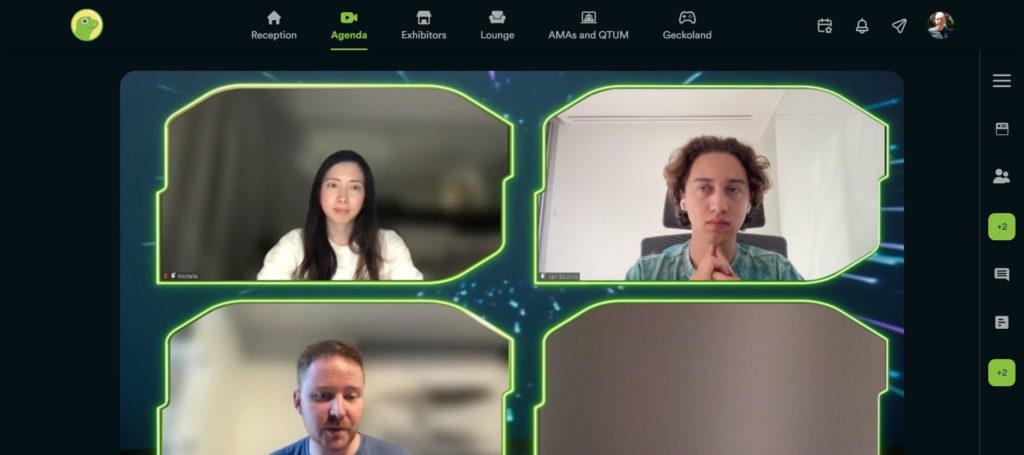

The GeckoCon conference took place online recently. On July 14th and 15, there were dozens of presentations about Web3, DeFi, the metaverse, and more. Panels consisted of four to five people each time, including a moderator. This article covers the “What’s Next for DeFi?” panel.

We start with an introduction to the panel and take it from there. So, let’s have a look what DeFi has in store for us.

Who Is in the Panel?

George Harrap is the moderator. He is co-founder of Step Finance and a crypto veteran for over a decade. He was a Bitcoin miner and started the first remittance company in crypto. Furthermore, he considers DeFi to be the most exciting part of crypto.

Murloc is co-founder of Trader Joe. You could hear his voice but not see his face during the presentation. Trader Joe is the leading DEX on Avalanche.

Ivan GBI is a core contributor at Gearbox and LobsterDAO. Gearbox is a composable leverage protocol. LobsterDAO is an OG collective of DeFi and NFT degens and whales dating back to 2018.

Michelle Sun is a core contributor at Project Serum. This is a DEX built on Solana.

Where Is DeFi at Currently?

This is the first question from George. DeFi has been around for a few years now. The questions to answer are:

- Where have the last two years led us to?

- Have things changed? Think about DeFi summer (2020). That’s when many new protocols emerged.

- Ever since, have new things come along, are there new innovations, or does DeFi stand still?

Ivan

Before the DeFi summer, there were already protocols around. For example, synthetics, MakerDAO, Compound, and Aave. There was some adoption; however, there were much fewer users. Crypto was still small, and that makes it hard to measure success. During the DeFi summer, more products arrived. For instance, AMMs, yield aggregators, and Curve. Furthermore, fixed income products made their entry. Decentralized finance hasn’t slowed down in innovation. However, the TVL and the number of users increased. In the last year, DeFi took a bit of a nosedive, just like the whole crypto industry. Nonetheless, still wonderful new products entered the market. He sees RWAs (real-world assets) entering DeFi in the future. One part of concern, however, is regulation.

George agrees to this last part and considers this a question without an answer. Regulation is most likely coming, but they don’t know how it will look like. He adds that during the DeFi summer, AMMs arrived on the scene with Uniswap. He states that AMMs are the critical building blocks for DeFi, and then he hands over to Murlock.

Murlock

He is fairly new to DeFi and didn’t do his first swap at Uniswap until a year ago. Not only that, but he also sees DeFi going through cycles, but thinks it’s still the future of finance. Users adopted AAMs. Uniswap did a fantastic job by making something complicated into an easy-to-use experience. Swap a token by just clicking one button. DeFi saw maturation of DeFi. We also saw P2E and M2E adaptation.

Here’s where DeFi shines. It takes something obscure but useful to many people and makes it grow.

It surprises him how many new people entering DeFi have no frame of reference. They are not familiar with many older protocols. As a result, they need to give good explanations how all their products work. He sees DeFi as an emerging market, which excites him, and he expects more growth.

George explains that AAMs in general don’t work with order books. However, Serum does. He hands over to Michelle.

Michelle

She mentions that TradFi and retail traders are familiar with order books. One of DeFi’s strong points is composability, the functionality of DEXes and integrating with each other. This leads to creating new products. Serum wants to power many products in their ecosystem. Currently, they have over 100 products using their back end.

However, during the last few months, she saw plenty of challenges across the industry. There are systematic vulnerabilities. She observes them across various chains and apps. Nonetheless, she’s still optimistic about decentralized finance development. She sees mainstream adaptation coming. But first, many shaky foundations need some working over. This allows the industry to come out with stronger foundations. There also needs to be more focus on the user experience.

There’s a Part 2 of this presentation, where you can read the rest of the discussion.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.