2022 started on a pretty rocky note for the entire cryptocurrency space. While the bear market isn’t a new phenomenon in the crypto space, 2022 bearish markets are now the most severe ever in crypto history.

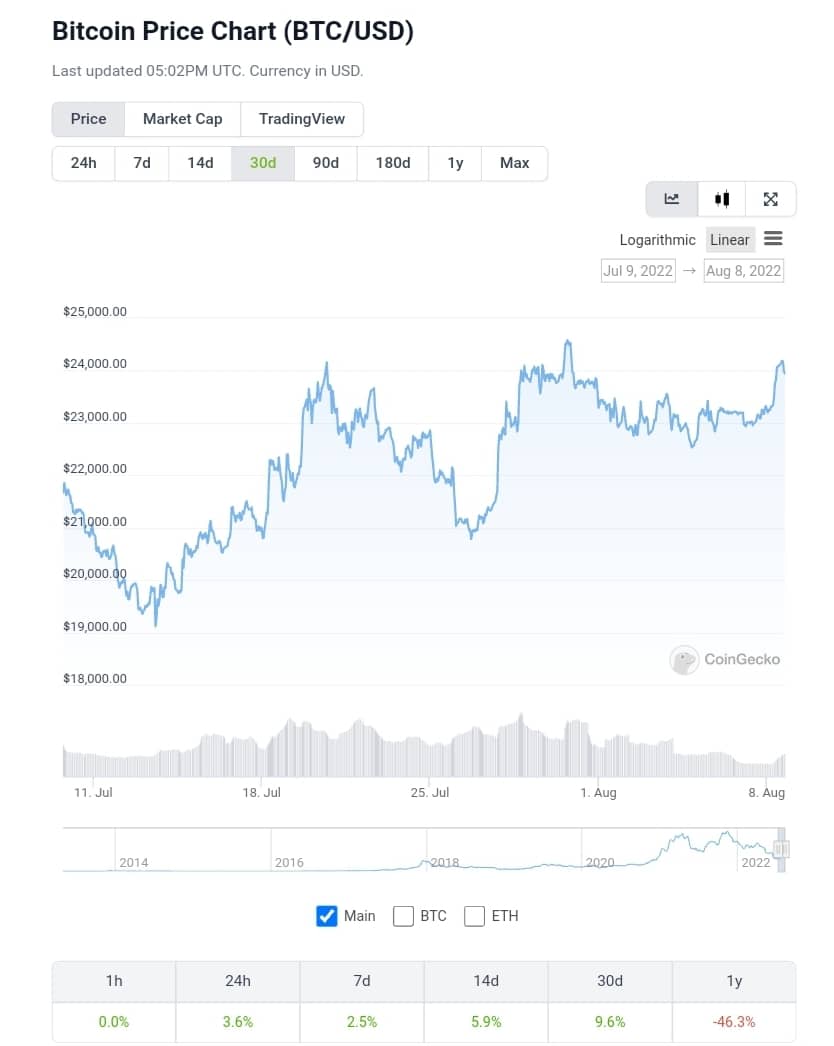

According to reports, as a result of the 2022 bear market, the crypto space has lost about $2 trillion of its value. Bitcoin, for example, lost over 66% of its value. It’s currently trading at $24,000 down from its all-time high of $69k in November 2021. Altcoins like ETH, MATIC, BNB, ADA, SOL, DOT, etc also registered various degrees of price losses. Therefore, leaving crypto investors battling with Fear, Uncertainty, and Doubts (FUD). Despite the bear market, the current analysis seems to suggest that the crypto winter might be coming to an end.

This article is a brief overview of the current market, the possibilities of mini bull runs, and how to safeguard your funds despite the current bearish trends.

Are There Mini Bull Runs in a Bear Market?

Before moving on to find out if there are mini bull runs in a bear market, we should understand what they are. A bear market by popular definition is a 20% decline from the price peak. A bull market, on the other hand, does not have a clearly defined definition. However, it is widely agreed that a bull market is one where “prices are on the rise or are expected to increase”.

It is also normal to have mini bull runs within a bear market. They even have a name, a bear market rally. Using the 2022 market as an example, we have recorded price increases despite the overall bearish trend in the market. Bitcoin has a 9.6% price increase over the last 30 days. This is despite its price still being a far cry from its November 2021 all-time high.

Source: CoinGecko

There is also the possibility of mistaking these mini bull runs as bull market trends. It is, therefore, important to be able to distinguish bullish trends from mini bull runs. As this will help properly guide your crypto investment decisions and choices.

How to Handle Bear Market in Retirement?

Retiring comes with a fair share of uncertainty. Retiring in a bear market is, therefore, a major concern for crypto investors. How then do you navigate retirement in the current bear market? There are several important steps to take note of when retiring in a bear market, the two important ones that come to mind are to;

- Diversify Your Portfolio – Instead of investing in a particular crypto, you could try out other aspects of the crypto space like NFTs, DeFi, etc.

- No Withdrawals – It is also important to avoid withdrawing your assets especially if you are already in a deficit. It is, therefore, advisable to stay put and weather the storm.

In conclusion, despite the current crypto market trends, the current analysis seems to show that the bottom is in for the crypto winter. One major vantage point for this conclusion is Bitcoin’s (BTC) price action. The ‘King Crypto’ over its 13 years of price cycles has never stayed below its low band line for so long. Other charts, signals, and factors further seem to affirm that the crypto winter is coming to an end soon.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.