Many DeFi protocols are still young and Aave is one of them, which is a household name in the ever-changing DeFi landscape. But they didn’t get there by just twiddling around.

They already released the Aave V3. This keeps them on top of the DeFi world. Therefore, in this article, you will discover everything about its latest version: V3.

Aave V3 Takes It to the Next Level

Even when Aave V3 tackled known technical issues. They upgraded a few major areas like capital efficiency, increased protocol security, decentralization. Also, as cross-chain functionality, and user experience.

The Aave V3 launch date was March 16th, 2022. They created a milestone by delivering a completely new and smooth experience. As a result, the AAVE token has been pumping and saw a 57.9% increase in just 14 days. We give you the lowdown on Aave’s V3.

1/ Aave V3 is here! 👻

The most powerful version of the Aave Protocol to date, V3 brings groundbreaking new features than span from increased capital efficiency to enhanced decentralization. Read what's new in V3 in the thread below👇or visit https://t.co/H3jTyKRqNs to dive in! pic.twitter.com/LXzn7660nA— Aave (@AaveAave) March 16, 2022

Moreover, one of the challenges the team had, was to tap into the unused funds in their smart contracts. This is in principle pure gold, so to speak. So, they set out to find ways to reuse inactive capital. Let’s have a look at how Aave V3 manages this and solves other issues. Here are the new features of the V3 protocol:

- Portals—The portals offer ‘permit listed‘ bridges. These clear the way for cross-chain transactions. As a result, assets can now move without problems between various networks.

Source: Aave blog

2. High-Efficiency Mode: This gives a higher borrowing potential, where borrowers can now use their collateral to the max. For example, with high leverage forex trading. But also with more productive yield farming.

3. Isolation Mode: Aave governance can list new assets as ‘isolated’. They have a fixed debt ceiling, and you can only use them as collateral. Furthermore, you can’t use any other assets as collateral. Although, you can add other assets, only to get more yield. You can only use specific coins, like stablecoins. As a result, the protocol limits risk and exposure to these new assets.

Source: Aave blog

These are the important new features, the heavy hitters. However, there is more in the pipeline.

Fine-Tuning Aave V3

Aave V3 also offers many smaller improvements. A lot of these gear towards a better user experience. One of the things the team looked into are L2 Updates, like designs for improving reliability and user experience. However, Chainlink still powers the Aave Oracle network.

On the other hand, a special design for the L2s is the Price Oracle Sentinel. This has a liquidation grace period. Furthermore, under specific circumstances, it deactivates borrowing. Currently, only for L2s, but in the future also for L1s.

What everybody likes are better gas prices. With some innovative features, gas prices dropped by no less than 20-25%. As always, the community takes center stage with Aave. They encourage community contribution. The team does this with a new and well-organized, modular codebase.

Last but not least, there are improvements in risk management. Various risk caps came into life. To clarify, supply and borrow caps. The borrow caps reduce insolvency risk. On the other hand, the supply caps limit the amount of an asset supplied to the protocol. Overall, this added a protective layer to the protocol.

Therefore, in case you like to dig into the nitty-gritty of all this, the Aave V3 white paper has all the details.

Source: Aave blog

Adding More Cross-Chain Opportunities to Aave V3

Cross-chain and interoperability are the keywords in DeFi so far in 2022. It comes as no surprise that Aave V3 tags along with this. From now on, users will be able to manage tokens from Avalanche, Polygon, Arbitrum, Fantom. Also, Optimis and Harmony.

Moreover, the deployment of the Ethereum mainnet is still up in the hands of the community. A decision will be in the making at a later stage. Moreover, the team added cross-chain governance voting.

Also, you will be able to access Aave V3 through a variety of new wallets and access points. The integration will be possible for instadapp, debank, 1Inch, paraswap, zapper, DeFisaver, and Zerion. Just to name a few, there are more.

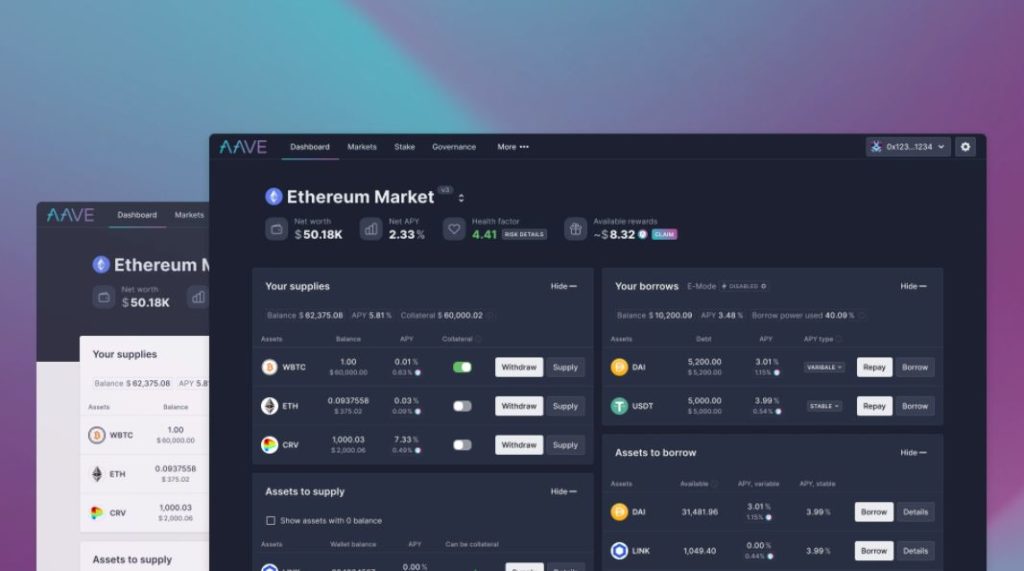

A New Design for the Aave V3 dApp

To make everything more user-friendly, designers blew away some cobwebs and gave it an overhaul. As a result, the IPFS (InterPlanetary File System) gives you:

- Access simplified transaction flows.

- Faster load times.

- A restyled dashboard for an improved view of your assets.

Therefore, this comes with many other features that make the app more effective. For example, transaction flows will need fewer steps, and the page layouts are new. Also, the navigation patterns are now a lot easier to use. Furthermore, building on the Aave interface is easier.

Source: Aave blog

Safety in Aave V3

The Aave V3 team didn’t release the code without testing. In contrast, it underwent some harsh testing. Not only one, but two audit phases took place. Just to make sure that there are no weak points for bad actors to enter the protocol. Any problems that popped up, the team dealt with immediately. Of course, this reduces risks of hacks or other unpleasant events.

The audits involved the following renowned audit firms

- Sigma Prim

- Trail of Bits

- Open Zeppelin

- ABDK

- PeckShield

Furthermore, Certora did a formal verification.

Conclusion

Aave protocol’s core concepts are still there in V3. For example, stable rate borrowing, instant liquidity, and the concept of aTokens. However, we also see many new improvements in a few major areas like capital efficiency, risk management, and decentralization.

For the time being, Aave V3 is the icing on the cake. It takes DeFi to another level. As a result, we also saw an outstanding pump of the Aave token.

Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.