After Terra’s ecosystem fell, Kujira switched from the Terra blockchain to the layer 1 protocol Cosmos. In this short time, Kujira has developed 4 milestones.

Kujira began on the Terra (now Terra Classic) blockchain as ORCA, a liquidation platform specializing in Anchor Protocol liquidations. It had nearly $3 billion in loaned assets at its peak. Kujira transferred to Cosmos as its own independent Layer 1 blockchain following Terra’s death spiral. Since then, it has built a suite of interconnected products, with more on the way. Here are the 4 milestones that Kujira developed in 2 months:

- Its own chain with Blue, the heart of the Kurjira ecosystem

- FIN, Decentralized exchange

- Stablecoin (USK)

- Orca, liquidation engine

1/ #Kujira is the true successor to all that was good about the #Terra / #Luna / #UST ecosystem.

Forget Terra 2.0, look into Kujira. A thread. 🧵@TeamKujira rebounded after the Terra collapse with its own chain, exchange, stablecoin & liquidation engine.

All in two months! 👇 pic.twitter.com/ouOfl7xvYh

— Duo Nine | YCC (@DU09BTC) August 17, 2022

BLUE

BLUE is crucial to the Kujira ecosystem. It includes the ecosystem dashboard, wallet, a simple swap UI, an IBC bridge, and the governance portal.

Kujira’s wallet on the Blue dApp includes extensive features, enabling users to send tokens with vesting periods to multiple recipients. This might be used by protocols, DAOs, or anybody who wants to make payments with custom vesting periods without having to create their own vesting contract.

SOURCE: Kujira

The BLUE Swap interface is similar to a basic swap UI found on an AMM DEX. Swap trades, on the other hand, are routed through Kujira’s own CLOB DEX, FIN. This provides an alternate frontend for individuals who are unfamiliar with the more complicated trading interface that FIN provides.

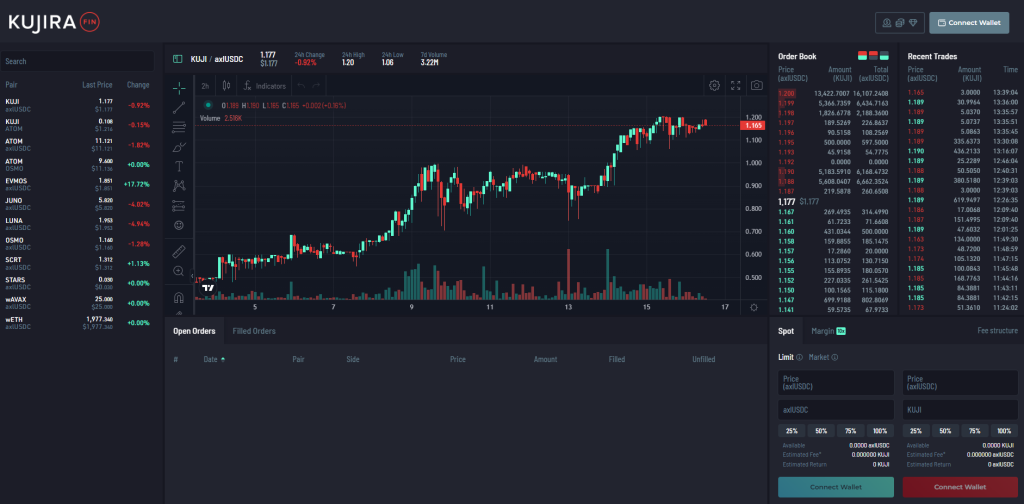

FIN

FIN is a 100% on-chain, decentralized order book exchange. In contrast to AMMs, which use incentive liquidity pools for trading liquidity, central limit order book (CLOB) DEXs such as FIN match orders from buyers and sellers who establish orders at a certain price. Sellers, arbitrage bots, and market makers generate liquidity as a result.

SOURCE: Kujira

There is no need for inflationary token rewards with FIN. This increases capital efficiency, allowing farmers to reinvest their profits elsewhere. Consider Kucoin, but completely decentralized and on-chain.

There is no need for extra fees to stimulate transactions because there is no reliance on money to execute them. In summary, it’s much cheaper, there’s a possibility of missing a trade, and there’s no room for bias in which trades bots choose to perform.

USK stablecoin

In order to create a more sustainable DeFi model and establish the foundation for decentralized money, Kujira launched the stablecoin $USK. It is an over-collateralized Cosmos stablecoin soft-pegged to the USD and initially backed by $ATOM.

📢 Our biggest ever announcement to date 👇👇

"KUJIRA $USK STABLECOIN LAUNCH "https://t.co/LMiBKXTNfm

Please read the Medium in detail as it's jam packed with all the info you need. Welcome to the start of something beautiful 🐋💙$KUJI

— Kujira (@TeamKujira) August 8, 2022

They are utilizing a trustworthy, strong theoretical method used by Maker DAO. Furthermore, being a native Cosmos stable, $USK provides $ATOM with another use case driving value accrual.

Similar to the gold standard, $USK would have $ATOM collateral in reserve on the Kujira blockchain. It could theoretically be used to buy back $USK, thus assuring its value.

Unlike fiat, money is not generated out of thin air in this scenario. Furthermore, fractionally reserved ponzinomics is not at play. $ATOM alone is insufficient to ensure $USK stability, but it still plays an important role.

ORCA

ORCA is a public market for liquidated collateral that allows individuals to purchase liquidated assets at a discount.

On Terra Classic, ORCA allowed users to bid on Anchor Protocol liquidations using UST and aUST. Anchor’s liquidation queue contract enabled this by incentivizing liquidators to liquidate loans by allowing them to get the underlying collateral at a discount.

ORCA also enabled users to profit during market downturns, as liquidations are more likely when the price of underlying collateral drops. Successful bidders received assets at a lower cost, with many utilizing ORCA as a DCA tool to buy cheap bLUNA and bATOM during market downturns.

⬆️ In addition, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ALTCOIN BUZZ – BINANCE – GET UP TO $800* ON SIGN UP

Sign up using the links below on Binance Exchange and get the following benefits

- $100 Sign-Up bonus*

- 20% Trading fee discount for life*

- FREE $200 worth of Altcoin Buzz Access PRO Membership*

- Plus $500 Unlockables*

Sign-Up Links –

For more details visit*

*Terms & Conditions Apply

Disclosure: Altcoin Buzz may receive a commission, at no extra cost to you, if you click through our links and make a purchase from one of our partners.