Acala is the premium DeFi protocol in the Polkadot Ecosystem. It has a varied suite of services. Their aUSD stablecoin is also getting a lot of traction getting support from a $250 million fund.

This makes the Acala Protocol interesting for DeFi users. In this guide, we will learn, how to bridge DOT to Acala, how to use Liquid Staking and how to mint aUSD.

Table of Contents

Prerequisites to Use Acala

To use this protocol, you need to have:

- Install Polkadot.js chrome extension to interact with the Acala Protocol.

- Create an account. Save your keys to a personal space (do not share). The gas fees are paid in ACA Tokens. Note that, you will need a minimum of 5 DOT to participate in Acala DeFi.

Now, the other thing you need to know is how to send ACA tokens, the native token of Acala Network, and DOT tokens too. Here is a brief guideline.

1) Sending ACA in Acala

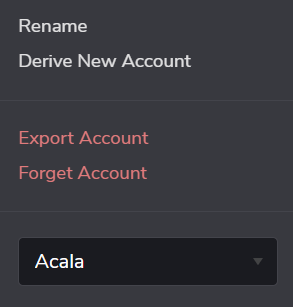

First, you need to go to Polkadot.js. Select the chain as Acala. Then, you can send your ACA to this address directly from the exchange.

2) Sending DOT in Acala

Follow these steps:

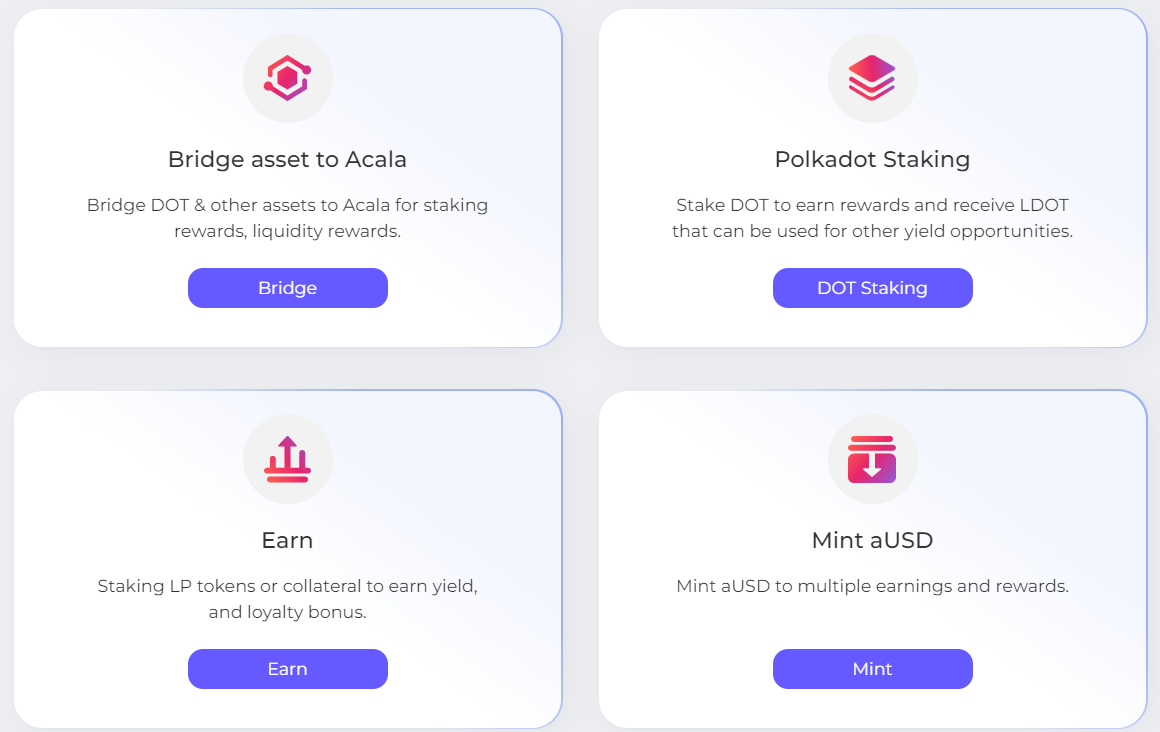

- Go to Acala’s DeFi application.

- Go to Home and click on Bridge Assets to Acala. Once the DOT is bridged to the Acala Network, you can participate in staking and liquidity rewards.

- Click on Bridge.

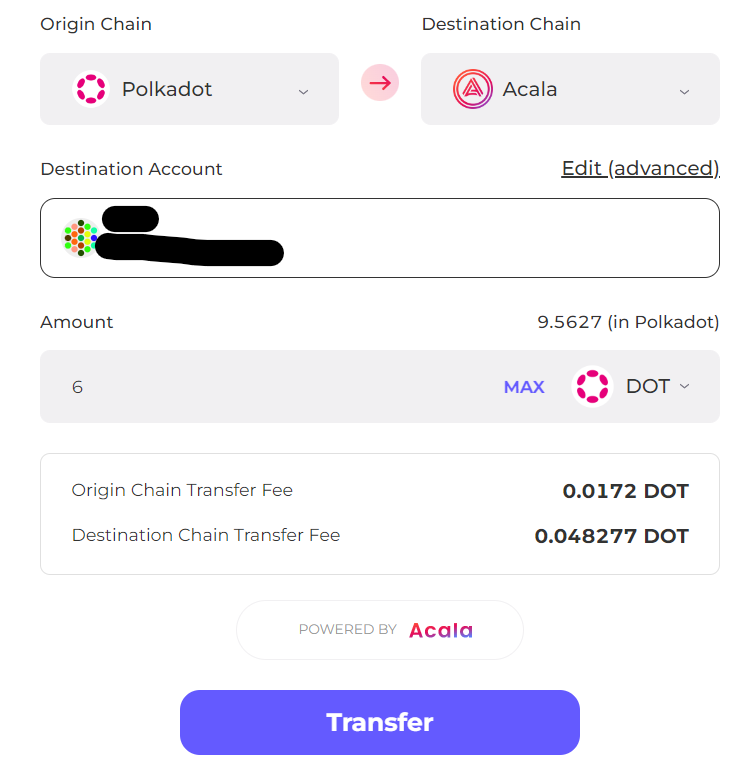

We will now send DOT from the origin chain (Polkadot) to the destination chain (Acala).

- Click on Transfer. Enter your password in the polkadot.js extension to sign the transaction.

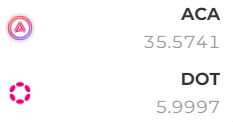

You will see both ACA and DOT in your account.

Now, you’ll learn how you can inject DOT in the staking feature:

DOT Liquid Staking in Acala.

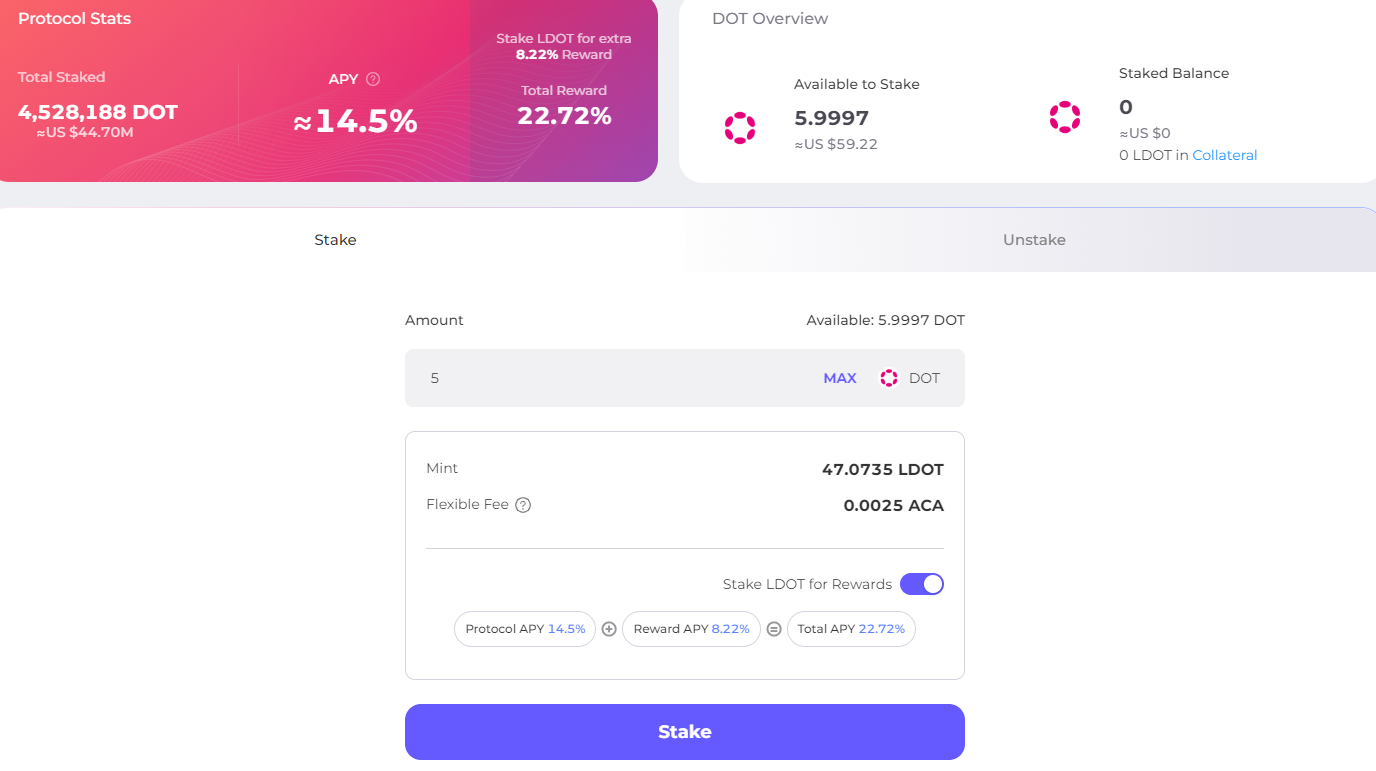

We will now go to liquid staking and stake DOT. Remember, the minimum required is 5 DOT.

There is an important thing you should note. LDOT is not 1:1 pegged with DOT. Hence when we are staking 5 DOT, we are getting 47 LDOT in mint. This is a risk you should consider.

You get a protocol APY of 14.5% and a reward APY of 8.22%. However, the 8.22% reward APY might fluctuate in DOT value. The LDOT is automatically staked to get the 8.22% rewards.

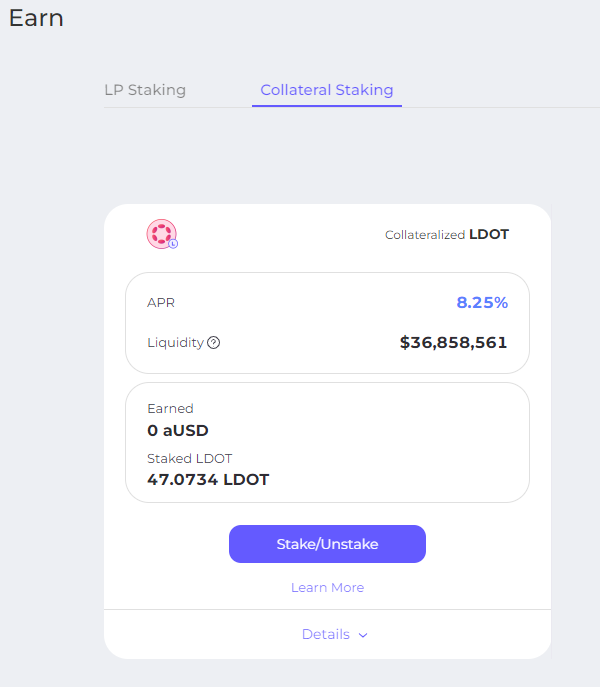

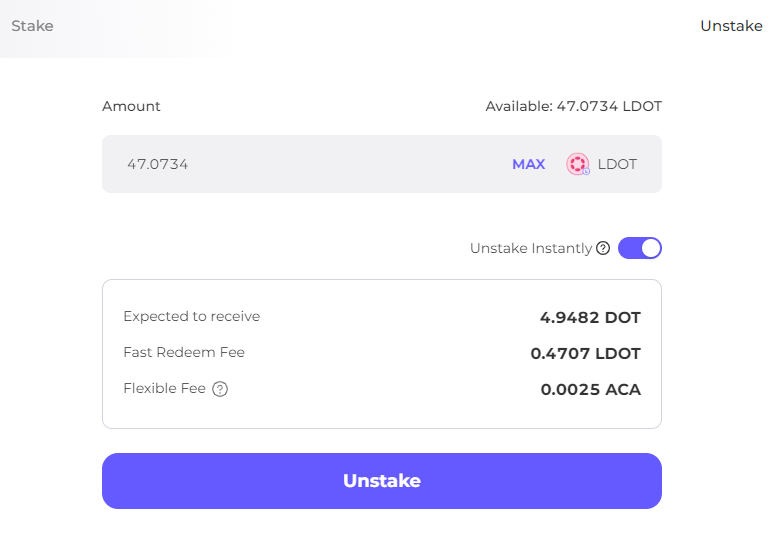

You can find it in Earn à Collateral staking. You can keep it to earn rewards or use it to explore other features of Acala. We will unstake LDOT now.

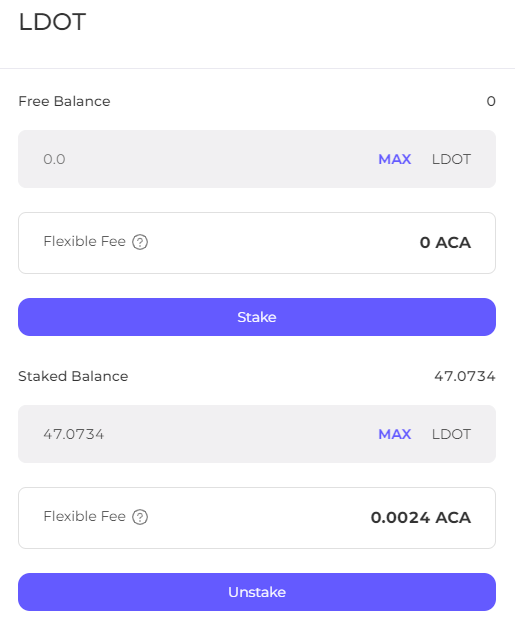

You need to click on “Stake/Unstake”

In addition, you can use this LDOT to get your DOT Back. Notice the small reduction in the DOT amount, be cognizant of that.

Mint aUSD in Acala Network.

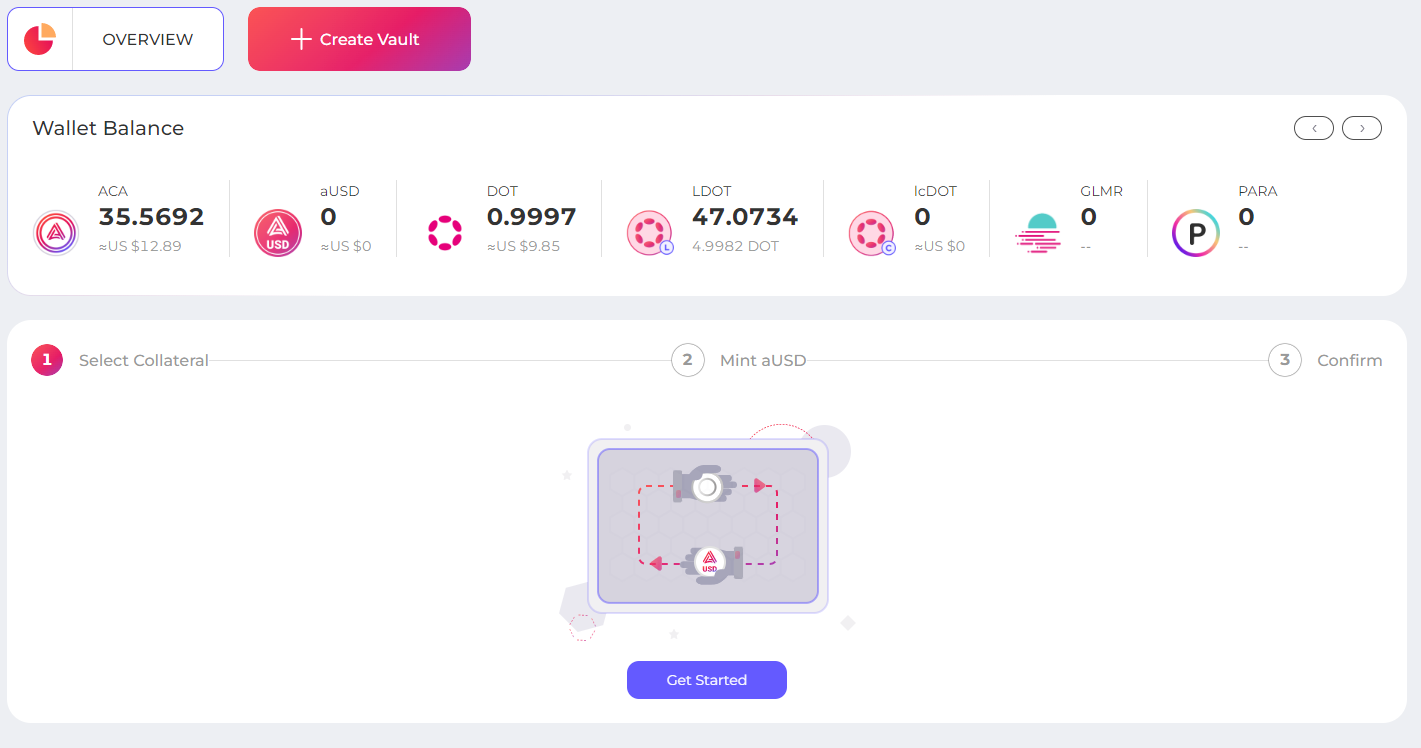

First, you need to:

- Go to Mint aUSD.

- Click on Get started.

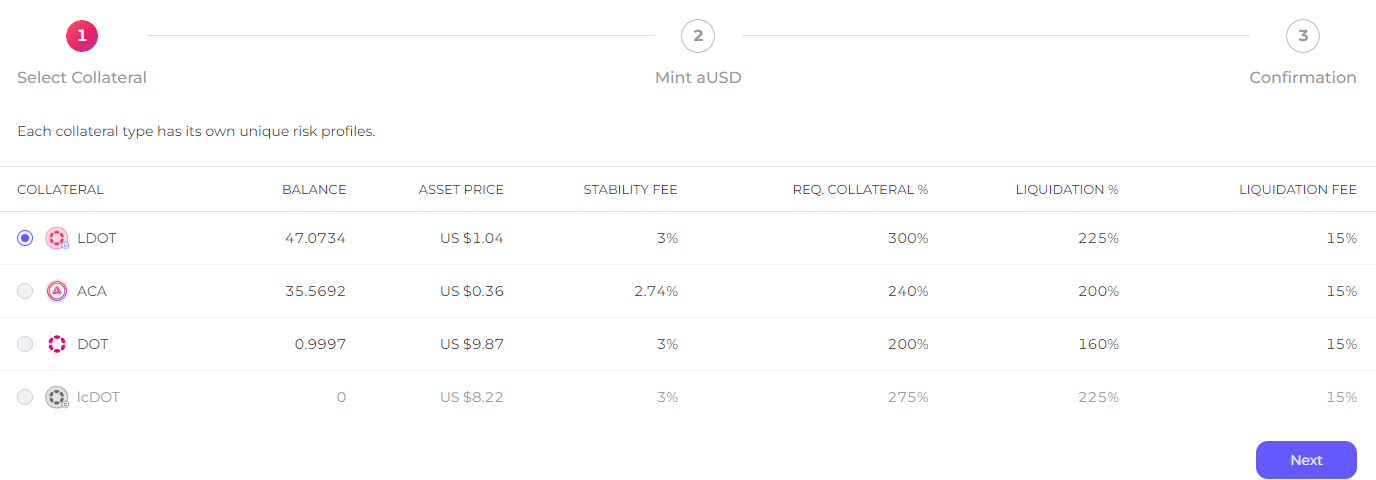

- Select your collateral. In this case, we will select LDOT.

Also, each collateral has different risk profiles in the Acala Platform. This means that you will get a different value of aUSD as a loan by locking the same amount of two different collaterals.

Let’s take the example of ACA (Required collateral of 240%). This means that If you put $240 worth of ACA, you will get $100 worth of aUSD. For that, the required collateral percentage is 200%. As a result, if you want $100 worth of aUSD, you will need to lock $200 worth of DOT.

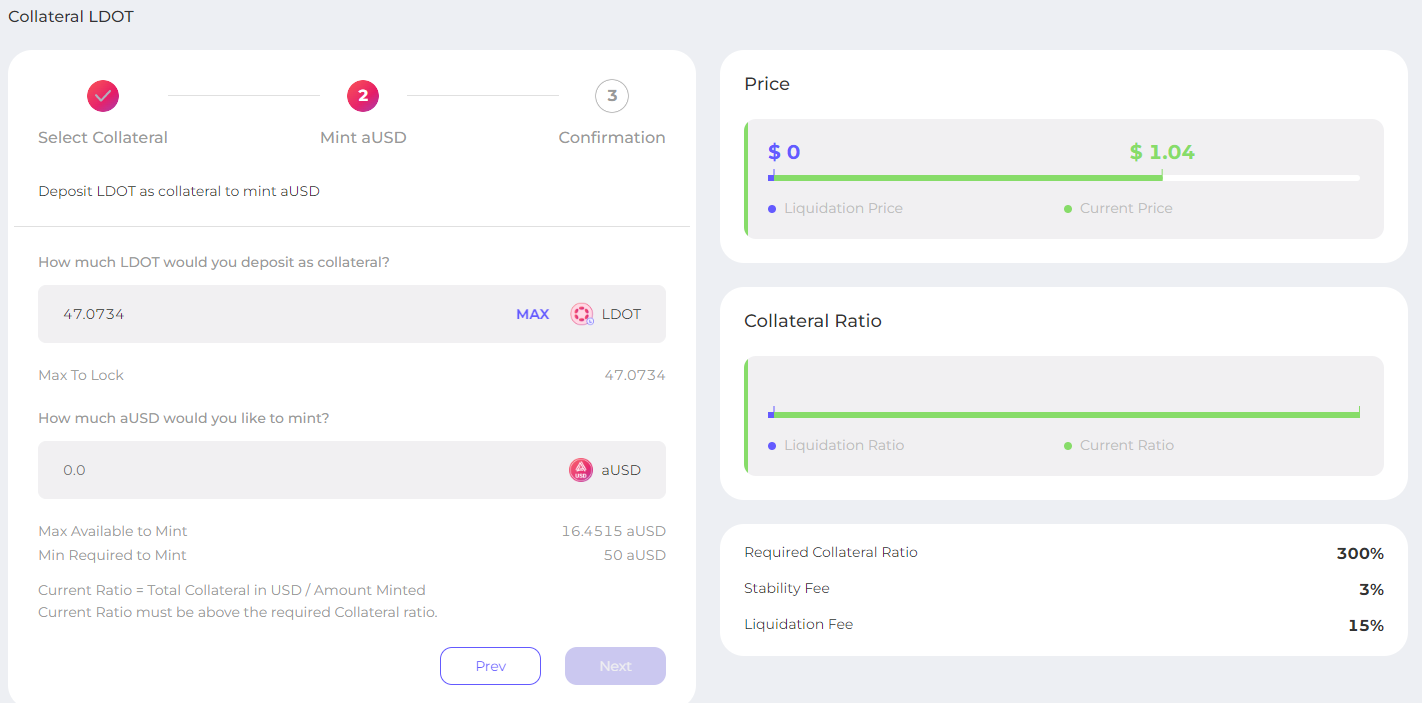

Note the following. For LDOT, the required collateral ratio is 300%. Therefore, this means that you will receive 1/3rd of your LDOT value in aUSD loan.

Also, the minimum aUSD you can mint is 50. You can use this stable coin for any activity in the Polkadot ecosystem.

Why would you use aUSD?

In addition, there are 2 major reasons for you to use aUSD.

- Participate in De-Fi in Polkadot. Lock your collaterals, take a loan, and use it to purchase another token. Refund the loan, when in profit (be wary about Liquidation)

- Use aUSD as a transfer of value within the Polkadot and Kusama ecosystem. The entire Polkadot ecosystem is gearing up to accept aUSD as the standard stablecoin. As a result, more adoption and more utility within the ecosystem. Use aUSD for purchases, participating in Launchpads, minting NFTs, etc.

Why Would Ecosystem Projects Use aUSD?

On the other hand, maintaining and managing a decentralized stablecoin is tedious and risky. This is better left to a Decentralized Finance Protocol. The projects can then focus on their core value proposition. Therefore, Acala is the most important De-Fi project in Polkadot, hence it has the fund, the community, and the network to push aUSD’s adoption. Moreover, some of the important factors to choose aUSD are

- Yield & Liquidity: Projects can use their reserves to get more stability in the form of a Stablecoin (aUSD).

- Polkadot’s universal routing asset: aUSD is poised to become a universal trading pair, swapping and transferring enormous value within the ecosystem.

- Seamless transfers: Receive, use and send aUSD to any parachain without using bridges.

- ERC20 and Substrate Compatible: aUSD is both ERC20 and substrate compatible. This means that it will be easily able to move cross-chain.

Finally, for more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

Above all, find the most undervalued gems, up-to-date research and NFT buys with Altcoin Buzz Access. Join us for $99 per month now.