Tron’s stablecoin, the USDD, is de-pegging since yesterday. The current price is around $0.979. At the same time, the TRX token takes a hard fall as well. It’s down 17.8% since yesterday. Although, there is a slight recovery. It looks like the Terra Luna/UST scenario.

But is it for real? The de-peg seems more stable than the UST situation. Does Justin Sun, the Tron CEO, know something that Do Kwon didn’t know? Let’s take a dive into this and see what is going on with the USDD de-peg.

The USDD De-Peg

The USDD is, just like the UST, an algorithmic stablecoin, where TRX and BTC are backing it. The USDT and USDC stablecoins play a smaller part in the backing.

The UST crashed just one week after launching USDD. An interesting detail. Sun says he learned from that debacle. However, UST and USDD have some things in common. On the other hand, they are also different in other aspects.

#TRX burning for #USDD https://t.co/eFFAXW7eZL

— H.E. Justin Sun 🅣🌞🇬🇩 (@justinsuntron) June 11, 2022

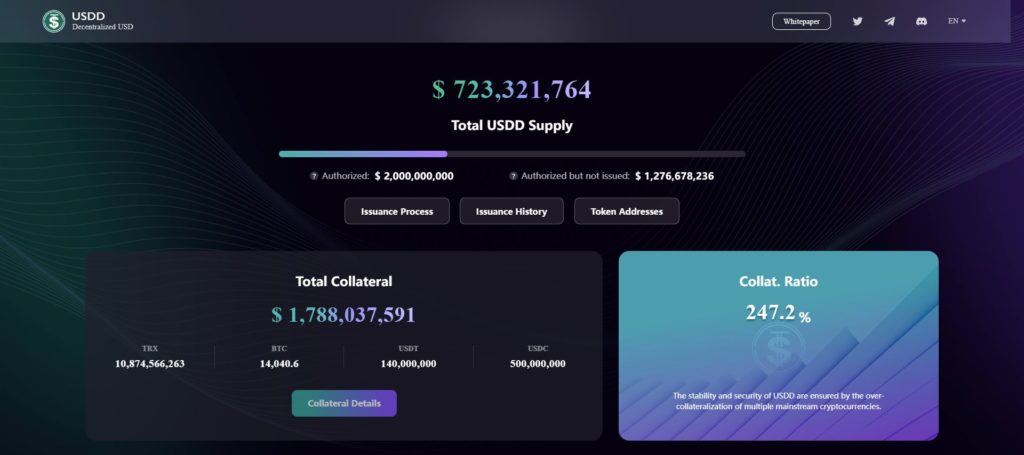

Also, they’re similar when we look at the burning mechanism. Trading TRX is the main factor to keep the peg. They do something different, though. They over-collateralize the USDD. See the picture below.

Source: USDD website

Now, there are a couple of things to say about this setup. For starters, it may not be such a good idea to use such volatile crypto as TRX. That’s proven to be right since TRX dropped by almost 18% over the last 24-hours.

As a result, if you take TRX out of the collateralized sum, it looks different. Now there is with current TRX prices around $1.1 billion collateral left. Furthermore, crypto researcher Res®️ has a point. He explains this well in a Twitter thread. The USDT is jUSTD. That means that these $140 million USTD are in JustLend as a deposit.

Therefore, this brings the current collateral close to around 130%. Res®️ thinks that number is even lower. He explains this in a different Twitter thread. That’s a bit different from the listed 246%. This means that there is not much room left to wiggle if any.

1/ And it's starting$USDD is currently just 92% collateralized by the Reserves (even considering $TRX funds) ⚠️

If you subtract $TRX, it turns out collateralization ratio is currently 73%

Also, the 140M $USDT are not really USDT, but jUSDT 👇 pic.twitter.com/fKYaIQEd1D

— Res ®️ (@resdegen) June 12, 2022

Adding BTC as Collateral

According to Res®️, in his thread. On June 6th, they bought another 1,000 BTC. This was around $30 million at the time.

Also, on June 7th, they sent another $100 million USDT from the reserves to Binance. This was to buy more BTC and TRX. Moreover, on June 11th, they use $50 million to buy more BTC. According to Justin Sun, this was with new capital. To clarify, supposedly this was not from the reserves.

In addition, he explains the collateral % in detail in another thread. He comes to a 95% collateral instead of 246%

However, the bottom line is that are buying volatile assets by selling their stables. What are your thoughts on this? Is this a smart move? Currently, BTC is down around 16%. It even dipped below the $21,000 price.

In other words, the BTC and TRX prices keep dropping. The USDD supply becomes bigger. As a result, the under-collateralization risk increases.

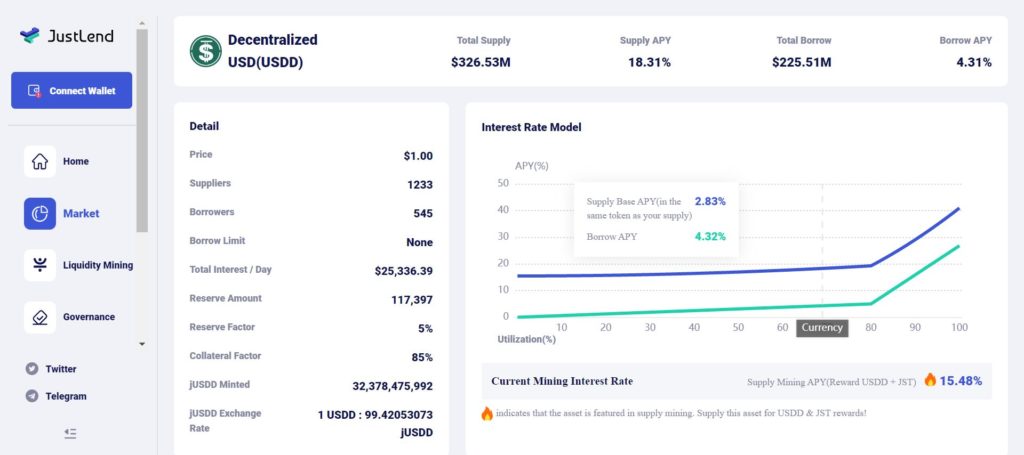

To sum up the UST downfall, this started after the Anchor protocol yield dropped to 18%. That used to be 20%. Justin Sun offers a similar yield with USDD in JustLend with 18.3%. According to Res®️, it was even down to 11%.

Don’t forget that JustLend started the USDD APY at 30%. Furthermore, also here, we see that there are more lenders than borrowers. The difference is $100 million. Just like Anchor, it’s not possible to sustain this yield. See the picture below.

In the meantime, the Tron DAO Reserve has received $700 million in USDC. That’s to hold the peg.

700 million USDC has been injected into @trondaoreserve for #USDD peg. Well done! https://t.co/r11PnBte4g

— H.E. Justin Sun 🅣🌞🇬🇩 (@justinsuntron) June 13, 2022

However, more twists and turns are available. A Twitter handle inside Nansen mentioned that Oaptial is transferring large funds of USDD. They also capitalized when the UST lost its peg.

Oapital (labelled on @nansen_ai), one of the funds involved in capitalising off of the $UST de-peg is now actively making large transfers of $USDD and other stables.

Doesn't look great. pic.twitter.com/DBoubXoWvu

— Nansen Intern 🧭 (@nansen_intern) June 13, 2022

Similarities and Differences Between USDD and UST

Let’s have a look at what makes Trons’ USDD similar and different from Terra’s UST.

- Similarities

They are both algorithmic stablecoins. Furthermore, they are not backed by collateral. You mint USDD by burning TRX and vice versa.

The Tron DAO backs the USDD. They plan to have a $10 billion reserve in crypto to support the peg. The Luna Foundation Guard (LFG) has a similar plan. $10 billion in BTC and AVAX to keep the UST peg.

- Differences

According to Justin Sun, UST grew too fast in a short time frame. There was also too much leverage. The market cap was huge, but they had small reserves before the collapse. He also thinks that the Anchor yields were too high and lacked market variables.

On the other hand, he wants to keep the USDD market cap below the TRX market cap. That’s currently $715.5 million over $5.6 billion. Furthermore, the reserve consists mostly of BTC and TRX. Topped up with USDT, USDC, BUSD, DAI, and TUSD. These stablecoins should deploy, once USDD loses the peg. Which we see happening now. $700 million USDC was deployed on June 13th.

Also, Anchor didn’t have a withdrawal limit. JustLend plans to have withdrawal limits.

This reduces part of the risk of fast sell-offs. To clarify, UST was relying much more on LUNA than USDD does on TRX. To fight off the negative funding on Binance, by shorting, the Tron DAO directs $2 billion.

ICYMI: Tron deploys $2 billion from reserves to guard against shortshttps://t.co/va09jvz2q4

— The Block (@TheBlock__) June 13, 2022

Conclusion

This ain’t over until it’s over. So far, Justin Lend and Tron seem to handle things better compared to Do Kwon and Terra. However, there’s still a de-peg, but it does not seem as drastic as we saw with UST. Here’s what our technical analysis experts at Altcoin Buzz had to say about Tron.

Will this, further undermine any trust that’s left in algorithmic stablecoins? We will have to wait until the fat lady finishes her song.

⬆️Moreover, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Finally, find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.