Liquidity mining and yield farming has been in the crypto space for quite some time and has received good user adoption. Uniswap is one of the major AMM-based swap protocols that offers liquidity mining and maintains trading volume. Then comes Luaswap and Sushiswap, which attract users with their mouth-watering yield rewards functionality.

The Adventure Token and LUNA Fund is the next and the advanced version of the liquidity and yield farming concept that offers multiple returns on your investment.

Table of Contents

What is Adventure Token?

Adventure Token ($TWA) is a deflationary community ERC-20 token. The token is programmed in such a way is that every single transaction, be it a buying, selling, or transfer activity, leads to the burn of one percent of the total transaction value of the token.

The project started with 101 million Adventure tokens and 94% of those have already been burnt or locked for 2 years and will all be burnt on release in November 2022.

The project currently has a circulating supply of 5.9 million that will further reduce at a rate of 1% of the transactional value with each transaction. Also, no more tokens will be added to the supply now. This constant decrease in token supply will be led to an increase in token price.

The Adventure Token smart contract has been audited by the famous auditing Certik.

Adventure LUNA Fund

Another important term that is associated with the platform is the Adventure Luna Fund.

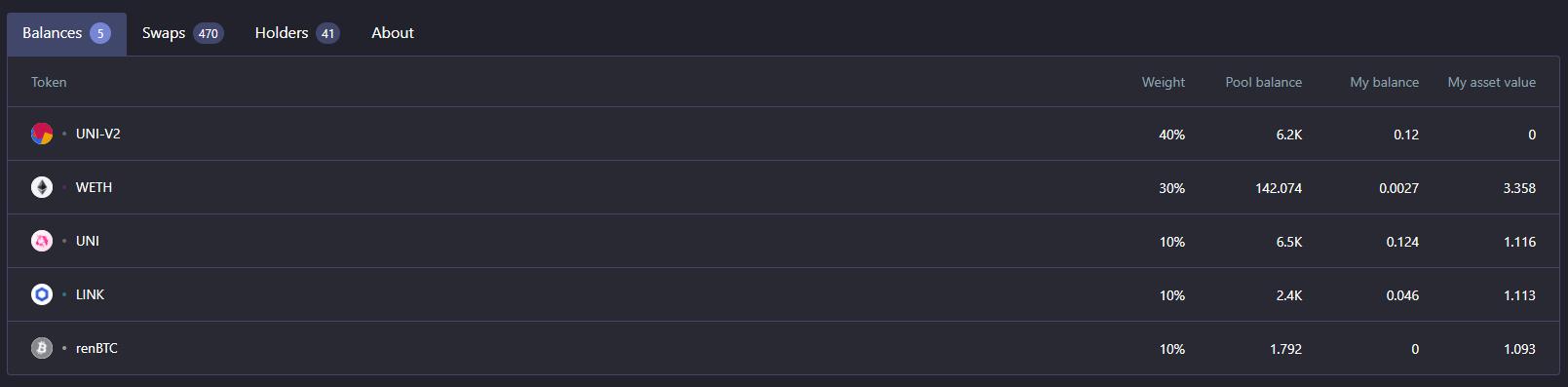

The Adventure Luna Fund is made up of five tokens:

- Uniswap (UNI)

- Ethereum (ETH)

- Bitcoin (BTC)

- Chainlink (LINK)

- Adventure LP Token (UNI V2)

The LUNA Fund runs on the Balancer Protocol. The Fund maintains the portfolio of all associated users and controls the Adventure Token price. With every trade, 1% of Adventure Tokens are burnt, reducing the overall supply.

The Luna Fund lends funds to other exchanges and traders, and the fund takes a 2% fee for every transaction. In addition to it, you will also receive Balancer tokens ($BAL) weekly on Tuesday for providing liquidity to Balancer.

Usage Guide

To use the Adventure Token, go to the homepage.

The platform also lists the steps that need to be followed, starting from buying the Adventure Token to the final step to deposit the tokens into the Balancer pool.

We will now see how you can perform each step in greater detail.

Step 1: Get the Adventure Token

You can get the Adventure Token from Uniswap.

- Buy Adventure Token From Uniswap

Go to Uniswap and connect your MetaMask wallet.

Double-check the token contract address. You can get the token address from Coingecko.

As you can see from the below snapshot, we are swapping some ETH with TWA tokens. Enter the amount of tokens that you wish to buy and confirm the Swap activity.

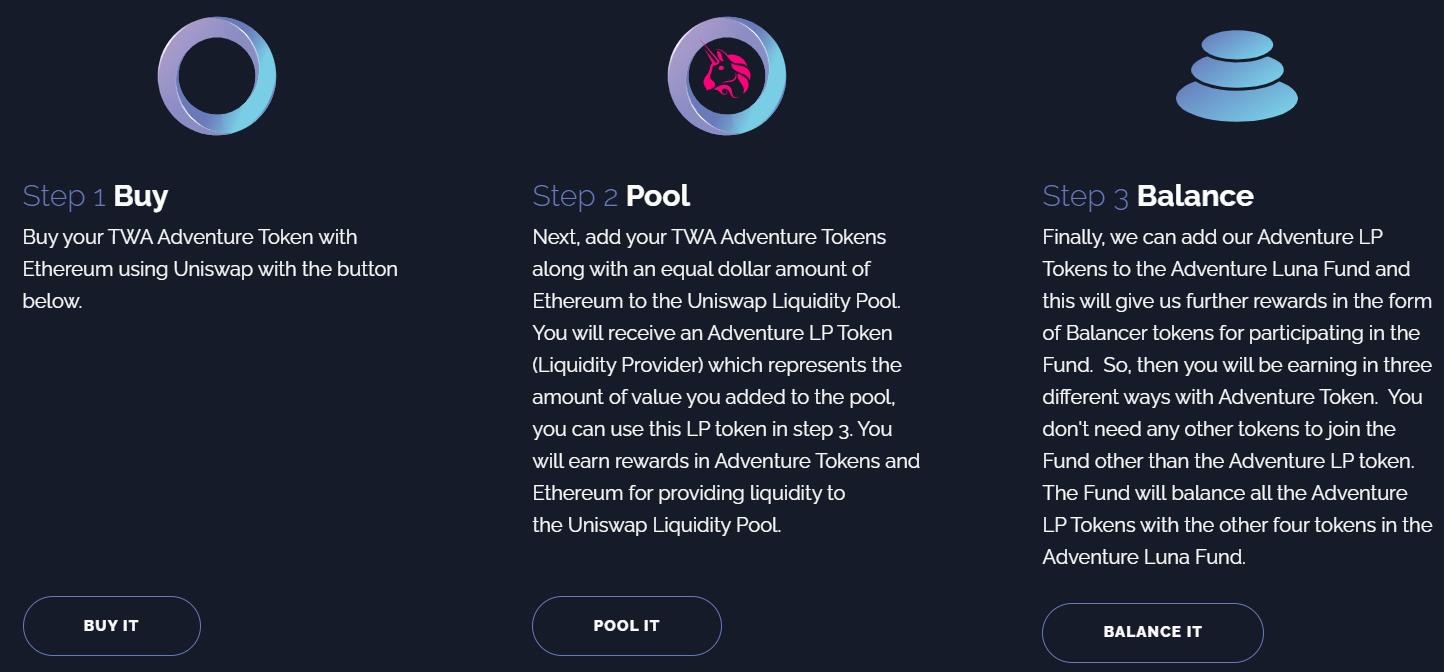

A MetaMask transaction is triggered. Once the transaction is successful, you can see the TWA token in your MetaMask wallet.

- Adventure Token in MetaMask

If you are not able to see the token in your MetaMask wallet, then you have to add the token by giving the contract address of the token in the Custom Token tab.

See the below screenshot and add the token address. You can now see the TWA token in your wallet.

TWA contract address: 0xa2ef2757d2ed560c9e3758d1946d7bcccbd5a7fe

Important: We have swapped 20 tokens but have received only 19.8 TWA tokens in our wallet. The 1% of 20 TWA tokens (.2) is burned, and we have received the remaining 19.8 TWA tokens as per the deflationary program associated with the Adventure token.

Step 2: Pool It

1. Generate Adventure Token Liquidity Pool on Uniswap

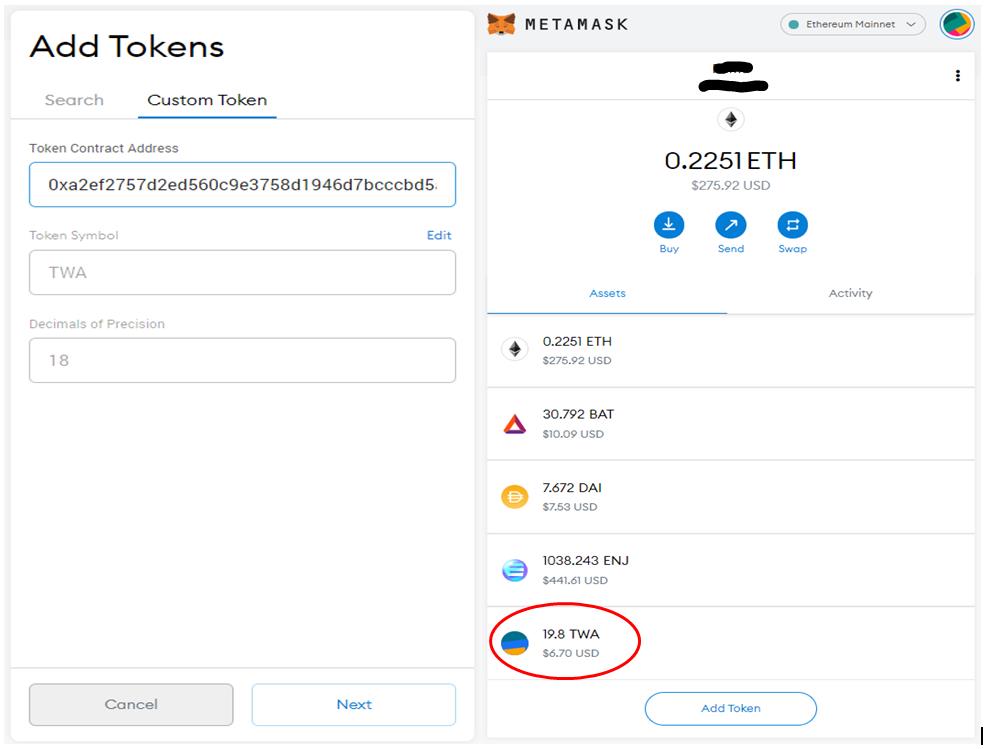

So now you have $TWA Adventure Token in your wallet. You can use this Adventure Token and add an equal amount of Ethereum into the Adventure Token Liquidity Pool on Uniswap.

The Adventure liquidity pool gets 0.3% of every TWA/ETH transaction on Uniswap. These fees are divided among the liquidity providers.

Users are required to add liquidity into an Uniswap pool with the TWA-ETH pair.

To add liquidity, go to the Uniswap Pool.

Enter the amount of TWA tokens you wish to add to the liquidity pool and an equivalent amount of ETH will automatically get entered.

Since you are using this liquidity pair for the first time, users need to approve the pair first before adding liquidity.

Once approved, you can now supply the liquidity by clicking on the Supply button.

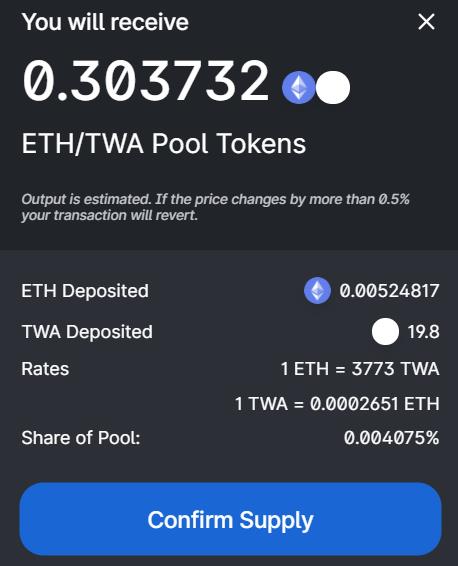

The application will display the amount of pool tokens that you will receive. Confirm the Supply.

A MetaMask transaction is triggered. Confirm the transaction.

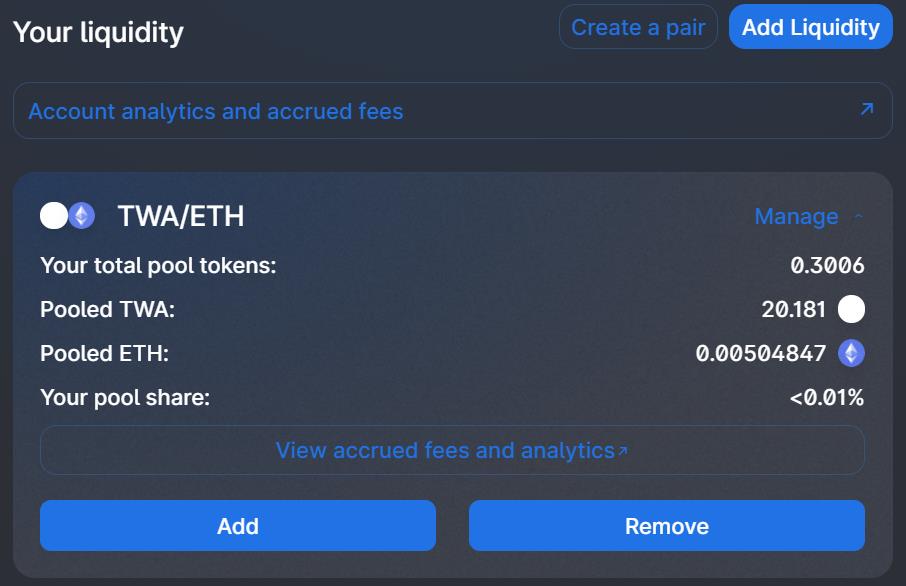

You can see your TWA-ETH liquidity details now.

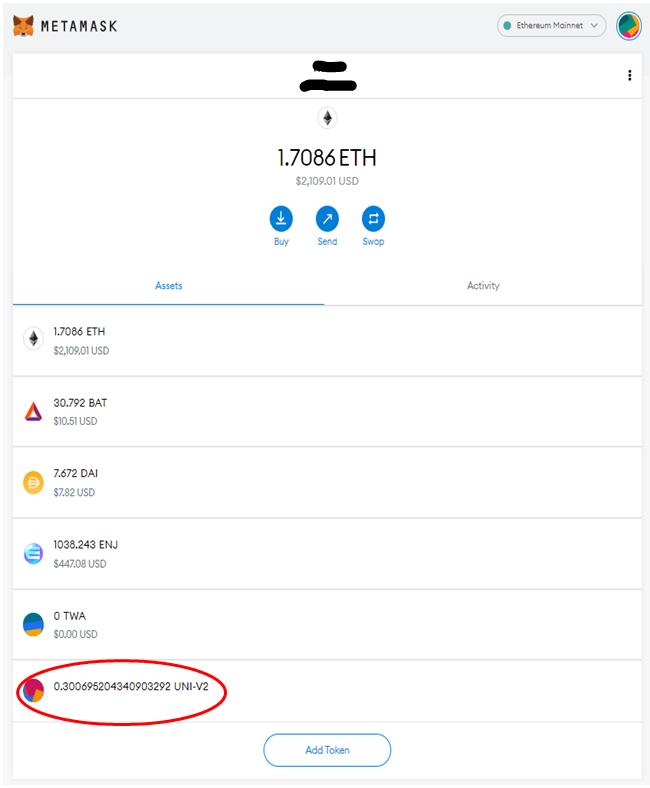

2. Uniswap Pool Token in MetaMask Wallet

You can also check the TWA-ETH liquidity pool token in your MetaMask wallet.

Step 3: Balance It

Finally, users can add the Adventure LP Tokens to the Adventure Luna Fund and receive rewards in the form of Balancer tokens. You will earn a fee equal to 2% of all transactions, which is then divided among the liquidity providers.

The Adventure LP token will be sufficient to join the Luna Fund, and you don’t need the other tokens to join the pool. The Fund will balance all the Adventure LP Tokens with the other four tokens in the Adventure Luna Fund.

Now go to the Balancer pool, which is better done by clicking on the Balance It button appearing on the Adventure Token homepage.

You will be redirected to a Balancer pool. Connect your MetaMask wallet.

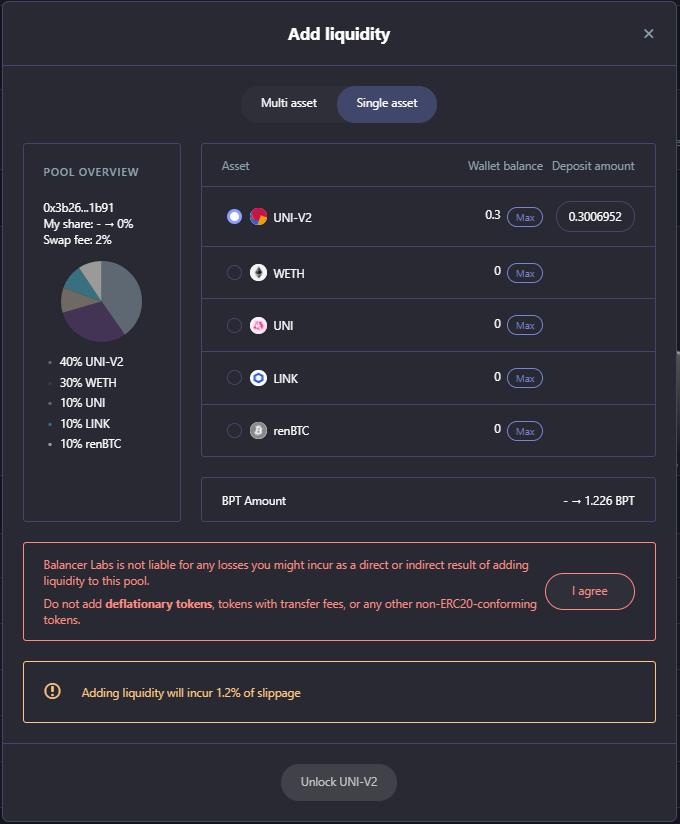

Once your wallet is connected, you can see your Balancer pool token (BPT) that you can use to add liquidity.

Click on Add Liquidity and go to the Single Asset tab.

Select the UNI-V2 token and enter the amount of token you wish to add to the liquidity.

To provide liquidity, click on the Unlock UNI-V2 button and confirm the MetaMask transaction.

After the transaction is successful, you can see your LUNA Fund details from the bottom of the Balancer pool page.

Remove Liquidity

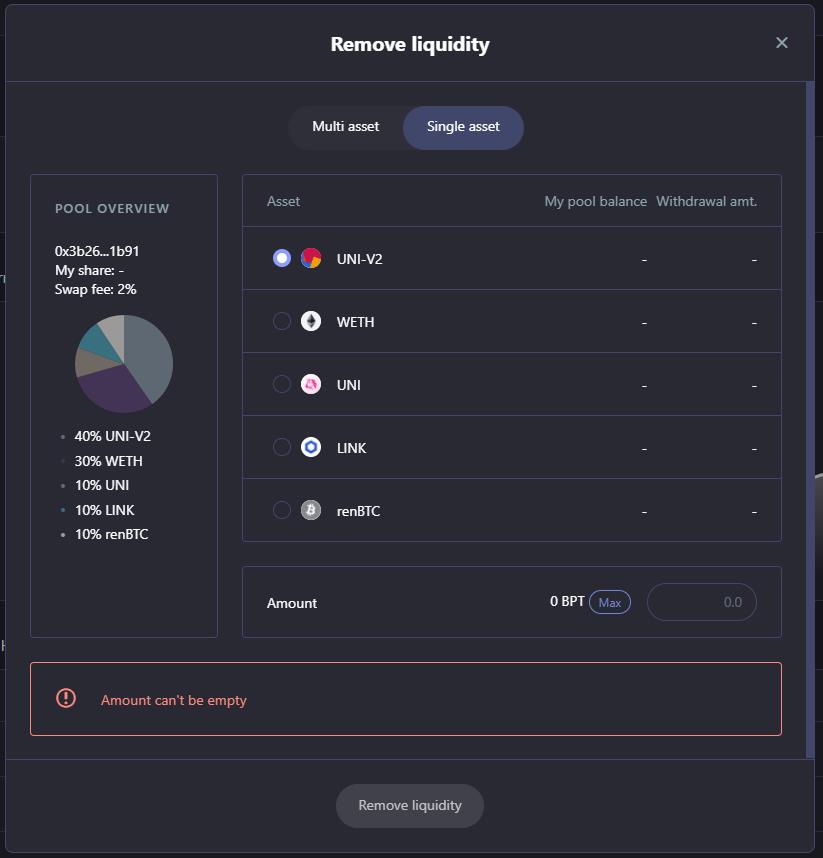

Users will be able to choose their desired tokens that they would like to get deposited in their wallet if they opt for removing liquidity.

To remove liquidity from the Balancer protocol, click on the Remove Liquidity button.

You can choose either a single asset or a multi-asset. Then select your desired token.

If you want to withdraw the Adventure LP token (UNI V2) that you have deposited, then you will need to follow the entire process in reverse. That means you need to first remove liquidity from the Balancer protocol and then the TWA/ETH Adventure Liquidity Pool on Uniswap to finally get the ETH and TWA token.

We have provided liquidity in the yield farm supported by the DeFi dashboard (which we will explain in our next article), hence no LUNA Fund details are appearing in the above screenshot.

In the next part of this article series, we will explore the DeFi dashboard and see how you can add liquidity into the yield farm and earn more rewards.

Resources: Adventure Token

Read More: Notable Projects Built On Polkadot – Part II