Did you know that you can now seamlessly transfer tokens across rollups with HOP Protocol? This protocol makes these transfers fast, transparent, and trustless.

This article is an in-depth overview of the HOP Protocol, its major features, tokenomics, etc.

What is HOP Protocol?

As previously disclosed, HOP Protocol facilitates token transfer across rollups and other shared layer-1 networks. Also, the transfers are usually fast, and trustless. Therefore, providing users with much-need transparency, seamlessness, and easy usage.

Moreover, token transfers on rollups are generally slow, expensive, and difficult to figure out. However, the HOP Protocol proposes a permanent solution to these issues. The protocol furthermore cuts costs while also facilitating cross-rollups asset transfers and composability of dapps. Simply put, this means that with the HOP protocol, assets can easily move from one rollup to the other.

Gm Hop DAO 👋

Today, Hop begins its journey to become core Ethereum infrastructure, operated and controlled by our community. pic.twitter.com/OPbPmSjlLR

— HopProtocol (@HopProtocol) May 5, 2022

Before we move on, Let’s find out more about rollups

What Are Rollups?

Rollups are the bedrock of the Ethereum (ETH) scaling plan. A rollup is also a unique layer 2 (L-2) scaling solution. It is usually equipped with an execution layer that completes transactions similar to how the Ethereum blockchain operates. However, ETH is known for its high transaction fees, so roll-ups complete transactions at very low costs. They also help the Ethereum blockchain to scale by improving throughput and moving data storage and computation analysis off-chain.

There are essentially two (2) types of rollups:

- Optimistic rollups.

- Zk-rollups.

The major difference between both rollups is the process of validation they go through by their base layer-1 (L-1) chain. Most times the ‘rollup exit time’ is quite high when transferring assets across rollups. Note that the ‘rollup exit time’ is the speed by which data can travel from a rollup to its base L-1 chain.

Moreover, optimistic rollups make use of fraud proofs and usually require about 24 hours to one week as exit time. Zk-rollups, on the other hand, make use of validity proofs. Its confirmation and validation time is near instant albeit somewhat expensive.

To truly enjoy the benefits of using rollups, users need to be able to seamlessly and easily transfer assets. Hence, the need for HOP Protocol.

More on HOP Protocol

HOP protocol operates a General Token Bridge to facilitate scalable rollup-to-rollup asset transfers. The bridge is a perfect example of a third-party bridge that helps bridge ERC-20 tokens. HOP token b ridges employ two major processes to facilitate quick, seamless, and cost-effective token transfers.

1. Using a Cross-network Bridge Token – With this method, users can quickly move tokens across rollups. They can also be claimed on the base layer-1 chain. This method is also fast and cheap.

2. Using Automated Market Makers (AMM) – With AMM, token swaps between each bridge and canonical tokens can easily take place. This approach furthermore helps to incentivize the process of balancing liquidity on the network.

Together, both approaches will allow asset transfers between L-2 tokens with the General Token Bridge as a third-part asset.

How Does HOP Protocol Works?

The use of the bridge results in the creation of Hop Bridge Tokens. The tokens are L-2 tokens with the letter ‘h’ added in front of their usual ticker symbol. So, Ethereum (ETH) becomes ‘Hop ETH’ or ‘hETH’.

Here’s why we believe @HopProtocol offers one of the best bridges in the ecosystem!

A Deep Dive 🧵https://t.co/HguZd45t3T

— LI.FI – Powers any cross-chain strategy (🦎,🦎) (@lifiprotocol) January 25, 2022

For example, transferring 5 ETH tokens into the L-1 Hop bridge will result in the minting of 5 Hop ETH or hETH from an L-2 Hop Bridge. The token can also be easily swapped for its underlying assets. That is, hETH can also be easily converted back to ETH.

For a Hop transfer to be successful, certain information has to be provided. The information includes:

- The ID of the destination chain. That is the ID for the L-1 destination or rollup.

- The amount to be transferred.

- Lastly, the recipient’s wallet address.

Staking on HOP Protocol

Some of the top features of the HOP Protocol include staking, providing liquidity via liquidity pools, sending tokens, etc.

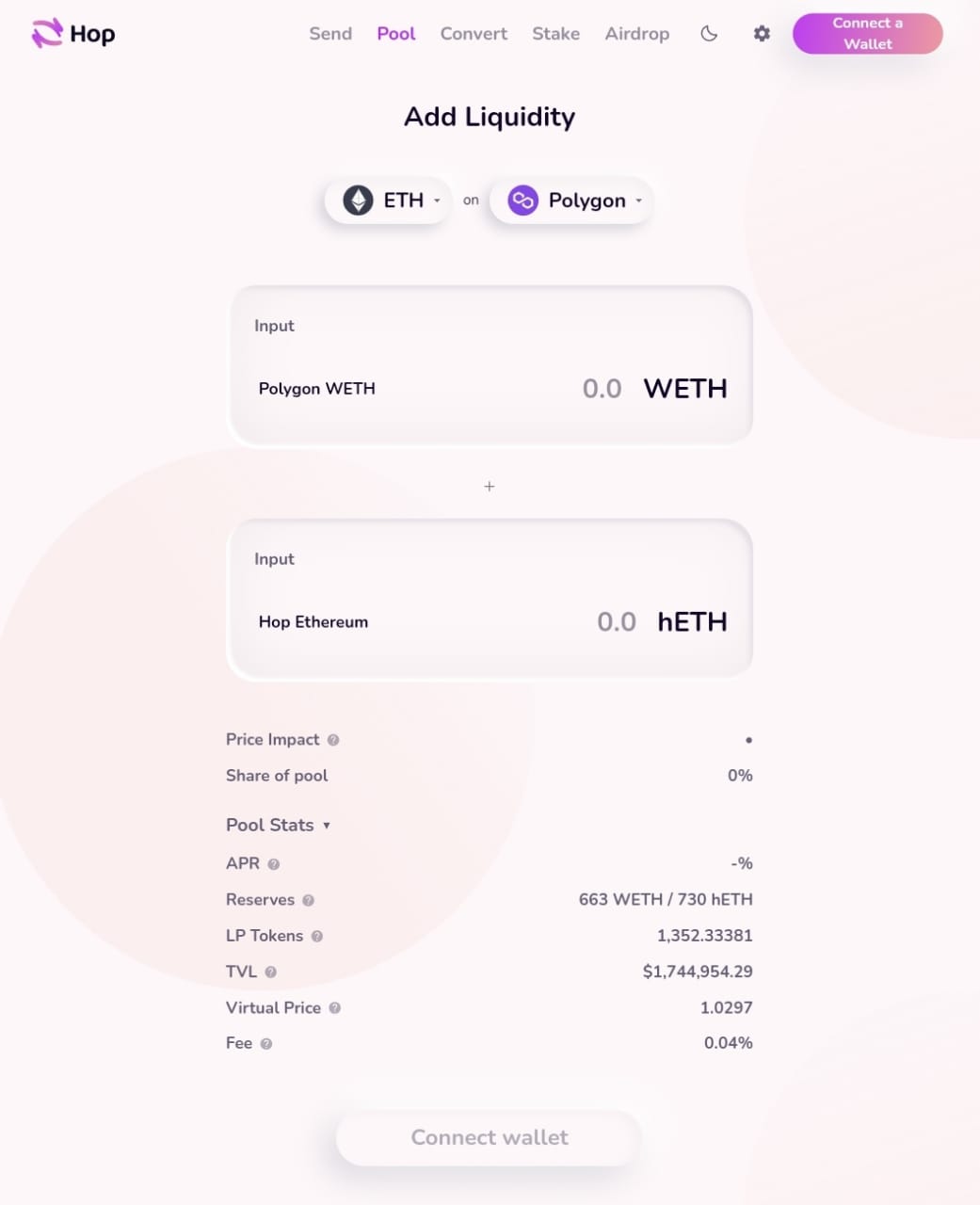

Providing liquidity on HOP requires users to add Hop tokens (hUSDC, hETH, etc) in AMM liquidity pools on HOP. Users can also simply add native tokens (USDC, ETH, etc) to the HOP AMM liquidity pools. Notably, every asset on HOP also has an AMM liquidity pool.

Source: HOP Protocol

To provide liquidity, users need to deposit HOP into the liquidity pool. Then, bridge the token from the Ethereum chain to the destination chain via Hop Bridge. This is done using the “Convert” feature. Interestingly, LPs on HOP also earn swap fees on every transaction on the Hop Bridge.

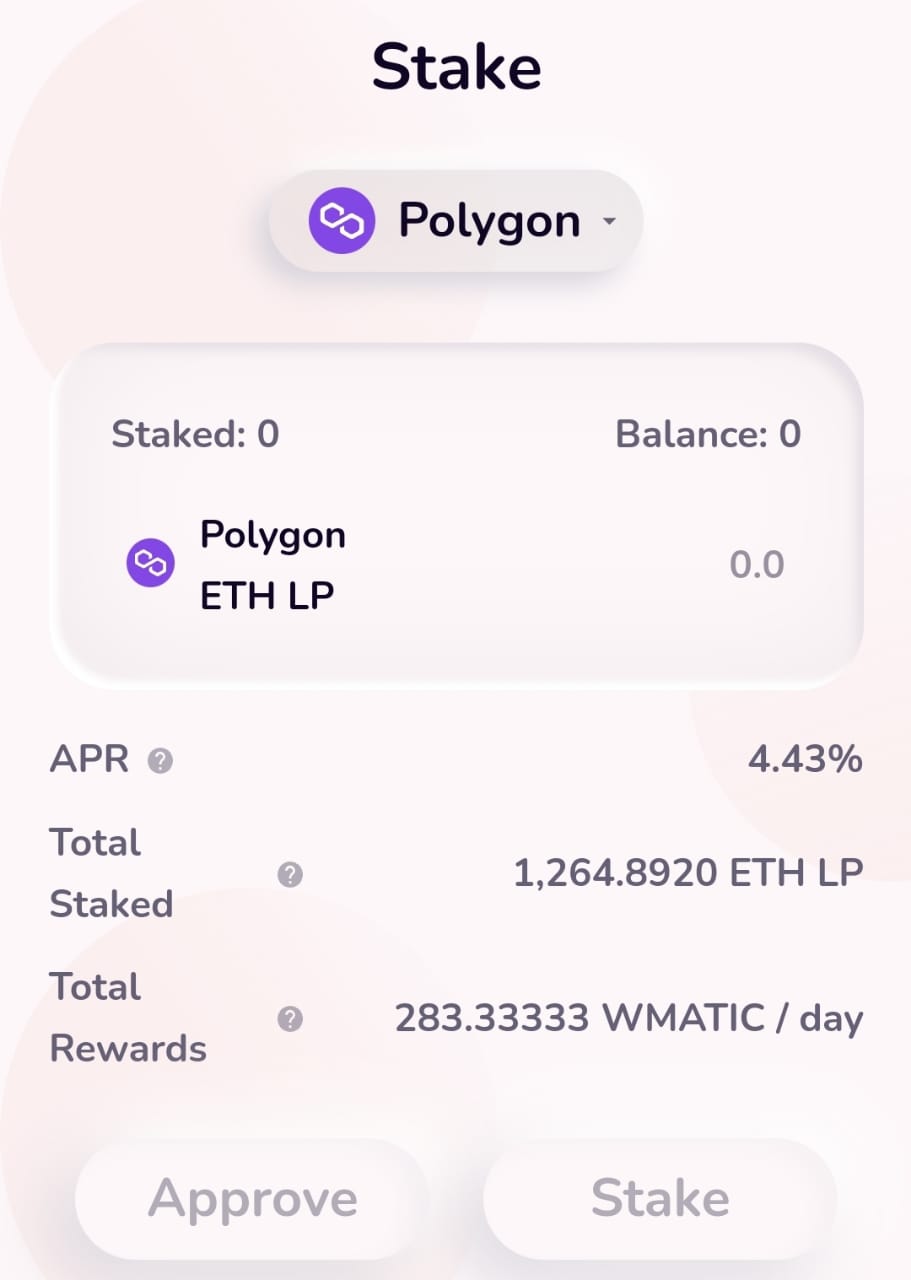

Also, HOP holders can stake and earn amazing APRs. Some of the staking opportunities available on HOP include:

- Staking Polygon USDC LP will result in an APR of 1.17%

- Polygon USDT LP staking will result in APR as high as 8.16%

- Staking Polygon (MATIC) will result in APR as high as 4.48%.

Here is an example on Polygon’s blockchain:

Source: HOP Protocol

Rollup-to-Rollup Transfers

Cross-rollup transfers are one of the most important aspects of HOP protocol. With Hop’s Bridge and Canonical tokens, users can easily carry out rollup-to-rollup transfers. Such transfers on HOP are scalable and do not require any L-1 intervention.

For example, if a person with Rollup A canonical DAI needs Rollup B canonical DAI will need to:

- First swap his\her Rollup A canonical DAI for “hDAI” via AMM on Rollup A.

- Send the “hDAI” from Rollup A to Rollup B via the Hop Bridge.

- Once liquidity is available, the user receives the desired “hDAI” on Rollup B.

Also, Liquidity Providers (LPs) are a key part of the HOP ecosystem. For their participation, they usually receive an estimated 0.3% reward on each swap.

Tokenomics

HOP is the native token of the HOP Protocol. HOP token is also a governance token providing its holders with voting rights on the HOP Protocol. It also has a total supply of 1 billion tokens and a circulating supply of 38,3 million HOP tokens.

repost:

There will be an initial supply of 1b $HOP tokens:

• 8% airdropped to early users

• 60.5% to the Hop treasury

• 22.45% to the initial development team (3 yr vesting, 1 year cliff)

• 2.8% saved for future team

• 6.25% to investors (3 year vesting, 1 yr cliff) pic.twitter.com/rQ7xcGa9ba— HopProtocol (@HopProtocol) May 5, 2022

According to DappRadar, the protocol completed over 149,709 transactions in the last 30 days. Alongside, a total volume of $58,869,504.47 and a balance of $31.55 million. Also, at the time of writing, the token was trading at $0.104 with a market cap of $4 million and a 24-hour trading volume of $804,000.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.

Nice article 👍