Kava is a layer 1 chain in the Cosmos Hub. This gives it access to the fast and scalable Cosmos IBC network. As a result, it’s also interoperable. It combines the Cosmos advantages with the developing power of Ethereum. Kava also boasts an extensive DeFi network.

So, we’re going to have a closer look at decentralized exchanges or DEXes on Kava.

Only 1 hour to @MareFinance Surge event. No lockup, fully liquid. $ETH $USDT $USDC $DAI Let's go! 🌊 pic.twitter.com/OiyglrLQEA

— Kava (@KAVA_CHAIN) May 9, 2023

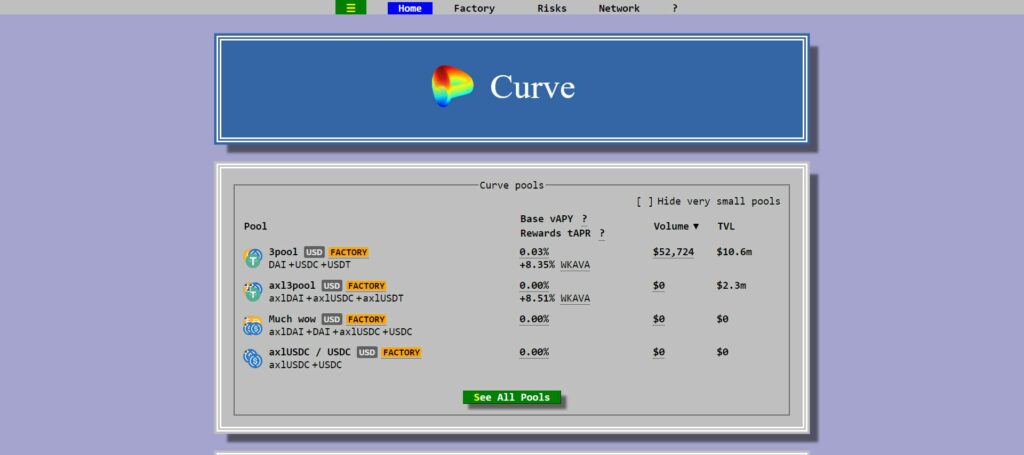

1) Curve

Curve Finance is one of the bigger DeFi protocols out there. It’s a decentralized liquidity aggregator. Some of its appealing features are, for instance, low fees and slippage. To reduce slippage, the protocol uses a specific formula. Curve offers stablecoin and various tokenized assets trading.

It is active on no less than 12 different chains and Kava is one of them. According to DeFiLlama, it’s the biggest DEX on Kava. It has a TVL of $12.89 million. However, its total TVL for all chains is $4.19 billion. Its daily volume is around $174 million on all chains. The protocol takes the sixth spot in the market cap on Kava. Curve launched here in September 2022. Other chains it deploys on are, for example:

- Ethereum with $3.9 billion TVL

- Arbitrum with $85.94 million TVL

- Polygon with $60.36 million TVL

- Optimism with $39 million TVL

- Fantom with $25.17 million TVL

- Or Avalanche with $16.58 million TVL

Upon launching on this network, Curve had the highest rewarding pools of all chains it deployed on. Rewards were up to 115% on USDC, USDT, and DAI. The picture below shows one of Curve’s current promotions on Kava.

Source: Curve

2) Kava Swap

According to DeFiLlama, Kava Swap sits at the 10th spot for TVL on the Kava chain. Its TVL is $3.5 million, and it’s only deployed on Kava. This swap is a DEX and has an AMM (Automated Market Maker) model. It also has its own token, SWP. The DEX has a daily volume of around $341,751. It launched in August 2021.

Kava Swap is part of the Kava app. The app also offers liquid staking, minting, lending, and other earning options. For example, farming or liquid staking. Liquid staking allows you to earn more passive income. After you stake your principal asset, you receive a new token. This token represents the underlying asset. You can use this ‘liquid’ token to lend it, stake it, or use any other DeFi option available for this token. So, Kava Labs has a good tutorial on how to use this DEX.

MultiSurge is coming live in 3 days!

Extraordinary high yields for your favorite #EVM assets: $USDT $USDC $wBTC pic.twitter.com/R57Ris4vmk

— Kava Swap (@Kava_Swap) April 22, 2023

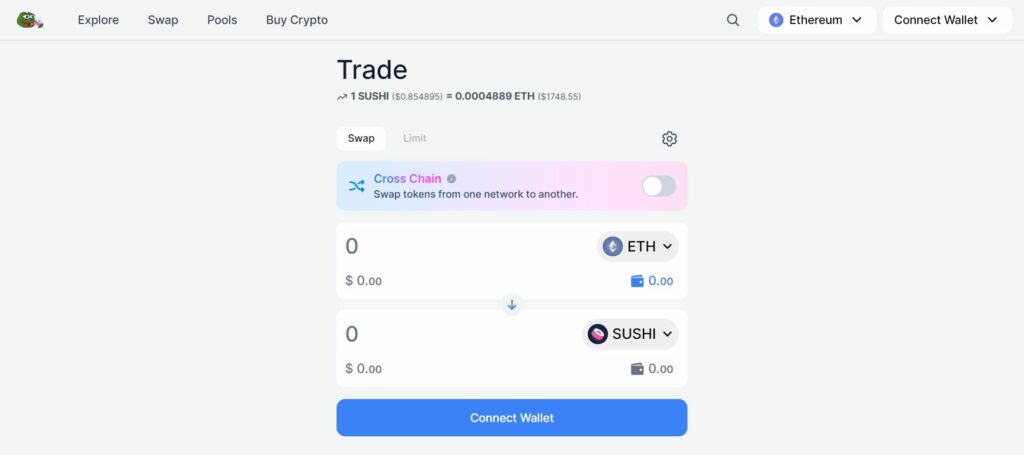

3) SushiSwap or Sushi Trident

In the current DeFiLlama charts, Sushi Trident takes the 12th spot by TVL on Kava. This is an AMM framework. In other words, you can deploy and build AAMs on it. However, it is not an AMM itself. In October 2022, Sushi deployed three Dapps on Kava. This included Trident, BentoBox (Vaults), and Onsen (farms).

Still, Trident has a TVL that is just above $1 million. So, Sushi Trident deployed on 8 chains. Its overall TVL is $12 million. Other chains you can find Sushi Trident on:

- Optimism.

- Arbitrum.

- Polygon.

- BNB Chain.

- Avalanche.

You can find Sushi products on no less than 25 different chains:

- BentoBox (Vaults) on 11 chains.

- SushiSwap V3 on 13 chains.

- Kashi (lending) on 5 chains.

- Furo (a payment streaming platform) on 11 chains.

Kava also deployed an Ethereum bridge. This allowed Sushi users for the first time to take part in the Ethereum and Cosmos networks. The picture below shows the SushiSwap UI.

Conclusion

We looked at the top 3 decentralized exchanges on Kava. These included Curve, Kava Swap, and SushiSwap.

The current price of SUSHI is $0.8748. It has a market cap of $168.4 million. The max supply is 250 million tokens. There is a total supply of 248 million tokens. Out of these, 192.7 million tokens already circulate.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.