The Quant network aims to fix one of the critical issues of blockchain technology, which is the lack of interoperability. An extremely exciting system developed by Quant to address the interoperability issue is Overledger. This is not a blockchain but an operating system that connects blockchains. Along with that, it uses multi-chain applications (mApps) to connect existing traditional networks to a blockchain.

In our prior Quant Network series, we have explained its architecture, token utility, tokenomics, and much more. However, in this particular article, we will talk about the architecture of the Overledger Network Community Treasury and how it provides even greater utility to QNT.

Table of Contents

What is the use of the Treasury model?

To begin with, let us understand what is an Overledger Network Community Treasury model. Basically, it is a multi-chain application (mApp) that uses a collection of smart contracts for its operational logic. Before we take a deep dive into the Treasury and how it works, let us look at its potential benefits for the Quant Network.

- The Treasury model enables scalability. Precisely speaking, it off-chains a majority of transactions from the Ethereum blockchain and allows only a minimal number of transactions to use the chain. Consequently, Quant network performance hardly gets affected by the congested Ethereum network.

- The Treasury design includes an Escrow Deposit. This requires both developers and gateway providers to lock some amount of QNT to keep a payment channel active. Such a design will reduce the circulating supply of QNT and will also provide it additional utility. With more QNT in escrow deposits, the gateway providers can receive more traffic.

- The developers pay the fees to Gateway operators in QNT.

- QNT is also used to pay dispute settlement amounts between the developers and the gateway providers.

- To set up a Payment Channel, the developers and gateway operators need to get their QNT deposits approved by the Treasury. This amount must be greater than the license fees.

The Overledger Network Community Treasury design provides staking-like benefits. Let me explain:

- The QNT tokens remain locked inside the Treasury model

- No new coins minted

Thus, the demand for QNT will keep on increasing and will lead to a price surge. However, unlike most of the staking projects, no new tokens are being minted. Thus, the value of the QNT token will not get diluted.

What does the Treasury model look like?

To understand the treasury model and its functions we first need to understand with whom the Treasury will interact. Here is a visual presentation of the same:

Source: Quant Network

- Dev Portal oversees the network access.

- Developers are the ones who consume functionalities provided by the network.

- Treasury oversees the payments between the developers and Gateways.

- Gateways provide the functionality on the network.

To become a developer or a gateway provider, one needs to access the network via the Dev portal. According to the official guide, the developers and gateway providers, also known as stakeholders, need to provide two Ethereum addresses:

- QNT wallet address: This will hold QNT for making any payment to the Treasury. It can also act as a cold wallet.

- The operator address: Used to call functionality on the treasury smart contract.

We have composed a complete guide on how you can participate in the Quant Network Community Treasury Public Test.

Payment channel design

Unlike Lightning Network and Bitcoin, Quant’s Treasury model uses a uni-directional payment channel. A uni-directional approach to the payment channel makes sure the payment processing happens even if any of the stakeholders goes offline. This is a big advantage over the bi-directional Bitcoin and Lightening Networks where both the sender and receiver need to be online for the payment to go through.

More advantages of Uni-directional payment

- In case a gateway goes offline, the Treasury can store payments on its behalf and process it as and when the gateway comes online.

- Routing payments through the channels becomes easy.

- In case a gateway goes offline and never comes back, the Treasury can place the payments on-chain so that the gateway receives them.

The payment channel design establishes a trustless environment. While blockchain acts as a root of trust, the application liveness ensures the smart contract will get executed and the payments will be made.

How is a Payment Channel set up?

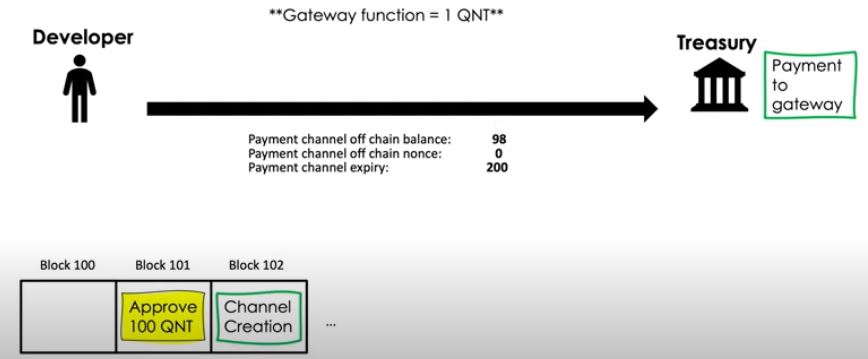

A developer approves a QNT amount and broadcasts the message to the blockchain. Once this step completes, the Treasury creates a payment channel, which is also recorded on the blockchain. Along with that, it also sets the payment channel expiry term.

In the diagram below, the channel has an expiry of block 200. As soon as the block 200 is created, the payment channel between the developer and the gateway operator will expire.

Source: Quant Network

Treasury smart contract architecture

As discussed earlier, the smart contract stores the operational logic of the Treasury. Furthermore, the smart contracts here store information like payment channels, escrow deposits, and additional data.

There are primarily seven different types of smart contracts.

Source: Quant Network

-

Treasury Smart Contract

This is the key smart contract and stores the Treasury Ethereum address, the linked contract address, the fee rates, and the deduction rates in case of any faulty service.

-

Treasury Factory Smart Contract

This smart contract can create payment channels and escrow deposits. It also stores the code for both of them. Along with that, it stores the list of created payment channels and escrow deposits.

-

Payment Channel Smart Contract

This smart contract stores the operators and QNT wallet of the stakeholders. It also holds QNT. This releases only when the payment channel receives a valid claim. Or is paid to the sender when the payment channel expiration period gets over. A single payment channel smart contract can allow many claims and time extensions.

-

Escrow Deposit Smart Contract

It functions quite like the payment channel smart contract. It stores the QNT wallet and operator addresses and also releases QNT if it receives a valid claim. After the expiry period, it releases the QNT to the depositor.

-

Treasury Deposit Smart Contract

It holds QNT that is released to the developers or gateway only after a valid claim.

-

Rule List Smart Contract

These smart contracts store the list of rules that the stakeholders – the Treasury, the developers, and the gateways – must adhere to. In case any stakeholder does not abide by the rules, QNT will be deducted from their escrow deposit according to the details in the Rule Smart contract.

-

Rule Smart Contract

Separate Rule smart contracts store the deposit deduction rules of each payment channel. These are then listed in the Rule list.

To wrap

As a multi-chain application, the Overledger Network community treasury ensures QNT payments flow from developers to gateways in an accountable manner. In addition, a gateway or a user is penalized in case of faulty behavior.

Along with that, the Treasury also reduces the on-chain transactions. With such an approach, it is able to save on the ETH gas fee on its transactions and complements one of the purposes of Overledger system.

At Altcoin Buzz, we have been extremely bullish about the Quant Network. Here is the Quant Network exclusive video on our Altcoin Buzz YouTube channel that explains why we are so bullish about QNT.