Vauld is a cryptocurrency platform based in Singapore. Vauld helps customers to purchase, lend, borrow, and trade cryptocurrency from a unified platform.

The General Manager of Altcoin Buzz, Anindya (Ani) Baidya, anchored the Vauld AMA session on our Telegram channel with Darshan Bathija, the CEO of Vauld.

Below is a recap of the AMA session with Darshan Bathija to understand what the ecosystem is up to. Also, the AMA is in three segments: introduction, deep dive, and community questions and answers.

Segment 1: Introduction to Vauld

Background Information

Q – How was the concept of Vauld created?

I tried to bank with Bitcoin in India in 2016 and all that I saw was platforms driving speculation of this new asset that I wanted to bank with. I actually tried to pay for things with Bitcoin in India with no success.

Additionally, I wanted to compound my BTC holdings without trading (since I’m really bad at it), which is why we decided to build a fixed income crypto experience that we are known for today. Over the coming 12 months, we would like to enable more touchpoints of finance and better establish ourselves as a platform where folks can accumulate wealth in crypto.

Q – Where is the team based out of?

Vauld is a team of 120 people at the moment and rapidly growing (if you’re looking to join crypto full time), with about 110 in India. Sanju and I (both co-founders) sit out of Singapore since we are licensed here.

We’re primarily tech people excited about the upside of crypto through digital ownership, payments, and banking. Happy to answer any questions that you may have.

Segment 2: Deep Dive

About the Platform

Q – So what is Vauld? What are your offerings?

We’re an exchange and lending platform. We started about 3.5 years ago as a lending platform where customers could build passive income in crypto. Also, we pay 6.7% on BTC and ETH and up to 12.7% on stablecoins.

We have ~290 tokens listed, and you can trade all of them straight from INR. Think of the difference between a Paytm Wallet (every exchange out there) and a savings account plus FD experience (us). You can trade and earn interest without having to allocate funds in interest accounts, which I think is really cool.

Q – 6.7% in BTC is amazing. Today, Binance announced an increase in the percentage for savings plans to 5%. Vauld will be hugely different from that, right? First of all, higher APYs and also you do not have time limits for a plan?

No time limits or caps for the plan. Binance also has caps (total amount) each account can subscribe to. We have no such caps, and you can earn the same rate on 100% of your capital.

Q – But help me understand your product better. Let’s do it step-wise. If I lend my BTC, I earn 6.7%. Do you have a link for all such rates? All I need to do is do KYC and send money, right?

All you need to do is KYC and send money. 6.7% is through a fixed deposit of one month that compounds every month. Here is more information.

Q – On the borrowing part, how does it work? Let’s say I deposit 10K worth of BTC, what’s the LTV? And will I still get interest on lending BTC?

The borrowing terms are as flexible as they come. The loan is instant with a collateral ratio of 150% or higher. So if you deposit 10K USD worth of BTC, you can get stablecoins or anything else worth 6,667 USD.

If you lock your BTC as collateral to the loan, you will not get interest on the asset since that is kept in cold storage.

Q – Cool. What are the interest rates on borrowing? Can you please provide a link so that our community can see?

The borrowing rates are here. It’s the lending rate +1% on an annual basis. The good thing is you can pay back your loan any time you want and the interest owed is calculated at the annual rate and accrued every day.

Q – Do you have a liquidation process if LTV goes below 150%?

We have a liquidation process, but not at 150%. We make margin calls at 120% and liquidate at 110%.

Q – On the verge of liquidation, do the users get notifications (something which DeFi cannot do yet) to top up?

They do. We have a team that calls them as well. We also drop messages on Telegram to ensure they avoid going through liquidation because that’s the worst-case scenario, and we want to avoid it.

Q – In terms of regulations, you are registered in Singapore. You are also focusing on INR. Is your main target market India? Can you elaborate?

We have customers in 190 countries. Crypto, by its nature, is unifying this way and we really like that we’re not too dependent on any one country. We are regulated in the U.S. as well in 15 states and are on track to launch ramps and be regulated in 40 states by mid-April.

The intent for 2022 is for us to bring native ramps for folks in the U.S., UK, Europe, and Australia.

Coming to India – it’s where Sanju and I are from and, hence, this market is dear to us. But we started in 2018 – during the banking ban and built Vauld from day one to be global. Most of our business is from outside India, and we think this will continue to be the case.

Q – This might be a trade secret question; you might choose not to answer or answer partially. Your business is that of “Yield.” How do you generate yield? Do you run nodes personally or with third parties?

The yield is generated by working closely with institutions looking for leverage if it’s a PoW coin and through staking if it’s a PoS coin.

Q – You have some big competitors like BlockFi and Celsius. What will be your USP that helps you to compete?

They’re financial companies that happen to have tech platforms. We are a tech company in the finance space. We build products and customer support like a start-up, and they do it like a finance firm.

This results in us having instant withdrawals (they take days), instant chat support (they take days to weeks), and trading and lending 18 months before them.

We will always be faster, support more blockchains, and be better for the customer. We think of exchanges offering yield as our competition since they are tech companies, not the current lending platforms.

Q – Is your exchange orderbook your own, or are you leveraging other platforms?

We pull liquidity from Binance for crypto to crypto pairs and have our own orderbook for fiat pairs. We will transition to having more internal pairs over time as long as it doesn’t come at the cost of speed of execution (liquidity).

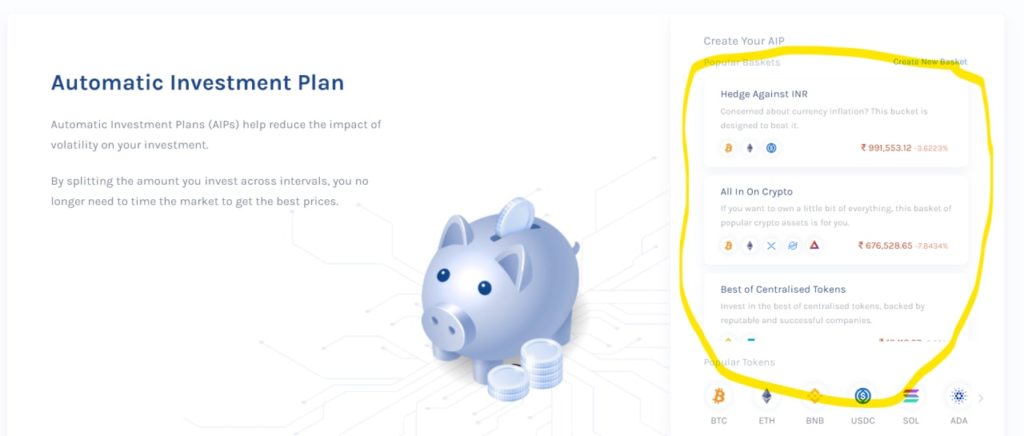

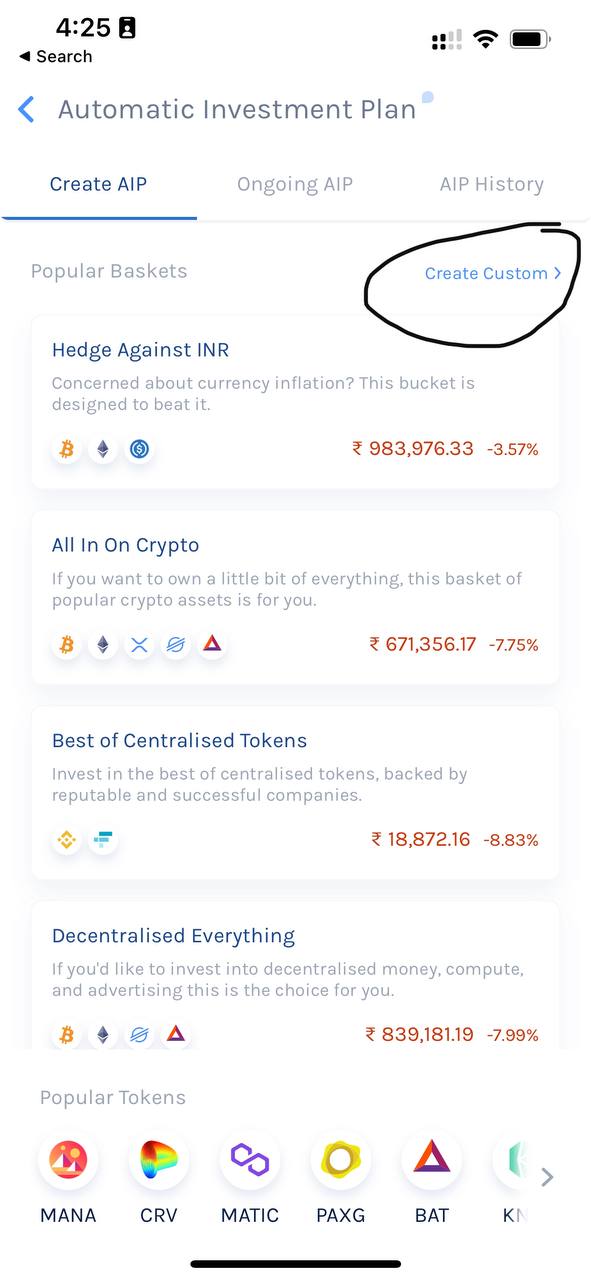

Q – What also interests me the most is your AIP plans. There are so many plans to choose from and are almost customized for different types of risk-takers.

How do these work, and how do you create these plans?

I realized that I hadn’t bought any crypto between 2018-2020 and that was because I didn’t want to time the market.

Time in the market > timing the market.

We know that the traditional financial world has solved for this through SIPs and dollar-cost averaging offerings, which is why we rolled out AIPs to either buy the dip or buy regularly.

Additionally, the baskets help you diversify from one project so that you get exposure in sectors or aspects of crypto that you’re bullish about.

We talk to customers about “why crypto” very often and build plans to directly service that need

Q – Just as a curious user, will you bring in the drag and drop feature in baskets? For example, in Digital ownership, you have Enj and Mana. I would like to maybe bring in EFI and replace ENJ or Sand for Mana. Is that theoretically possible for a platform?

Yes, you can create your own baskets and decide allocations based on your preference as well.

Q – Will the value directly follow the proportionate market rates or do you have your own algorithms?

It will directly follow the market rates. It’s not actively managed.

Segment 3: Community Questions and Answers

For this segment, the five best questions shared $500 in $USDC. Some of these questions are listed below:

Q. Twitter – I believe you are aware of the security issues related to your sector. Since VAULD requires KYC, how do you ensure that its clients are not vulnerable to data breaches?

We get independently audited by two different security firms once a month and after every major release. So, along with efforts around security certifications such as ISO and PCI DSS, we do at least two independent penetration tests by world-class companies and intend to increase this with time.

Breaches are a point of failure for our business, and we treat it with the seriousness that it comes with.

Q. Twitter – Does Vauld accept incoming deposits from a bank account belonging to someone other than the Vauld account holder? Like, can I send crypto from my Vauld wallet to my cousin’s Vauld wallet? Can I deposit INR from my bank account to my cousin’s Vauld account?

No, since we legally can’t. To do that, we would need a PPI, payment bank, or banking license and be regulated by RBI.

Spoiler: it’s not for a lack of trying to get the license.

Also, join us on Telegram to receive free trading signals.

Find out more about the blockchain and crypto space on the Altcoin Buzz YouTube channel.

Disclaimer

The information discussed by Altcoin Buzz is not financial advice. This is for educational, entertainment, and informational purposes only. Any information or strategies are thoughts and opinions relevant to the accepted levels of risk tolerance of the writer/reviewers and their risk tolerance may be different than yours. We are not responsible for any losses that you may incur as a result of any investments directly or indirectly related to the information provided. Bitcoin and other cryptocurrencies are high-risk investments so please do your due diligence. This article has been sponsored by Vauld. Copyright Altcoin Buzz Pte Ltd.