Aptos is a Layer 1 blockchain. It is also one of the newer chains on the block. Its mainnet launched in October 2022. Since that date, they have been working and building to establish themselves. Step by step, they are getting a foot in the door. Its DeFi space continues to grow. Aptos also has an active NFT community.

So, time to take a closer look at what Aptos is about. We will answer six popular questions about Aptos over the course of two articles, this being the first.

The hack is back! The next stop on the #AptosWorldTour is…

AMSTERDAM!

Save the date: June 5-7, 2023

We can't wait to see what the next batch of talented builders will come up with next! 💡

Stay tuned for applications, opening soon 👀

Who's ready to join us? pic.twitter.com/vnq0t1h06G

— Aptos (@Aptos_Network) February 20, 2023

What Is Aptos?

Aptos supports smart contracts and dApps. Its founders, Mo Shaikh and Avery Ching, worked at Meta. They were building Meta’s abandoned blockchain project. For this, among others, they used the Move programming language. They use the same Move language in Aptos.

Its launch was highly anticipated and hyped. The platform is also referred to as an Ethereum or Solana killer. In respect to Ethereum, it can do the same as Ethereum, except, it’s faster and cheaper. With Solana, it’s a different story. Solana is already faster and cheaper compared to Ethereum. However, Aptos may be faster than Solana.

The founders were also able to raise $350 million in funding. This was mostly VC investors, including FTX. As you may remember, shortly after the mainnet launch, FTX collapsed. The platform’s Series A investment round was actually led by Sam Bankman-Fried. This was for $150 million. So, Aptos got off to a rocky start.

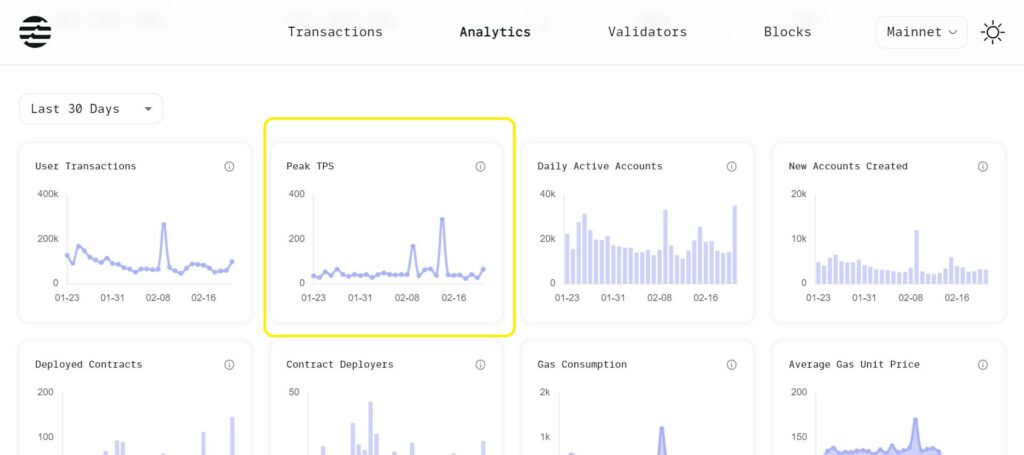

Part of that rocky start was also a chaotic mainnet launch. Instead of the anticipated 150,000 TPS (transactions per second), they delivered 18 TPS. However, with hardly any interaction at that moment, understandable. Nonetheless, over the last 30 days, their peak was “only” 288 TPS.

The tokenomics weren’t revealed until after the mainnet launch. To call this unusual is an understatement. The tokenomics were also not very transparent. As a result, a lot of criticism was their share. However, it appears that the project’s tokenomics will undergo an update. The picture below shows the platform’s analytics over the last 30 days. Its TPS is in the yellow box.

Source: Aptos Explorer

How to Become an Aptos Validator

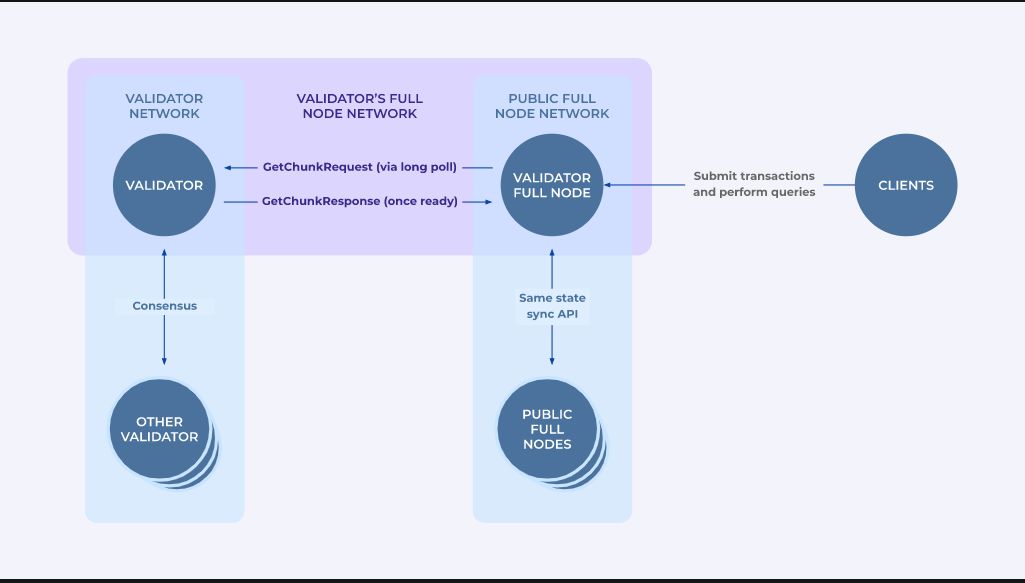

If you want to become an Aptos validator, you have four different options. You can run and deploy the following:

- Validator node (VNs) — Take part in consensus and drive transaction processing.

- Validator fullnode (VFNs) — Keeps up-to-date and captures the state of the blockchain. The validator operator runs this. It connects directly to the VN.

- Public fullnode (PFNs) — Not run by validator operators. They can’t directly connect to a validator node. You need a VFNs to synchronize them. This is an optional node.

- Archival nodes (ANs) — A fullnode that has all blockchain data since the blockchain started.

If you want to run your own Aptos validator, you also need to meet plenty of technical requirements. Here’s a detailed explanation of how to set this up from the Aptos docs.

On the other hand, it may be easier and more convenient to use a validator service. They run the node and set everything up for you. However, you’re in control of your own node. Here’s a description by Blockdaemon on what it takes to use its service. There’s a fee involved, but they take care of the technical part. The picture below shows how the Aptos nodes are set up.

APT Use Cases

The native APT token has two main use cases. You can use it for staking, and you can use it to pay for all gas fees.

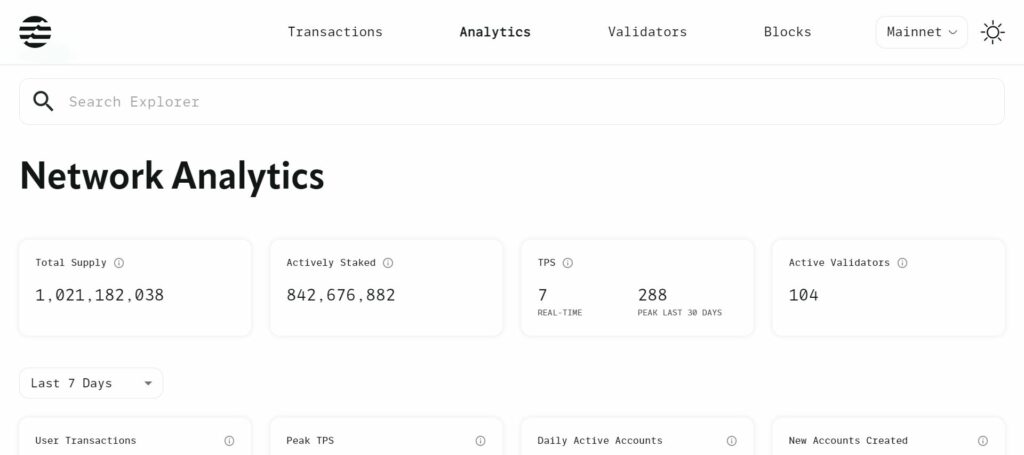

Out of the current total supply of 1.021 billion tokens, 842 million are already staked. That’s almost 84%. However, due to the protocol’s tokenomics, the staked tokens belong mostly to the team. Furthermore, during the first year, there’s a limited number of tokens available. But after this initial year, there will be a lot more tokens available. This may have a negative effect on the APT price.

The gas fees in the Aptos ecosystem are low. This makes for a nice change compared to, for example, Ethereum. Sending APT or NFTs between wallets hovers around $0.05. The picture below shows the number of staked APT.

Conclusion

In this two-part series, we answer popular questions about the ecosystem of Aptos, a Layer 1 blockchain. To learn more about Aptos, read our Part 2 article.

The current APT price is $13.92. Their market cap is $2.36 billion. From an initial total supply of 1 billion tokens, only 169 million circulate. By market cap, Aptos already takes the #32 spot. You can buy the APT token on all major exchanges.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.