If you haven’t already guessed it, we’re huge fans of Kava at Altcoin Buzz. We’ve written a beginner’s guide to Kava. We’ve brought you the top 3 wallets to store its native $KAVA token. And, we’re keeping you abreast of its ecosystem developments too.

Speaking of developments, boy, does Kava have some. Indeed, with its recent Kava Rise program, many developers are flocking to Kava. And this shows in the growth of its Decentralized Applications (dApps).

As of now, according to DeFillama, Kava houses a total of 125+ dApps on its chain! In turn, this has brought a Total Value Locked (TVL) of $218 million. Today, we’ll explore the top 5 DeFi protocols in Kava. These protocols are leading the charge to increasing Kava’s TVL and adoption.

#1 – Kava Lend

First of the top 5 DeFi protocols in Kava is Kava Lend. Kava Lend was previously known as Hard protocol. It’s a cross-chain money market that allows lending and borrowing of crypto assets. These assets include $BTC, $XRP, $KAVA, $BNB and other stablecoins.

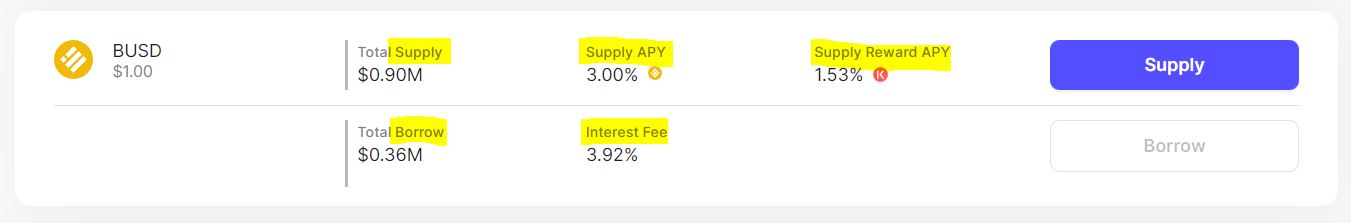

By supplying an asset into Kava Lend, you can earn a healthy yearly return. For instance, you can earn a total of 4.53% per year on your $BUSD deposits shown below. On the flip side, you can also borrow $BUSD. But, you’ll need to pay an interest fee of 3.92% per year. Moreover, the amount of $BUSD you can borrow will depend on the amount of $BUSD you supply within Kava Lend.

As of now, Kava Lend has a TVL of $90.49 million. It’s the top DeFi protocol on Kava. Next, let’s take a look at the runner-up, Kava Mint.

For DeFi to grow, it must evolve. Access to growth does not need to mean increased exposure to risks, which is the core principle guiding the Kava Ecosystem

Check out Kava’s new product naming structure that reflects the evolution of the Kava Ecosystem 🧵👇 pic.twitter.com/5mswM8LNQH

— Kava (@KAVA_CHAIN) August 26, 2021

#2 – Kava Mint

Next of the top 5 DeFi protocols in Kava is Kava Mint. Kava Mint is pretty similar to Lend. It’s also a Lending protocol. The difference lies in the asset borrowed. For Lend, the asset you borrow could be any of its supported assets. But for Mint, you’re minting $USDX instead. For info, $USDX is the native stablecoin for the Kava ecosystem.

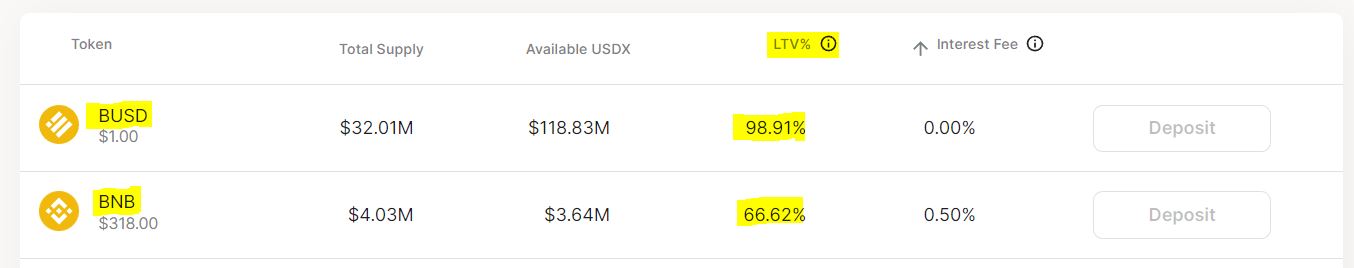

Kava Mint supports 7 assets as collateral for deposits. Once you’ve supplied these assets, you can then proceed to mint a limited amount of $USDX. Said limit will be a % of the asset you deposit, in dollar value. Let’s take a look at some examples below:

- For $BUSD: If you supply 1,000 $BUSD, you can mint 98.91% of your collateral in $USDX. That means based on the LTV%, you can mint 989.1 $USDX.

- For $BNB: If you supply 1 $BNB, you can mint 66.62% of your collateral in $USDX. That means you can mint a total of 66.62% x $318 = 211.85 $USDX.

The principal idea behind Kava Mint is to unlock value. When you simply HODL your assets, it’s really not doing much for you. But if you supply collateral to Kava Mint, you can unlock its value in terms of $USDX. With said $USDX, you’re then free to participate in the many DeFi offerings on Kava.

Moving on, let’s segue into the next dApp.

#3 – Kava Earn

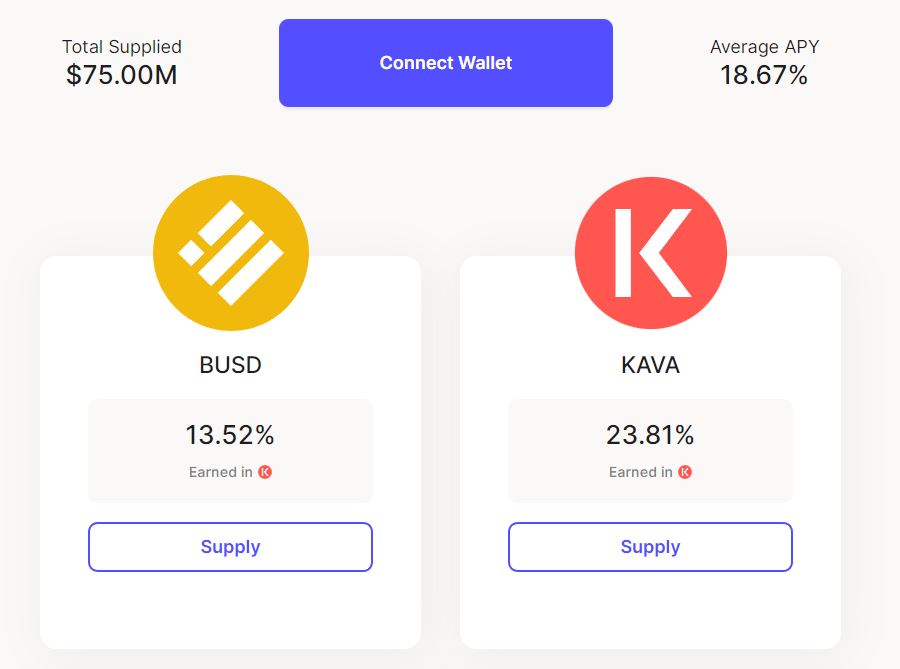

The third of the top 5 DeFi protocols in Kava is Kava Earn. In Kava’s own words, Earn is “DeFi made easy”. And we couldn’t agree more. Indeed, Earn greatly simplifies DeFi for users on Kava. Just take a look at their User Interface (UI) below. By depositing $BUSD or $KAVA, you can get a good yearly return. Without doing any work at all.

In the backend, it’s the pre-made DeFi strategies that’re doing the heavy lifting. You can take a look here at how these strategies create such good yields. Simply put, Kava Earn takes complicated DeFi and simmers it down into simple deposit and withdraw transactions. All of this is so that we, as users, can get the best yields without racking our brains.

As of today, Kava Earn has a TVL of $45.69 million. Now, let’s move on to #4.

#4 – Kava Liquid

Next of the top 5 DeFi protocols in Kava is Kava Liquid. As its name suggests, Kava Liquid is a Liquid Staking protocol. Here, you can liquid stake your $KAVA tokens. In turn, you’ll receive $bKAVA, which represents your stake. Unlike normal staking, you can send, receive or use your $bKAVA for DeFi. So, this unlocks the value of your staked $KAVA.

CONFIRMED: #KAVA Liquid Staking launch obtains huge usage.

Over 15% of all staked KAVA now Liquid Staked and in #DeFi protocols within 12 hours! pic.twitter.com/oKZ8JpN5yR

— Kava (@KAVA_CHAIN) October 27, 2022

Oh, and did we forget to mention this? Staking your $bKAVA on Kava Earn nets you a nice 23% APY in $KAVA tokens! Again, that’s a much better return than simply HODLing your $KAVA in the wallet.

As of time of writing, Kava Liquid has a TVL of $45.33 million. Lastly, let’s talk about a DeFi protocol which spans across multiple chains.

#5 – AcryptoS (ACS)

Last, but not least, of the top 5 DeFi protocols in Kava is AcryptoS. AcryptoS stands for Advanced Crypto Strategies. It’s a multi-chain Yield Optimizer protocol. Today, it has vaults across 15 popular blockchains! These include Ethereum, Binance Chain, Arbitrum and of course, Kava.

🎉We are thrilled to be officially part of #KAVA Rise!

Kava's $750M incentives program, rewards projects based on TVL achieved🚀Stake in our vaults now, & grow our TVL together🔥https://t.co/EE12pXVn93

💰LP Vaults with @EquilibreAMM

💰Single-token Vaults with @MareFinance pic.twitter.com/o8ELAq2KKv— ACryptoS.com ⚔️ (@acryptosdao) March 16, 2023

AcryptoS has been around the block for some time. Since November 2020, to be exact. It’s main product on Kava are its Vaults. Said vaults include:

- Single-Token Vaults: For example, $USDT or $USDC vaults.

- Multi-Token Liquidity Pool (LP) Vaults: For instance, $WBTC/$ETH or $DAI/$USDC vaults.

“So, if they’re called Vaults, then what’s inside?”. You may be asking.

Well, each of these vaults contain unique, smart contract-run, DeFi strategies. These are designed to ensure users like you and me get the best yields for our deposits. Yet, yields are not the only consideration. These strategies are designed with safety and sustainability in mind. With this, our initial deposits are never compromised.

For more of these vaults on Kava, you can visit the ACS dApp here. As of now, AcryptoS has a TVL of $40.4 million across 15 chains, and $12.6 million on Kava alone.

Conclusion

Voila! That concludes our choices for the top 5 DeFi protocols in Kava. Now, what’re you waiting for? Let’s connect your wallets and put those idle $KAVA tokens to work!

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Check out our most up-to-date research, NFT and Metaverse buy, and how to protect your portfolio in this market by checking out our Altcoin Buzz Access group, which for a limited time, is FREE. Try it today.