Over the last couple of weeks, there has been a bloodbath going on in the crypto space, especially in the DeFi arena. Terra Luna was the first high-profile victim of the recent massacre. However, Celsius and crypto hedge fund Three Arrows Capital, or 3AC, have had smoke in their camp in recent days. Investors and other stakeholders are asking questions, and everyone needs an answer to these recent failures.

The recent crashes in the crypto space have raised eyebrows, with some even casting doubt on the legitimacy of the crypto industry. However, despite calls for more regulation, blockchain is pretty predictable. Many of these recent crashes have long been detected and predicted thanks to on-chain transparency. Our previous article examined how the lack of liquidity caused the recent crashes. But, this piece will show you how trustworthy on-chain records are in predicting events in the market.

What Happened in the Market?

The recent crashes have without a doubt rattled everything and affected trust. Terra’s LUNA was one of the leading stablecoins in the market, led by the controversial Do Kwon. However, in early May, Terra LUNA dropped to an all-new low while its stablecoin, TerraUSD (UST), lost its peg. The Luna meltdown was caused by its affiliation with TerraUSD (UST), Terra’s algorithmic stablecoin. The algo stablecoin is controlled by computer codes that keep its price stable. So, to stabilize the prices of these tokens, the procedure entails burning or minting LUNA/UST.

UST began to de-peg after a substantial amount of the stablecoin was dumped. In a panic, more UST was sold, resulting in the minting of additional Luna and an increase in the circulating supply. It had the unintended consequence of causing the price of Luna to plummet.

Celsius, a crypto lending platform, alarmed the entire market when it suddenly announced on June 12 that it was stopping all withdrawals. The platform noted that this was due to severe market conditions and a need to maintain liquidity.

Celsius’ native token, CEL, dropped by 70% in a single hour after the news. And by the next day, it was trading at a loss of more than 40%. CEL’s decline coincided with a massive sell-off that saw crypto’s overall market capitalization plummet to less than a trillion dollars. All of this happened as Bitcoin continued its shocking downward journey.

.@CelsiusNetwork is pausing all withdrawals, Swap, and transfers between accounts. Acting in the interest of our community is our top priority. Our operations continue and we will continue to share information with the community. More here: https://t.co/CvjORUICs2

— Celsius (@CelsiusNetwork) June 13, 2022

3AC Joins the List

Singapore-based crypto hedge fund Three Arrows Capital is the next entry on the list of recent scares. 3AC was reportedly founded in 2012. The crypto hedge fund manages approximately $10 billion. Some of the top blockchain projects are part of its clients. 3AC has positions on platforms like:

- BlockFi

- Ethereum

- Axie Infinity

- Bitcoin

- Solana

There are rumors that the hedge funds might have run into problems. 8BlocksCapital, one of 3AC’s business partners, has come out to claim that 3AC improperly spent over $1 million of their assets.

8) Fast forward to 24 hours ago, our funds monitoring script noticed that ~1m was missing from our accounts with them. We reached out to @KyleLDavies , the Ops team on Telegram about the missing funds- no replies. We tried calling them- they were online and they didn't pick up.

— Danny (@Danny8BC) June 16, 2022

After speaking to people with a direct relationship with 3AC, Yuan realized that the worst was yet to come. He wrote, “What we learned is that they were leveraged long everywhere and were getting margin-called. Instead of answering the margin calls, they ghosted everyone. The platforms had no choice but to liquidate their positions, causing the markets to further dump.”

13) FWIW, for the most part, they aren't speculating with clients' money like Celsius was (maybe a thread another day about our dealings with them in 2019), however, here they did use our funds (~1m USD) to answer their margin calls.

— Danny (@Danny8BC) June 16, 2022

Other sources claim that 3AC has kept little contact with its counterparties since being insolvent. The hedge fund is also alleged to have lost a significant amount of money as a result of the Terra ecosystem disaster.

However, early Tuesday morning, Three Arrows Capital co-founder Su Zhu took to his page to offer assuring words to their community. He wrote, “We are in the process of communicating with the relevant parties and fully committed to working this out.”

We are in the process of communicating with relevant parties and fully committed to working this out

— Zhu Su 🔺 (@zhusu) June 15, 2022

These Crashes Were Already Forseen

While many traders are mourning the loss of their assets to these failed platforms, the industry has long been aware of these pitfalls months before they happened. All thanks to on-chain transparency, several users were able to predict the fall of these platforms.

Kwon zealously promoted a project that was flawed on the inside, and when doubters objected, he retaliated with rage and brashness. Despite the confidence in his project, many blockchain experts had already warned of the disasters ahead.

Kwon trumpeted the world-changing possibilities of the Luna currency in innumerable tweets and interviews. He successfully gained a circle of investors and followers who he boldly called the “Lunatics.”

Even as skeptics doubted the currency’s technical basis, Terraform Labs received more than $200 million from investment firms to fund crypto ventures created with the currency. The entire value of Luna soared to more over $40 billion, igniting a flurry of interest among day traders, start-up founders, and affluent investors.

But while things were going smooth for Terra, many saw what looked like foul play and called the attention of the crypto community to them. Among the many critics was hedge fund manager Kevin Zhou of Galois Capital, who noted that Terra’s mechanics were flawed. Kevin claimed that greed was at the root of Do Kwon’s Terra empire. He compared the collapse to the Romans’ siege of Carthage.

Listening to Kevin Zhou from @Galois_Capital on how he shorted the $40B algorithmic stablecoin #Terra_Luna. Really hammering home how flawed the project was with greed at the root. Never understood how the 20% yield via Anchor worked. Answer? Venture Capital marketing dollars!

— TheCoinedBanker (@TheCoinedBanker) June 10, 2022

Looks like Do Kwon was right. If he goes down, he takes the whole crypto space down with him.

— Galois Capital (@Galois_Capital) June 17, 2022

On-chain Sources are Reliable

Kwon rolled out Terra 2.0 to save his empire from a total crash. He claimed that Terraforms Labs, the company behind Terra, would not hold any of the new tokens. However, several users have found that to be false. According to Twitter user FatMan, who is a Terra whistleblower, Terraform Labs holds about 42 million LUNA tokens.

Do Kwon has stated numerous times that TFL has zero new LUNA tokens, making Terra 2 'community owned'. This is an outright lie that nobody seems to be talking about. In fact, TFL owns 42M LUNA, worth over $200m, and they're lying through their teeth. (1/6) pic.twitter.com/D1HIWpAWHG

— FatMan (@FatManTerra) June 6, 2022

FatMan reported that Do Kwon and Terraform Labs have other secret and hidden wallets with at least 42 million LUNA tokens. He also provided the wallets’ links to back up his claims. FatMan linked Do Kwon to two of the wallets, while Terraform Labs is said to own the other three.

TFL Dawn (11.28M): https://t.co/67XVH8t50D

TFL shadow wallet (2.01M): https://t.co/k5k3g02LP2

TFL MM (0.72M): https://t.co/16CqyPcUL4

Do Kwon shadow wallet #1 (19.69M): https://t.co/kfFx1ck8gR

Do Kwon shadow wallet #2 (9.11M): https://t.co/pevv1xT0yR

Total: 42.81M LUNA (2/6)— FatMan (@FatManTerra) June 6, 2022

he stole LUNC and USTC money from terra station wallet. pic.twitter.com/MmB9uGpzg6

— SoiQuay (@SoiBac115) June 6, 2022

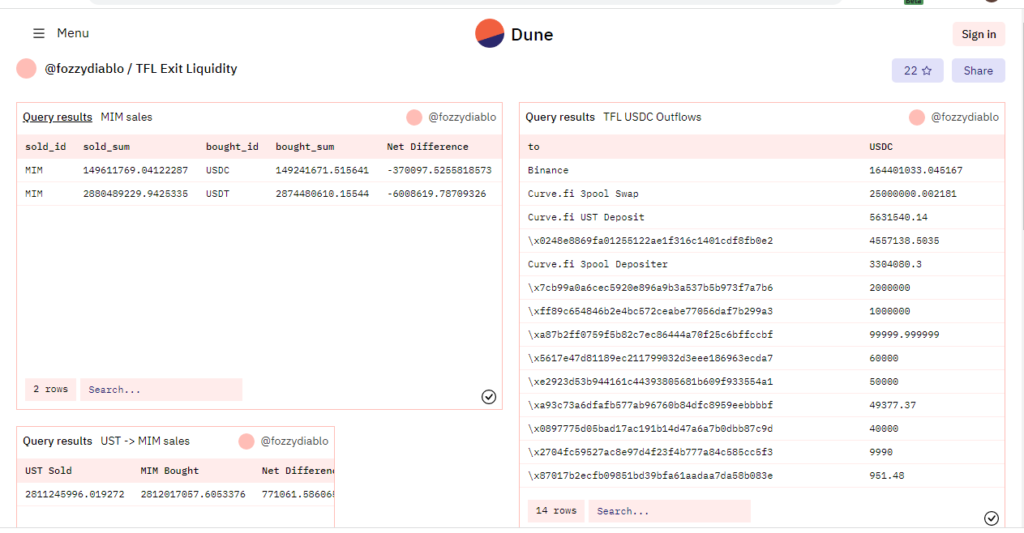

In another post, FatMan accused Kwon of cashing out $2.7 billion from UST into USDT and USDC. He went further to share snapshots of the wallet address.

UST is the future, he said. Decentralized money is sound money, he said. UST won't depeg, he told you. 'Centralized stablecoins will rug you eventually.' So why did he cash out $2.7b from UST into USDT and USDC? Were all those words just lies? (Spoiler: yes.) (8/13) pic.twitter.com/JQTy5Bfm6z

— FatMan (@FatManTerra) June 11, 2022

Experts Warned About Terra’s Fall

Reports have it that the SEC is currently investigating the Terra mastermind over possible money laundering. Some of these claims are yet to be verified. However, it is not impossible to detect fraud from some of these project creators. Thanks to the nature of blockchain technology, we can access this information and detect scams.

FatMan isn’t the only one to accuse Kwon of a planned attack. Months before Terra’s collapse, a Twitter user, Fudzy, had already accused the South Korean of being fishy. He shared several images which showed that things were bound to go south soon.

How hard did @stablekwon bend over @danielesesta and $SPELL bagholders. Lets find out… 🧵 pic.twitter.com/YIVxBZY91v

— Fudzy (@fozzydiablo) January 28, 2022

Fudzy and the rest have shown that we can use on-chain information to detect fishy events. Blockchain is a method of storing data in such a way that it is difficult to alter or manipulate the network. It also makes the data accessible to anybody at any moment, ensuring that all transactions are open and transparent.

BREAKING: Terra employees reportedly confirmed to the SEC that Do Kwon cashed out $80 million a month prior to the $LUNA and $UST crash.

— Watcher.Guru (@WatcherGuru) June 9, 2022

On-chain transparency means that blockchain technology is reliable in detecting fraud. For example, Chainalysis issued a report detailing the transactions that crippled UST. The platform was able to access these transaction records because they are available on-chain.

On-chain Transparency and the Celsius Scare

There are several tweets and posts all revealing aspects of Terra, 3AC, and Celsius. Despite the explanation given by these projects, the industry already has its answers by looking at some on-chain metrics.

Many regulators believe that high-yield crypto lending services like Celsius are unregistered securities. Four U.S. states previously sent cease-and-desist letters to Celsius. Here’s what a Twitter user had to say about Celsius.

“The Celsius Network story has all the makings of a truly great Michael Lewis book. $70m Stakehound loss, $50m Badgerdao loss, convicted fraudsters like Moshe Hegog, hushed bailouts, HODL Mode, and porn star executives. Will probably even be made in to a movie at some point.”

A Twitter user, CryptoJoe, recently explained why he feels Celsius employees might have been fraudulent. CryptoJoe argued that blocking margin repayments would be a sort of fraud if customers aren’t reimbursed for liquidations they couldn’t avoid due to the firm’s limitations.

While the corporation claims to have roughly $10 billion in total worth locked on the network, CryptoJoe and his partner, on-chain analyst Riley, were only able to uncover $2 billion through their on-chain investigation.

They did, however, note that such research can’t find coins kept in centralized finance services like crypto exchanges. The duo admitted that their investigation can’t guarantee that they’ve found all of Celsius’ assets.

The Crypto Space Is Predictable

However, no matter the explanation given, the industry will always be aware of what these projects are up to. Many of these projects have been accused of laundering money. The point is that we can always find these transactions on-chain.

According to Twitter user Two Comma Pauper, on-chain metrics are put together by combining basic blocks such as:

- Sending and receiving addresses and the entities behind them

- Coin/token balances

- Amount sent/received

- Transaction counts and type (outgoing vs. incoming)

- Miner/validator rewards, fees, etc.

- Time

By studying these yardsticks, one can easily predict trends in the market before time.

Sick & tired of being bullish at tops & bearish at bottoms? Do you day-dream "what if" scenarios where you buy troughs and sell the pico top? I got you covered with my on-chain analysis masterclass (even if you're "SHIB to $1" special).

Part 1 here:https://t.co/H3e8g62jgQ

— Two Comma Pauper (@twocommapauper) February 15, 2022

To prove that there is such as thing as on-chain transparency, data scientist Bennett Tomlin already detected Celsius’ crash in November 2021. He shared a long Twitter thread predicting how the platform would eventually fade out.

Remember if the price of Bitcoin starts to drop quickly Tether may be forced to liquidate all the Bitcoin they hold as collateral for their loans to Celsius

— @[email protected] (@BennettTomlin) November 8, 2021

Last May, Celsius reportedly lost about 35,000 ETH on Stakehound and said nothing about it. However, several platforms detected this and raised awareness. Dirty Bubble Media was among the platforms that pointed this out.

We are first to report that #CelsiusNetwork lost at least 35,000 Ether in the Stakehound key loss debacle back in May 2021. Celsius is bagholding over 42,000 Stakehound stETH in verified wallets.https://t.co/YIDPHYIGng@Bitfinexed @DoombergT @BennettTomlin @QTRResearch

— Dirty Bubble Media: 🌡☠️ (@MikeBurgersburg) June 6, 2022

In Conclusion

Regardless of how surprising these collapses are, they have been glaring to the entire industry for a while. As an investor, you can rely on on-chain transparency to help you detect fishy projects. As seen in several tweets in this piece, many experts have long detected the current situation. This shows that data on the blockchain is truly transparent and go a long in keeping the system in check.

⬆️Win $6,699 in bonuses in our exclusive MEXC-Altcoin Buzz Giveaway! Find out more here.

⬆️Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Finally, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.