Tomb Finance has a unique feature that stands out. Their TOMB token pegs to the Fantom (FTM) token instead of fiat, like USD. This brings new use cases and liquidity to the Fantom Opera Network.

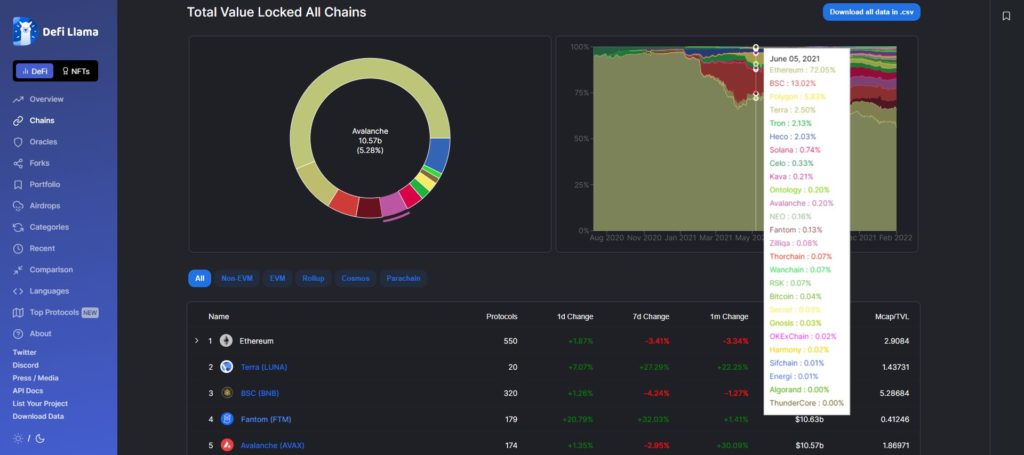

FTMpad is such a new use case, the first launchpad and incubator on Fantom. Fantom is one of the fastest and cheapest blockchains around at the moment. As a result, they recently managed to become the third ranking blockchain in the world for TVL. Tomb Finance, are strong believers in the Fantom Opera network.

Therefore, they have pegged their TOMB token to FTM. On the other hand, Fantom is EVM compatible. This means that all Ethereum smart contracts can run on the Fantom blockchain. This explains part of their popularity.

ℙ𝕖𝕘 𝕧𝕤 𝕄𝕒𝕣𝕜𝕖𝕥:

During uptrends, downtrends, sideways, & market dumps, the peg has held strong. Through both euphoria & uncertainty the peg has held the line as we continue to build and look to the future with Felix, Fanty, & Lif3. Keep Calm & Tomb On!$TOMB pic.twitter.com/12a5Wtb7MZ

— The Game of Tomb 👻 (@tombfinance) February 24, 2022

How Does the TOMB Algorithmic Token Work?

TOMB token is an algorithmic stablecoin, pegged to 1 FTM by seigniorage. These are stablecoins with flexible money supplies. In turn, algorithms have programs that govern the buying and selling of stable coins. This is how they maintain the peg to the token price. Currently, it takes 500,000 FTM to run a Fantom node. This, along with its fixed supply, means that FTM will become scarce over time. The TOMB token design is to use it as a medium of exchange. They want to become Fantom Opera’s main medium of exchange.

Although TOMB pegs via the algorithm in an active way, it is not collateralized to FTM. Therefore, it is also not valued at 1 FTM at all times. This is important to understand the various coins used in Tomb Finance.

- TOMB token — Medium of exchange. It has a mechanism with built-in stability which maintains the peg to FTM. To make the most out of this token, stake it! It has an uncapped supply.

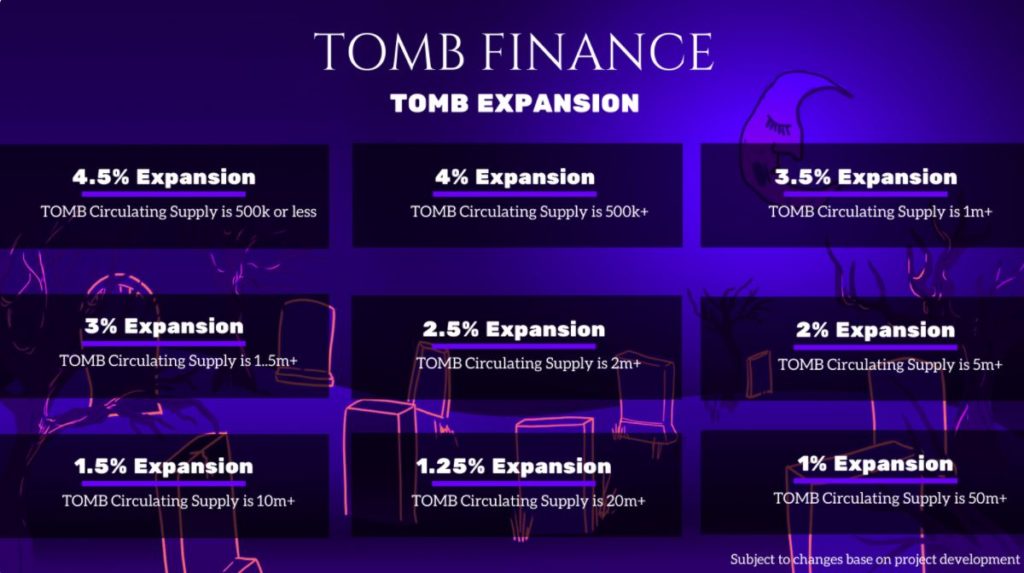

- TSHARE — Tomb Shares measure the TOMB Protocol value. It also represents shareholder trust in keeping TOMB close to the peg. TSHARE has a capped supply of 70,000 Shares. Furthermore, it is also a claim to a TOMB Share. Tomb Finance prints this when there is an expansion phase. The expansion phase is when the TWAP or Time Weighted Average Price of 1 TOMB > 1 FTM.

- TBOND — Tomb Bonds. Buy discounted TOMB when TWAP 1 TOMB < 1 FTM. Issued TBONDS allow buying TOMB at current prices. This burns TOMB tokens (deflation) and gets the TOMB price up to 1 FTM. Redeem TBONDS again when the TOMB price is above the peg. This creates inflation and pressure to sell TOMB above the peg. In turn, this pushes the price back, closer to 1 FTM. This is the contraction phase.

TOMB’s Tokenomics or How to Take Part in the Protocol?

It is possible to take part in the protocol in a couple of different ways. This also shows the most attractive farming pools and staking options on Tomb Finance.

- Start on SpookySwap, a DEX that runs on the Fantom Network. Add liquidity to the TOMB-FTM pool. Depending on how much liquidity a person adds to the pool, it earns a proportional share of rewards. Rewards come from the 0.2% transaction fees. In return, for providing liquidity, each LP receives LP tokens. Now take the LP tokens to Tomb Finance.

- In the Cemetery, stake the same number of TOMB and FTM or your LP tokens. This earns TSHARES in the TOMB/FTM LP.

- Also in the Cemetery, stake the same number of TSHARES and FTM. This earns TSHARES in the TSHARES/FTM LP.

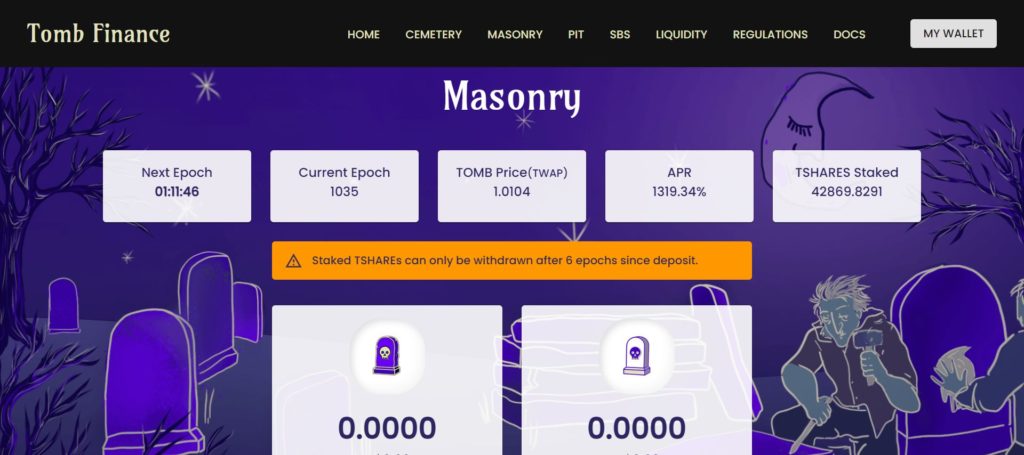

- In the Masonry, stake TSHARES in the TSHARES Pool. This earns TOMB. However, before withdrawal, there is a locking period of six epochs. Each epoch is approximately 6 hours. The Masonry is where Tomb Finance mints TOMB tokens.

- During the contraction phase, buy TBONDS. Remember, the protocol burns each TOMB used to buy TBONDS. This means there are less TOMB in circulation, hence the TOMB price increases. Therefore, TOMB gets closer to the peg again. Once 1 TOMB equals 1 FTM, redeem the TBONDS in the Pit during the expansion phase.

Swapping TBONDS to TSHARES happens in SBS. However, is everyone keeping track of the amount of income they are generating! All the 5 steps mentioned earn income! Compounding all these earnings, gives a high APY. Up to 400% is possible. On the other hand, there is also an impermanent loss risk, albeit it is a low risk.

What Happens With Under-Pegged and Over-Pegged Periods?

Many people state a blockchain’s market cap should be like the TVL of all dApps on that blockchain. However, pretty much every blockchain has a higher TVL. This means that they are correctly valued or overvalued. There is however one exception. That is Fantom. The market cap is, at the time of writing, $4.3 billion. TVL comes in at $10.63 billion. This makes for a Fantom Mcap/TLV ratio of 0.41%. Following this logic, it is undervalued. With a current price of $1.73 this means it should be $4.25. Still, the price is not at that level. So, what is happening?

During an under-peg period, let’s assume FTM sees a price increase from $2 to $2.5. 1 TOMB now equals 0.8 FTM. Do you realize that you can now sell a $2 TOMB for TBOND, that you redeem when TOMB is back at $2.5?

To go one step up, sell FTM for TOMB. At current sample price, 4 FTM swaps for 5 TOMB. In turn, these swap for 5 TBOND. The last step is to redeem these 5 TBONDS for 5 TOMB when they are back at peg (5 FTM).

Furthermore, when TOMB is under-peg, as a rule, the FTM price went up on the market, putting sell pressure on FTM. FTM will lose some value, but TOMB holders pick up the gains.

During an over-peg period, the Masonry prints TOMB as long as a person has TSHARES. Although the TOMB is now back at $2, the Masonry distributes more TOMB. By the time TOMB is back at peg, that same person now holds more TOMB! Below is a picture of the TVL for all DeFi protocols. Fantom ranks fourth!

Source: DefiLlama

Fantom’s Price

The above sample affects Fantom’s price as follows. In 2021, there was 21% increase in FTM supply or 250 million. This is the reward release for staking FTM. TOMB saw around 170 million printed in the Masonry during a 3-month period. This increases the percentage of available FTM and TOMB even more. Instead of buying Fantom, people went to TOMB. As a result, Fantom’s price remains undervalued.

What Are the Latest Developments of the Protocol?

The latest developments of the protocol are TOMB forks. 2OMB and 3OMB came on the scene, offering higher returns. Therefore, people left Tomb Finance. They immigrated to these two protocols.

While the TOMB token’s total and circulating supply are the same at just under 143 million, the maximum is technically infinite. However, since TOMB has a peg to Fantom, it really needs to behave as Fantom does to maintain the peg and Fantom has a fixed supply with ~83% of its tokens circulating the marketplace. TOMB’s price is $1.73 while Fantom’s is also $1.73. Peg intact.

Conclusion

The market is in turmoil because of the Russia – Ukraine conflict. Passive income from stablecoins seems to be the best way forward. Tomb Finance offers just this at a high APY with stable pair farming.

Also, Join us on Telegram to receive free trading signals.

Finally, For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.