The crypto market has been undoubtedly disappointing for traders this year. No one expected things to go the way they did, especially after such a bull market as we had in 2021. However, even the best traders know that these things happen in the crypto market.

Market cycles are a natural part of any financial market. However, the crypto market is volatile and moves quickly. This means that a lot of change takes place per time. As an investor, knowing the current crypto market cycle is essential. This would help you direct and focus your strategy.

Understanding Crypto Market Cycles

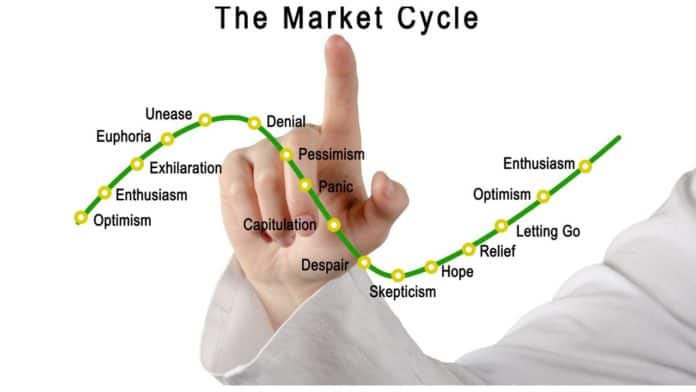

Market cycles are not exclusive to Bitcoin. In conventional markets, they refer to the time frame between two market highs or lows. In the conservative stock market, these cycles typically last for extended periods of time. The picture above, seen in a tweet shared by DeFi investor, Route 2 FI, and created by Karen Bennett, a writer at CheatSheet, best explains the psychology of a market cycle.

Source: Twitter

The picture describes the most prevalent emotions investors experience during a fluctuating period in the market. As simple as they look, these human emotions play a huge role in our financial markets, even more than the fundamentals.

The image outlines the core stages in the crypto market cycles that repeat over time. However, not every market cycle will follow this picture’s timeline. So, it’s not a hard and fast rule. However, it ought to provide some insightful information about the psychology of market cycles. These phases are experienced by all markets for a short time. Here is a brief description of every phase:

1) Hope

Hope is the first stage that shows that the market is slowly returning to a good run. It comes after the last stage of the cycle, “Disbelief”. During the hope stage, there are positive indications of a bull run. However, people are still concerned and cautious. So, they make little investments to reduce huge losses.

2) Optimism

The optimism stage is the period where new capital flows into the system and prices start to increase. We only get to the optimism stage after a long-term rise in the market. So, investors have faith in the market again and inject cash into it.

3) Belief

After a sustained upward trend, the emotions change from “optimism” to “belief.” Here, investors are beginning to search for new ways to invest as well as opportunities. The belief stage is one of the core signs of a bull market.

4) Thrill

Investors who know their way around the market are often thrilled by the new opportunities in the market. At the thrill stage, the emotions are high. There are multiple projects to select from. Everyone believes the chances of a decline are slim. So, the market is up and running. However, experts often warn you to maintain control over your emotions at this stage and try to be as reasonable as possible.

5) Euphoria

Euphoria characterizes the end of a significant build-up in the market. At this stage, there is complete faith in the market and literally, nothing can stop the already-high emotions. Here’s where the excessive cash comes in. You can also anticipate the press to create pieces about the newest crypto millionaires. Stories about the bull market will fill the media.

6) Complacency

The bull run isn’t expected to last forever. Some people will profit from it, while others will feel disappointed by their unfulfilled goals. As a result, the good run will slowly begin to decline. The first indicators of a market reversal start to appear at this stage. People believe the complacency stage is simply a little break before the bull run resumes, which makes this an extremely risky period. A lot of investors are unprepared for the impending market turn.

7) Anxiety

At this point, people realize that ” things don’t last forever in crypto.” They notice that the market is turning around and is dropping in value and money. Most people prefer to be in denial during this stage. However, they risk incurring more losses this way.

8) Denial

While the value of their investments continues to plummet, many investors choose not to sell in the hopes of an even larger upward reversal. Investors at this stage take a defensive stance because they believe they have invested their funds prudently. However, in most cases, not a single penny may escape unscathed. Almost everyone gets drenched in the storm.

9) Panic

Here, the bear market has established itself as the new normal. To the dismay of many traders, things get worse at this stage and there is little anyone can do. So, in a bid to salvage their funds and reduce losses, investors and traders sell their assets out of panic.

10) Depression

Traders and investors are losing their faith in the market at this stage. Here’s where little growth occurs. Some traders even go into “anger”. This is the point where stability and organization re-emerge. It could, however, take a while before things get back to normal.

Crypto market cycles are hard to predict. So, it is important to note that risk contributes to the duration and amplitude of these cycles. We can safely conclude that markets don’t rise or fall indefinitely. They are bound to go through different periods.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.