The DeFi ecosystem is one of the most innovative yet nascent aspects of the entire blockchain and crypto ecosystem. Therefore, ensuring you make informed investment decisions cannot be over-emphasized.

In line with this, Umami Finance ushers in a new and sustainable way to earn passive income in the DeFi space. The protocol focuses on setting the pace to usher in the future of finance. To achieve this, Umami Finance is creating a network of strategy vaults for many top blockchains like ETH.

This article is an in-depth overview of the Umami Finance ecosystem, its mechanism, products, and its native token UMAMI tokenomics.

Important Information About Umami Finance

Umami Finance’s main interest is in facilitating sustainable, risk-free, Arbitrum yields. The protocol is also based on the Arbitrum network and vies to become a major player in DeFi. To achieve this, Arbitrum is building an expanding system of vaults. These vaults will essentially provide sustainable means for users to earn risk-free passive income across DeFi.

Also, the entire Umami ecosystem uses its native token UMAMI. Staking UMAMI tokens will provide users with a steady passive income stream of ETH tokens. Generating these yields also take place in Umami POL (Protocol Owned Liquidity) and revenue fees from its vaults.

The protocol also boasts of several unique partnerships, an in-app bridge, as well as a fiat-to-crypto on-ramp. Umami Finance also helps create awareness for the Arbitrum network. Helping to further expand the ecosystem as well as increase its user base.

Interestingly, Arbitrum is currently the Ethereum (ETH) layer 2 chain with the most users.

Top Features of Umami Finance

Umami Finance boasts of several features designed to facilitate easy passive income earning for its users. Some of these features include;

1. Marinate

Marinate on Umami Finance helps to unlock the protocol’s value creation from its POL and deposit it as passive income to users. It is also Umami’s main source of passive income for users.

Marinators need to deposit UMAMI tokens to earn mUMAMI as rewards. The rewards can, however, only be withdrawn on the first day of every month. wETH rewards, on the other hand, are available immediately.

2. Compound

Umami finance users can also increase their earnings by making use of the mUMAMI autocompounder. The autocompounder uses ETH rewards to purchase more UMAMI tokens that are then deposited back into Marinate. This, in turn, helps to compound users’ rewards and increase their APY earnings. Also, Compound on Umami will help ensure continuous buying pressure on UMAMI tokens.

3. Protocol-Owned Liquidity (POL)

The protocol currently boasts about $6 million in treasury liquidity. The liquidity is further distributed across multiple vaults, farms, and LPs to ensure continued yield for Umami treasury.

50% of the yield goes as passive income to marinators. The other 50% is redirected to the treasury to increase more $ETH payouts.

Other top Umami products include; its upcoming stablecoin vault, its fiat-to-crypto on-ramp, etc.

It's official: Umami's highly anticipated $USDC Vault goes LIVE on Wednesday, July 27! 🥳

Still have questions about the vault? Check out this gorgeous video by @Edddis3 for a detailed walkthrough. pic.twitter.com/6bg7aLIoI9

— Umami (@UmamiFinance) July 25, 2022

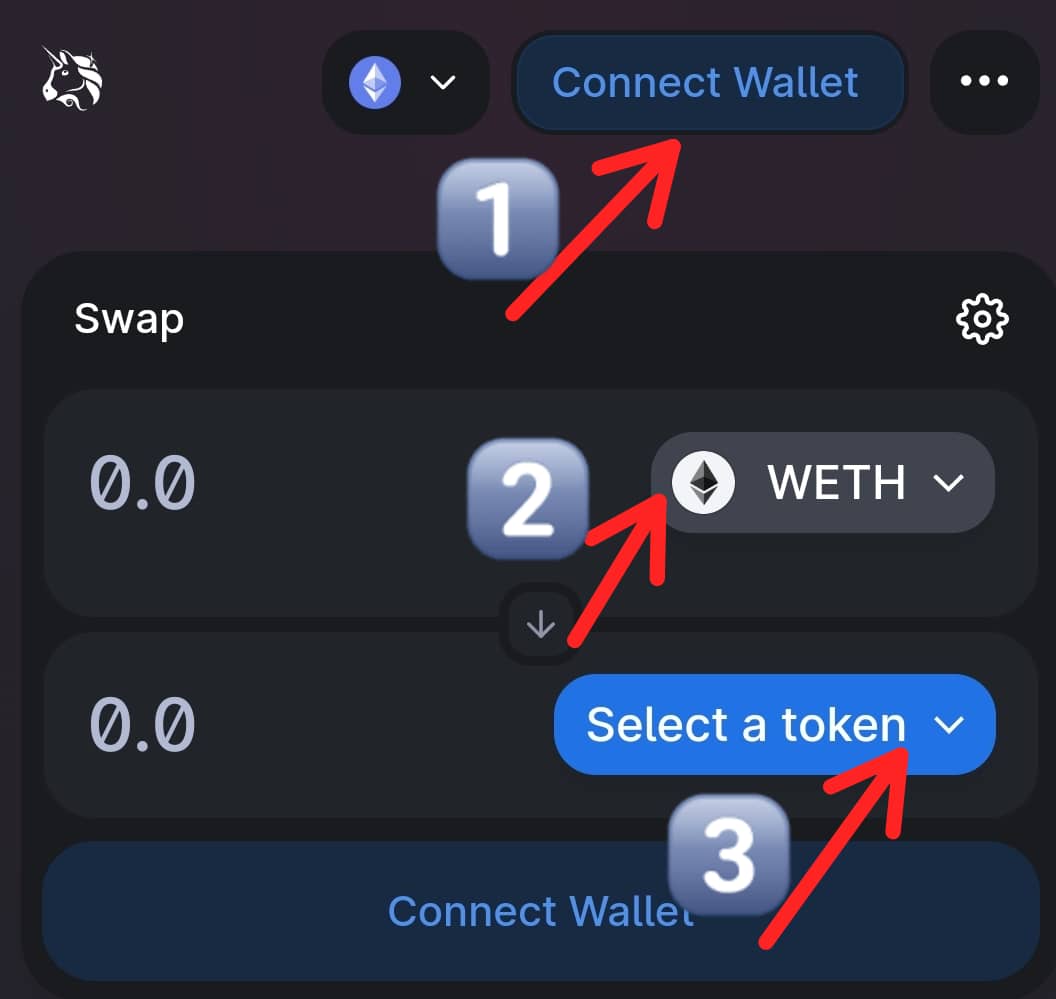

How to Swap Tokens on Umami

Source – Umami Finance

- From the homepage, Click on the ‘Swap’ icon. It will send you to the Uniswap homepage.

- Next is to connect your wallet. You can choose from several compatible wallets like Coinbase, Metamask, WalletConnect, etc.

- After connecting your wallet, you can then easily swap your WETH rewards for other tokens like ETH, DAI, USDC, USDT, etc.

UMAMI Tokenomics

- UMAMI

UMAMI tokens are the native token of Umami finance and help to power the protocol. The token also has a maximum supply of 1 million UMAMI and a current circulating supply of about 650,000 UMAMI. The token functions as both a governance and protocol fee for Umami. Interestingly, the token also employs a zero (0) emission model to help ensure top-notch max upside for its holders.

The token can also be used on both Marinate and on the mUMAMI autocompunder. The protocol also set aside about 20% of its total token supply to support its current team members. The other UMAMI tokens yet to go into circulation are kept in the Umami treasury.

- mUMAMI

mUMAMI serves as reliable proof of depositing UMAMI tokens on Marinate. The token also automatically gathers $ETH as passive income.

- cmUMAMI

cmUMAMI is gotten from depositing mUMAMI in the Umami autocompunder. It also automatically compounds $ETH income for Marinators by reinvesting mUMAMI tokens in Marinate.

In conclusion, Umami Finance (UMAMI) currently has a TVL of $11,979,368 and an estimated monthly revenue of $442,378. Also, its $UMAMI token is currently trading at $22.67 with a 24-hour trading volume of $100,091. The token price is also down by 3.4% in the last 24 hours.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.