders to utilize no more than 10% of their budget or monthly income given the seriousness of the risk in cryptocurrency trading. Additionally, using borrowed funds when trading is not a good idea because it increases credit risk.

Risk/reward ratio, position sizing, and stop loss and take profits are three major categories that can be used to group risk management tactics.

Stop Loss and Take Profit

A stop loss is an execution order that closes a position when the price falls to a certain limit. Contrarily, a take profit order is an executable order that closes open positions when prices reach a specific level. Both methods of risk management are effective. Take Profits allow you to exit the transaction before the market turns against you, whilst Stop Losses prevent you from trading in deals that aren’t profitable.

Stop market and trailing stop orders are both supported by the trading platform. When a certain price is reached, a stop market order automatically executes a buy or sell order. When price moves past a certain percentage or fixed currency amount threshold, a trailing stop will automatically execute a market buy or sell order. It does this by intelligently tracking price movement.

Risk/Reward(R:R) Ratio

The risk/reward ratio contrasts the potential returns with the actual amount of risk. In trading, a position can become more profitable the riskier it is. You can decide when to enter a transaction and when it is not profitable by knowing the risk/reward ratio. The risk/reward ratio is calculated as per the below formula(R)

R = (Target Price – Entry Price) / (Entry Price – Stop Loss)

Most seasoned traders, on average, are willing to risk 1-3 percent of their capital.

Risking more than that could swiftly deplete your trading account.

Position Sizing

The size of a trader’s position determines how many coins or tokens they are willing to purchase. The possibility of making large returns tempts traders to deposit 30%, 50%, or even 100% of their trading capital in cryptocurrencies. However, this is a disruptive action that puts your finances in grave danger. Never put all of your eggs in one basket is the cardinal rule. Here, the correlation between position size and stop loss price is crucial to bear in mind.

Trade Example

When determining the size of a position, two forms of capital are used. One is known as “Enter Capital,” and the other is known as “Risk Capital.” The first is the amount of money you are willing to put into each and every transaction. We suggest that traders consider this sum to be the magnitude of any new order they place, regardless of the nature of the order. The second includes risk capital, or the money you could lose if the trade doesn’t work out.

Position Size is calculated as follows: (Entry Price – Stop Loss) / ((Trading Capital * Risk Per Trade)) * Entry Price

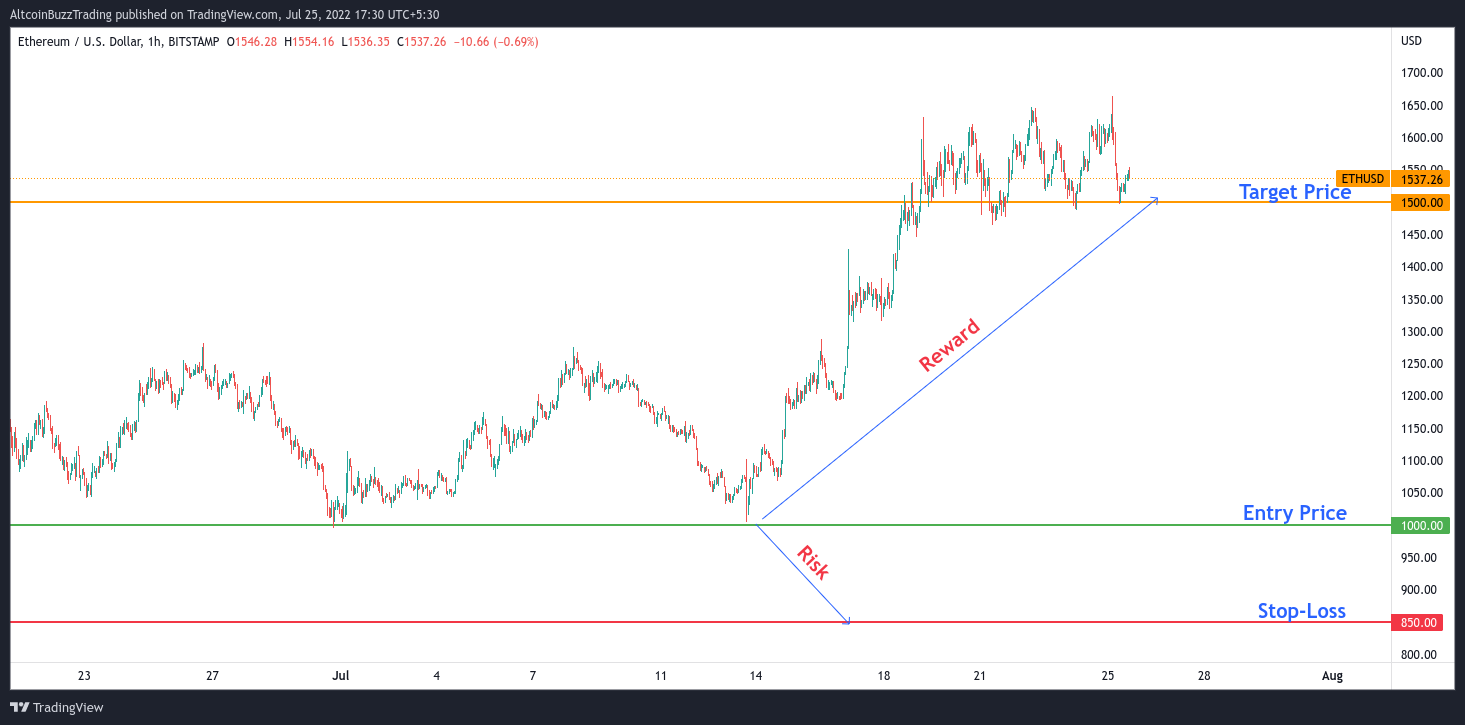

Let’s say our goal is to buy ETH with USDT to sell it at $$1,500 with $2,000 in total trading capital.

Risk on each Trade: 2%

Entry Price: $1,000

Stop-Loss: $850

Our position size would be:

P= ((2,000 * 0.02) / (1,000 – 850)) * 1,000 = 266

$266, or 13 percent, of the trade’s position size, is open. However, because of our Stop Loss, which will close the transaction when it reaches the predetermined level, we only take a 2 percent risk.

Risk/Reward(R:R):

From the previous example:

Entry price: $1,000

Stop Loss: $850

Target price: $1,500

R:R would be:

R = (1,500– 1,000) / (1,000 – 850) = 3.4R or 1:3.4

A ratio of 1:3.4 is good. Also, We caution traders against using a ratio that is less than 1:1.

Conclusion

Understanding your individual risk tolerance and keeping sensible position sizes could help you manage your risk better. One of the most crucial elements of cryptocurrency trading is risk management, and how to use it to prevent losing your entire deposit on the first day.

And for our best, freshest research on NFT buys, Layer 1 chains, DeFi, or games, come check out Altcoin Buzz Access. Plans start at only $99 per month

For more information on cryptocurrency, visit the Altcoin Buzz YouTube channel.

Images courtesy of TradingView.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational and informational purposes only. Any information or strategies are thoughts and opinions relevant to accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided.

Do your own due diligence and rating before making any investments and consult your financial advisor. The researched information presented we believe to be correct and accurate however there is no guarantee or warranty as to the accuracy, timeliness, completeness. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. Copyright Altcoin Buzz Pte Ltd. All rights reserved.