Who is the biggest private company holding Bitcoin on their balance sheet as a Treasury asset? Correct, that’s MicroStrategy. No other company, disclosing that they hold BTC, comes close. Michael J. Saylor is not only co-founder but also the current Chairman and CEO.

Saylor knows how to put his words and money where his mouth is. Last week, they bought another 480 BTC, worth $10 million. Right in the middle of this bear market. So, it’s about time we take a closer at MicroStrategy and Mr. Saylor.

After investing 100 hours we all come to realize that #Bitcoin is 100x bigger than the next best digital commodity network and utterly unique. I take the long view in my cheerful, constructive conversation with @cvpayne as we talk BTC & debunk the critics.pic.twitter.com/YeqzfVd8xB

— Michael Saylor⚡️ (@saylor) June 21, 2022

What Is MicroStrategy?

MicroStrategy’s main service is to provide business intelligence. However, besides BI, they also offer plenty of other digital services. For instance, mobile software and cloud-based services.

Michael Saylor’s role starts in 1989 when he’s 24 years old. Together with Sanju Bansal and Thomas Spahr, he co-founds MicroStrategy. They were classmates at MIT. That’s the Massachusetts Institute of Technology, one of the world’s top technical schools.

Currently, Saylor is Chairman and Chief Executive Officer. Bansal was a Board member between 1997 and 2013. Spahr is a member of the Board since 2006.

On the other hand, Saylor is active in the company since the beginning. This makes him one of the longest-serving executives on Wall Street. In June 1998, he took back control over MicroStrategy. As a result, he holds 68.1% total voting power over the company.

With their recent purchase of 480 BTC, the company’s total BTC holdings stand at 129,698 BTC. This is 0.618% of the 21 million available Bitcoin. MicroStrategy’s average Bitcoin price is just above $30,000 per coin. Furthermore, Saylor claimed in 2021 to privately own over 17,000 BTC. He claims that his average buying price is under $10,000 per coin. This makes him an early investor.

Source: Flickr

How Profitable Has MicroStrategy Been Since Covid-19?

MicroStrategy started to invest in Bitcoin in November 2020, as an experiment. During the lockdown period of the pandemic, MicroStrategy spent all excess cash on buying BTC. This took on a life of its own, so to speak. In the end, they started using other means as well to buy more BTC. For example, crypto collateralized loans or share sales.

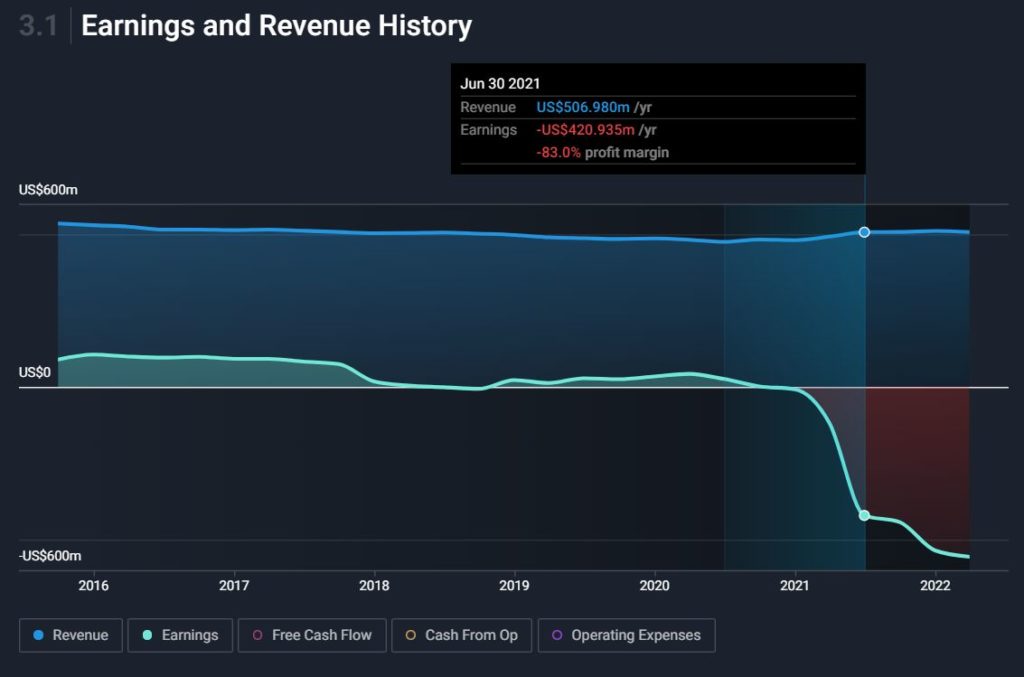

However, the big question is if this Bitcoin buying spree influenced their profitability. If we look back starting early 2018, we have seen three years of growth. Their share price went up a staggering 266%. But, as of early July 2022, they saw a 12-month non-profitable period. Their shares went down 66%. Revenue went up by 3%. See the picture below.

Source: Simply Wall Street

Although this revenue increase may seem promising in fact, it’s not as good as it looks. The simple reason is that they are still making a loss.

The first quarter of 2022 didn’t look too good either. Total revenue was $119.3 million, a 2.9% decrease to Q1 2021. Gross profit was $93.6 million. A year earlier, that was $100.4 million.

Bitcoin Holdings

Interesting are their BTC holdings. At the time, they had 129,218 bitcoins or $2.896 billion. Since they started to buy BTC, this meant an impairment loss of $1.07 billion. The original cost basis was $3.967 billion, and the market value stood at $5.893 billion. This made the average buy price $30,700 and the market price $45,602. For Q2 2022, these figures will look a lot less optimistic. More on this later, though.

So, to sum up, in 2020, MicroStrategy was still profitable. However, in 2021 they were not profitable. In the 2021 Annual Report (p.43), we see that all of the loss for 2021 is a result of Digital Asset Impairment Losses. In other words, marking their Bitcoin holdings down to a lower market value. Their operating business in software did not lose money, their Bitcoin holdings did (p.54). As a result, they had a 66% loss on their shares. Simply Wall st. forecasts another 3 years of a non-profitable MicroStrategy. Although they expect earnings to go back to 2020 levels.

Has MSTR Stock Become a Proxy for Bitcoin?

Who was the first publicly-traded company that purchased Bitcoin? Indeed, that was MicroStrategy. Soon, other companies followed suit. For example, Tesla, Square, and more.

They bought their first BTC in August 2020. Since then, they haven’t stopped buying. They even bought in the current bear market as we said earlier. It helps of course that the CEO is a top-notch Bitcoin permabull. Saylor sees buying Bitcoin in the same vein as buying Facebook or eBay when they started out. He also strongly believes that holding BTC beats holding fiat anytime.

However, MicroStrategy is now closely linked to BTC and its whims. That is rather unique, considering that they started out as selling software for BI. Over the last 20 years, that business has been stable, but not exciting. A 4% yearly revenue increase, with their MSTR stock fairly flat over that same period.

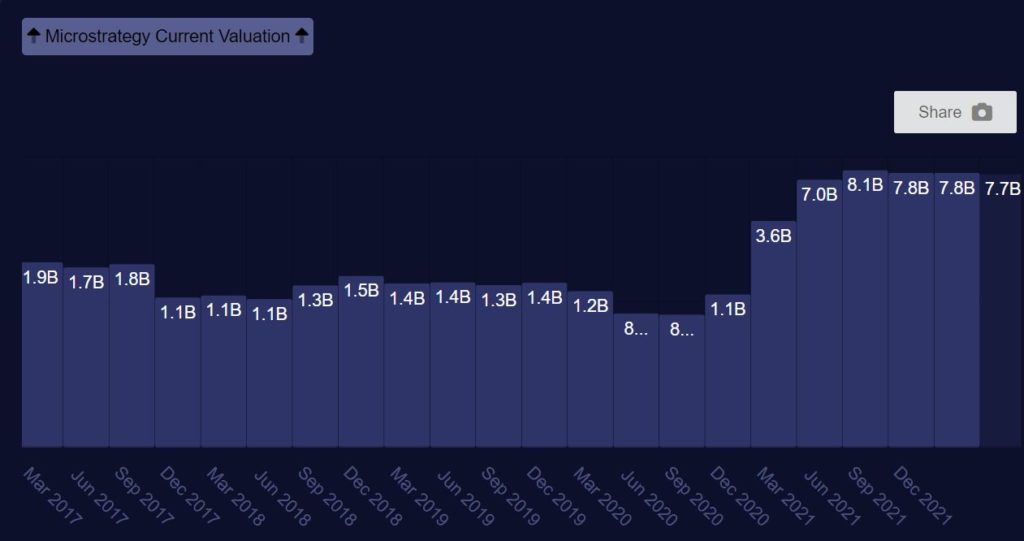

That all changed when they first invested in Bitcoin. Ever since, Bitcoin went up fivefold, only to come down hard in 2022. Nonetheless, their Bitcoin holdings kept increasing. And what happened to their ‘stagnant’ stock price? That went up as well. See the picture below, how the two relate to each other.

Source: Trading view

The MicroStrategy Treasury

So, when we look at the size of the MicroStrategy Treasury, what do we see? It’s filled to the brim with BTC. In other words, buying MSTR is currently the closest you can get to buying a proxy Bitcoin ETF in the US. This brings along a whole basket of risks and opportunities. For example, before the company bought any Bitcoin, its value was around $900 million. Q1 2022 shows a value of $7.7 billion. Since they started to invest in BTC, the company’s value went up. As a result, their stock price ties down to BTC. Software and BI seem to be secondary businesses nowadays. Although their cash flow is vital for more Bitcoin purchases. Even in 2021 when they lost money, Operating Cash Flow was more than $93 million (Annual Report, p.54).

Source: MacroAxis

What Are Saylor’s Bond and Loan Terms That Allow Him to Buy Bitcoin for the Company Treasury?

To buy Bitcoin, MicroStrategy went heavily into debt. They have three bonds that they need to pay back at specific times. Furthermore, they also have a bank loan.

Here are the bonds for starters. According to the CTH Group, MicroStrategy used only $500 million in its own capital. However, they financed another $1.7 billion with debt. Compared to their own funds, that’s 3.4 times more. They have done this with Unsecured Senior Convertible Notes. This defines the priorities in who gets paid back first. Convertible means that you can convert them into MSTR stock.

First Bond

They announced the first convertible bond program on December 7, 2020. This is a 5-year bond, due in 2025. The coupon rate is 0.75%, this is the amount of annual interest income paid to a bondholder. The conversion price is $398 and it has a negative interest rate at the bond’s current price of $160 (issued at $100). That’s when you can convert it into MSTR stock. MicroStrategy planned to raise $400 million but oversold for $650 million. Another sign the market approves of what MSTR is doing.

Second Bond

The second convertible bond program was on February 15, 2021. This is a 0% coupon with a conversion price of $1,432. That would be a nearly 10x return from its current stock price of $166. Out of the scheduled $600 million, they oversold for $1.05 billion.

Third Bond

In June 2021 MicroStrategy offered $500 million in junk bonds. The interest for this bond stood at $1.6 billion. Junk bonds have a higher risk, but also a higher return. These are also non-convertible bonds. The yield is 6.125%, due in 2028.

Bank Loan

In March 2022, the Silvergate bank loaned another $205 million to MacroStrategy, a subsidiary of MicroStrategy. As collateral, they put up $850 worth of Bitcoin. This is a three-year loan. With these $205 million, they plan to buy more Bitcoin.

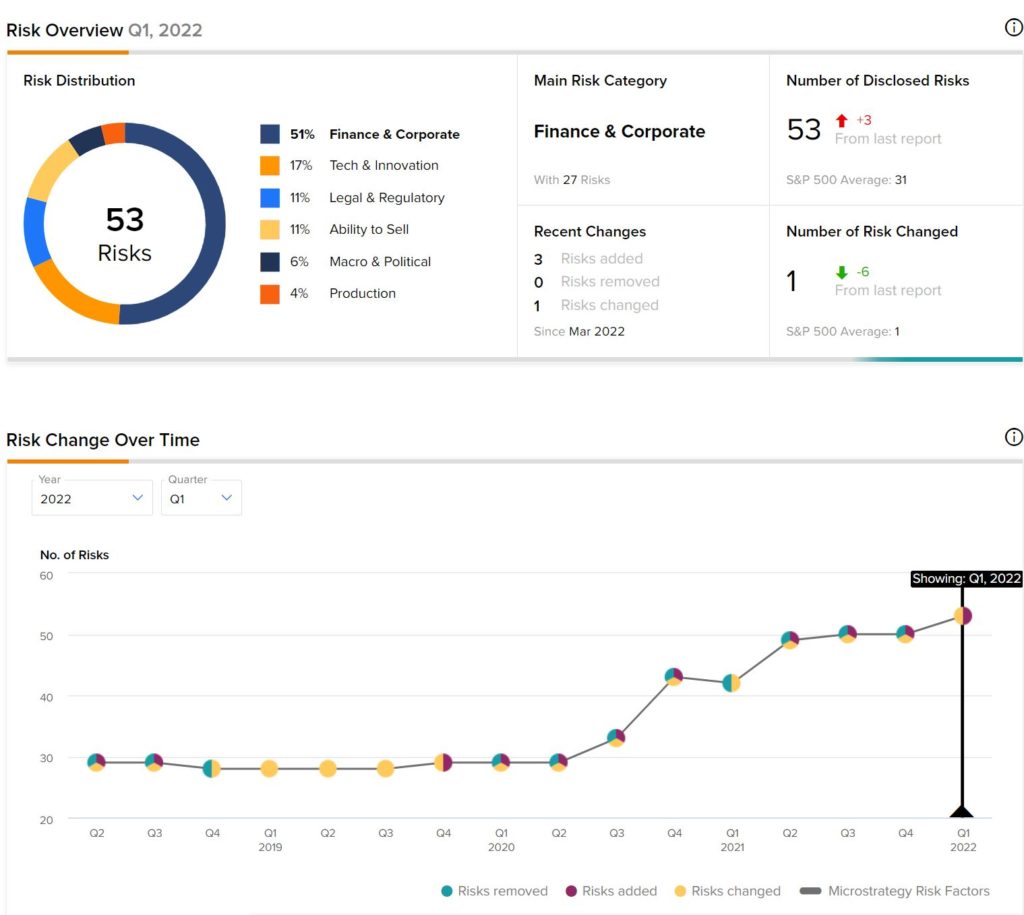

Now these are the three known bonds and just one bank loan. Late June 2022, MicroStrategy bought another $10 million worth of BTC. That is some high-risk betting by Mr. Saylor. As long as the Bitcoin price stays high, he will be just fine. However, in July 2022 the Bitcoin price ranges between $19K and $21K. So, this raises the question, where is the liquidation price for his Bitcoin. The picture below shows the current risk for MicroStrategy.

Source: TipRanks

What Is Their Liquidation Price?

The Silvergate bank loan shows that the liquidation price is just above $21,000. However, the BTC price has recently dropped consistently below this price. Nonetheless, there was no margin call. Michael Saylor keeps repeating that MicroStrategy is not at risk of liquidation. Saylor also mentioned that this is the only liquidation risk they have. He did, however, mention that if BTC dropped to $3,562, they may have a problem. That seems a far cry from the current $20k range that BTC moves around in. That’s because this loan is overcollateralized with Bitcoin. Saylor mentioned that they can even post more collateral, to avoid liquidation.

When @MicroStrategy adopted a #Bitcoin Strategy, it anticipated volatility and structured its balance sheet so that it could continue to #HODL through adversity. https://t.co/rPSUVPHUVw

— Michael Saylor⚡️ (@saylor) June 14, 2022

Is Saylor’s Bitcoin as a Treasury Asset a Smart Strategy?

Some people fully disagree with this statement. It can lead to interesting tweets like the one below.

Fun Fact: Michael Saylor might be the single worst investor in history.

He lost more money than anyone else in the Dot Com crash.

Now, he is under water over a billion dollars on the best performing asset of all time because he timed it wrong and bought the top with leverage. pic.twitter.com/VSlDA9RaiR

— Kurt Wuckert Jr | GorillaPool.com 🍌🍌 (@kurtwuckertjr) June 30, 2022

But is this so? Is he indeed the single worst investor in history? Well time will tell, for sure. However, here is a case against this statement. Nasdaq and Deloitte writing interesting articles about this topic.

For starters, the fundamentals of Bitcoin have never been better. This includes that it is regionally neutral, in contrast to bonds. There are no regional monetary or economic policies it needs to adhere to.

There are also hard-to-bank sectors that can’t set up payrolls or pay their due taxes. For example, the cannabis industry. As a result, they can’t get loans or set up deposit accounts. Bitcoin and other cryptocurrencies can solve this issue. Especially if they can offer compliant digital banking options to them.

The market is changing fast. Classic treasury management in only bonds and cash is under scrutiny. Change is a sure constant that asks for diversification in other assets. That’s where Bitcoin and crypto can make a difference. With regulation seemingly on its way, making it even more attractive. As the Nasdaq article states;

“Cryptocurrencies are becoming a more viable investment for corporate treasury managers because they offer a universal access point to invest.”

MicroStrategy paved the way. Now more corporate treasury managers will follow suit.

As for MicroStrategy, Saylor needs Bitcoin to rise in price again. This will eventually happen, but it may take a year or longer. Many analysts mention the next Bitcoin halving in May 2024 as the return of the bull market. That should give them enough time to pay back all bonds and loans if there are no major changes in the company’s cash flow.

Conclusion

MicroStrategy is an interesting topic. With Michael Saylor, one of the biggest cryptobulls in the world, at its helm. It was well worth taking a deep dive into both the company and its current CEO.

We looked at how profitable the company recently was. And we looked at how accounting for Bitcoin led to its 2021 losses. Furthermore, we investigated the MSTR stock being a proxy for Bitcoin. And confirmed that statement. It became fascinating when we look at how MicroStrategy managed to buy all this Bitcoin. We showed you their bonds and loan history with the most important details. Liquidation is another area we looked into, and Saylor states that they are just fine. To all corporate treasury managers, time to read the Nasdaq and Deloitte reports. In case you haven’t done so already.

⬆️Also, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Above all, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.