Cosmos is the layer 0 for the Cosmos ecosystem and IBC. In other words, it provides the foundation for other layer 1 blockchains to build on. For this, it offers an SDK (software development kit). Furthermore, it also offers consensus or cross-chain transfers.

All the other chains can make use of this infrastructure. So, let’s have a look at what Cosmos is all about. Here’s a short video on Cosmos.

ATOM’s Use Cases

ATOM, the Cosmos token, has three use cases.

- Pay fees with it. At the same time, this also makes it a spam-prevention tool. You can compare this with paying for ‘gas’ on Ethereum. So, the more computational power it requires, the higher the fees.

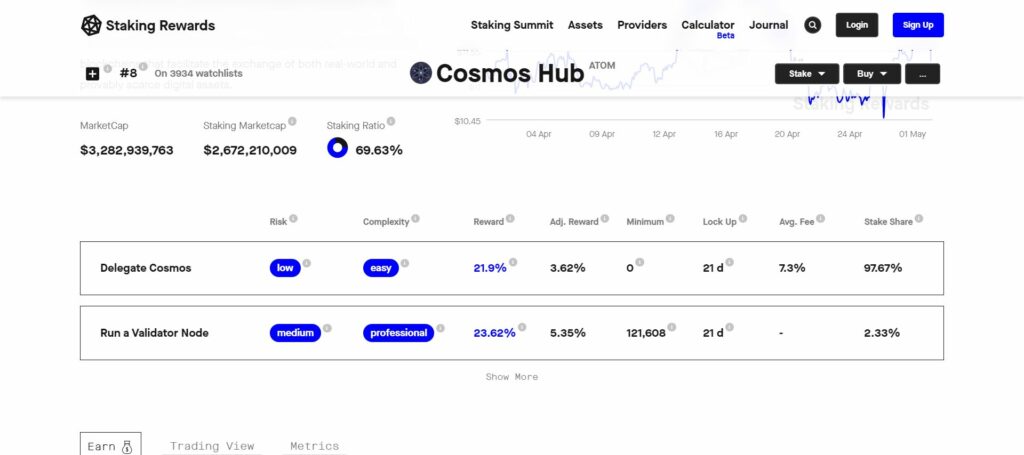

- Stake ATOM. As a nominator, you delegate your ATOM to a validator. This is non-custodial; it means that you remain in control of your tokens. In return for delegating, you receive a staking reward from the validator. Currently, validators receive 23.62% and nominators receive 21.9%. The staking ratio of all circulating ATOM is almost 70%. This is a good number, since it makes it more difficult to attack the network. A high staking ration gives good security to the network. See the picture below.

- Governance. As an ATOM holder, you can take part in governance. The more ATOM you hold, the higher your voting power is. For instance, you can take part in voting through your Cosmos compatible wallet.

Source: Staking Rewards

How to Buy ATOM?

You can buy the ATOM on plenty of exchanges. For example, on all major CEXes and on various DEXes. We’re going to look at the current biggest CEX, Binance. For DeFi, we look at the biggest DEX on Cosmos, Osmosis.

- Binance

This CEX has the biggest daily volume, with $3.597 billion. That’s 3.6x as much as #2, Coinbase. In monthly visitor numbers, they welcome 75 million people. Coinbase sees half of that number. Binance lists 355 coins with 1410 trading pairs. That’s not the highest number, but it is nonetheless a lot.

Buying ATOM is easy in Binance. For starters, you will need to set up a Binance account. Binance has a great guide that takes you through all the follow-up steps for buying ATOM.

- Osmosis

This is currently the most popular DEX on the Cosmos hub. According to DeFiLlama, its TVL is $164.9 million. Now, if you want to use Osmosis, you will need a Cosmos or IBC compatible wallet, like Keplr or Leap. To clarify, IBC is the ‘Internet of Blockchains’. It’s the Cosmos standard for blockchain interoperability.

Trading on Osmosis is not difficult. They have an insightful and easy to follow guide on what steps to take. Transaction fees on the IBC are well below a penny.

Source: Osmosis

Top 3 Cosmos Explorer Tools

Explorer tools are a fixed part of any blockchain. They help you find, for example:

- Transactions

- Activity in a wallet.

- Find information about new blocks

- Information about validators

- Governance proposals, etc.

As you can see, these tools are useful. So, we have a closer look at 3 popular explorers in the Cosmos ecosystem.

- Mintscan

The Mintscan explorer lets you find information about a wide variety of IBC chains. It’s multi-functional and likely the most popular explorer in the Cosmos ecosystem.

- Atomscan

The Atomscan explorer works similarly to Mintscan. It offers similar information. With all the IBC ‘zones’, that’s needed as well. A ‘zone’ is a blockchain inside IBC, that’s connected to the Atom Hub.

- Bitquery

The Bitquery explorer also offers information about other chains, outside IBC. For example, Ripple, smart contract chains, or UTXO chains. UTXO means, ‘unspent transaction output’. It defines the starting and ending points of transactions. This is, for instance, used by Bitcoin.

🔍Explorers on Cosmos Ecosystem

Explorers assist users in capturing key metrics in ecosystems. Here are the notable #Explorers specializing in providing data on @cosmos ecosystem

Leave a comment letting us know which #explorer you often use to view data👇#IBCGang #Cosmonauts pic.twitter.com/t3BrzsGPkl

— Cosmos Daily ⚛️ (@CosmosATOMDaily) July 8, 2022

How to Use Cosmos’ Explorer?

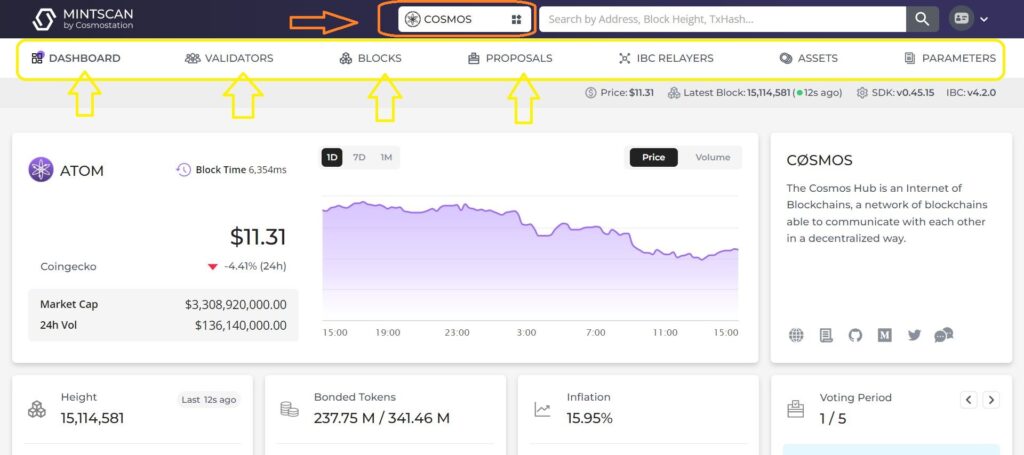

As a sample of how to use a Cosmos explorer, we look at Mintscan. As already mentioned, it’s currently the most popular explorer in the IBC. So, let’s see how you can use Mintscan.

On the very top, you can choose the IBC blockchain you want to use. It’s in the orange box with the orange arrow, in the picture below.

On the top of the page, there are all the different features you can explore. They are in the yellow box, and the first four have yellow arrows pointing at them. Here is some information on what you can do with each feature.

1) Dashboard – This provides you with information on transactions or wallets. It also provides general information:

- The current ATOM price

- Market cap

- 24 hour volume

- Bonded (staked) tokens

- The staking APR

- Current inflation percentage

2) Validators – A list of validators. It offers information:

- Cumulative share

- Uptime

- Commission

3) Blocks – This shows:

- Block height

- Proposer

- Block Hash

4) Proposals – A list of active and inactive governance proposals.

5) Relayers – They read data packets and communicate with them between blockchains.

6) Assets – This shows the price of each token in the IBC. It also shows the total supply and the number of tokens transferred out to non-native IBC chains. You can also find the on-chain supply here.

7) Parameters – For instance, parameters for, staking, governance, distribution, or slashing.

Conclusion

This is Part 1 of this Cosmos Beginners Guide. Here’s a link to Part 2. We covered four popular questions about Cosmos.

The current ATOM price is $11.24. Its market cap is $3.2 billion. The max and total supply are infinite. Currently, 292.5 million ATOM tokens circulate.

⬆️ For more cryptocurrency news, check out the Altcoin Buzz YouTube channel.

⬆️ Our popular Altcoin Buzz Access group generates tons of alpha for our subscribers. And for a limited time, it’s Free. Click the link and join the conversation today.