Although we have a temporary bull run, we are still in a bear market. We have a good idea of how cryptocurrencies behave during a bear market. But what’s the story with NFTs in a bear market?

This article covers exactly that. We look into the question if NFTs are a good alternative. So, without further ado, let’s get started.

Cryptos vs NFTs in the Bear Market

To find out if non-fungible tokens are a good alternative in a bear market, we need to look at volume. This allows us to compare it with cryptocurrencies. So, first, we have a look at the volume of cryptocurrencies.

They say #NFTCommunity is dead during the #bearmarket. Well for me it doesn't seem to be dead.

2,7 million tweets under #NFTCommunity for the past 7 days. #NFT #NFTs pic.twitter.com/uJmsO9Gskv

— NFT Community Ranking (@NFTCommunityRa1) August 9, 2022

During Q2-2022, the top 20 cryptos in the market cap lost about 30% in value. However, with the current mini bull run in the bear market, we see BTC gain 7% and ETH 12%. Therefore, the numbers for Q3-2022 may look more positive. Nonetheless, back in Q2-2022. The TVL in DeFi lost 68.13%. It went from $170 billion to $56 billion. The DEXs trading volume also lost around 38% compared to Q1-2022. So, this gives us a reference.

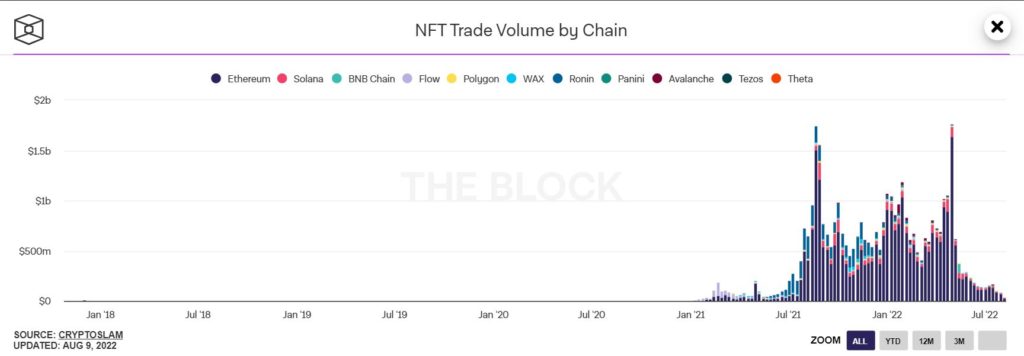

Now, let’s have a look at Non-Fungible Tokens. According to CryptoSlam, The volume of sales in USD went during Q1-2022 from $3.7 billion to $2.1 billion. In Q2-2022, it went from $3.2 billion to $722 million. In July, it dropped further to $535 million. However, that’s still more than July 2021 with $410 million. In August, NFTs 2021 started to break all sales and volume records.

Moreover, if we look at trading volume compared to the first half of 2021, it’s up by a staggering 4,700%. The second half is still up by 200%. Q1-2022 was still one of the best quarters for sales and volume for NFTs. Transactions reached a new ATH during Q2-2022, with 12 million.

NFT Volume is Down

So, what we see is that Non-Fungible Tokens volume is down. Recently, even as much as 60%. But it’s not all as bad as it may look like. NFTs seem to react differently to a bear market. That’s for the last two months. Before that, volume was still doing fine. NFTs are not as much down as cryptocurrencies. Some cryptos went down 90% in value.

There’s now less money in Non-Fungible Tokens. However, sales have been steadily going on. Another thing to consider is the liquidity of NFTs. They are less liquid due to their uniqueness. Crypto tokens are more liquid and easier to sell.

One thing to look out for is quality. Just as L1 chains remain steady in crypto, so do blue chip NFTs. The floor prices of blue chip NFTs remained fairly steady. Sure, blue chip NFTs are expensive, so maybe a fractionalized blue chip is a good option.

Non-Fungible Tokens are currently in a downturn. However, it seems, as if they’re not as much tied in to the crypto market swings. NFT traders are still making moves. The number of active NFT collections remains steady. Transactions just reached an ATH. For now, NFTs seem to be a good alternative during a bear market.

Source: The Block

What NFTs Can Survive the Crypto Bear Market?

You have a few options for NFTs that can best survive a crypto bear market. Your best option is blue chip NFTs. They have a proven track record in both growth and value. Furthermore, they established themselves already and are stable. This makes them a good choice as a long-term investment.

Since their floor prices can be high, it may be a good option to invest in fractionalized blue chip NFTs. Some samples of blue chip Non-Fungible Tokens include:

- Bored Ape Yacht Club (BYAC)—Floor price 82.48 ETH. A collection of 10,000 unique NFTs from Yuga Labs.

- Crypto Punks— Floor price 74.86 ETH. A collection of 10,000 unique NFTs from Larva Labs. However, Yuga Labs have acquired Larva Labs.

- Azuki—Floor price 7.95 ETH. Another collection of 10,000 unique NFTs by Chiru Labs. Despite rumors that this collection is dead, it’s still going strong.

- Doodles—Floor price 8 ETH. Once more, a collection of 10,000 unique NFTs.

- Clone X—Floor price 8.1 ETH. This collection has 20,000 unique NFTs.

•Bull or bear, Azuki is building towards the future of web3. We're in it for the long term.

•Builders need to experiment for web3 to challenge web2.

•Azuki is built on learnings from creating Phunks & other projects. This taught me to lead, not follow.https://t.co/Z2enFov8m9— ZAGABOND.ETH (@ZAGABOND) May 9, 2022

These are just a handful of samples of blue chip NFTs, there are plenty more out there. But besides blue chip Non-Fungible Tokens, it’s also important that an NFT has utility. If an NFT is only a collectible, it needs to have a strong foundation and community to survive. If not, their value may drop quickly. The utility can be twofold. Add real-world benefits and add interoperability. Users should get unique real-world experiences in the metaverse. This gives extra value to your NFTs.

Conclusion

So, we see that Non-Fungible Tokens fare well during a bear market. We showed you that they are a good alternative in a bear market. Furthermore, we showed you which NFTs can survive a bear market.

A bear market is a good time to buy NFTs. In general, their prices have dropped. Now you only have to wait for the bull market, to enjoy your profit.

⬆️For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️Find the most undervalued gems, up-to-date research, and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.